Maori Haka (War Dance), New Zealand

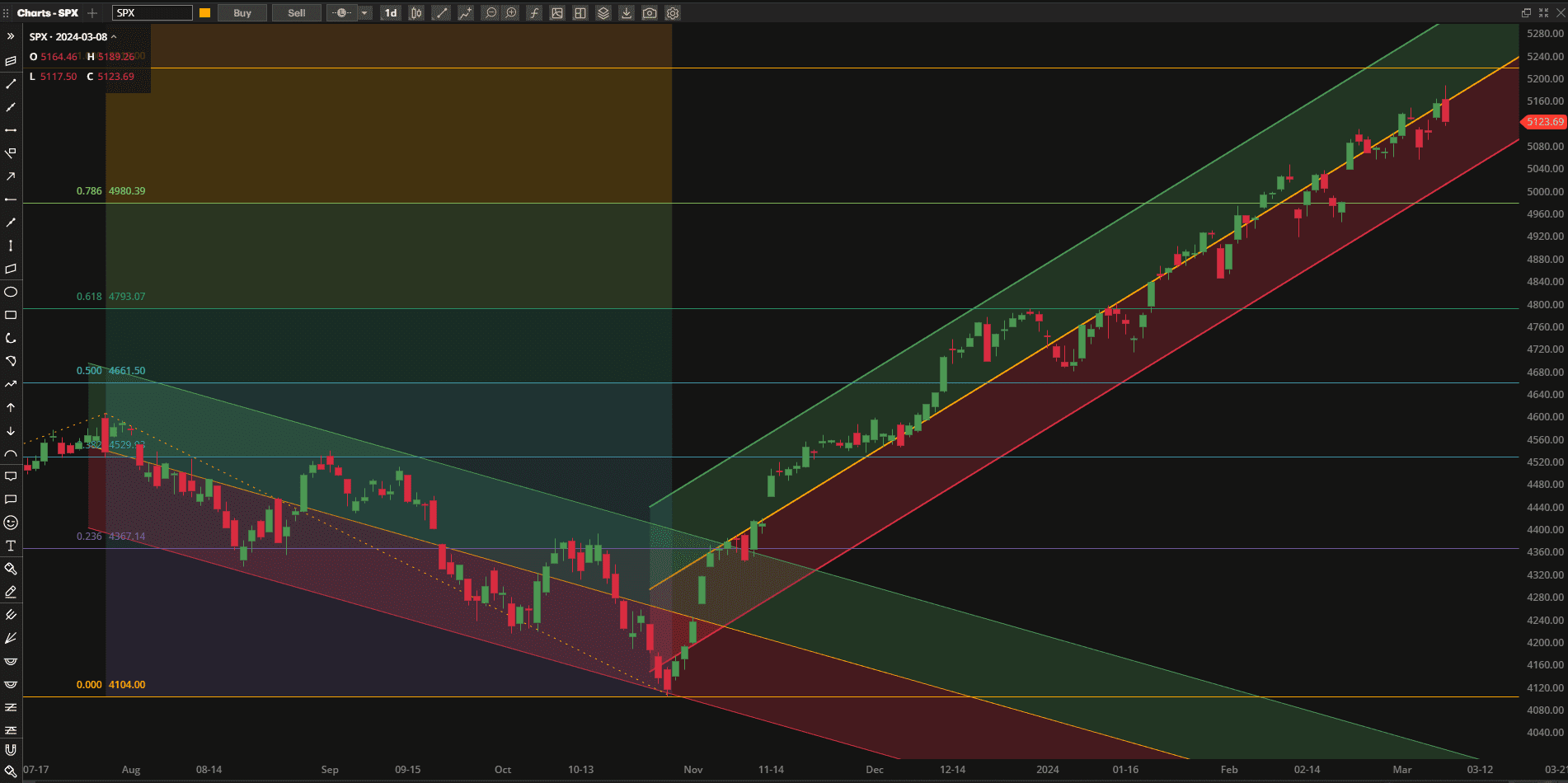

US Equities continue their climb towards the 5200 level but slowed down a little this week as they approach this potential resistance level:

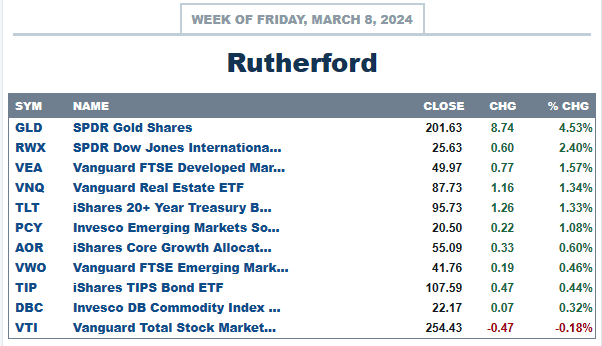

In fact, VTI (representing the US Equity markets) closed down slightly (~-0.2%) on the week and was the poorest performing ETF in the major asset class list:

In fact, VTI (representing the US Equity markets) closed down slightly (~-0.2%) on the week and was the poorest performing ETF in the major asset class list:

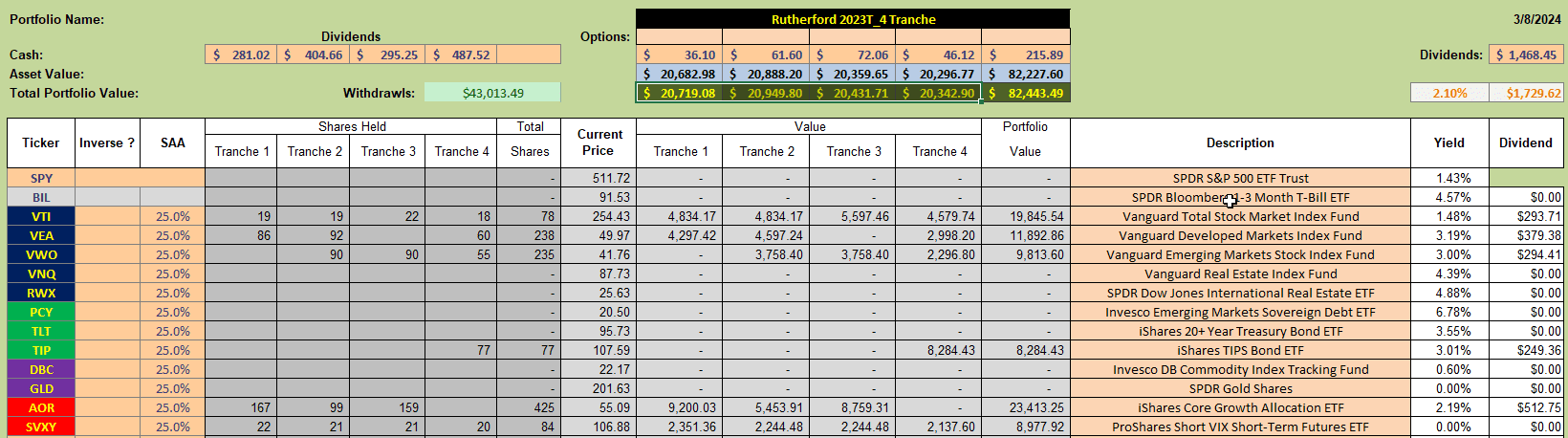

The rotation algorithm being used to manage the Rutherford Portfolio seems to be a little out of sync right now with the portfolio being heavily weighted towards equities:

The rotation algorithm being used to manage the Rutherford Portfolio seems to be a little out of sync right now with the portfolio being heavily weighted towards equities:

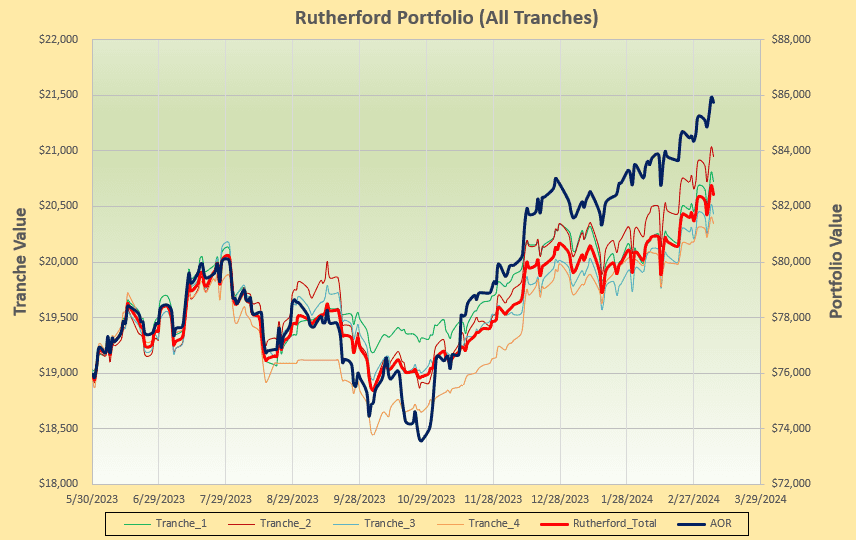

having sold out of GLD (Gold) – the week’s top performing asset class – in tranches 3 and 4 over the past 2 weeks. However, in terms of performance relative to the diversified AOR benchmark fund we have not lost too much ground:

having sold out of GLD (Gold) – the week’s top performing asset class – in tranches 3 and 4 over the past 2 weeks. However, in terms of performance relative to the diversified AOR benchmark fund we have not lost too much ground:

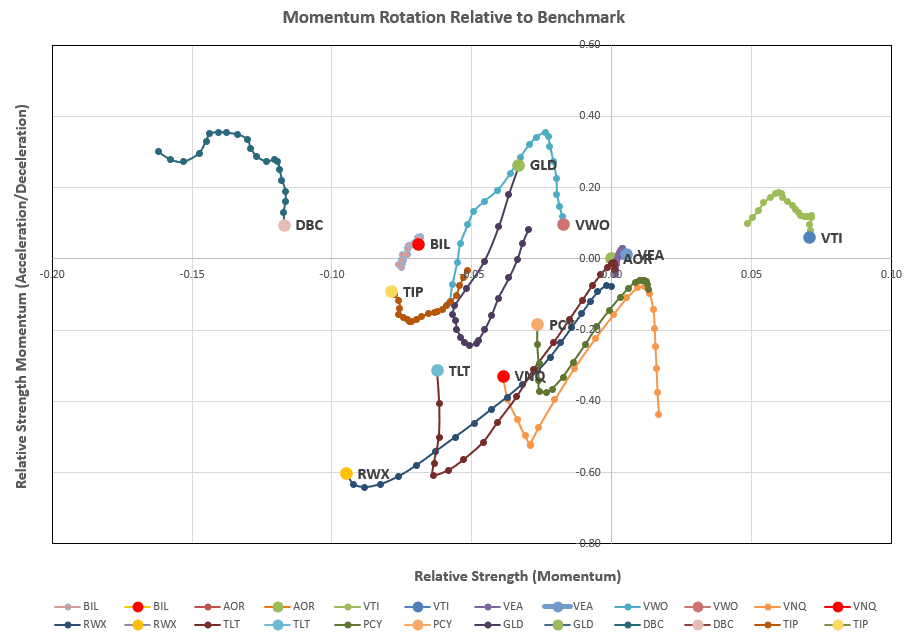

So, we check on the rotation graphs to see whether the picture has changed significantly and whether adjustments are called for in Tranche 1 of the portfolio (the focus of this week’s review):

So, we check on the rotation graphs to see whether the picture has changed significantly and whether adjustments are called for in Tranche 1 of the portfolio (the focus of this week’s review):

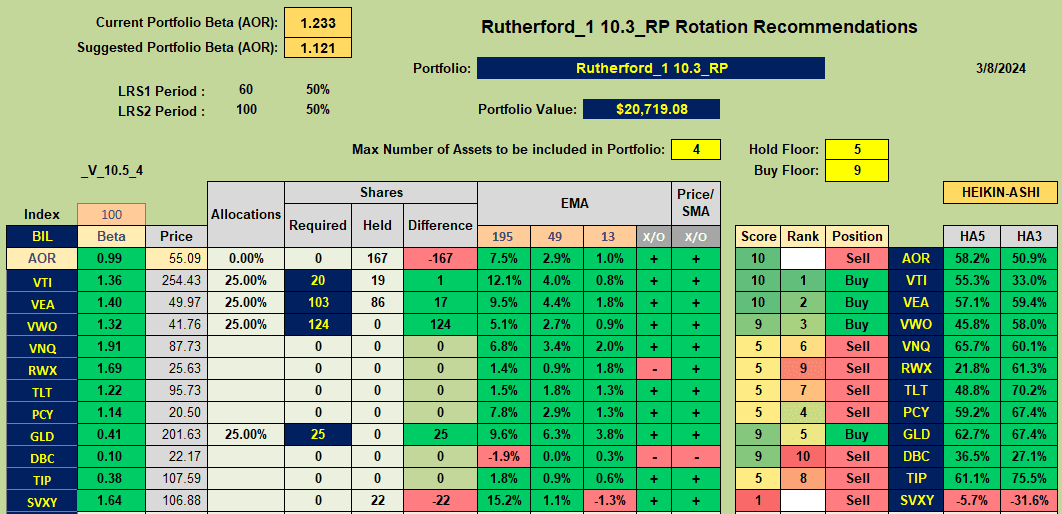

From the above we still see only VTI firmly entrenched in the desirable upper right quadrant, although weakening (decelerating) in terms of relative strength. Checking the detailed recommendations:

From the above we still see only VTI firmly entrenched in the desirable upper right quadrant, although weakening (decelerating) in terms of relative strength. Checking the detailed recommendations:

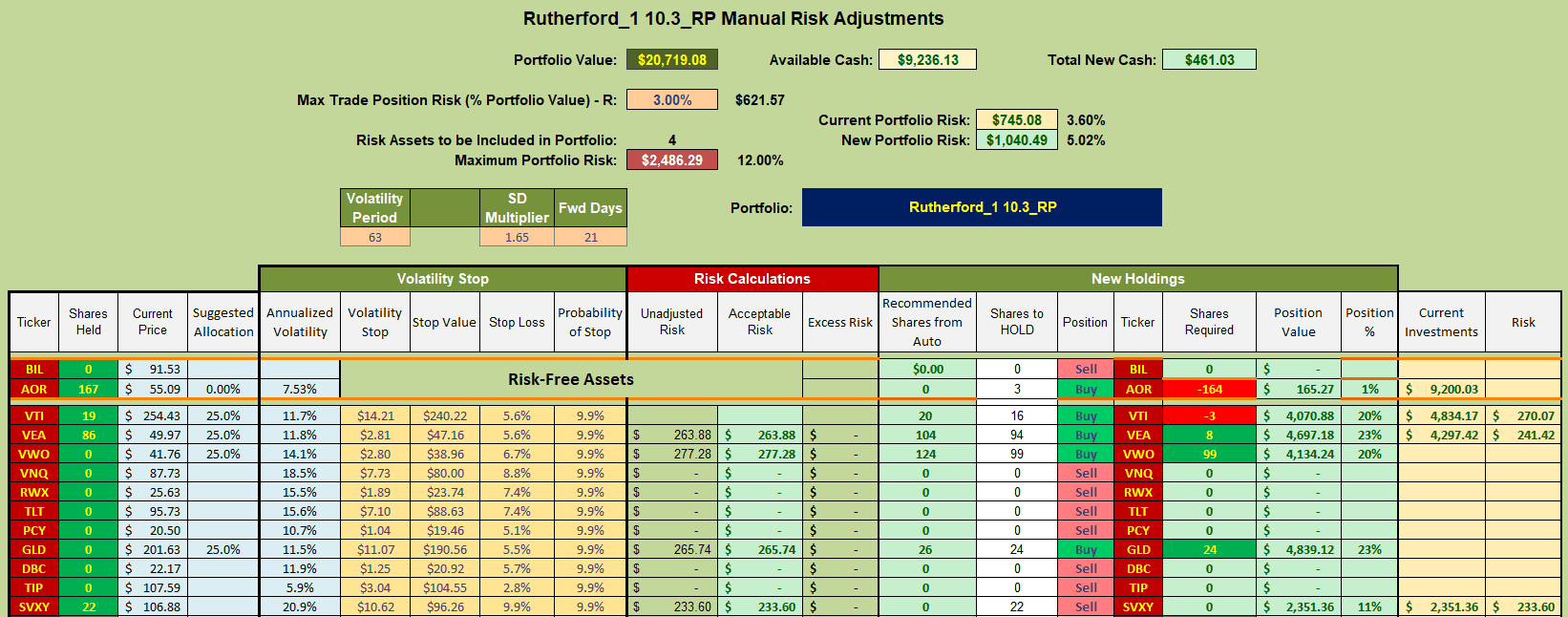

we still see global equities showing Buy recommendations with GLD coming back into Buy territory. This is a little scary after the recent surge in GLD, but we’ll stick with the recommendations since each tranche represents only 25% of the total portfolio and we should not get whiplashed too badly should we see a pullback in GLD. The adjustments for next week will look something like this:

we still see global equities showing Buy recommendations with GLD coming back into Buy territory. This is a little scary after the recent surge in GLD, but we’ll stick with the recommendations since each tranche represents only 25% of the total portfolio and we should not get whiplashed too badly should we see a pullback in GLD. The adjustments for next week will look something like this:

where I shall be selling my holdings in AOR (the benchmark fund) and using proceeds to add positions in VWO and GLD. I will not worry about the minor adjustments to VTI and VEA (presently held in this Tranche 1).

where I shall be selling my holdings in AOR (the benchmark fund) and using proceeds to add positions in VWO and GLD. I will not worry about the minor adjustments to VTI and VEA (presently held in this Tranche 1).

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.