Partial Remains of Hadrian’s Wall – a 73 Mile Fortress of the Roman Empire across the North of England

Partial Remains of Hadrian’s Wall – a 73 Mile Fortress of the Roman Empire across the North of England

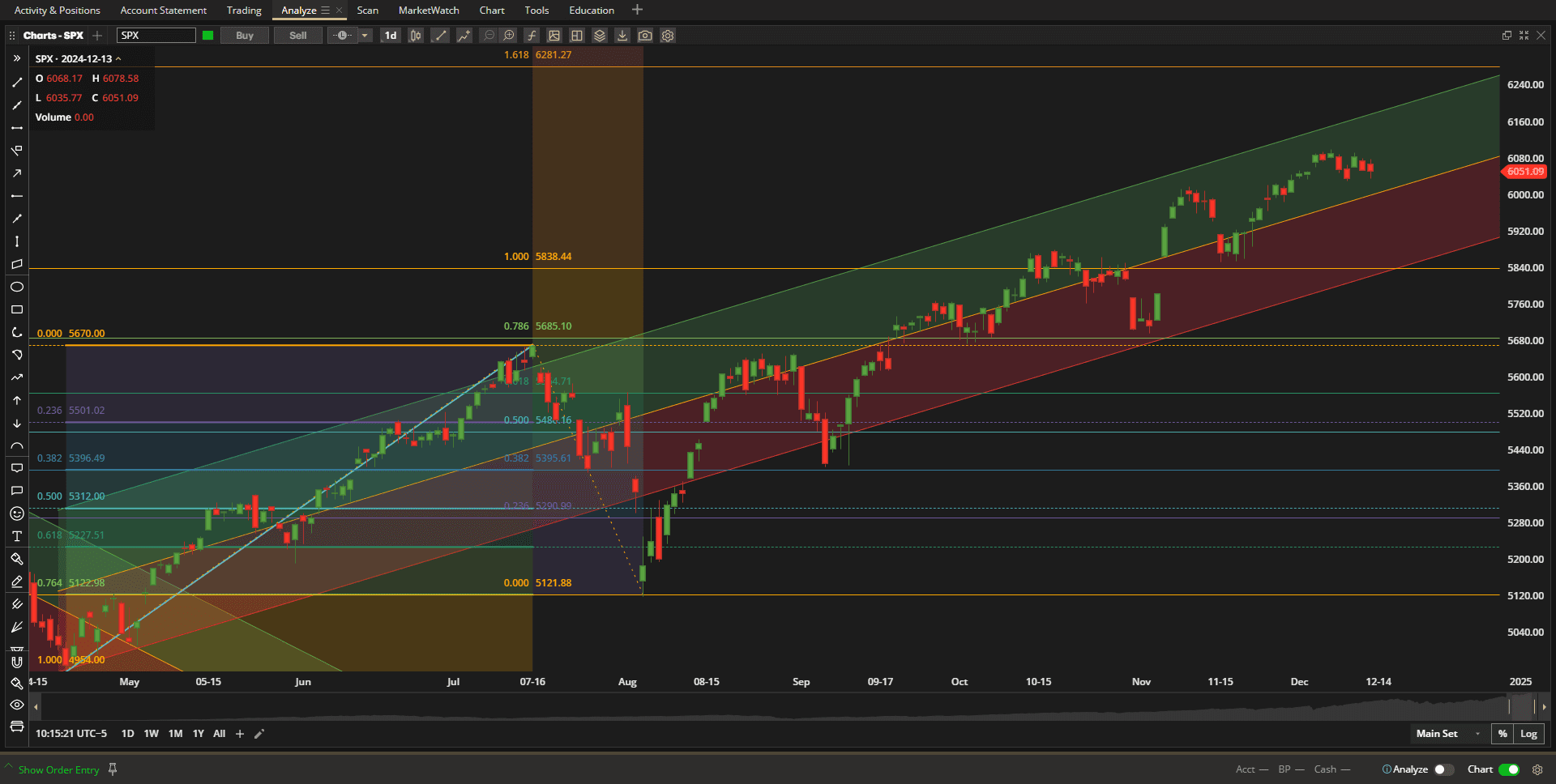

US equity markets were quiet again this week remaining in consolidation mode around the 6100 level in the SPX (S&P 500 Index):

Prices closed ~1% lower than last week’s close but Santa still has a couple of weeks to decide whether to stage a rally to the end of the year as we are still in a bullish uptrend with higher highs and higher lows.

Prices closed ~1% lower than last week’s close but Santa still has a couple of weeks to decide whether to stage a rally to the end of the year as we are still in a bullish uptrend with higher highs and higher lows.

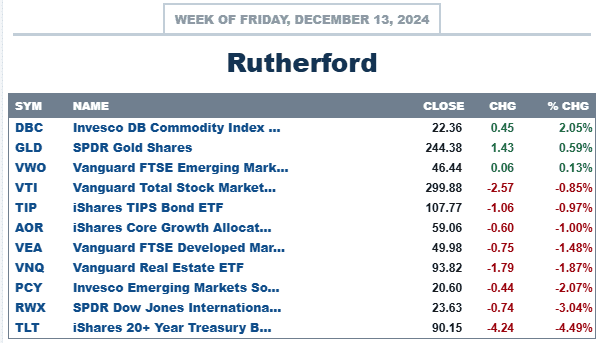

In terms of relative performance:

Commodities and Gold led the way with Emerging Market equities also showing positive returns.

Commodities and Gold led the way with Emerging Market equities also showing positive returns.

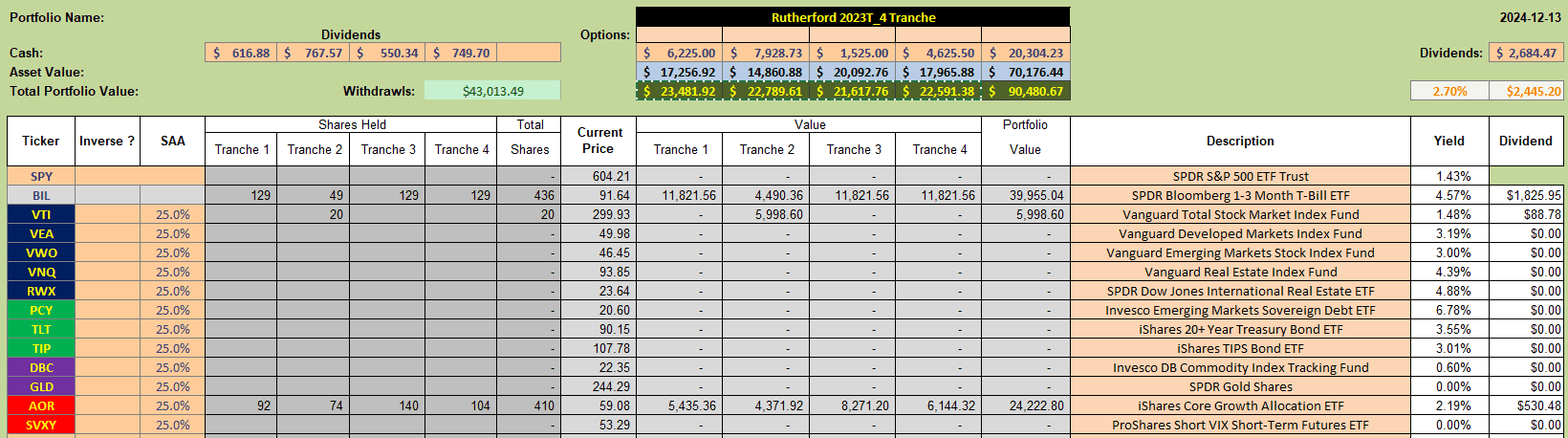

The Rutherford Portfolio is showing the following holdings as I wind down the use of this rotation model at the end of the year:

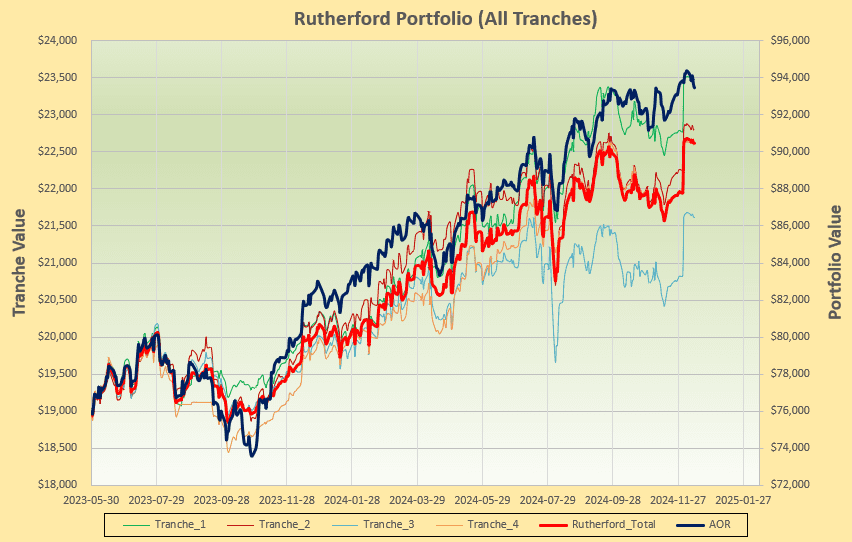

Because I am now only holding short-term T-Bills and the benchmark AOR Fund (apart from a small holding in VTI – US Equities – in Tranche 2) performance is showing little volatility:

Because I am now only holding short-term T-Bills and the benchmark AOR Fund (apart from a small holding in VTI – US Equities – in Tranche 2) performance is showing little volatility:

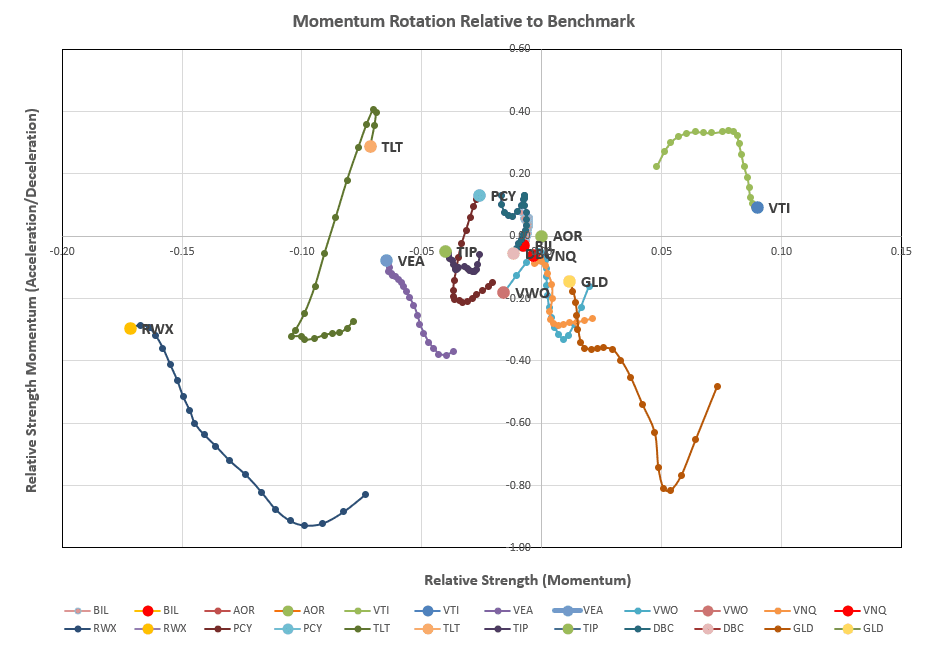

Taking a look at the rotation graphs:

Taking a look at the rotation graphs:

there is nothing to get exited about with only VTI showing up in the desirable top right quadrant.

there is nothing to get exited about with only VTI showing up in the desirable top right quadrant.

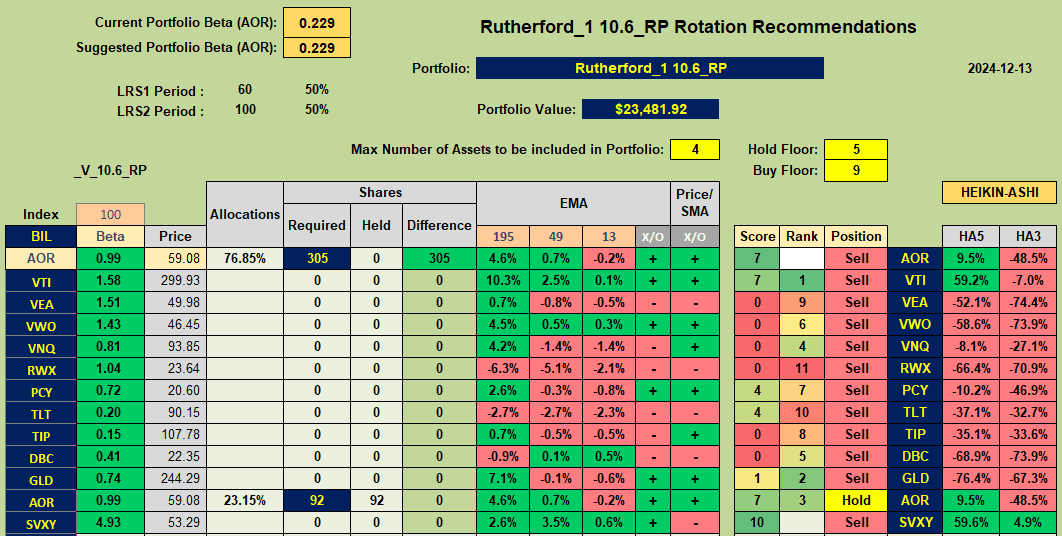

This is reflected in the ranking/recommendations sheet:

where all ETFs other than the benchmark AOR Fund are showing Sell recommendations with AOR as a Hold.

where all ETFs other than the benchmark AOR Fund are showing Sell recommendations with AOR as a Hold.

There will be no adjustments to the Rutherford Portfolio this week and next week will see the sale of the VTI shares as we review Tranche 2 and close down this rotation model.

I have found it a little frustrating managing to this model since it seems, intuitively, that the rotation signals should be effective as they provide a lot of (what would seem to be) useful information. However, I have not been able to utilize this information in an algorithm that results in better performance than other momentum models and, since I haven’t been able to beat the benchmark AOR fund over the past 18 month period, I am going to discontinue using this model.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Leave a Comment or Question