Defending the Fort – Edinburgh Castle, Scotland

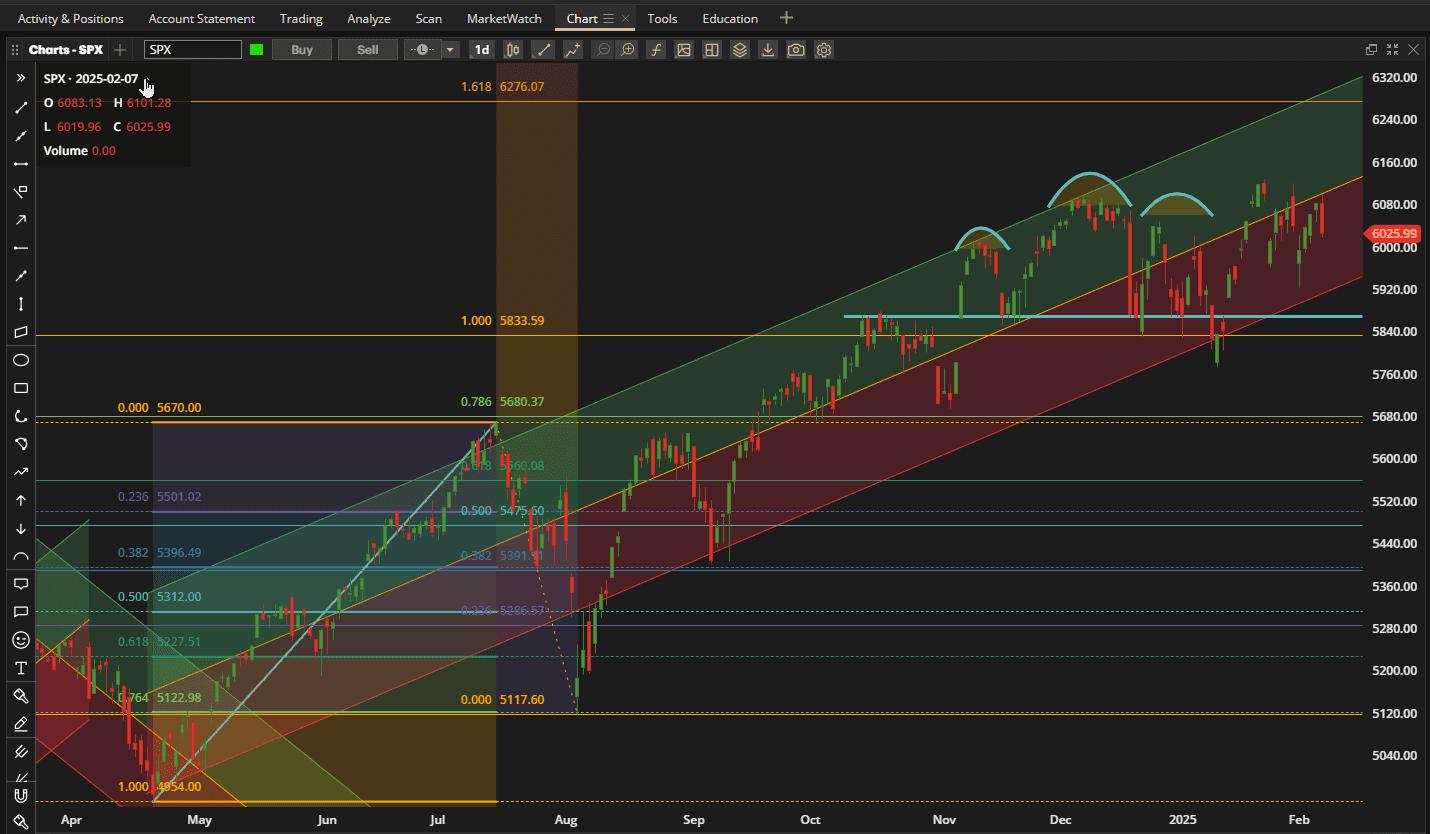

Another rather volatile week in US equity markets with no clear indication of a short-term trend:

….. although we remain in the longer term uptrend channel that started last May. We have now been churning sideways for the past 3 months. US equities remained relatively unchanged over the past week although SPY (the S&P 500 ETF) closed slightly lower:

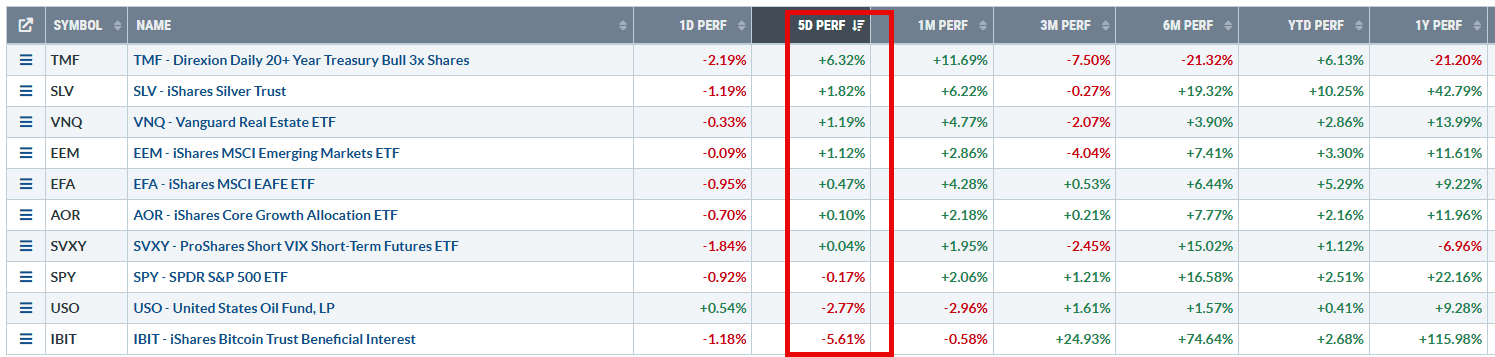

Bonds (TMF) led the way on a relative basis with crypto (IBIT) being the big loser.

Bonds (TMF) led the way on a relative basis with crypto (IBIT) being the big loser.

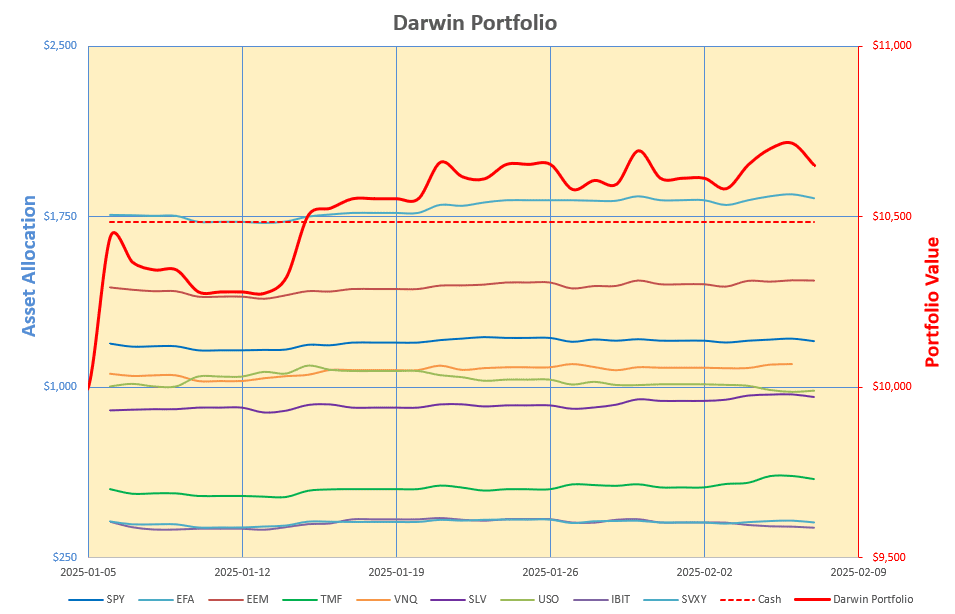

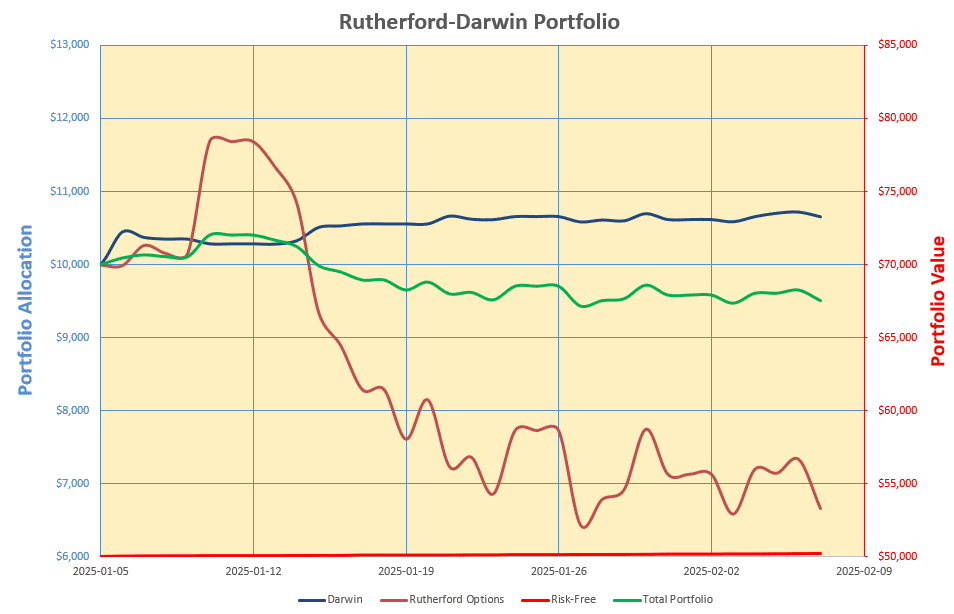

Looking at what happened in the Rutherford-Darwin Portfolio, our “risk-free” portion of the portfolio made a few more dollars – now contributing ~$220 to the portfolio over the 6 weeks since inception

In the “Buy-And-Hold” diversified portion of the portfolio:

we saw little change – although it did gain slightly and now contributes ~$650 to the portfolio.

we saw little change – although it did gain slightly and now contributes ~$650 to the portfolio.

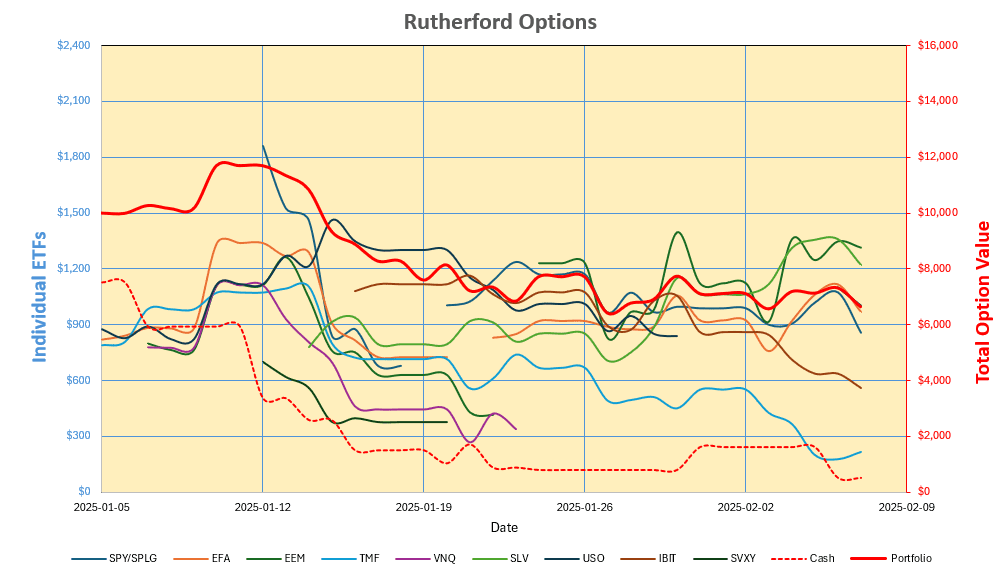

Unfortunately, I still don’t have the Options portion of the portfolio balanced as I would like and these holdings are magnified ~10X due to the leverage offered through the use of derivative products. However, volatility has settled down a little bit and this portion lost ~$400 on the week.

Overall, the portfolio handled the week fairly well (green line) and in line with the major indices/asset classes and what we might expect from a diversified portfolio:

Overall, the portfolio handled the week fairly well (green line) and in line with the major indices/asset classes and what we might expect from a diversified portfolio:

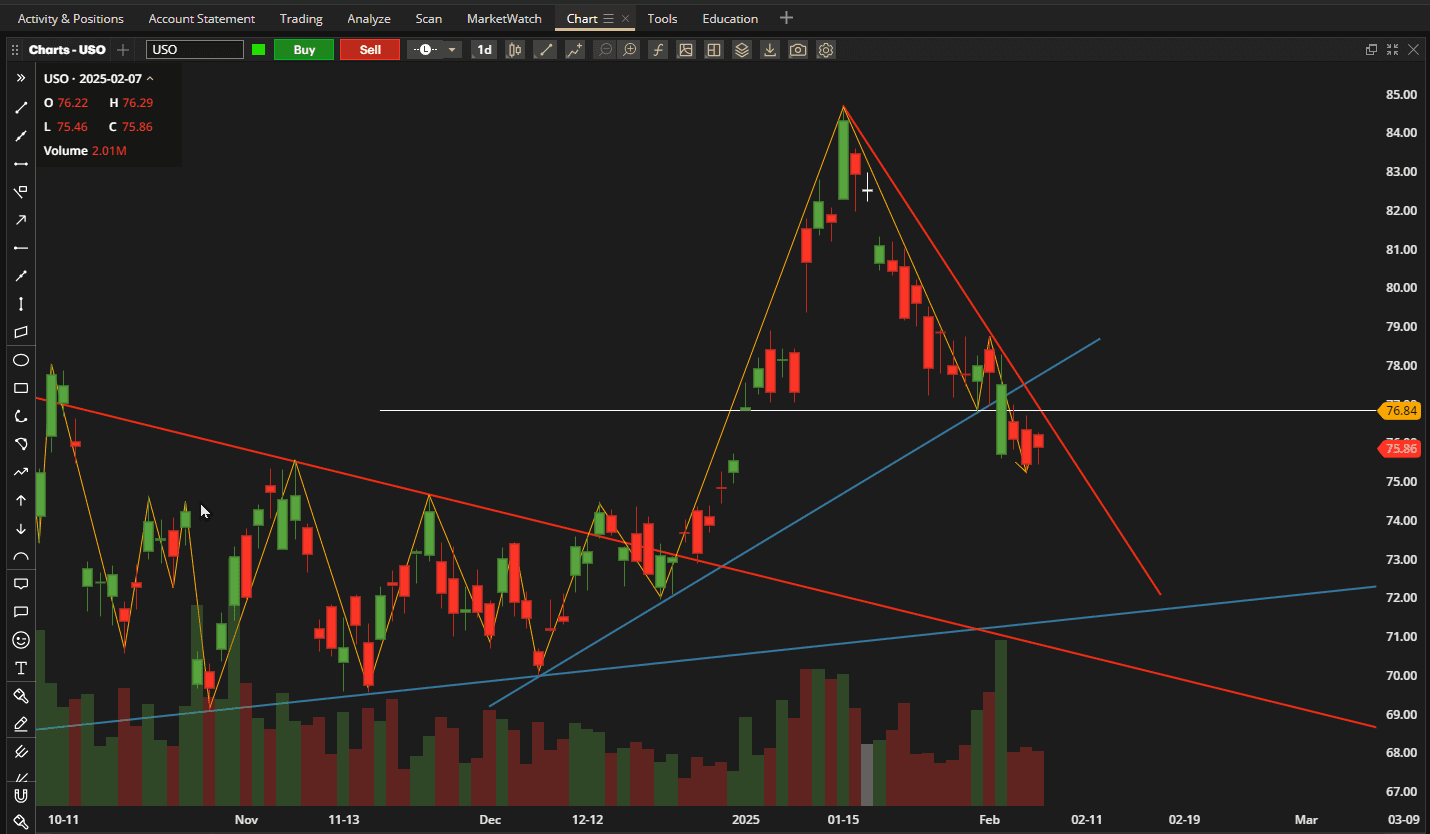

I continue to try to get the Option positions to where I am more comfortable so, this week I switched my bullish (Long Call) USO (Oil) position to a bearish (Long Put) holding. Looking at the (daily) chart of USO:

I continue to try to get the Option positions to where I am more comfortable so, this week I switched my bullish (Long Call) USO (Oil) position to a bearish (Long Put) holding. Looking at the (daily) chart of USO:

we see (tight) pivot low and pivot high points (light orange zig-zag line) about 1 week ago that allows me to draw a (tentative) bearish trend line (red line) from the January high. We subsequently closed below the pivot low and through the wide (blue) uptrend line – that started in December – on Wednesday. I have taken this as my signal to go bearish – it may be early but this asset can move quickly when it does move as we saw through January. I entered USO long in early January – and we see the impact of the moves clearly in the performance screenshots shown above. I closed the long position with a ~$500 loss. Working on a monthly review schedule, it is obviously difficult to capture profits and whether we show a profit or loss will be entirely subject to review date (timing) luck. Looking at weekly charts it is difficult to find entry/exit points so, even though I am trying to keep this to weekly reviews, with the aim of holding for at least a month, I need to break the detail down further to at least the daily charts to better define the trend and possible turning points. We’ll see how this works out.

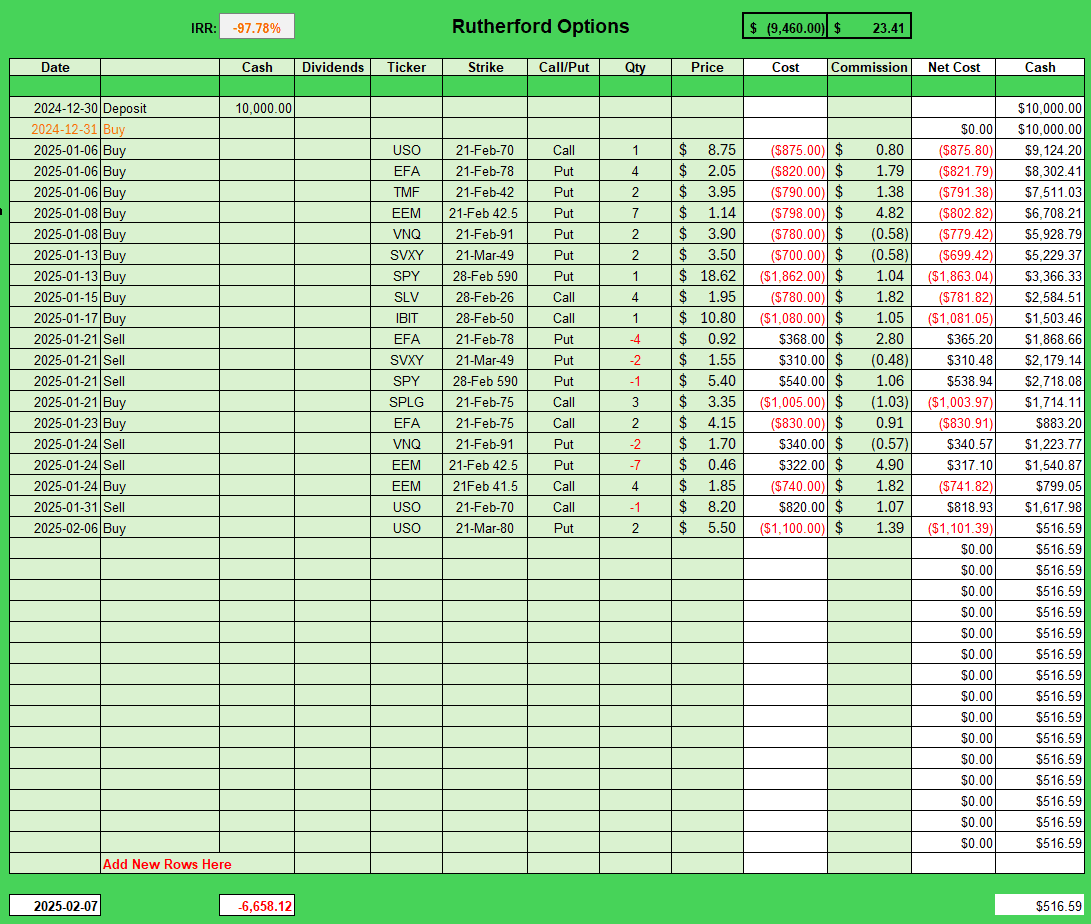

Trades to date look like this:

that leaves me with just over $500 in Cash. With only 14 days to expiration, I will be looking to close or roll positions over the next week to leave myself in a more comfortable position.

that leaves me with just over $500 in Cash. With only 14 days to expiration, I will be looking to close or roll positions over the next week to leave myself in a more comfortable position.

Stay tuned for next week’s exciting adventures!

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Leave a Comment or Question