Stained Glass window at Train Station in Dunedin, New Zealand

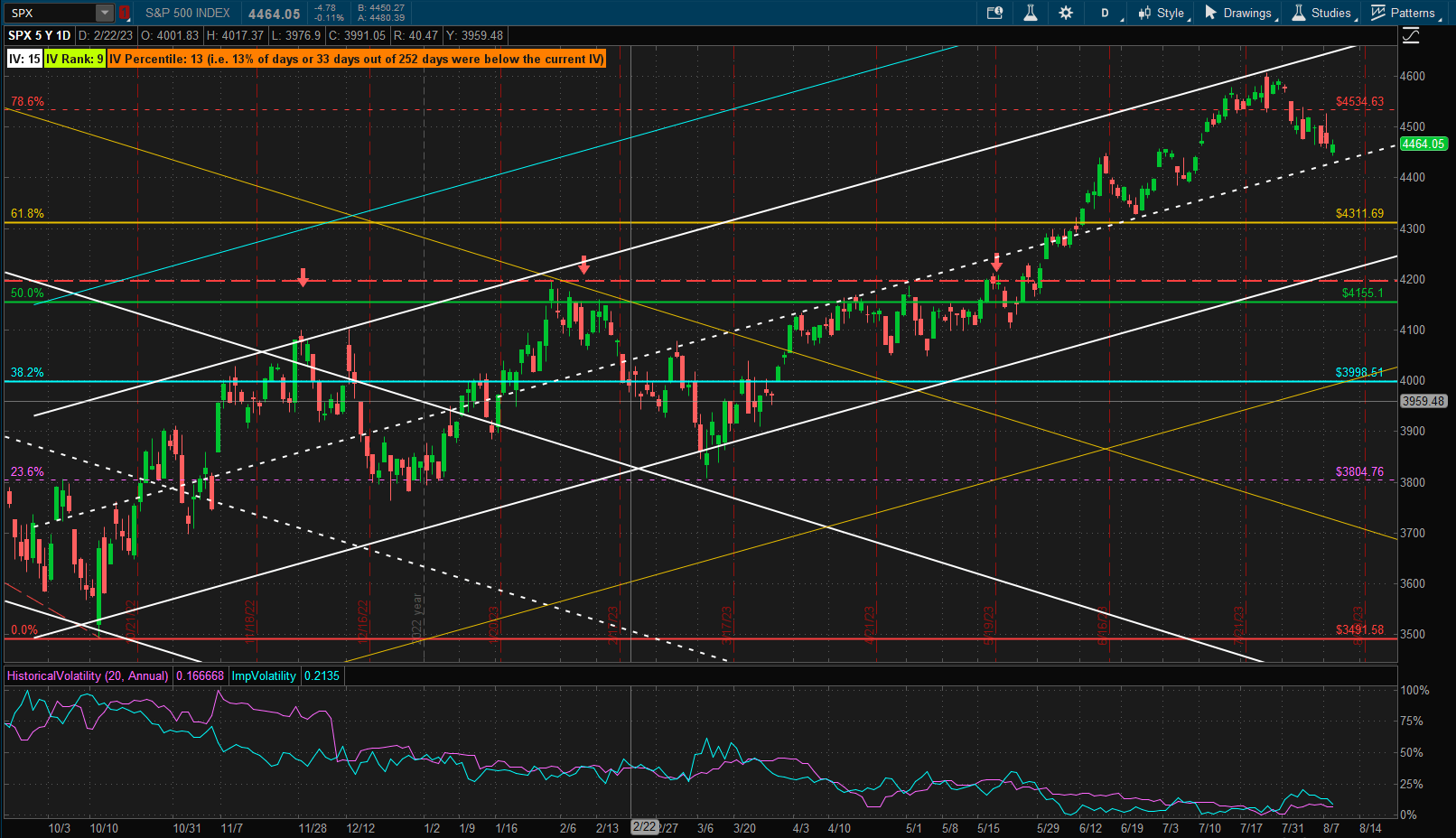

US equities showed continued weakness as prices pulled back from the highs of 2 weeks ago:

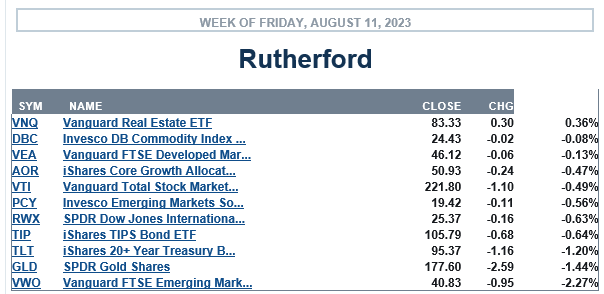

This weakness was reflected in other markets:

This weakness was reflected in other markets:

with only US Real Estate showing gains on the week

with only US Real Estate showing gains on the week

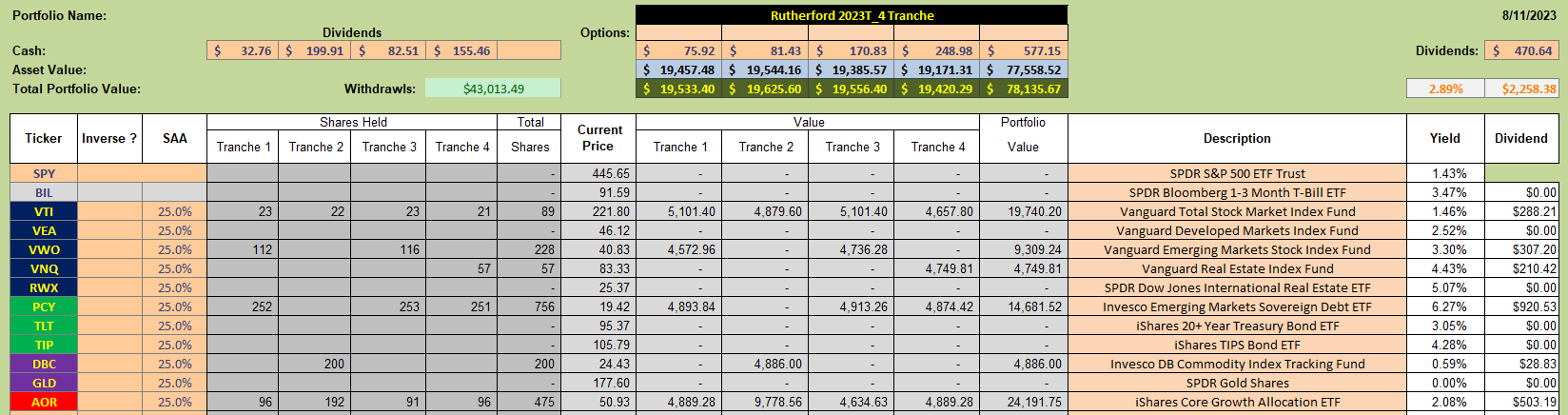

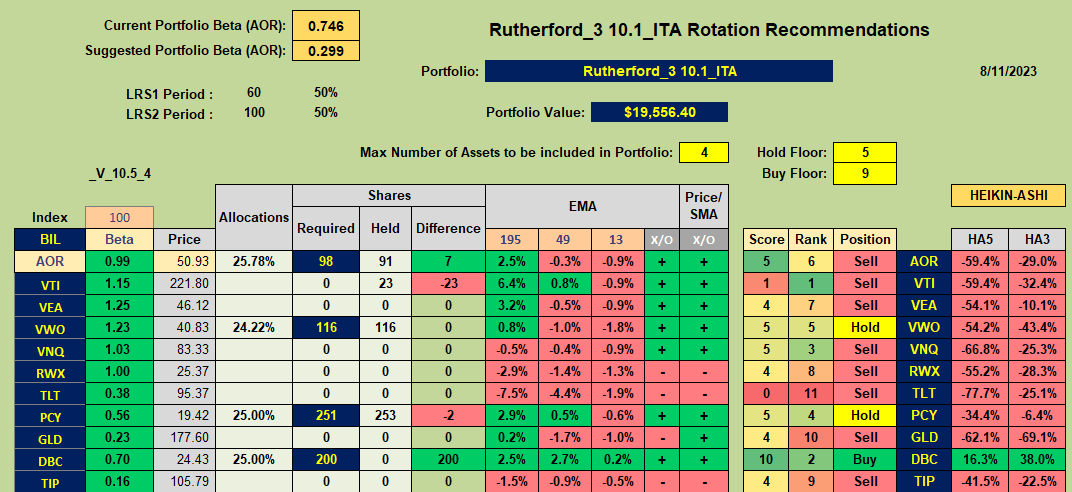

Holdings in the Rutherford Portfolio look like this:

with Tranche 3 (the focus of this week’s review) holding positions in VTI, VWO, PCY and AOR.

with Tranche 3 (the focus of this week’s review) holding positions in VTI, VWO, PCY and AOR.

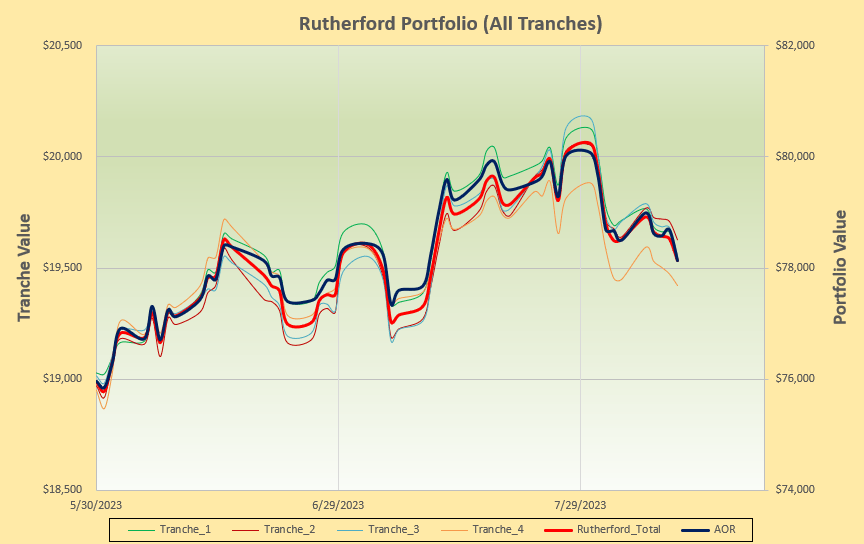

Recent performance of the portfolio looks like this:

accurately reflecting market conditions globally.

accurately reflecting market conditions globally.

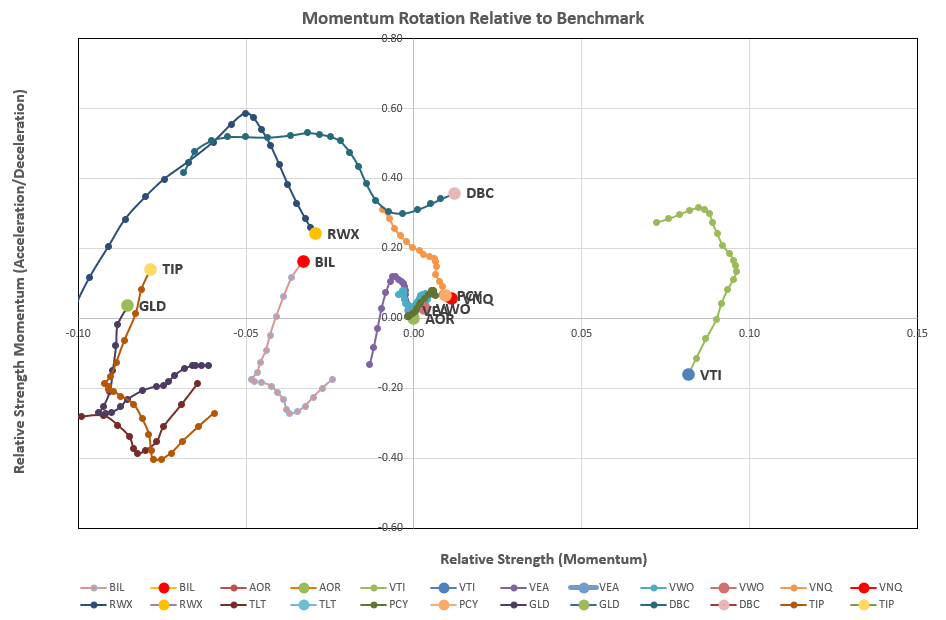

Checking on the rotation graphs (that are used in the management of this portfolio) we see the following picture:

where we see the recent weakness (downward movement) of US equities (VTI) despite their relatively strong momentum over the longer term (furthest to the right). DBC seems to be continuing the strengthening that we saw last week so we’ll check the recommendations coming from the algorithm used to sort out this mess:

where we see the recent weakness (downward movement) of US equities (VTI) despite their relatively strong momentum over the longer term (furthest to the right). DBC seems to be continuing the strengthening that we saw last week so we’ll check the recommendations coming from the algorithm used to sort out this mess:

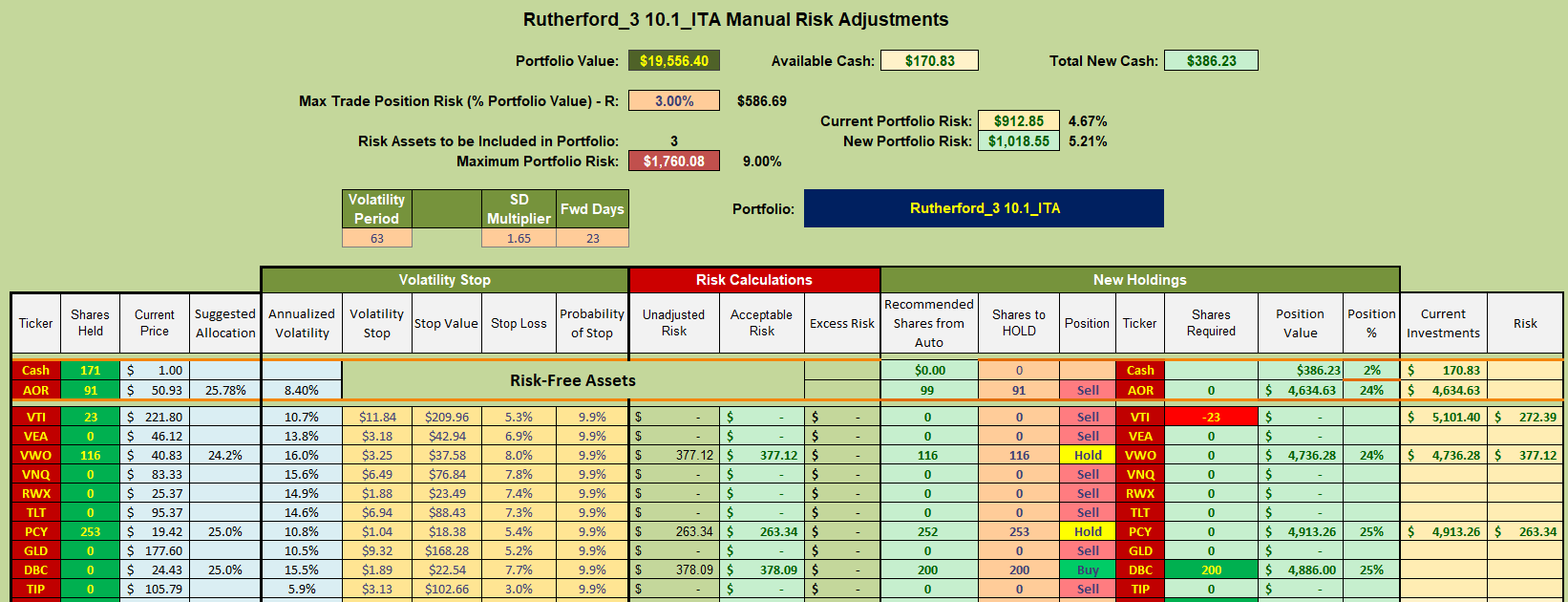

Sure enough, DBC is a recomended Buy with VWO and PCY as Holds. VTI is now a recommended Sell. Consequently, I shall be selling the VTI shares held in Tranche 3 and adding to holdings in DBC that were initiated last week:

Sure enough, DBC is a recomended Buy with VWO and PCY as Holds. VTI is now a recommended Sell. Consequently, I shall be selling the VTI shares held in Tranche 3 and adding to holdings in DBC that were initiated last week:

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.