Tugboat, Cairns, Australia

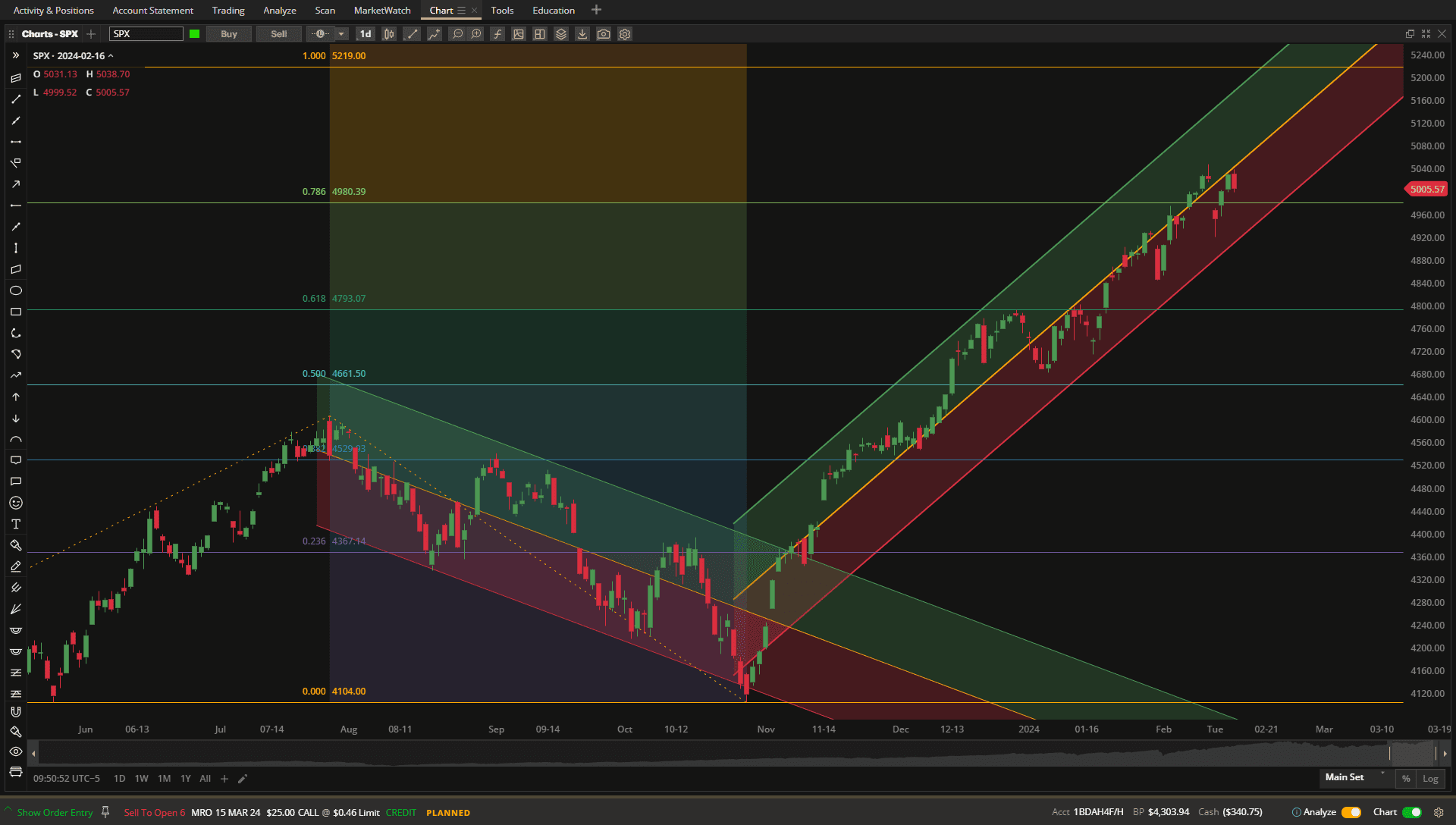

US Equities were basically flat on the week with the SPX closing down slightly although still near the center of the bullish trend channel:

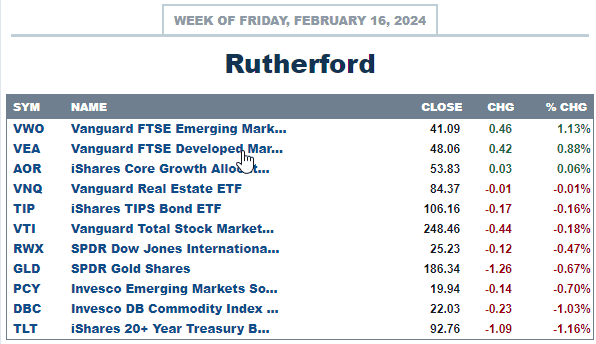

and with the performance of the broader based VTI Fund coming in around the middle of the pack for all major asset classes:

and with the performance of the broader based VTI Fund coming in around the middle of the pack for all major asset classes:

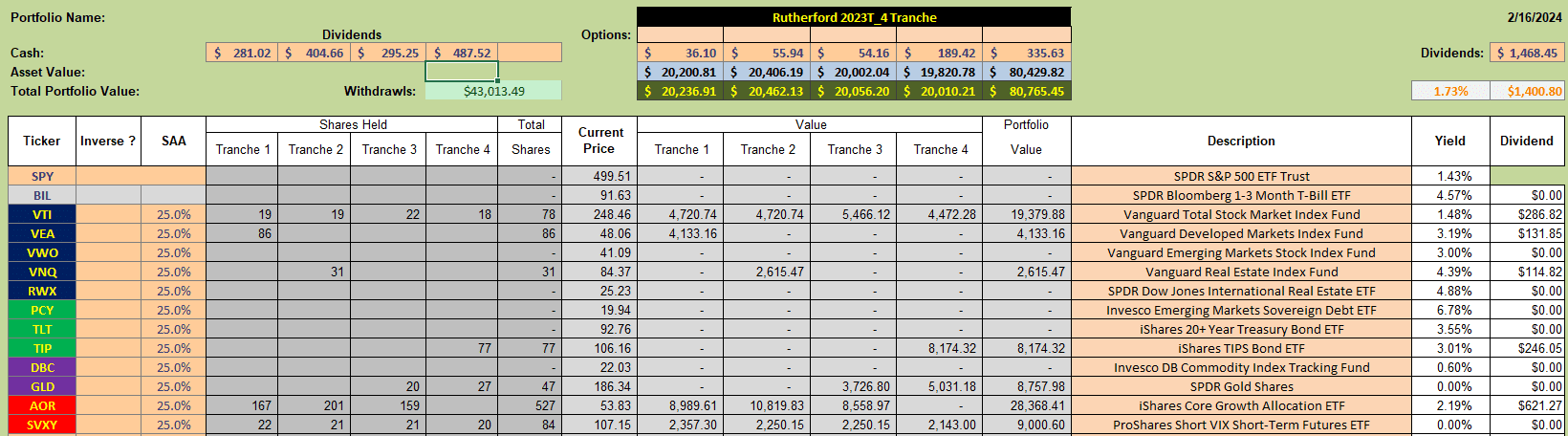

Current holdings in the Rutherford Portfolio look like this:

Current holdings in the Rutherford Portfolio look like this:

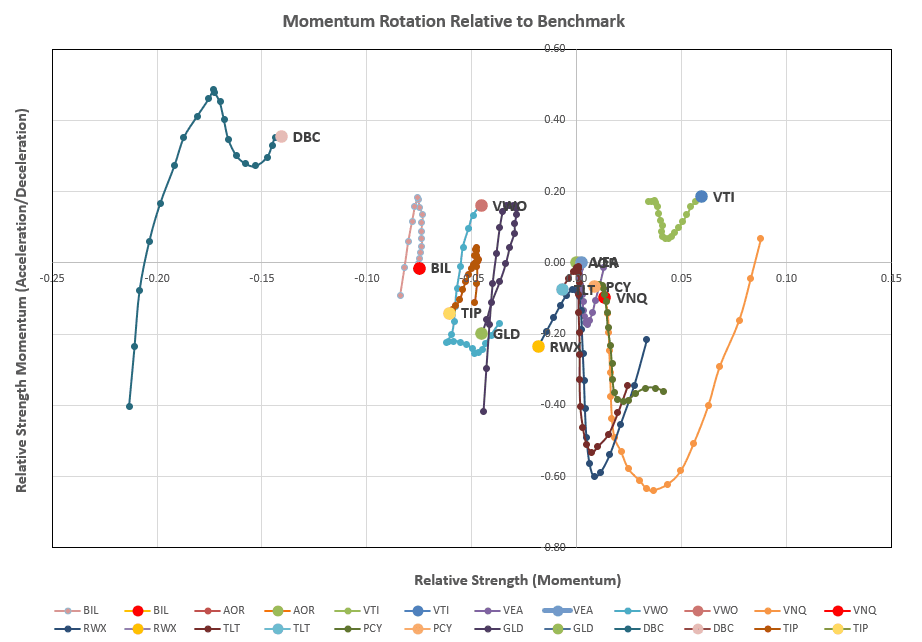

and this week we focus on Tranche 2 to look for possible adjustments. As usual we first take a look at the current rotation graphs:

and this week we focus on Tranche 2 to look for possible adjustments. As usual we first take a look at the current rotation graphs:

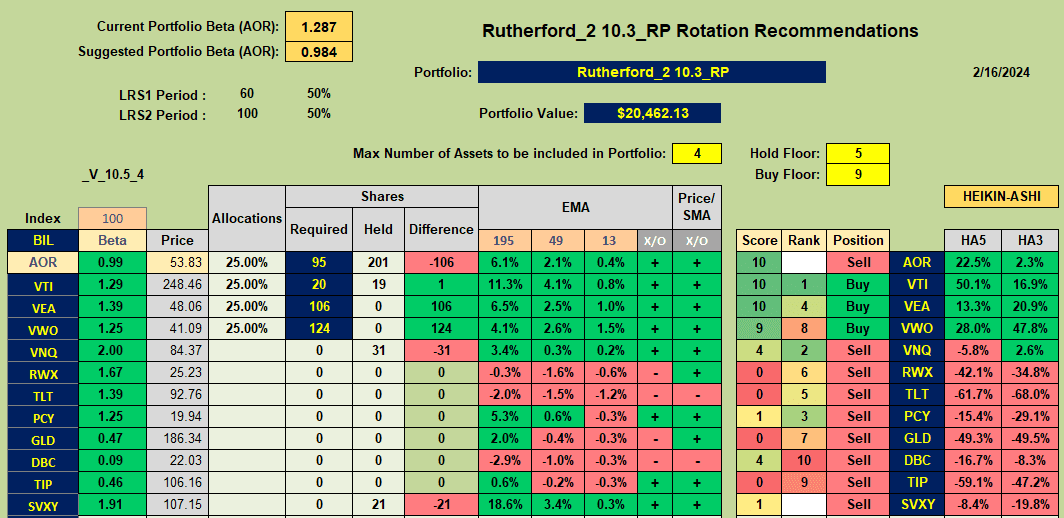

where we see that US equities (VTI) is still the only asset class showing strength in that top right-hand quadrant – so we move to the recommendation sheet:

where we see that US equities (VTI) is still the only asset class showing strength in that top right-hand quadrant – so we move to the recommendation sheet:

where we see additional recommendations to Buy shares in other equity markets based on recent short-term strength and positive signals from the 13/49-day EMA crossovers. VNQ (US Real Estate) that is currently held in Tranche 2 is a Sell recommendation. This week’s adjustments will therefore look something like this:

where we see additional recommendations to Buy shares in other equity markets based on recent short-term strength and positive signals from the 13/49-day EMA crossovers. VNQ (US Real Estate) that is currently held in Tranche 2 is a Sell recommendation. This week’s adjustments will therefore look something like this:

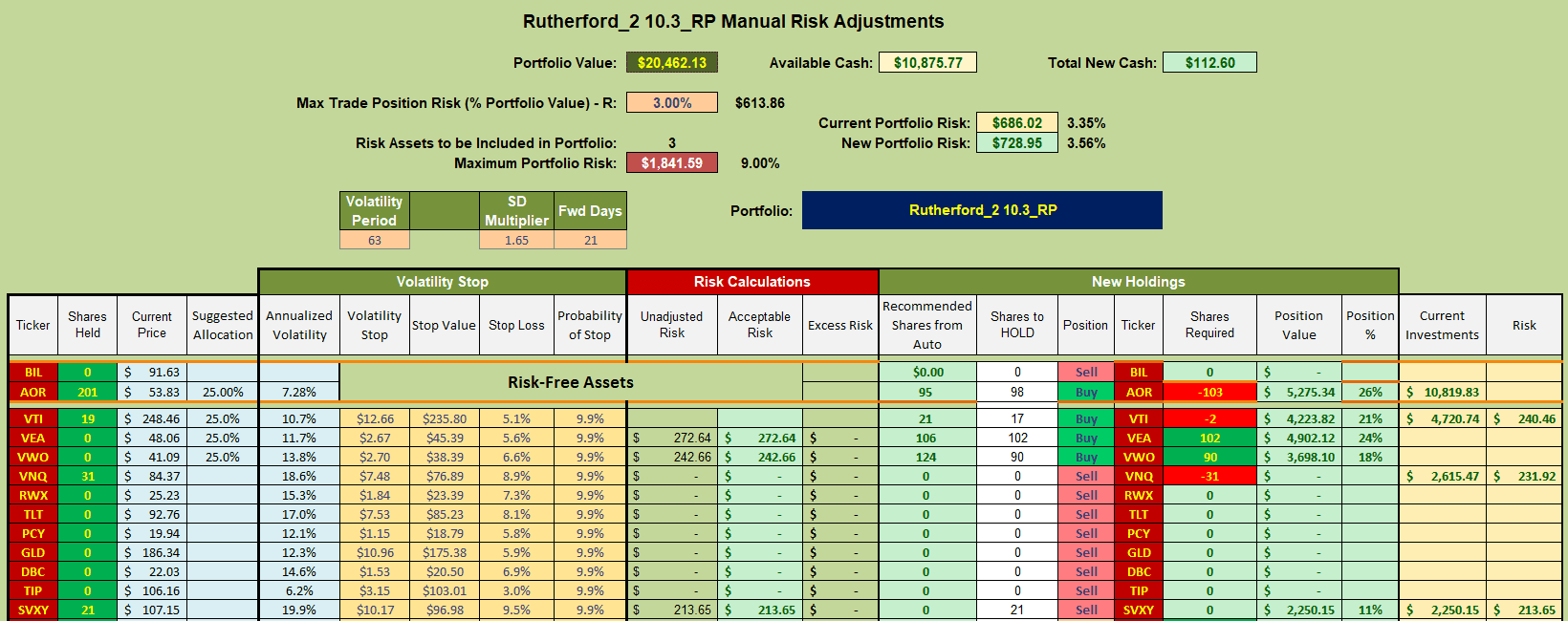

where the funds generated from the sale of shares in VNQ will be used to buy shares in VEA and VWO. In order to purchase the recommended number of shares in each of these ETFs I will also need to sell a portion (roughly half) of my current holdings in AOR (the benchmark Fund). However, if I wanted to save a few dollars in trading costs I could just as easily hold onto those shares since the Fund holds ~ 60/40 in equities and bonds, including international exposure, and simply use available funds to buy a few less shares in each of the 2 international equity funds – the difference in the impact of adopting either approach is likely minimal.

where the funds generated from the sale of shares in VNQ will be used to buy shares in VEA and VWO. In order to purchase the recommended number of shares in each of these ETFs I will also need to sell a portion (roughly half) of my current holdings in AOR (the benchmark Fund). However, if I wanted to save a few dollars in trading costs I could just as easily hold onto those shares since the Fund holds ~ 60/40 in equities and bonds, including international exposure, and simply use available funds to buy a few less shares in each of the 2 international equity funds – the difference in the impact of adopting either approach is likely minimal.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Leave a Comment or Question