Inside The Royal Palace, Bangkok, Thailand

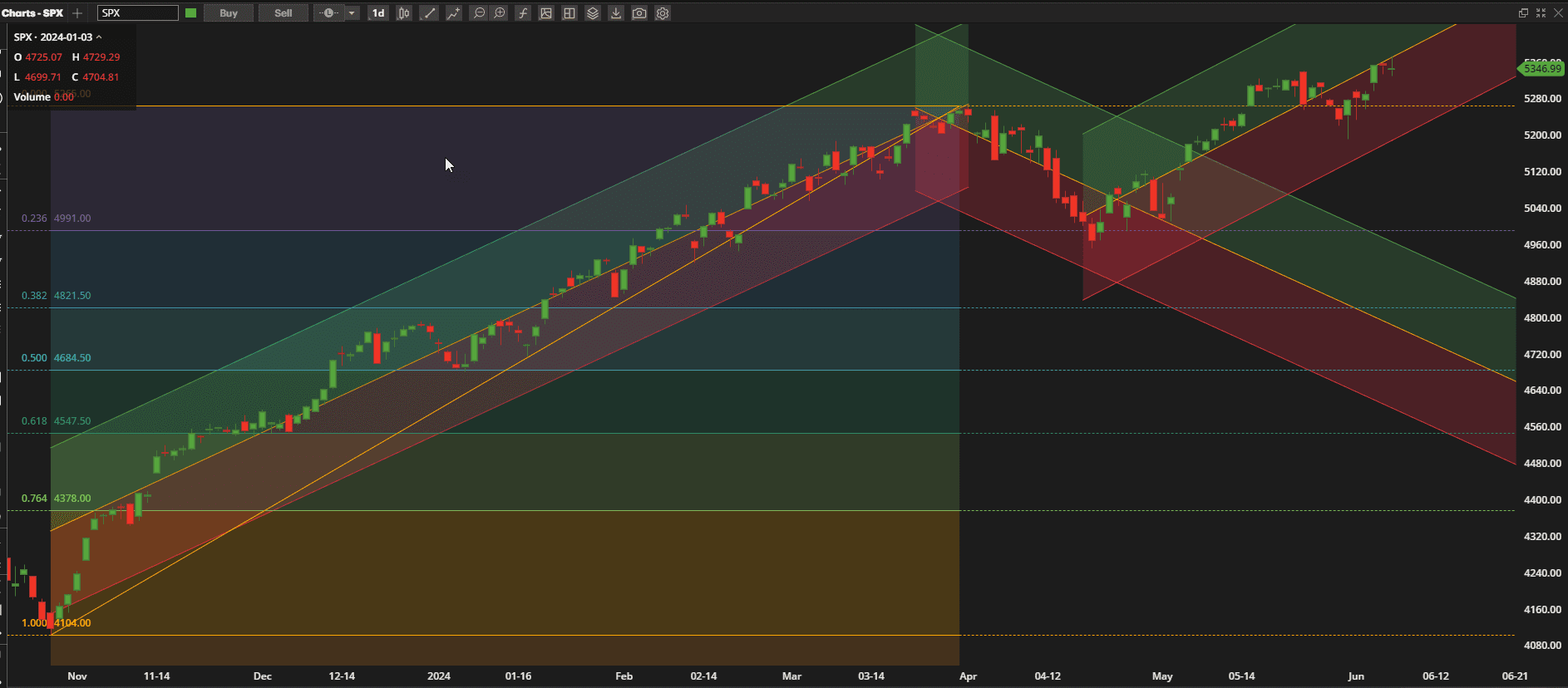

US Equities continued their upward climb hitting new all-time highs during the week and closing ~1% higher than last week’s close:

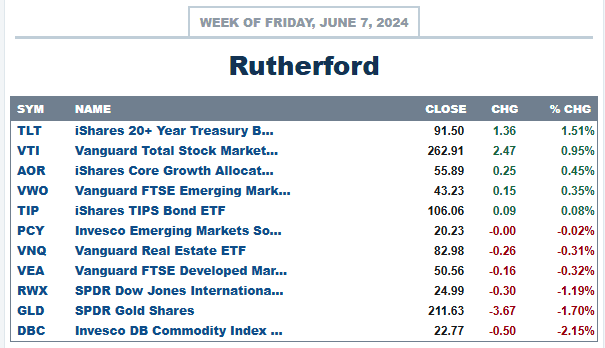

This again places US Equities near the top of the performance list of major asset classes:

This again places US Equities near the top of the performance list of major asset classes:

Commodities (DBC) and Gold (GLD) fell from grace this past week.

Commodities (DBC) and Gold (GLD) fell from grace this past week.

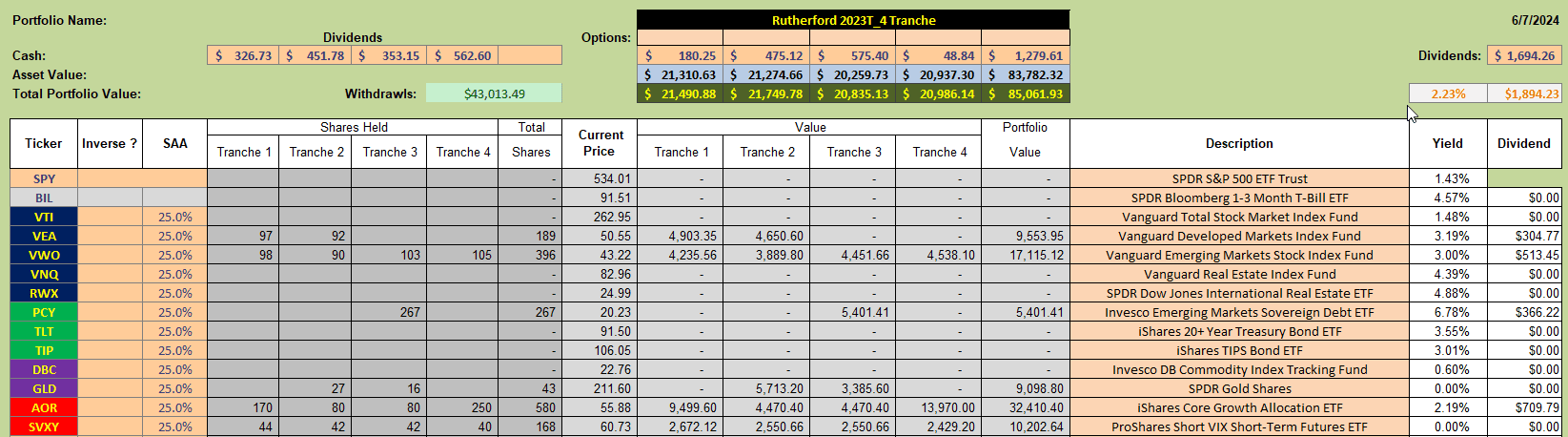

Current holdings in the Rutherford portfolio look like this:

and we shall be focusing on Tranche 2 that is holding positions in International Equities (VEA and VWO), Gold and our benchmark fund AOR (as well as our diversifying volatility ETF SVXY).

and we shall be focusing on Tranche 2 that is holding positions in International Equities (VEA and VWO), Gold and our benchmark fund AOR (as well as our diversifying volatility ETF SVXY).

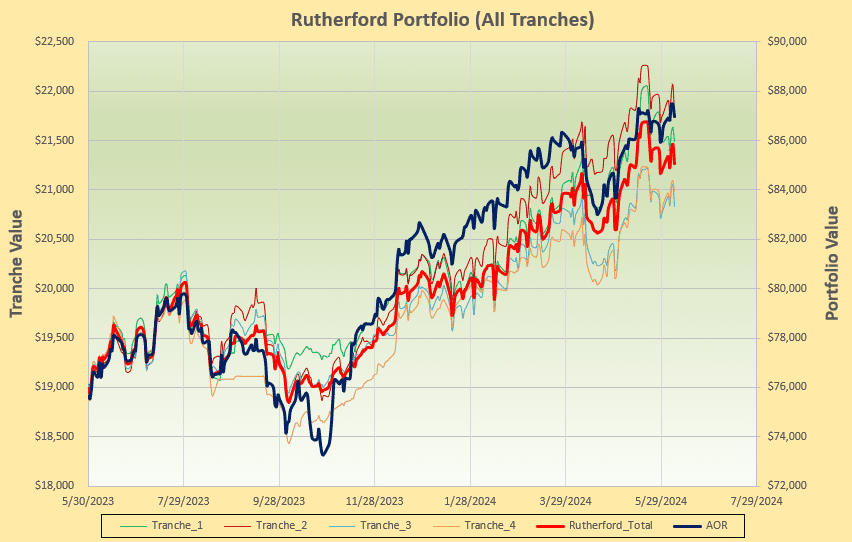

Performance of the portfolio looks like this:

and is currently struggling to keep up with the benchmark fund.

and is currently struggling to keep up with the benchmark fund.

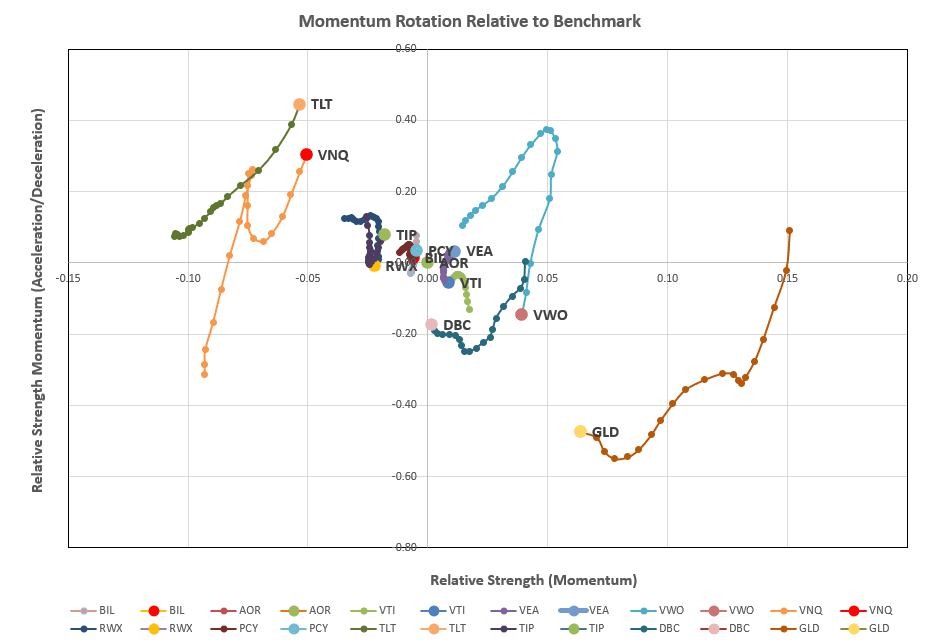

Checking on the rotation graphs:

we don’t see too much to get excited about with a lot of rotation out of the top right quadrant that favors long (horizontal axis) and short-term (vertical axis) momentum or relative strength.

we don’t see too much to get excited about with a lot of rotation out of the top right quadrant that favors long (horizontal axis) and short-term (vertical axis) momentum or relative strength.

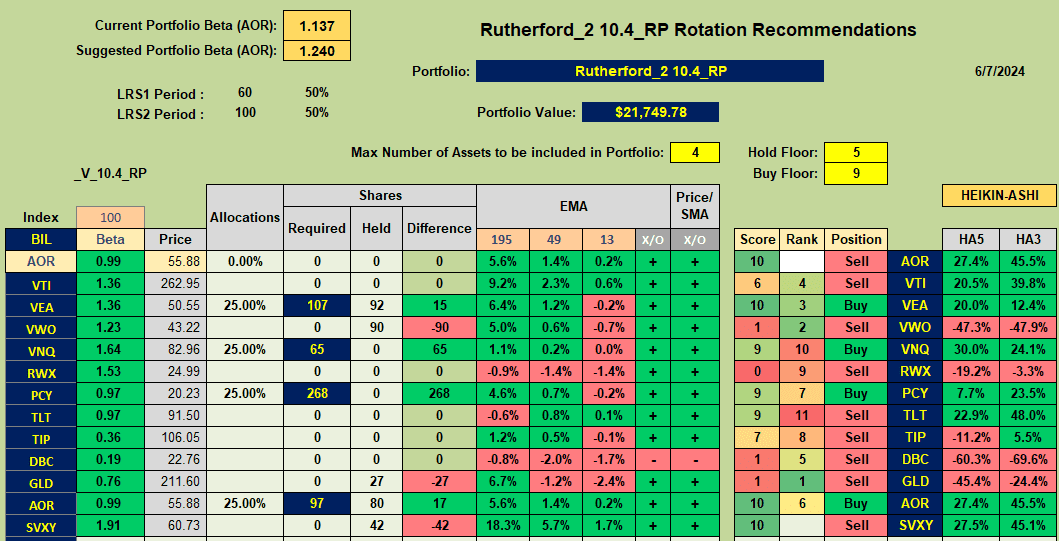

As an interpretation of the data we move to the ranking/recommendation sheet:

where we see Buy recommendations for VEA, VNQ, PCY and AOR with Sell recommendations for everything else. This is a little surprising since the rotation graphs don’t look encouraging and we haven’t seen too many Buy recemmendations over the past couple of weeks. However, we are still in an uptrend (at least in the equity markets) so we’ll trust the system and make adjustments that look something like this:

where we see Buy recommendations for VEA, VNQ, PCY and AOR with Sell recommendations for everything else. This is a little surprising since the rotation graphs don’t look encouraging and we haven’t seen too many Buy recemmendations over the past couple of weeks. However, we are still in an uptrend (at least in the equity markets) so we’ll trust the system and make adjustments that look something like this:

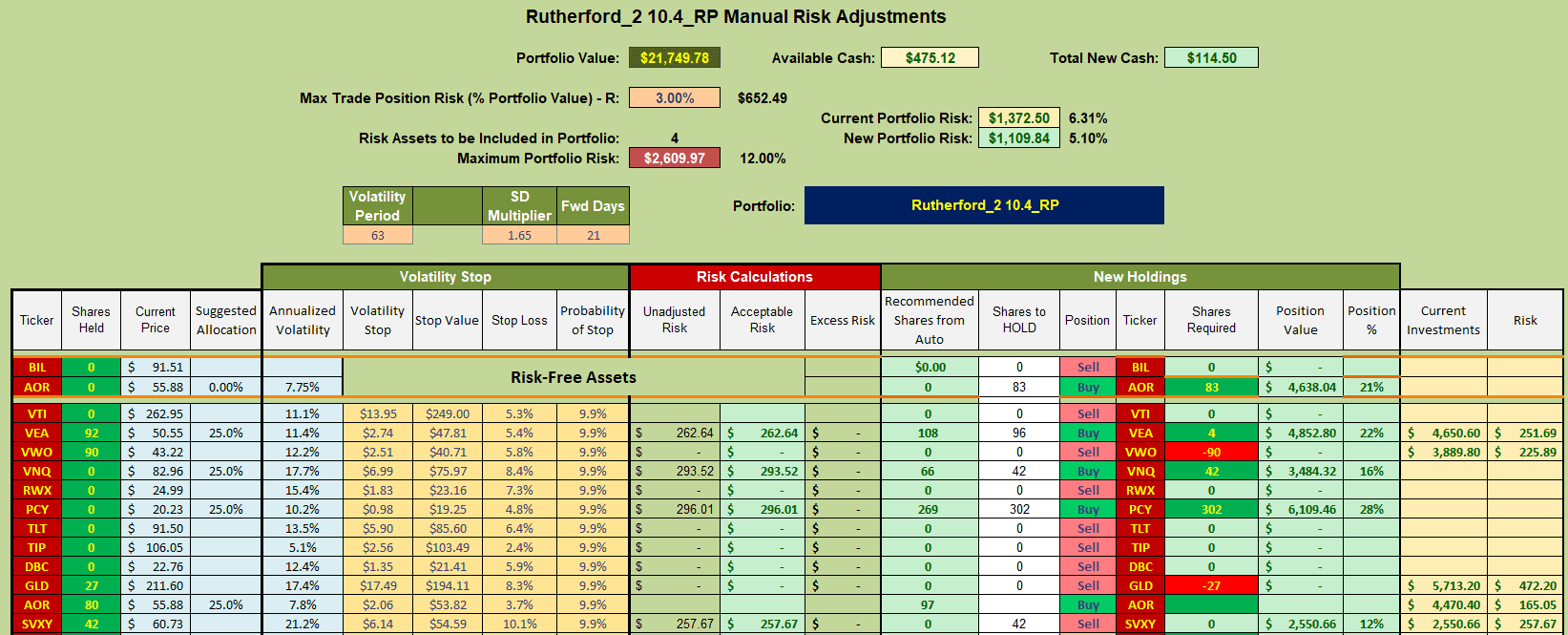

where I shall be selling holdings (in Tranche 2) of VWO and GLD and using the funds to buy shares in VNQ (US Real Estate) and PCY (Emerging Market Bonds). This is interesting and adds a little more diversity to the portfolio in these uncertain times. I will ignore the minor adjustments to AOR and VEA so as to minimize trading costs.

where I shall be selling holdings (in Tranche 2) of VWO and GLD and using the funds to buy shares in VNQ (US Real Estate) and PCY (Emerging Market Bonds). This is interesting and adds a little more diversity to the portfolio in these uncertain times. I will ignore the minor adjustments to AOR and VEA so as to minimize trading costs.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.