Fishing Fleet returning Home, Kamodo, Indonesia

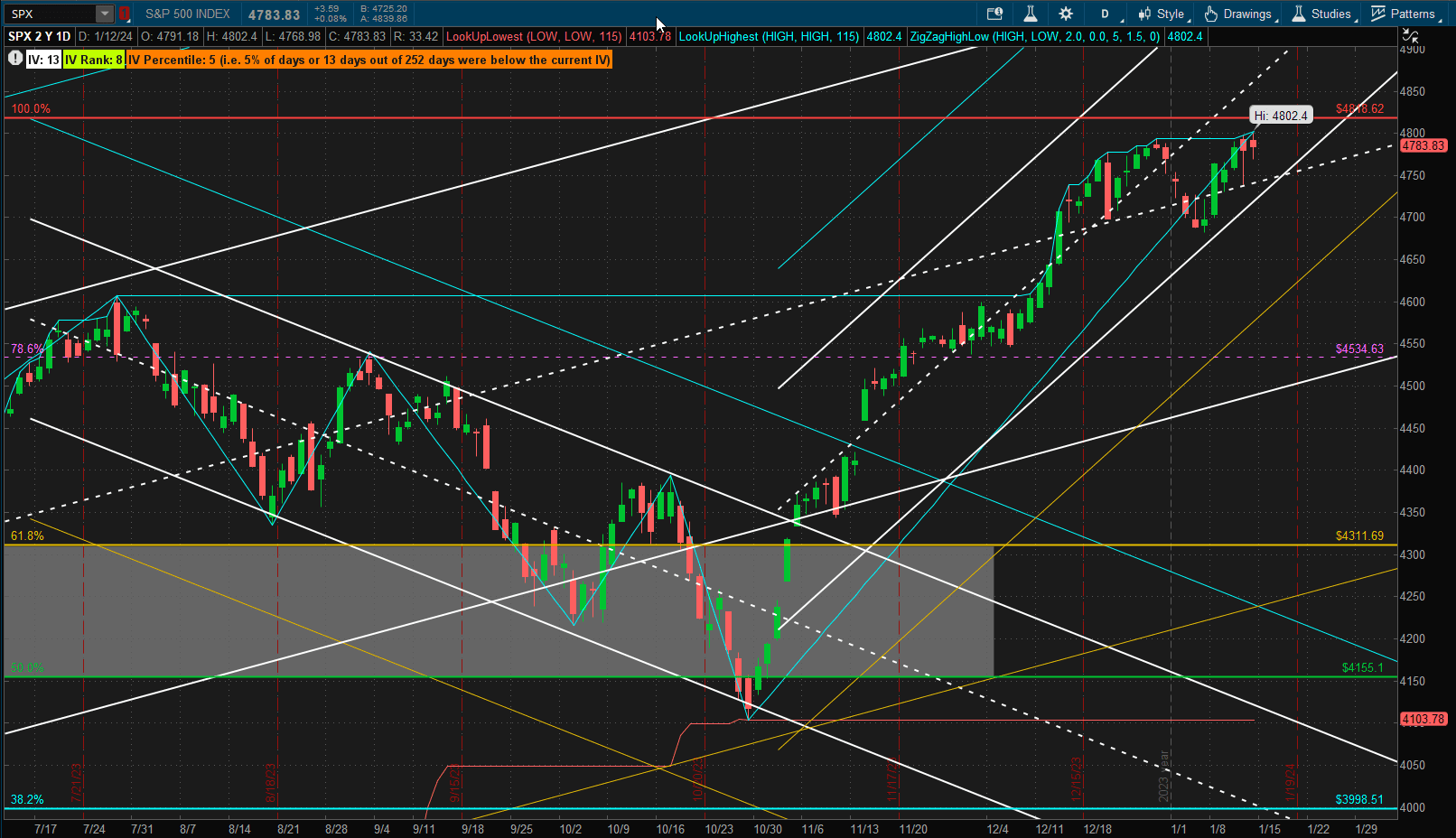

This may be the last time that you will see my usual chart of the SPX (S&P 500 Index) since my broker is kicking me off my preferred platform for analysis (ThinkOrSwim) and migrating my account to a new platform (that I haven’t yet been able to assess). In the past week we got a bounce from last week’s pullback and recovered to again test resistance at ~4800 – but were unable to close above this level:

we’ll have to wait to see what next week brings.

we’ll have to wait to see what next week brings.

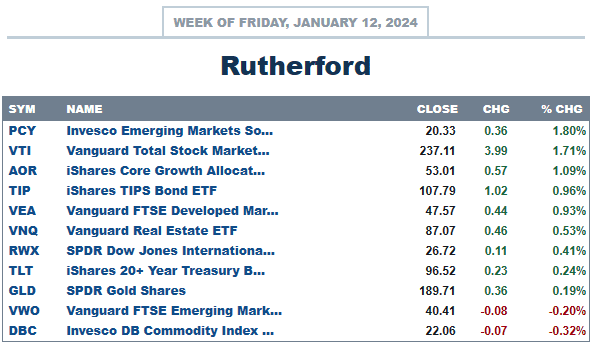

Relative to other major asset classes, US equities performed well:

finishing close to the top of the list with ~1.7% returns.

finishing close to the top of the list with ~1.7% returns.

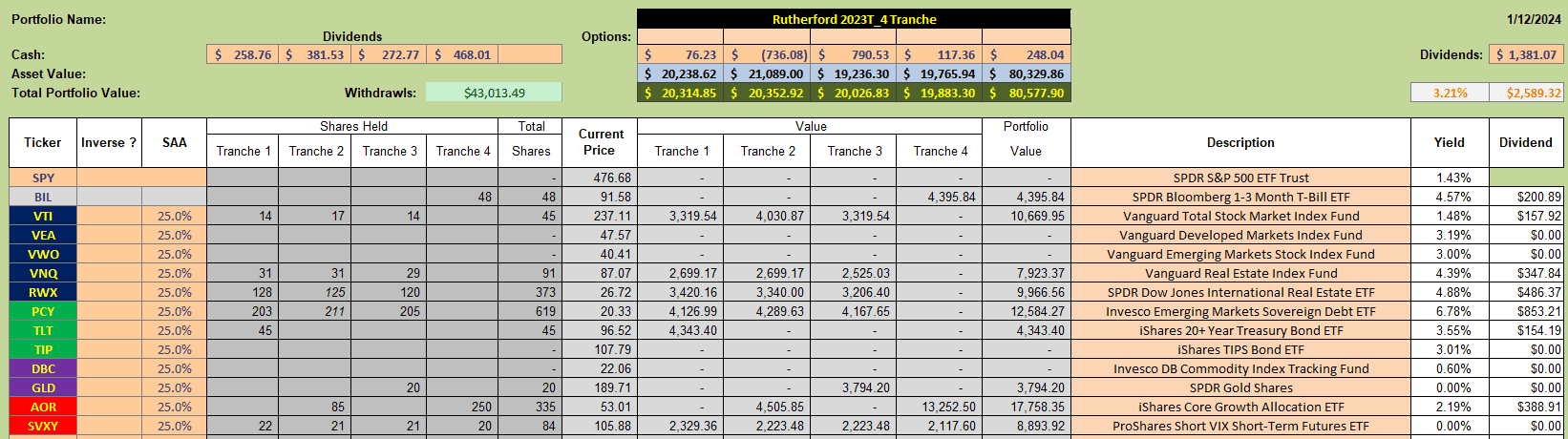

Current holdings in the Rutherford Portfolio look like this:

with major holdings in AOR (the benchmark fund), PCY (International Bonds) and VTI (US equities) – this week’s top 3 performing ETF’s. This resulted in the following performance:

with major holdings in AOR (the benchmark fund), PCY (International Bonds) and VTI (US equities) – this week’s top 3 performing ETF’s. This resulted in the following performance:

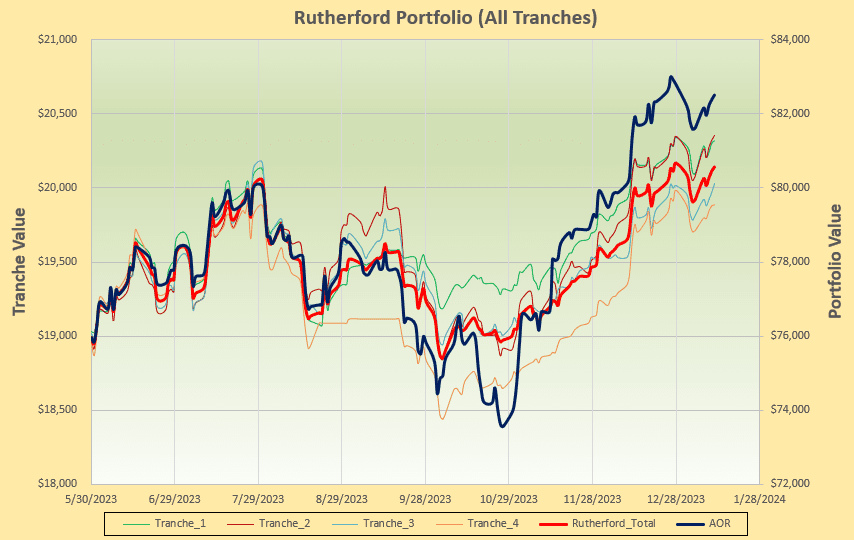

with the portfolio mirroring the performance of the benchmark.

with the portfolio mirroring the performance of the benchmark.

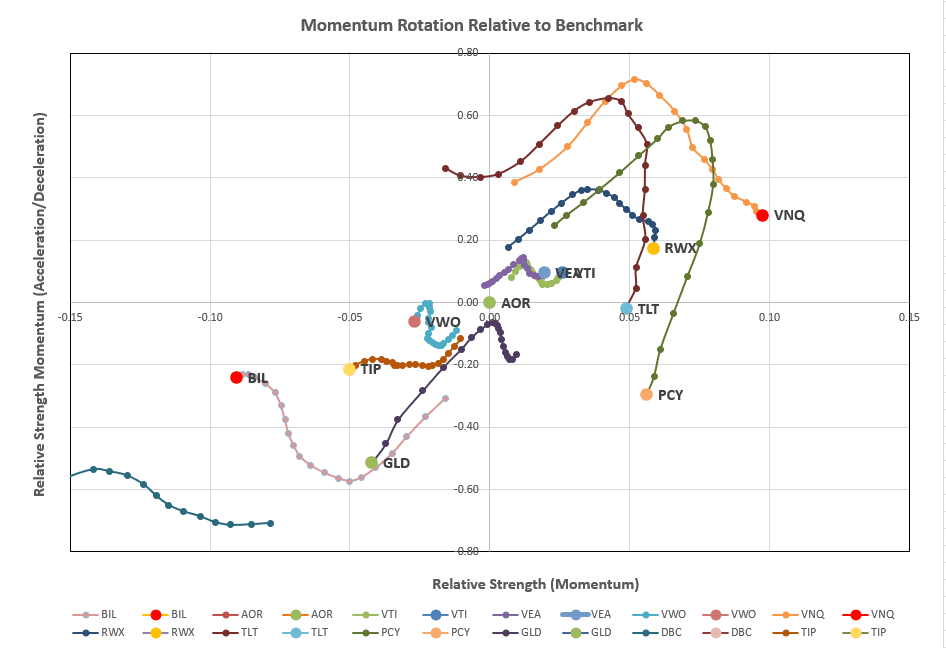

Tranche 1 (the focus of this week’s review) is holding positions in 5 “conventional” asset classes in addition to a ~10% holding in SVXY, a volatility ETF. So, we’ll check on the rotation graphs:

where we continue to see a number of assets in the desirable top right quadrant, albeit showing a slowing in longer term momenum as indicated by the top to bottom movement along the vertical axis (negative long-term acceleration or weaker short term strength – in some cases also negative). To help analyze the situation we’ll check the current recommendation from the rotation model algorithm being used to manage this portfolio:

where we continue to see a number of assets in the desirable top right quadrant, albeit showing a slowing in longer term momenum as indicated by the top to bottom movement along the vertical axis (negative long-term acceleration or weaker short term strength – in some cases also negative). To help analyze the situation we’ll check the current recommendation from the rotation model algorithm being used to manage this portfolio:

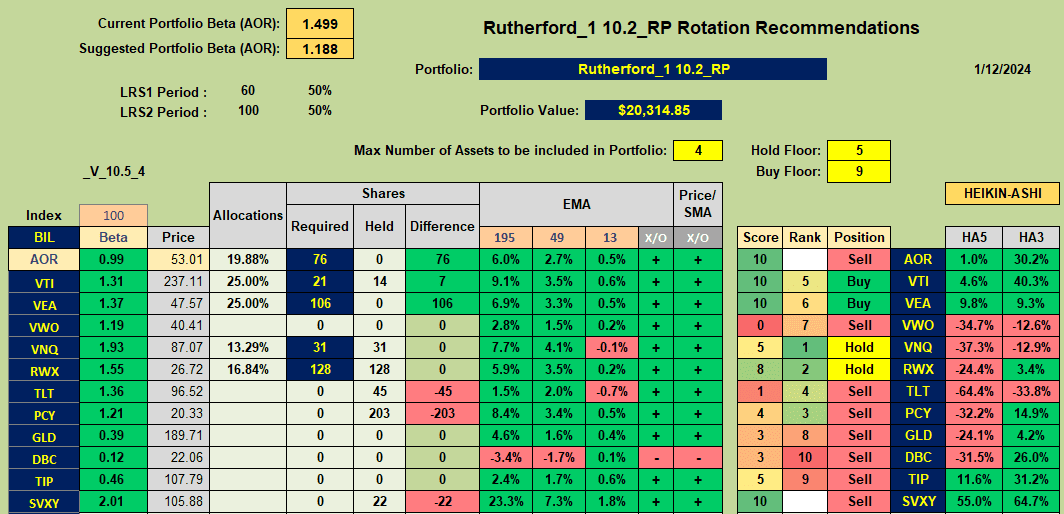

where we see Buy recommendations for VTI and VEA (equities) and Hold recommendations for VNQ and RWX (Real Estate). All other ETFs carry Sell recommendations.

where we see Buy recommendations for VTI and VEA (equities) and Hold recommendations for VNQ and RWX (Real Estate). All other ETFs carry Sell recommendations.

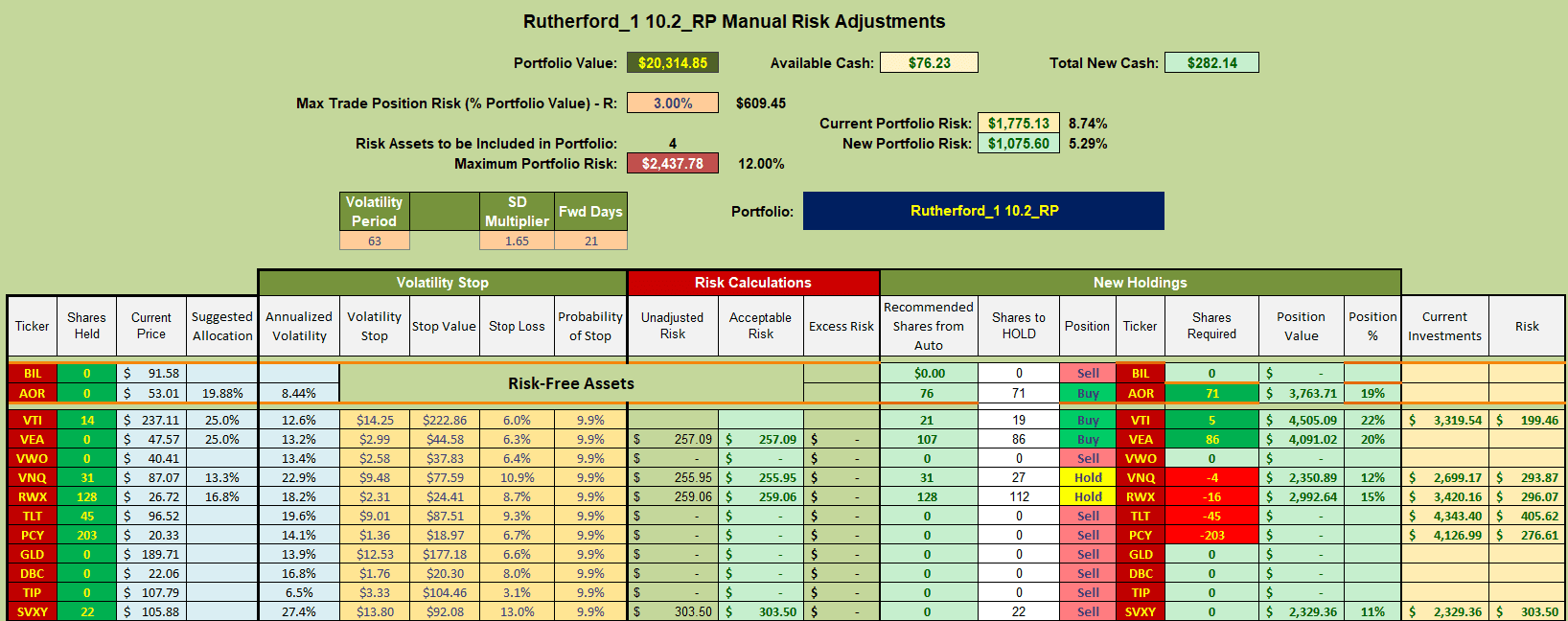

Consequently, this week’s adjustments will look something like this:

where I shall be selling current holdings (in Tranche 1) in TLT and PCY (Bonds) and using the proceeds to purchase shares in VEA and add to current holdings in VTI. I will not be selling any currently held shares in VNQ or RWX (to avoid trading costs) and I will use excess cash to add shares of AOR (since AOR is showing more strength than BIL).

where I shall be selling current holdings (in Tranche 1) in TLT and PCY (Bonds) and using the proceeds to purchase shares in VEA and add to current holdings in VTI. I will not be selling any currently held shares in VNQ or RWX (to avoid trading costs) and I will use excess cash to add shares of AOR (since AOR is showing more strength than BIL).

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

David,

I thought that Schwab was kicking us off StreetSmart Edge and forcing us Schwab users to use ThinkOrSwim. They are sponsoring webinars on how to use ThinkOrSwim, so am a bit confused about Schwab is actually doing.

~jim