Harbour at Greystones, Dublin, Ireland

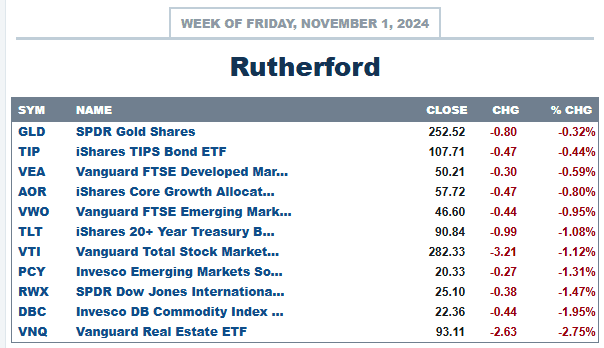

It was a disappointing week everywhere in the markets with all the major asset classes showing negative returns:

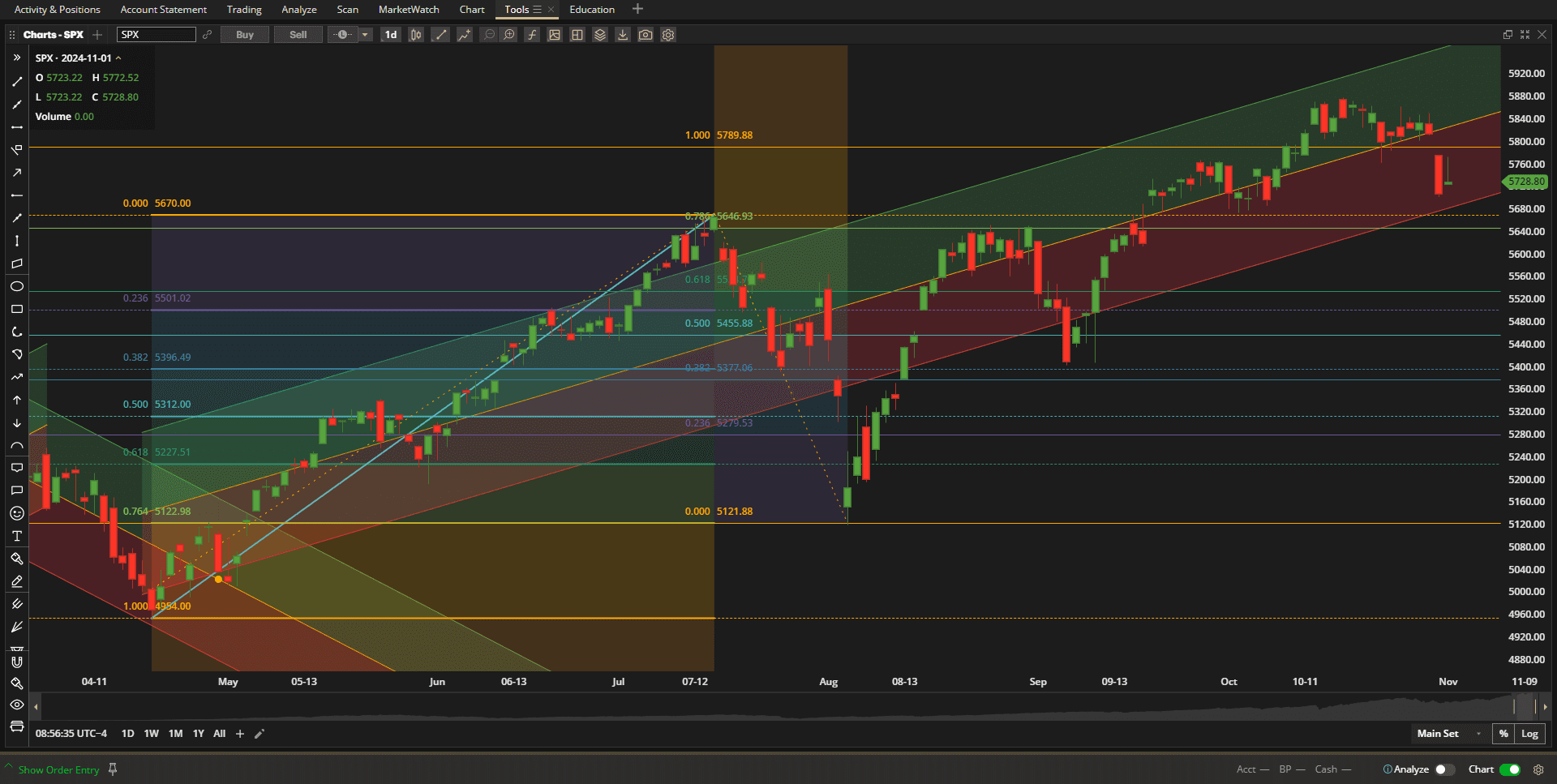

US Equities were in the middle of the list with prices dropping through the 5800 support/resistance zone in the SPX (S&P 500 Index) and closing near the bottom of the bullish trend channel:

US Equities were in the middle of the list with prices dropping through the 5800 support/resistance zone in the SPX (S&P 500 Index) and closing near the bottom of the bullish trend channel:

This is normal trend behavior and price would have to drop much further, below ~5400, before we might think about confirming a change in trend. To the upside, if we can test and penetrate the 5800 resistance area again, and takeout previous highs (~5880), we might easily see prices reach the psychologically important (round number) 6000 level perhaps by the end of the year – that is typically a seasonally bullish period for stocks.

This is normal trend behavior and price would have to drop much further, below ~5400, before we might think about confirming a change in trend. To the upside, if we can test and penetrate the 5800 resistance area again, and takeout previous highs (~5880), we might easily see prices reach the psychologically important (round number) 6000 level perhaps by the end of the year – that is typically a seasonally bullish period for stocks.

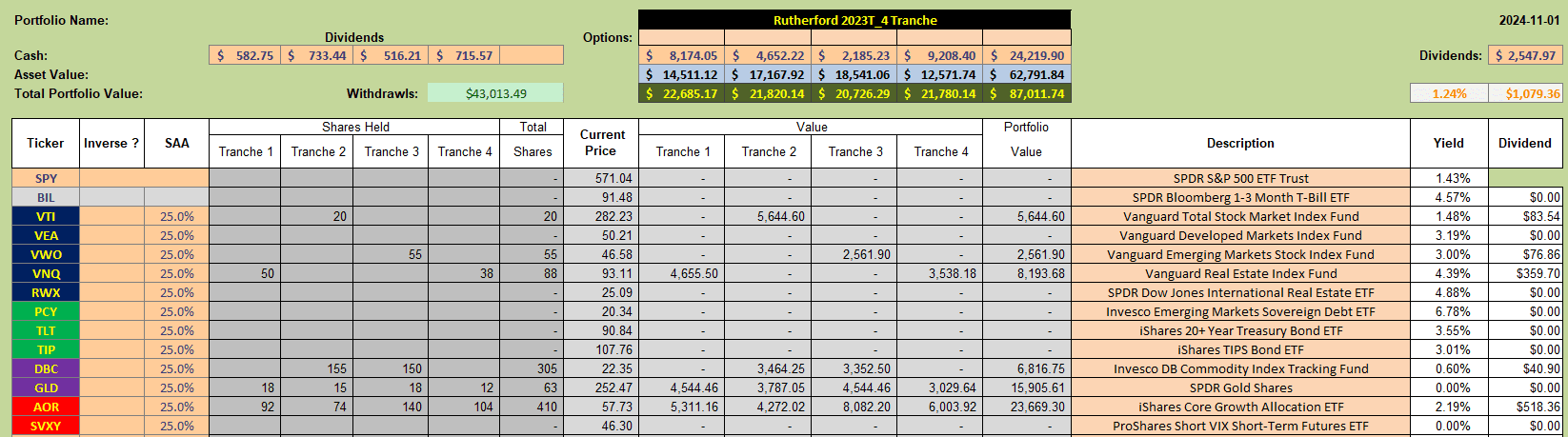

As reported in previous reviews of the Rutherford Portfolio I am in the process of cutting back in positions so as to free up funds that I am required to withdraw from my accounts before the end of the year. Current holdings in the portfolio look like this:

and I have, in fact, withdrawn another $17,100 from this account. I am not showing this as withdrawn – in the spreadsheet – at the moment, since it would distort the performance graphs that are shown below:

and I have, in fact, withdrawn another $17,100 from this account. I am not showing this as withdrawn – in the spreadsheet – at the moment, since it would distort the performance graphs that are shown below:

Thus, I am still showing ~$24,000 as being held in Cash.

Thus, I am still showing ~$24,000 as being held in Cash.

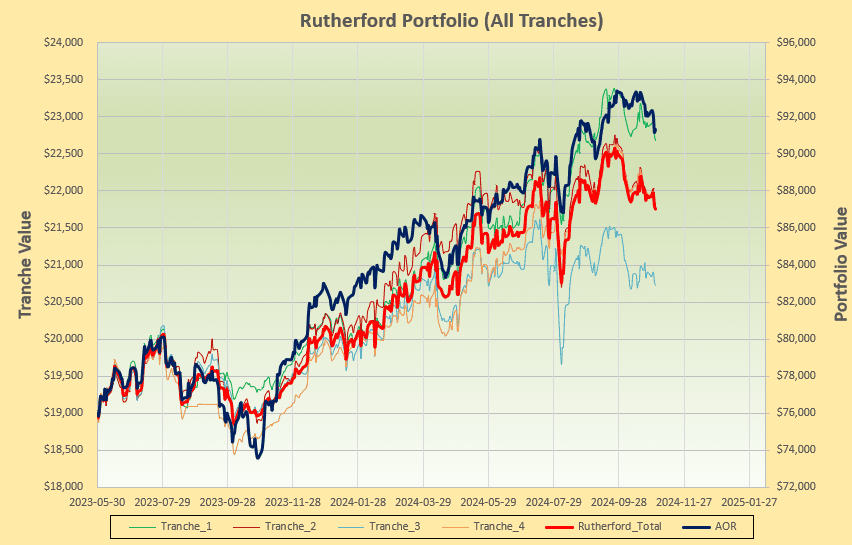

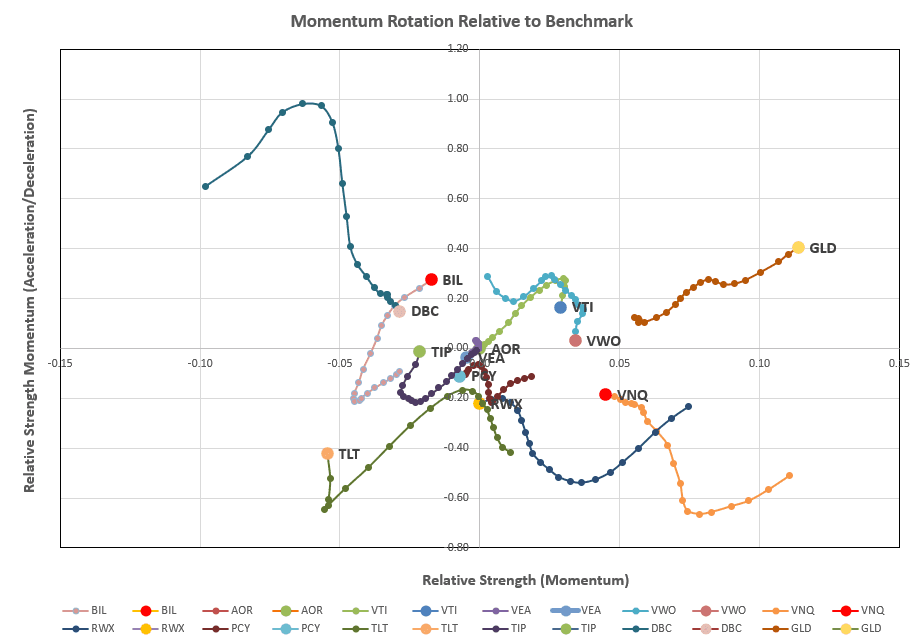

Checking this week’s rotation graphs:

we see that GLD (Gold) is the only major asset class showing both short- and long-term strength (moving upwards vertically and to the right horizontally).

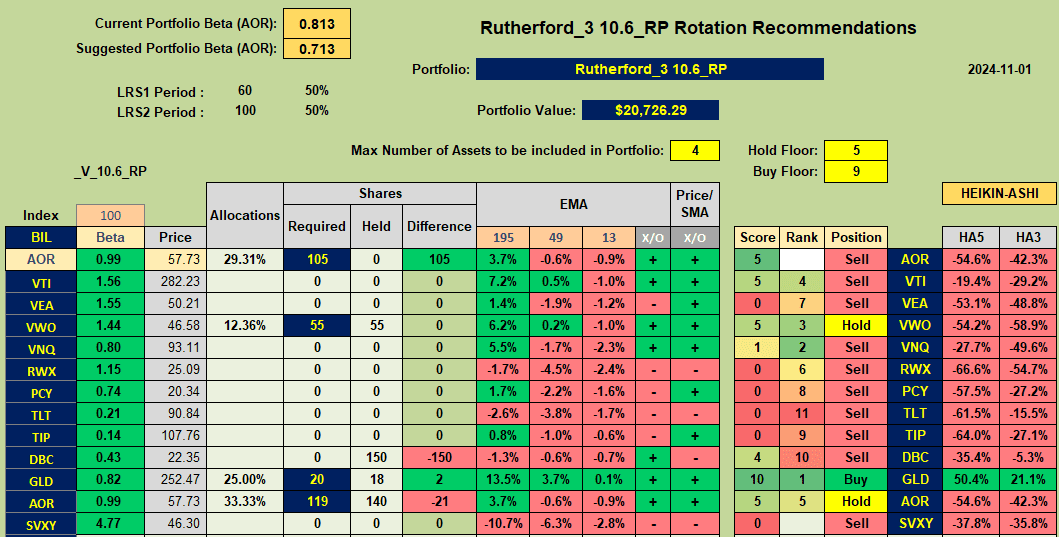

Rankings and recommendations from the rotation model look like this:

with GLD getting a Buy recommendation and VWO and AOR collecting Hold recommendations. DBC (Commodities) slips to a Sell as a result of weakness in Oil prices.

with GLD getting a Buy recommendation and VWO and AOR collecting Hold recommendations. DBC (Commodities) slips to a Sell as a result of weakness in Oil prices.

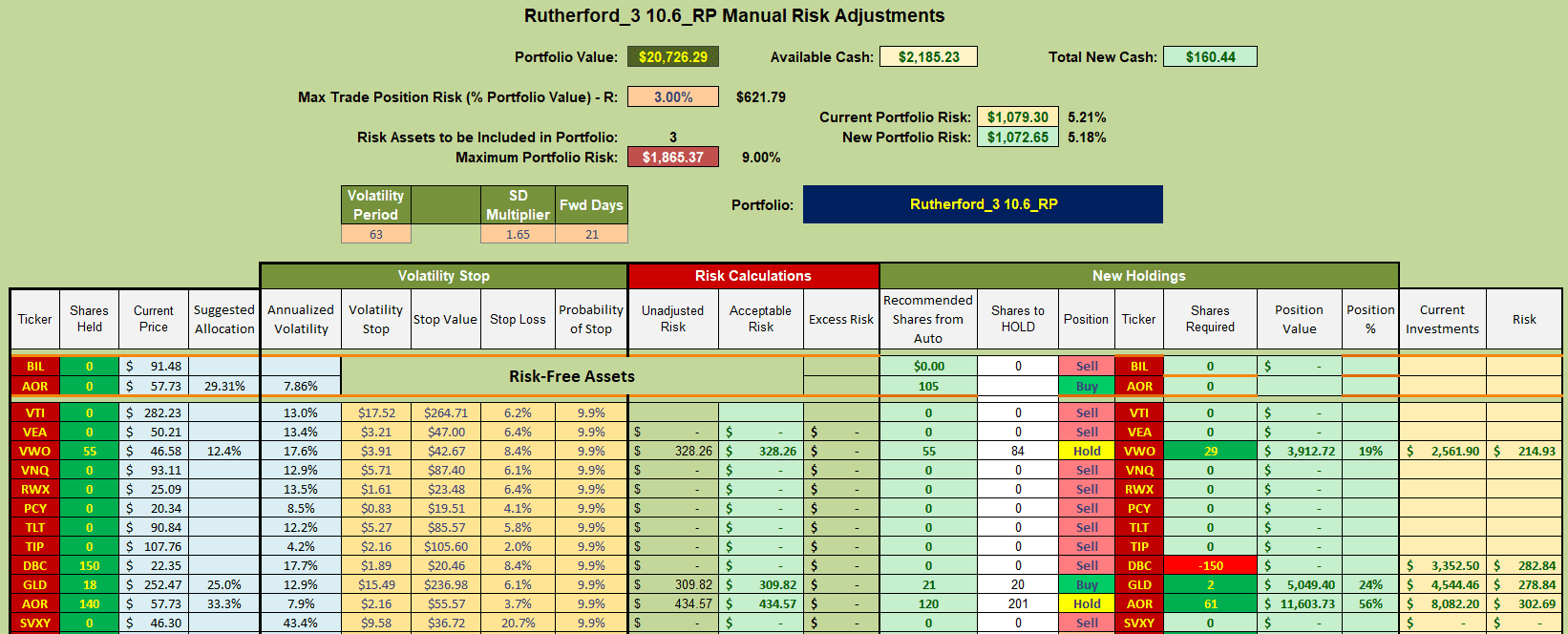

Adjustments for next week look like this:

This means that I shall be selling 150 shares in DBC. Since there are no new Buy recommendations outside of current holdings I will just keep the proceeds in Cash (or maybe BIL) until I have decided how I want to manage this portfolio going forward. It seems as though momentum systems have lost efficacy/edge over the past ~5 years and, although still probably valid, the impact of review date (timing) luck seems to make it difficult to keep up with simply buying and holding a benchmark ETF. However, this has no downside protection and will suffer when we see a bullback/reversal in trend.

This means that I shall be selling 150 shares in DBC. Since there are no new Buy recommendations outside of current holdings I will just keep the proceeds in Cash (or maybe BIL) until I have decided how I want to manage this portfolio going forward. It seems as though momentum systems have lost efficacy/edge over the past ~5 years and, although still probably valid, the impact of review date (timing) luck seems to make it difficult to keep up with simply buying and holding a benchmark ETF. However, this has no downside protection and will suffer when we see a bullback/reversal in trend.

I will wait and watch market performance once the elections are over 🙂

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Leave a Comment or Question