“American Falls”, Niagara Falls, New York, from Niagara Falls, Canada.

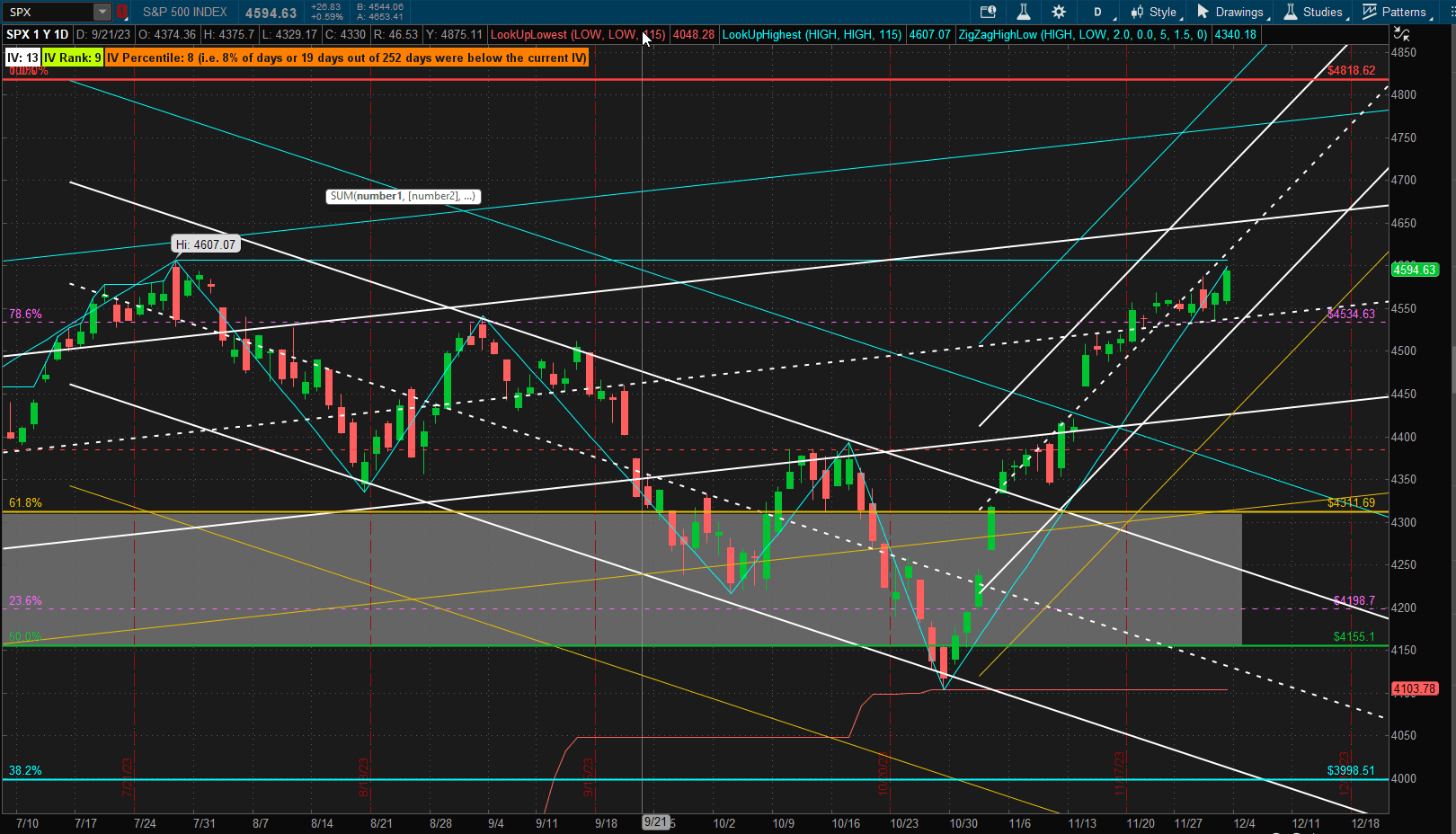

Action in US equity markets was pretty muted this week with consolidation just below resistance (and prior pivot high) at ~4600:

It will be interesting to see whether Santa can pull us above this resistance zone and towards the all-time highs at ~4810 (~4.5% higher) before the end of the year.

It will be interesting to see whether Santa can pull us above this resistance zone and towards the all-time highs at ~4810 (~4.5% higher) before the end of the year.

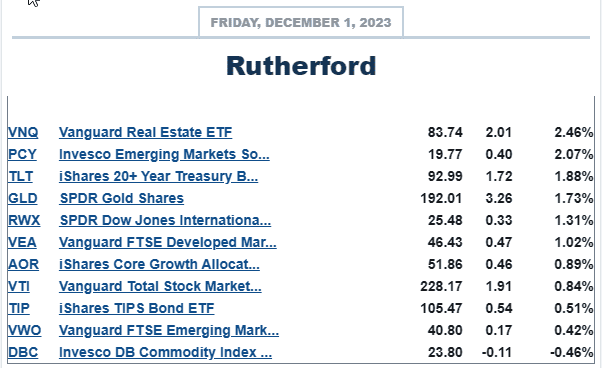

Despite the respectable performance of US equities over the past week this asset class was outperformed by Real Estate, Gold and Bonds:

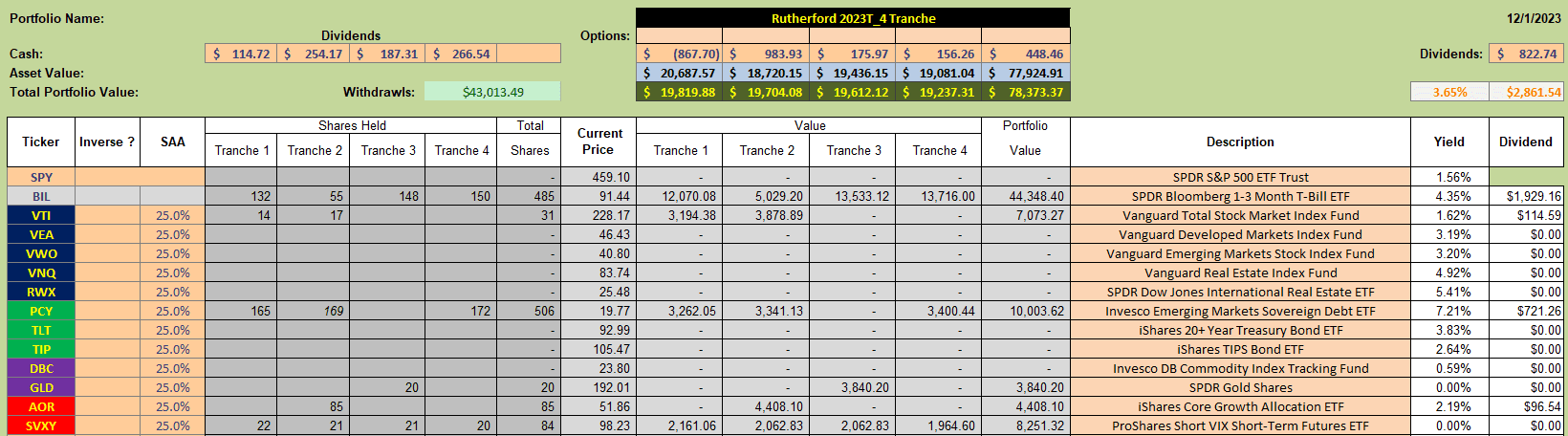

With holdings in the Rutherford Portfolio looking like this:

With holdings in the Rutherford Portfolio looking like this:

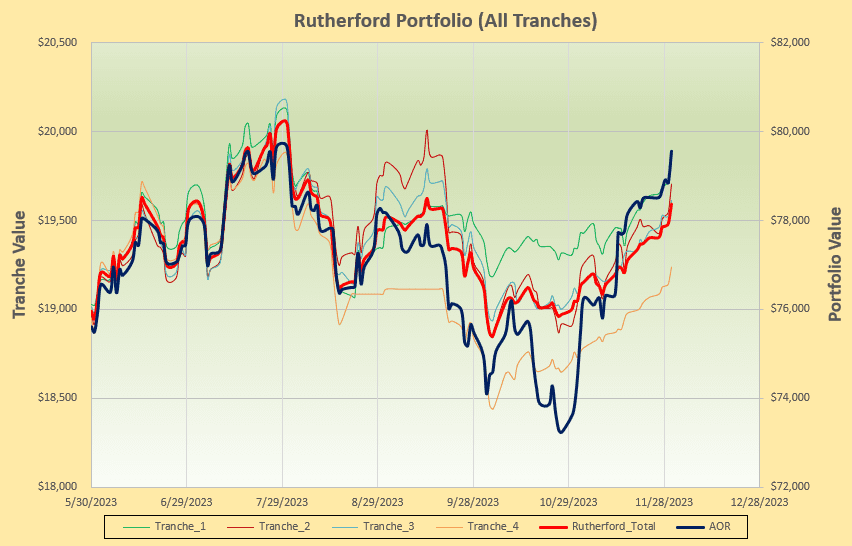

and, despite 55% of funds being held in BIL (proxy for Cash), performance was relatively good:

and, despite 55% of funds being held in BIL (proxy for Cash), performance was relatively good:

keeping up with the benchmark AOR Fund.

keeping up with the benchmark AOR Fund.

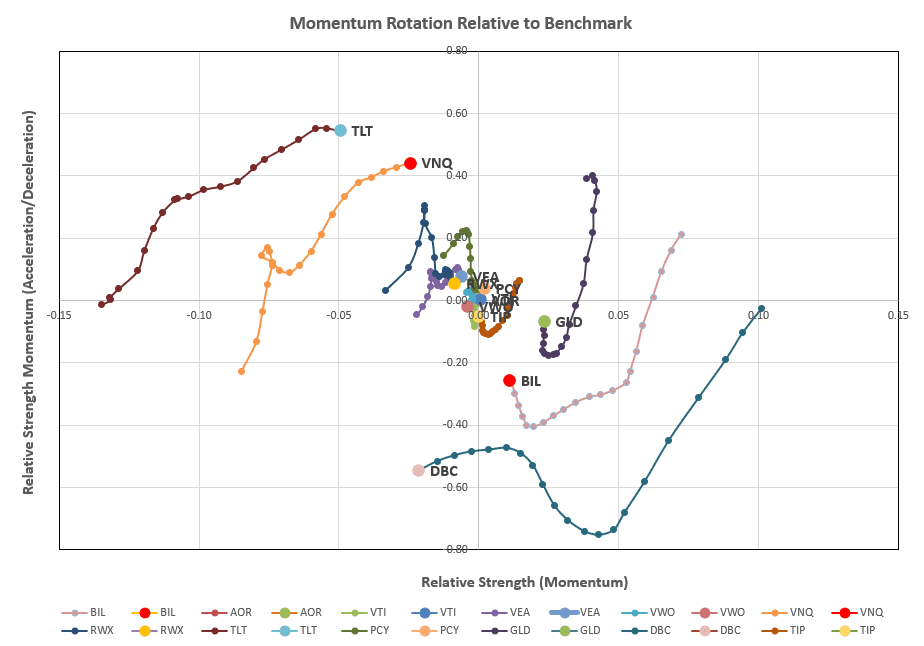

Checking the current rotation graphs:

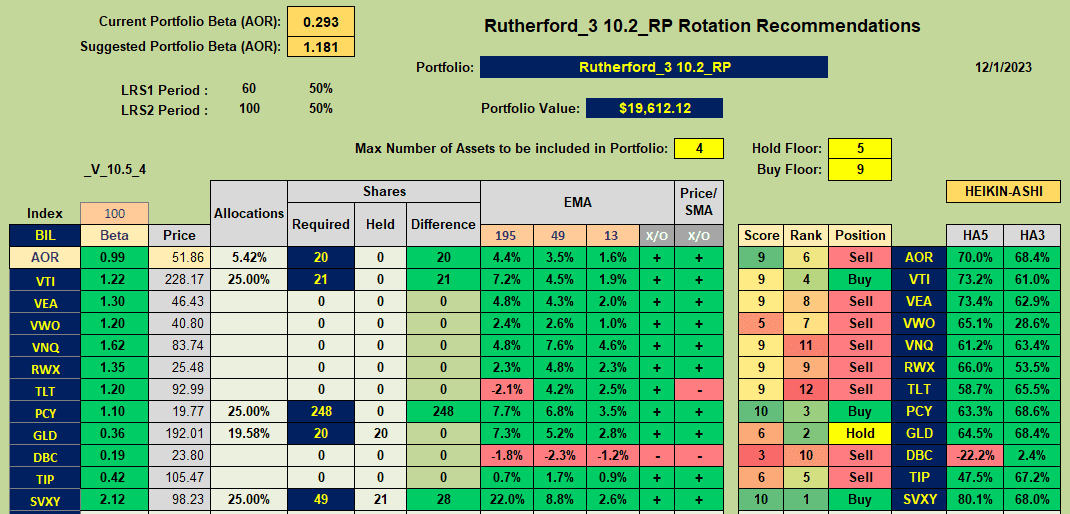

we are still not seeing strong action in the desirable top right quadrant (strong short- and long-term momentum) but the recommendations from the rotation model:

we are still not seeing strong action in the desirable top right quadrant (strong short- and long-term momentum) but the recommendations from the rotation model:

are to Buy shares in PCY and VTI and to Hold our positions in GLD.

are to Buy shares in PCY and VTI and to Hold our positions in GLD.

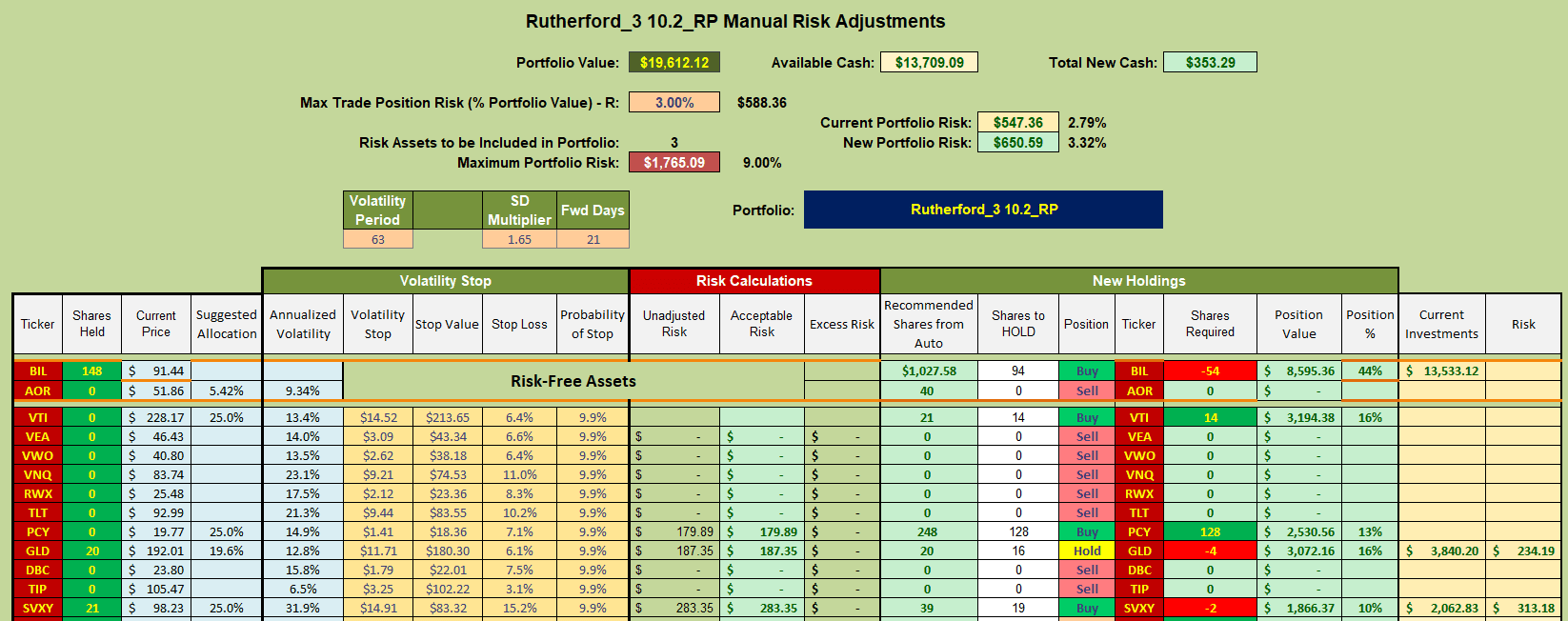

Consequently, this week’s adjustments will look something like this:

where I will be adding shares of PCY and VTI to the portfolio and selling the necessary number of shares in BIL to generate the necessary cash required for these purchases. I will not be making the small suggested adjustments to holdings in GLD or SVXY.

where I will be adding shares of PCY and VTI to the portfolio and selling the necessary number of shares in BIL to generate the necessary cash required for these purchases. I will not be making the small suggested adjustments to holdings in GLD or SVXY.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.