“Secret Gardens”, Koh Samui, Thailand

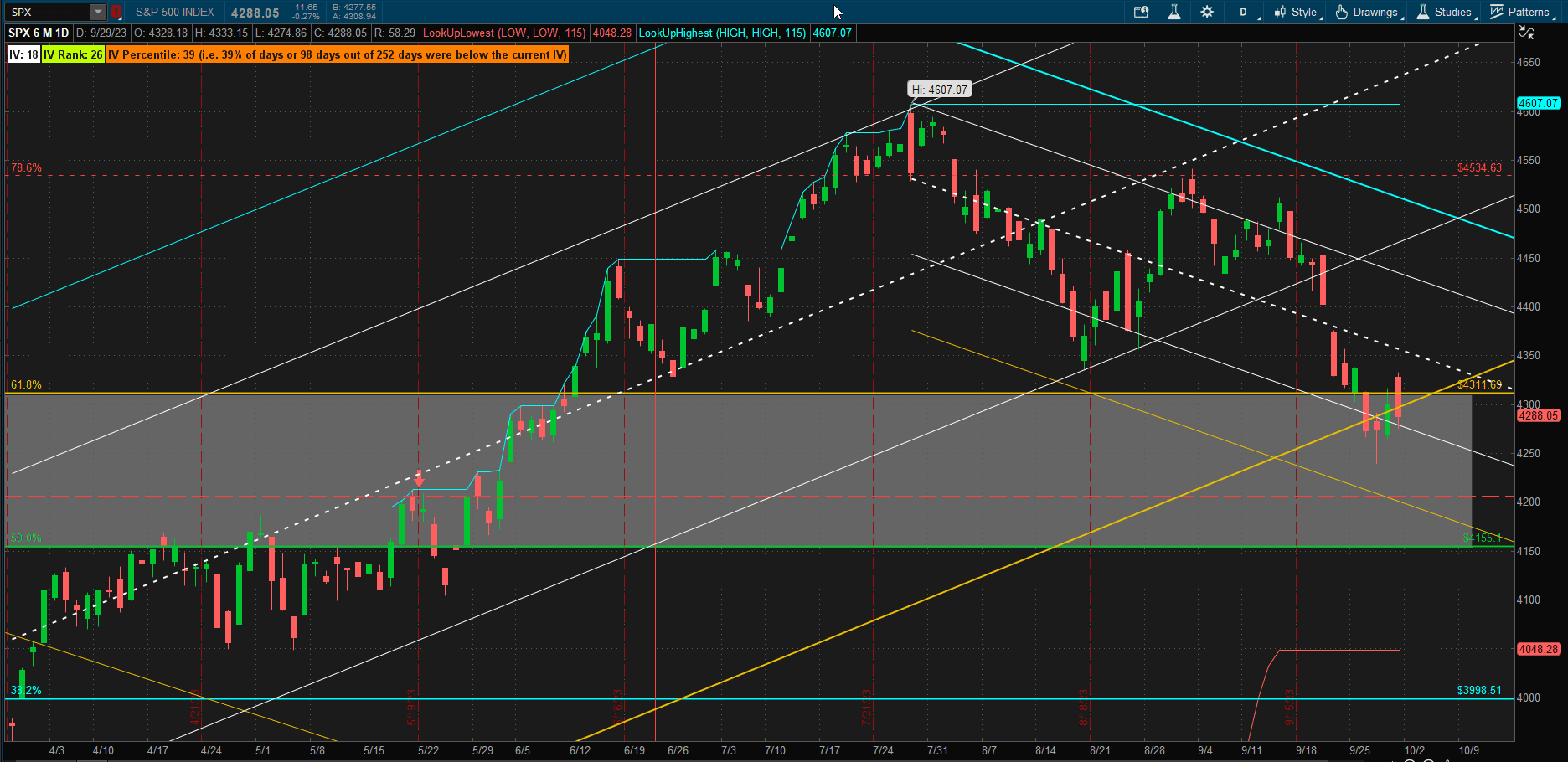

Last week US equities closed at ~4320 and sitting at the top of a potential support zone (4150-4300). The question was whether we would see support at this level (and a bounce) or whether we would see a continuation of the short-term downtrend that we have been in for the past couple of months.

The beginning of the week saw a continuation of the downtrend – technically confirming the downtrend by establishing lower lows following earlier lower highs. However the market found support at the 2 SD lower boundary (yellow line) of the prior uptrend – so we need to be a little careful here before predicting gloom and doom. We saw a bounce on Thursday but some of the gains were given back on Friday with the index closing 0.7% down from last week’s close.

The beginning of the week saw a continuation of the downtrend – technically confirming the downtrend by establishing lower lows following earlier lower highs. However the market found support at the 2 SD lower boundary (yellow line) of the prior uptrend – so we need to be a little careful here before predicting gloom and doom. We saw a bounce on Thursday but some of the gains were given back on Friday with the index closing 0.7% down from last week’s close.

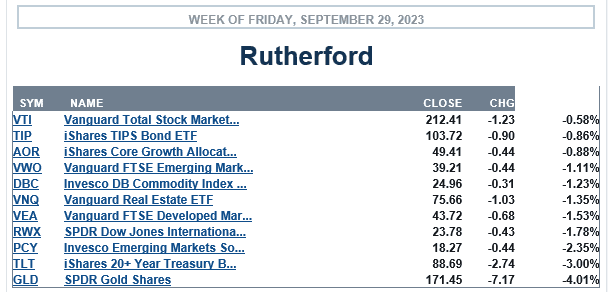

Despite this weakness, US equities were the strongest performing asset class, on a relative basis, with all other major asset classes losing even more value – particularly the “safe haven” classes of Bonds and Gold. So it was difficult to make money this week:

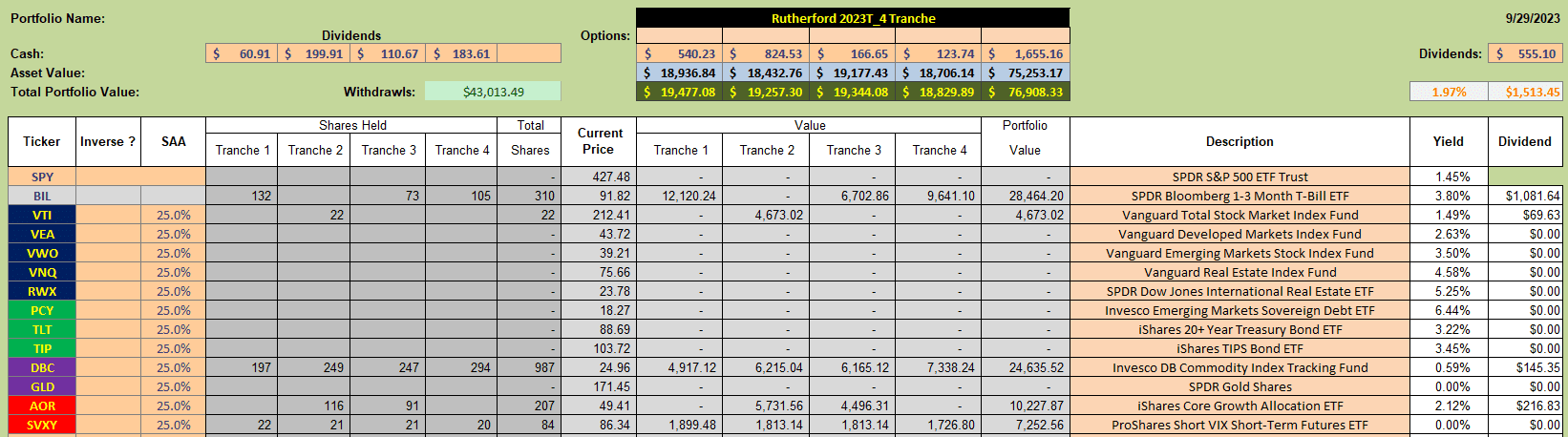

Current holdings in the Rutherford Portfolio look like this:

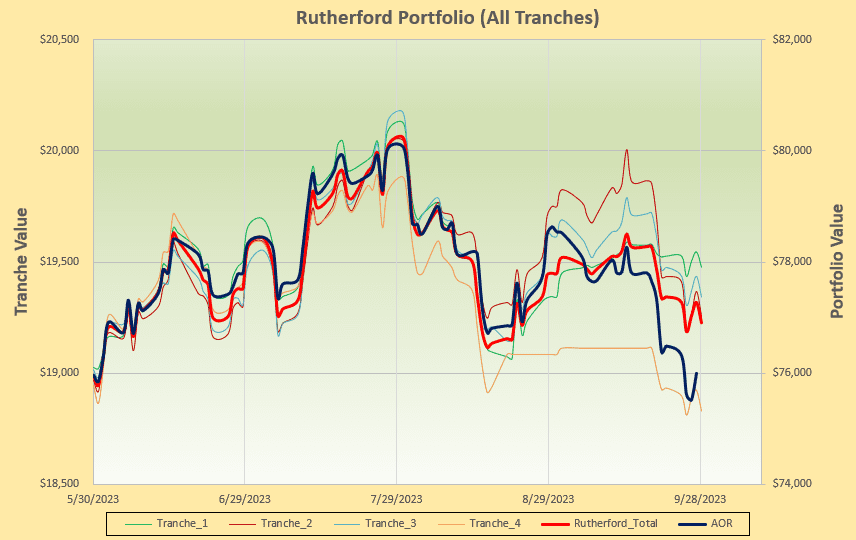

resulting in the performance shown below:

resulting in the performance shown below:

where we can see that we are managing to stay slightly ahead of the benchmark AOR fund.

where we can see that we are managing to stay slightly ahead of the benchmark AOR fund.

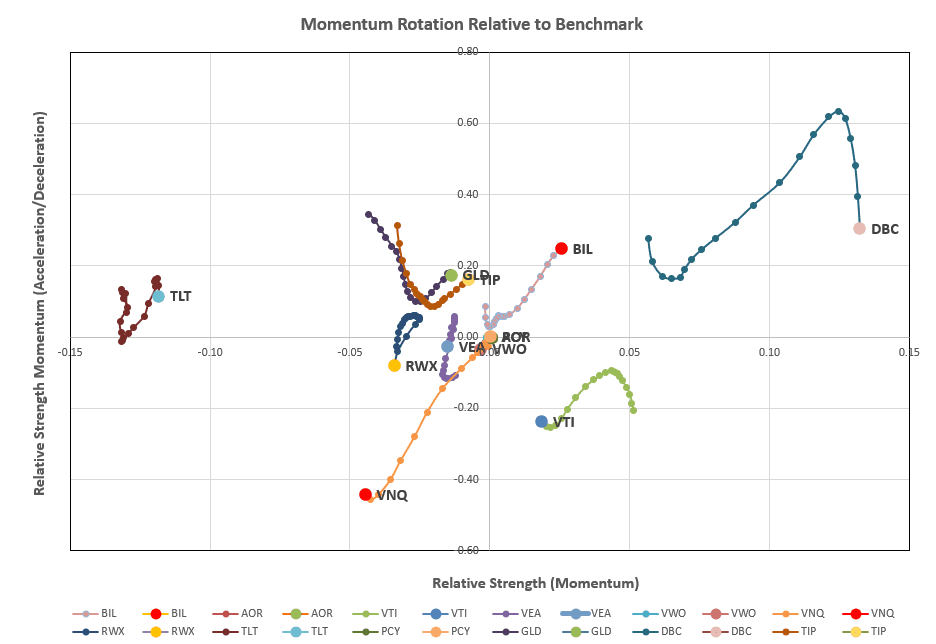

Checking on the rotation graphs:

we see strong long-term momentum in Commodities (DBC) – far right on horizontal axis – but a weakening in trend in the short term (falling down on the vertical axis). Rather disturbing is the fact that we see strong positive movement in BIL in the top right quadrant – and yet we know that BIL hardly moves – so this means that, on a relative basis, other asset classes are looking very weak.

we see strong long-term momentum in Commodities (DBC) – far right on horizontal axis – but a weakening in trend in the short term (falling down on the vertical axis). Rather disturbing is the fact that we see strong positive movement in BIL in the top right quadrant – and yet we know that BIL hardly moves – so this means that, on a relative basis, other asset classes are looking very weak.

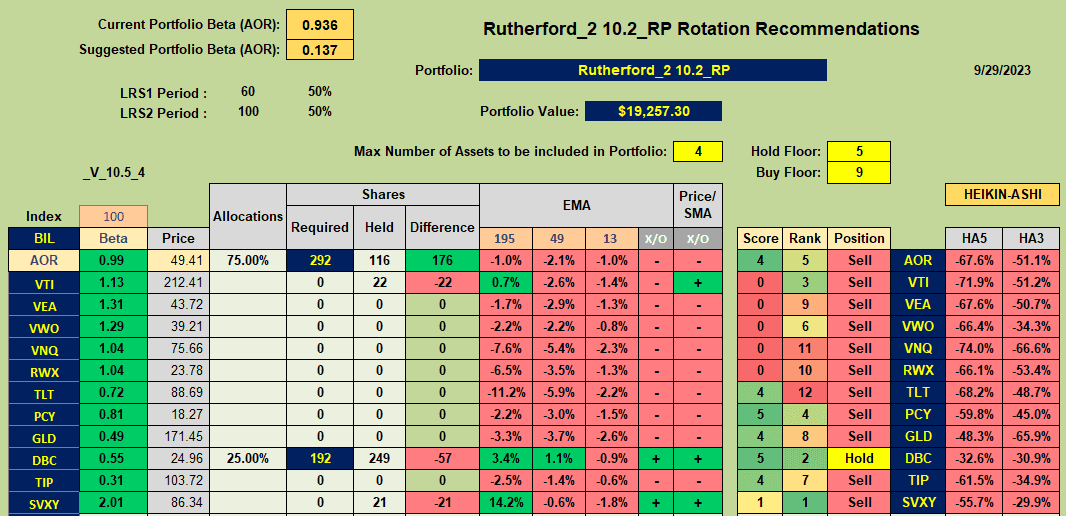

So we move on to the Tranche recommendation sheet:

where DBC is the only asset without a Sell recommendation – and DBC is only recommended as a Hold rather than a Buy.

where DBC is the only asset without a Sell recommendation – and DBC is only recommended as a Hold rather than a Buy.

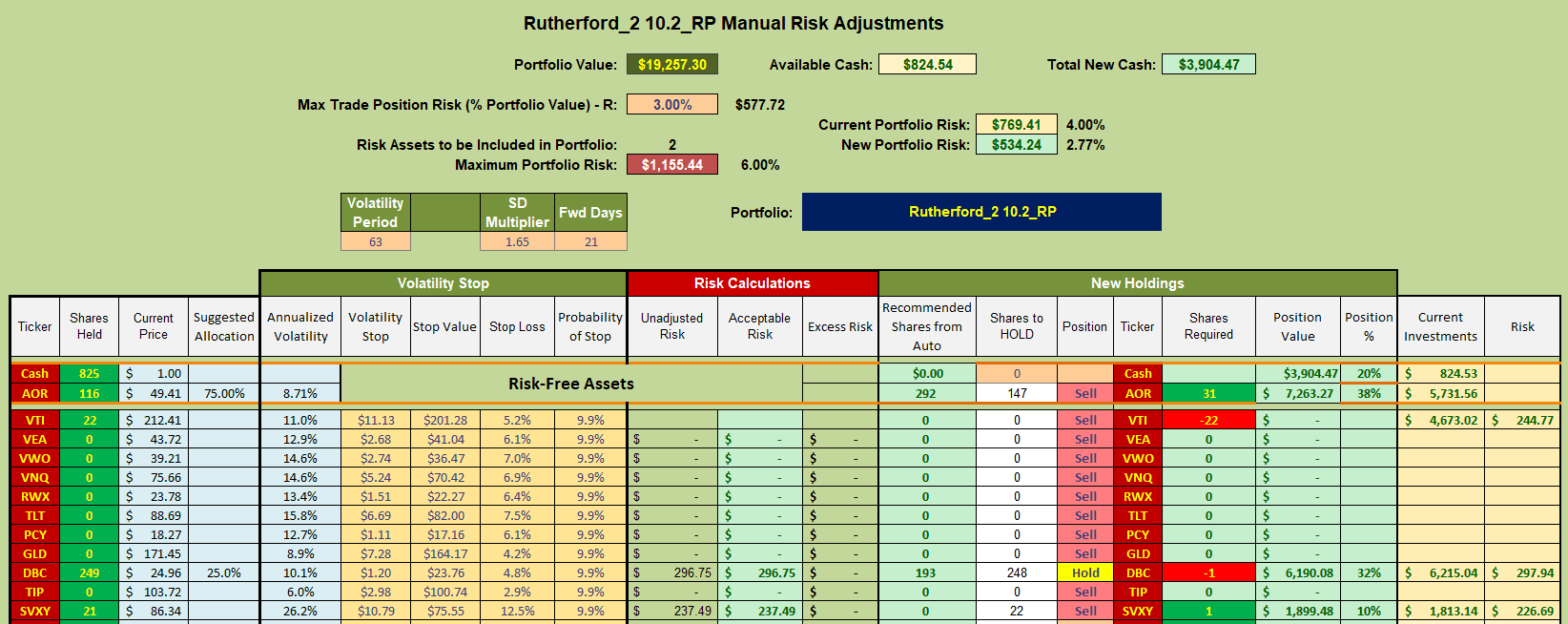

Since I am currently holding DBC in Tranche 2 (the focus of this week’s review) I will continue to hold my shares in this ETF, sell 22 shares in VTI, and use the available Cash to buy shares in BIL (not AOR due to Sell recommendation):

I will continue to hold the shares in SVXY since the 13/49 EMA signal is still positive. This is a discretionary decision due to the nature/diversification value of Volatility products – although if the market continues to decline this will not be a good decision 🙂

I will continue to hold the shares in SVXY since the 13/49 EMA signal is still positive. This is a discretionary decision due to the nature/diversification value of Volatility products – although if the market continues to decline this will not be a good decision 🙂

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.