Bangkok, Thailand

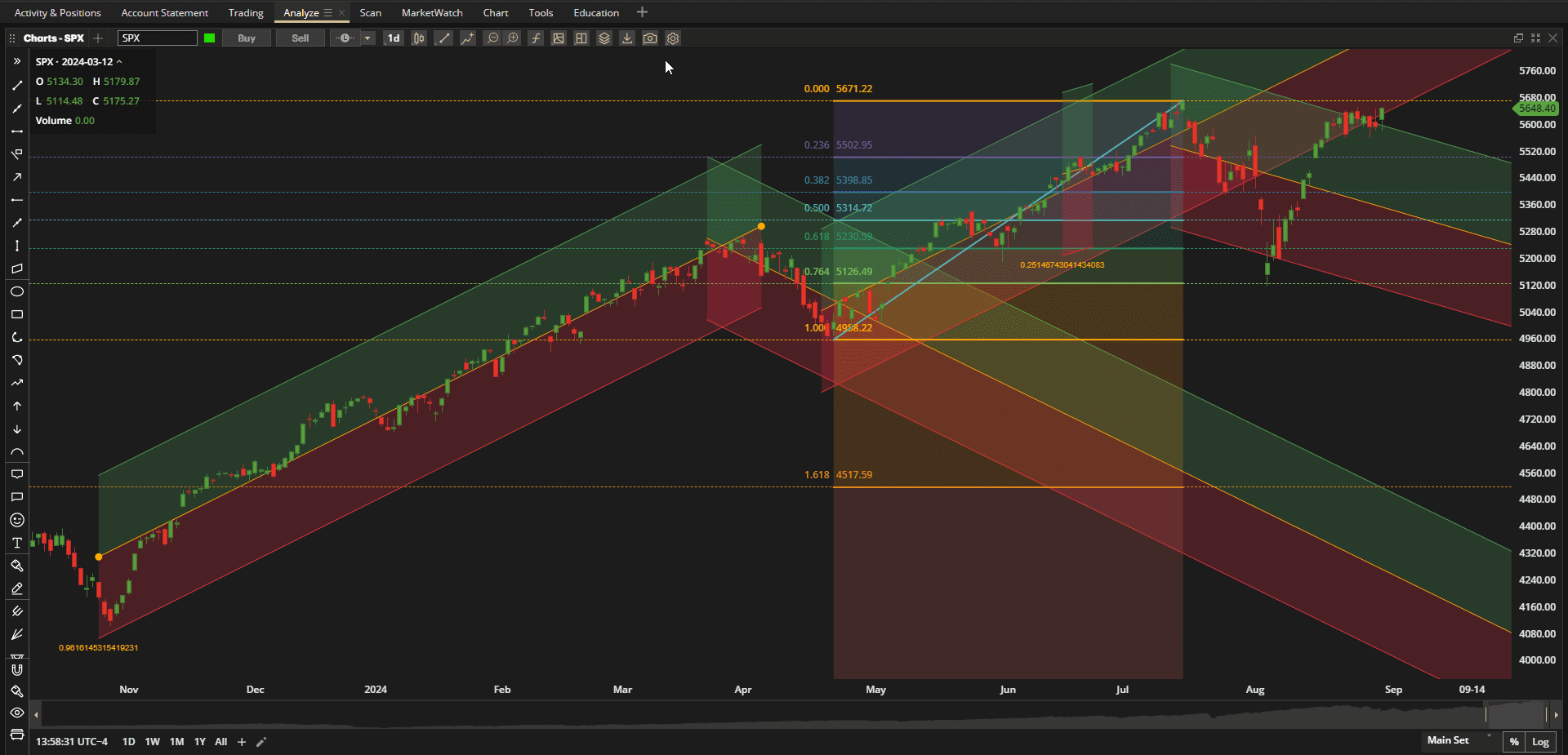

It was a week of consolidation in the US Equity markets with prices trading in a narrow range in comparison with the volatility of the past 2 months:

Prices are hovering at the resistance level of the all-time highs in the SPX (S&P 500 Index) and we must wait at least another week to see whether we break to the upside or see another pullback.

Prices are hovering at the resistance level of the all-time highs in the SPX (S&P 500 Index) and we must wait at least another week to see whether we break to the upside or see another pullback.

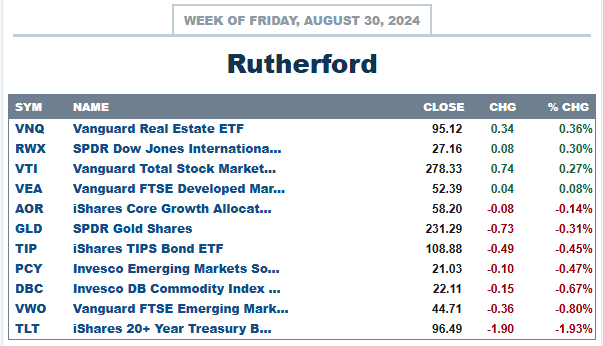

In relation to other major asset classes equities were fairly neutral:

with the Real Estate sectors leading the way (as they were last week) and long term treasuries being the poorest performing asset class.

with the Real Estate sectors leading the way (as they were last week) and long term treasuries being the poorest performing asset class.

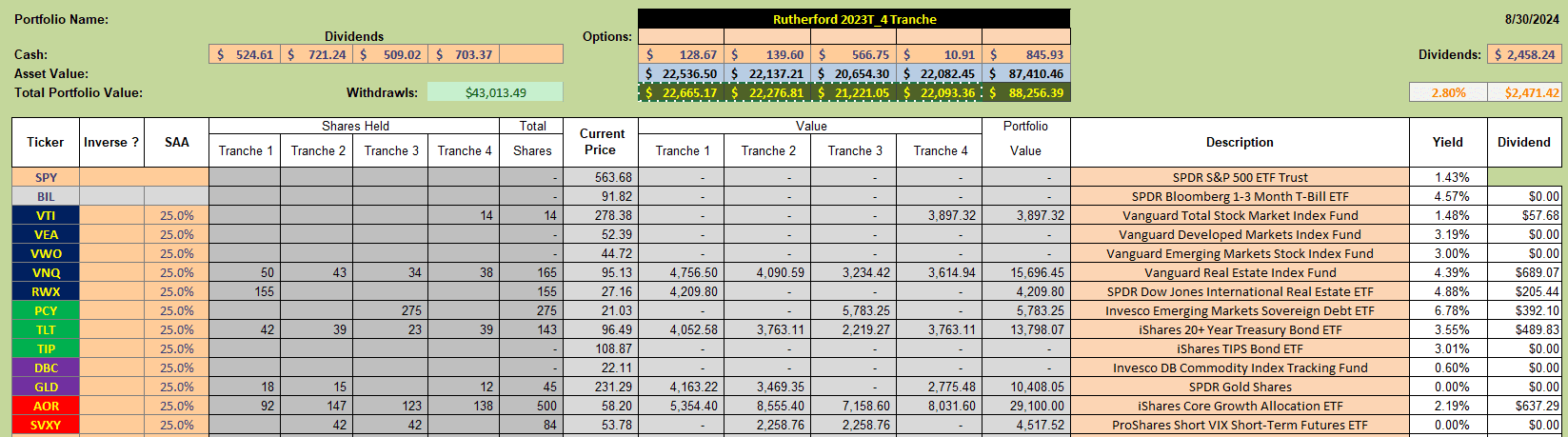

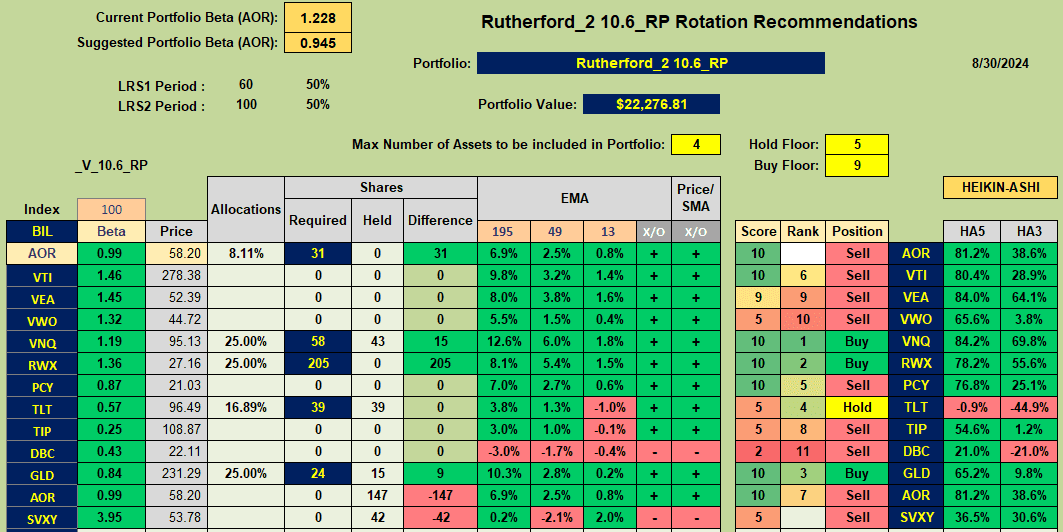

Current holdings in the Rutherford Portfolio look like this:

with Tranche 2 (the focus of this week’s review) holding positions in VNQ (US Real Estate), TLT (US Treasuries), GLD (Gold) in addition to the benchmark AOR Fund and the Inverse Volatility ETF SVXY.

with Tranche 2 (the focus of this week’s review) holding positions in VNQ (US Real Estate), TLT (US Treasuries), GLD (Gold) in addition to the benchmark AOR Fund and the Inverse Volatility ETF SVXY.

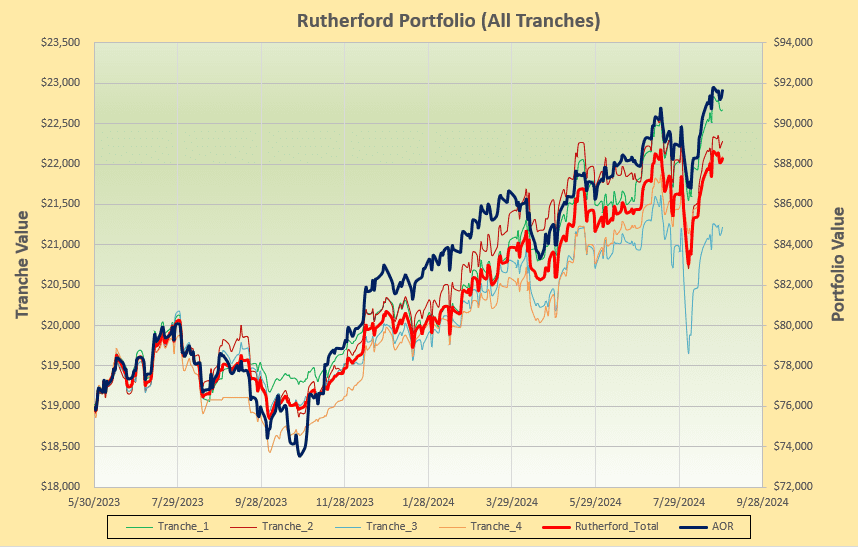

Portfolio performance looks like this:

with a ~7.5% variation in performance between tranches (review date/timing luck) and ~3% overall underperformance compared with the benchmark AOR Fund.

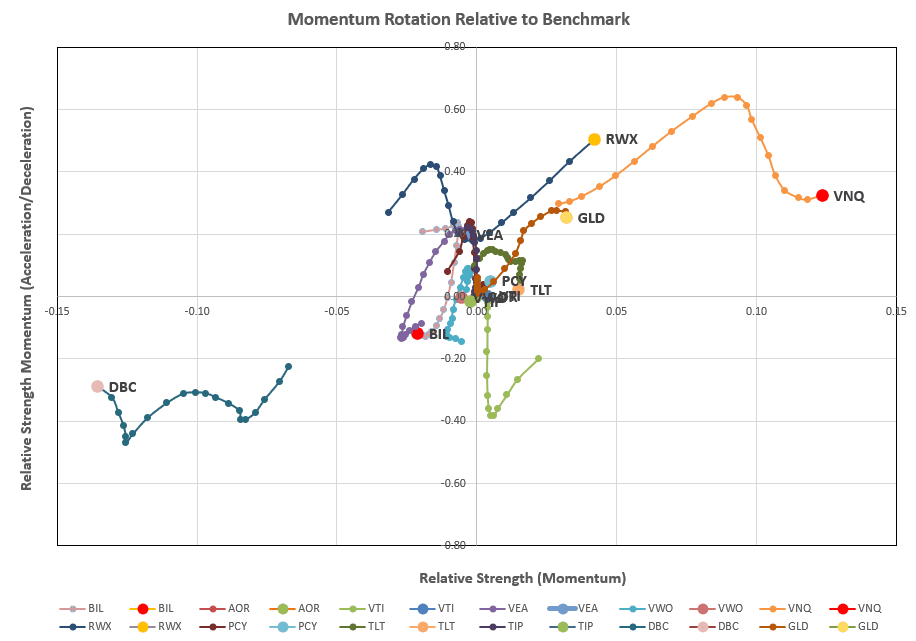

Checking the rotation graphs:

we see VNQ, RWX and GLD looking strong in the desirable top right quadrant and this is verified by the rankings and recommendations generated from the rotation model used to manage this portfolio:

we see VNQ, RWX and GLD looking strong in the desirable top right quadrant and this is verified by the rankings and recommendations generated from the rotation model used to manage this portfolio:

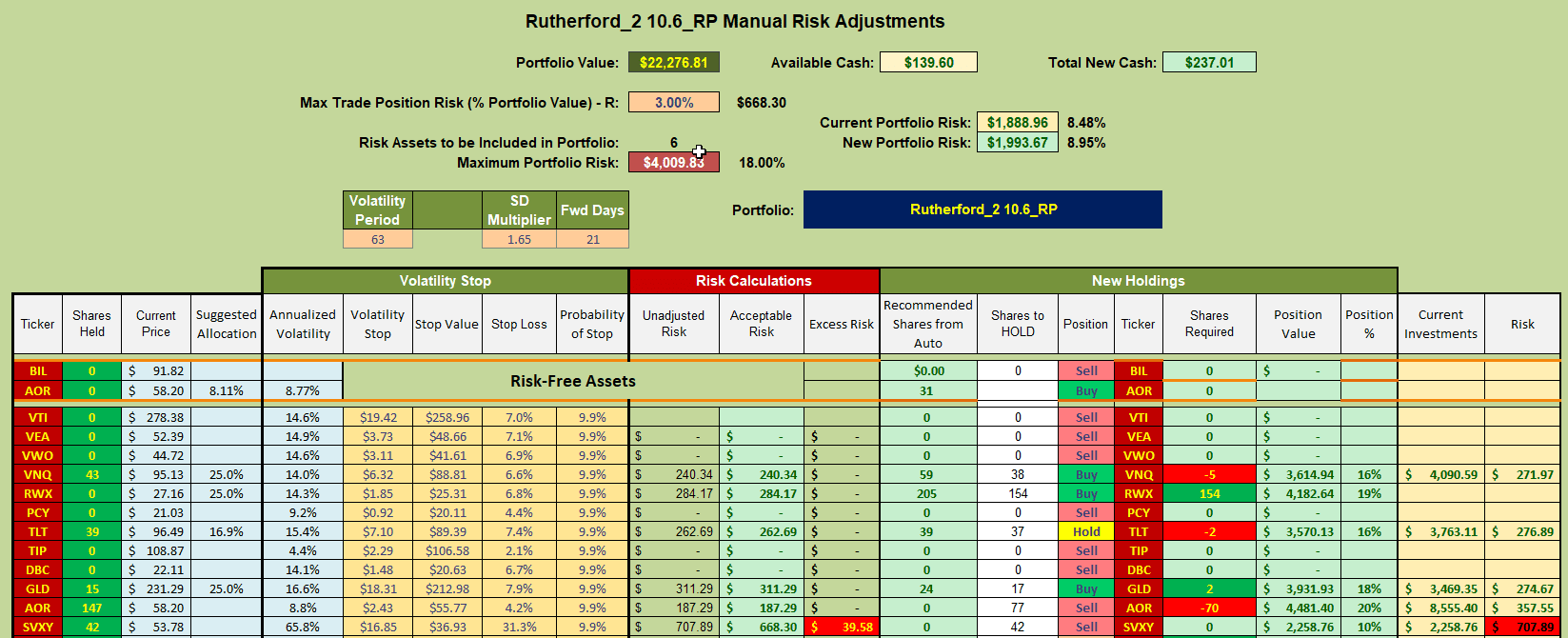

This means that my adjustments to Tranche 2 will look something like this:

This means that my adjustments to Tranche 2 will look something like this:

where I shall be selling shares in AOR and using the funds to open a position in RWX (International Real Estate). I will not worry about minor adjustments to other holdings and will make the discretionary decision to hold my current position in SVXY for diversification.

where I shall be selling shares in AOR and using the funds to open a position in RWX (International Real Estate). I will not worry about minor adjustments to other holdings and will make the discretionary decision to hold my current position in SVXY for diversification.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Leave a Comment or Question