Botanic Gardens, Singapore

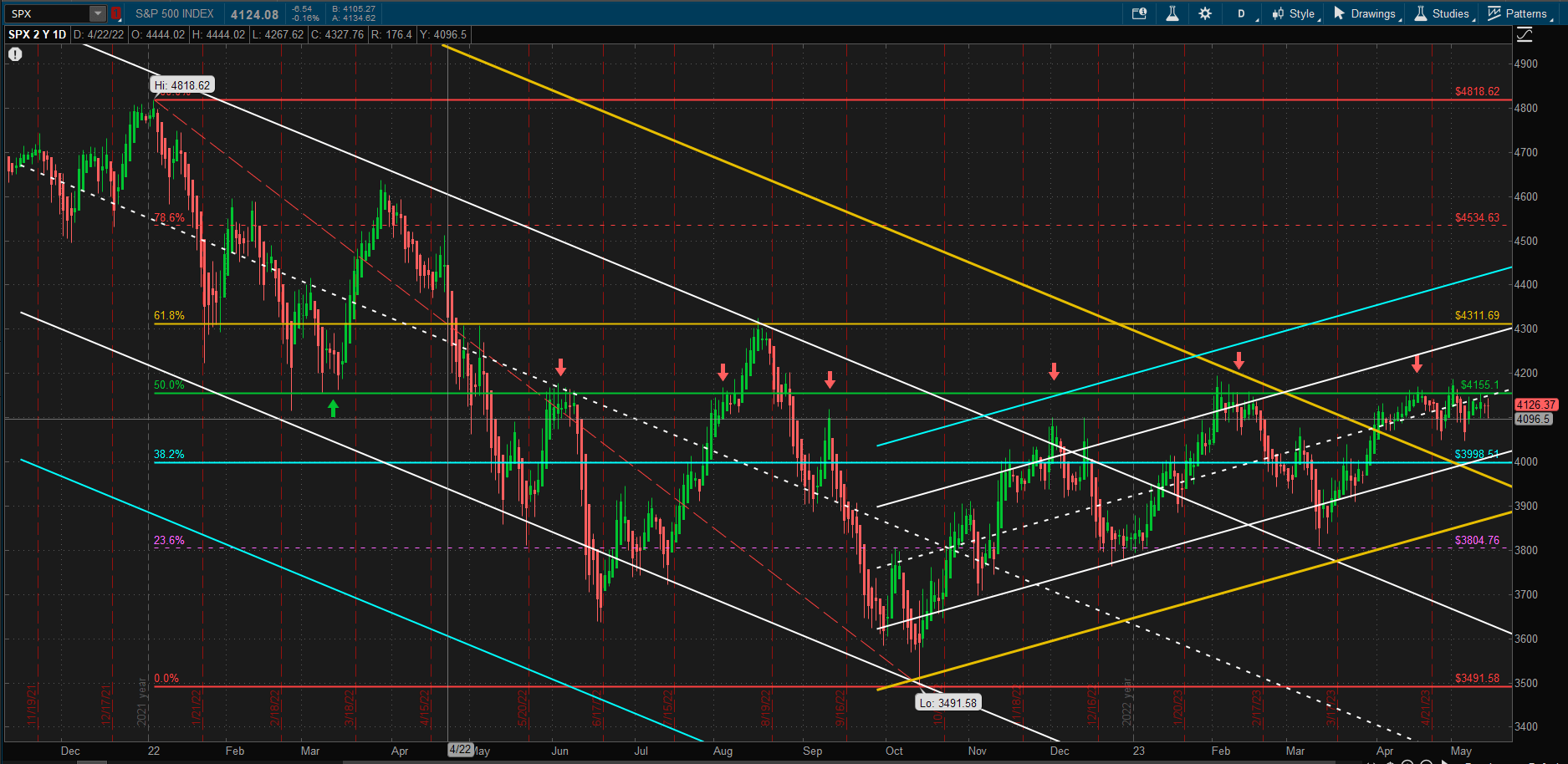

US Equities continue to consolidate at ~4150 (the mid-level of last year’s range):

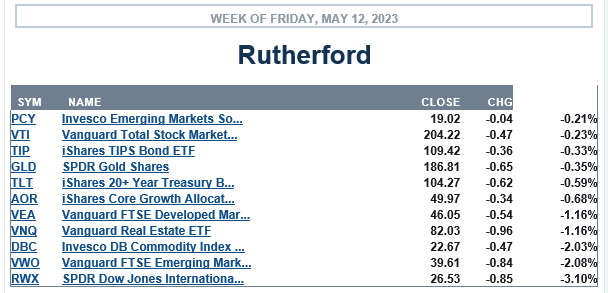

with the SPX closing down slightly from last week’s close. Despite this, on a relative basis, US equities were close to the top of the performance list with no major asset classes showing positive returns on the week.  So much for correlations and the benefits of diversification!

So much for correlations and the benefits of diversification!

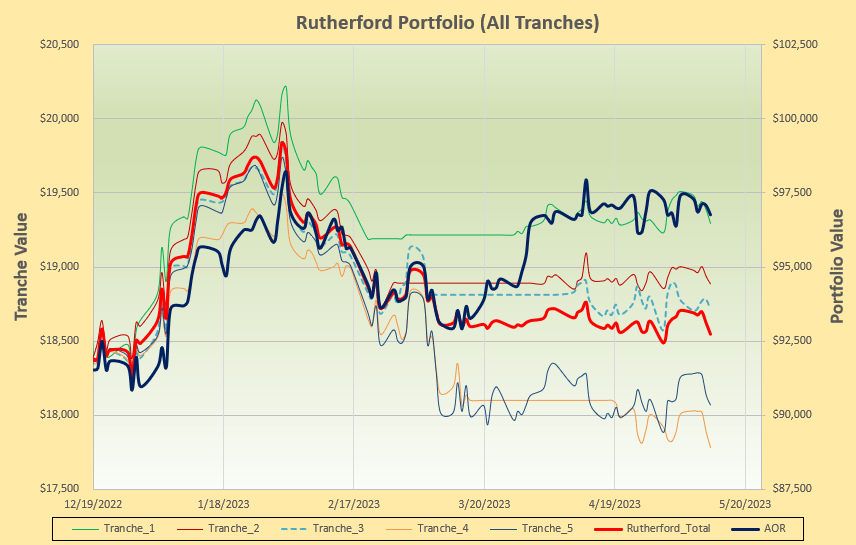

This miserable performance was reflected in the performance of the Rutherford Portfolio:

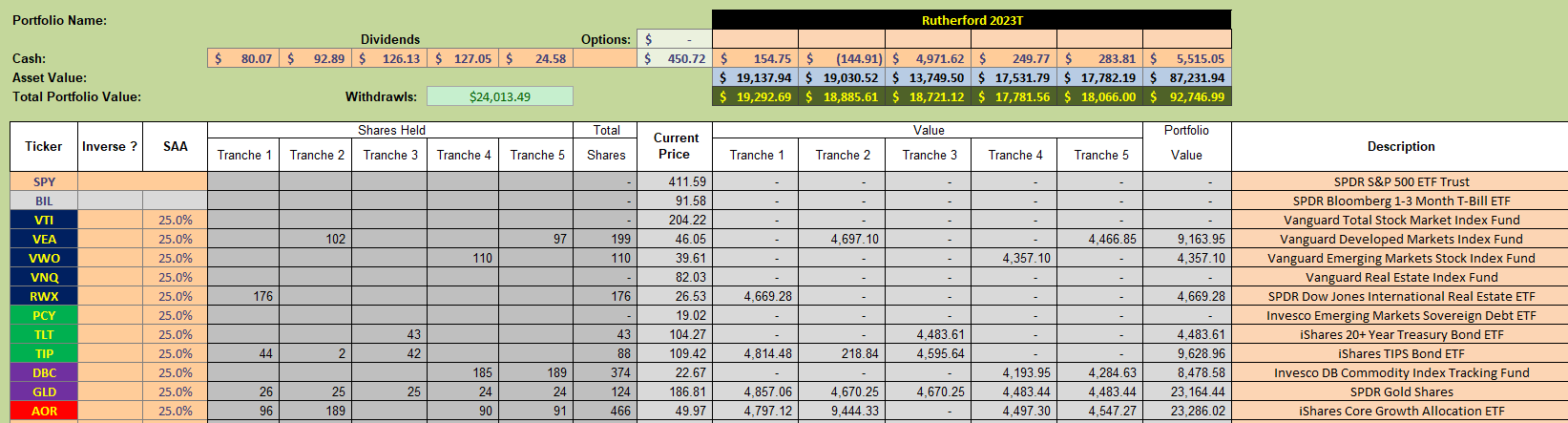

that comprises the following holdings in the five Tranches:

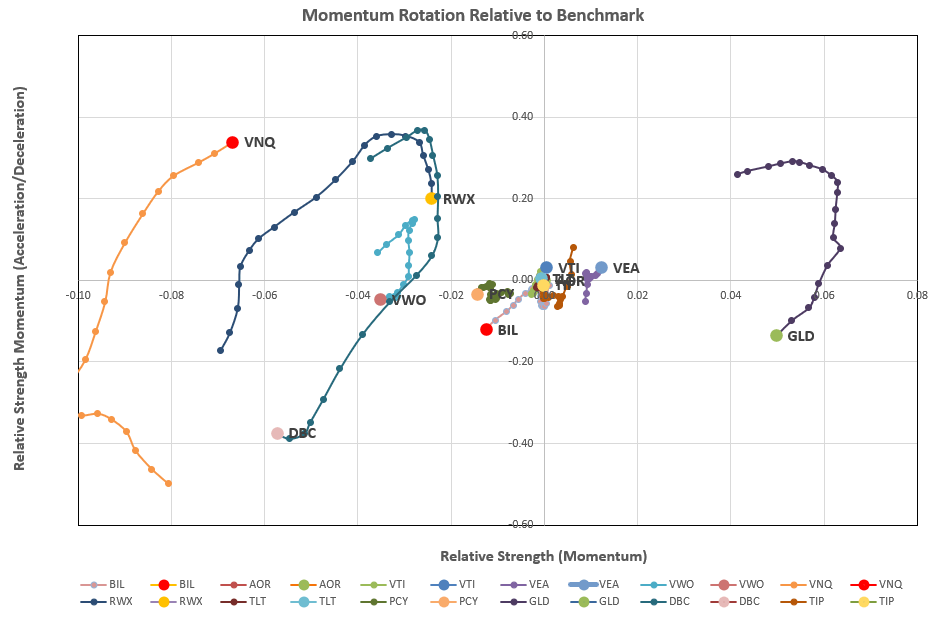

This week we review Tranche 3 – so we’ll first take a look at the rotation graphs:

This week we review Tranche 3 – so we’ll first take a look at the rotation graphs:

where we see a distinct lack of action in the desirable top right quadrant with GLD (Gold) rotating out of the quadrant due to recent weakness. The centre of the plot looks like a mess so we’ll zoom in to take a closer look:

where we see a distinct lack of action in the desirable top right quadrant with GLD (Gold) rotating out of the quadrant due to recent weakness. The centre of the plot looks like a mess so we’ll zoom in to take a closer look:

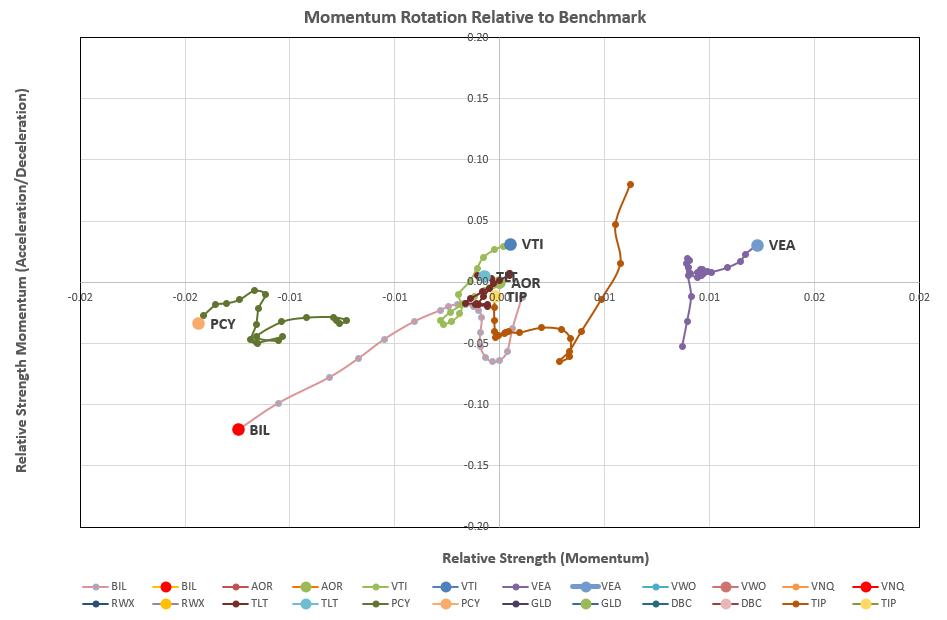

and we see some positivity in VEA (Developed Market Equities) so we’ll check out the recommendations from the Rotation model:

and we see some positivity in VEA (Developed Market Equities) so we’ll check out the recommendations from the Rotation model:

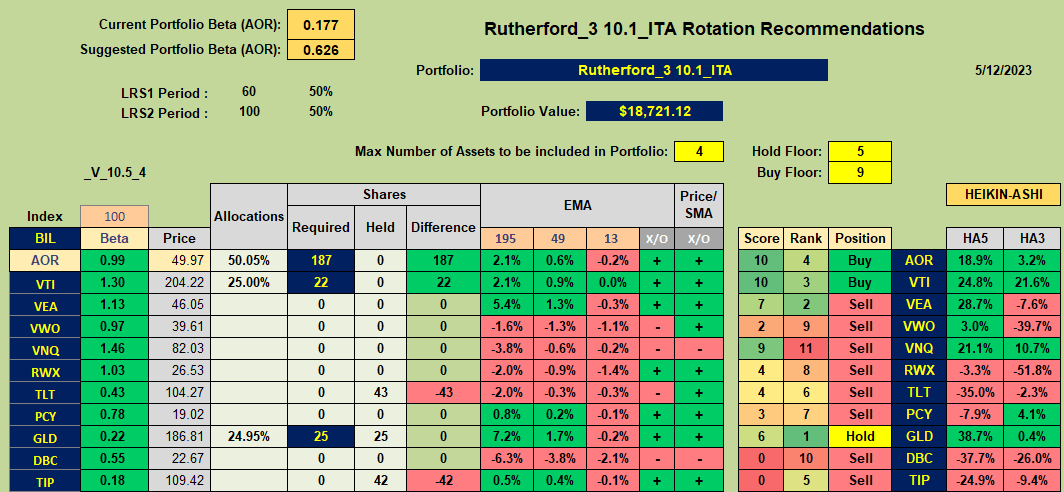

where we see Buy recommendations for VTI (US Equities) and AOR (Benchmark Fund) and a Hold recommendation for GLD.

where we see Buy recommendations for VTI (US Equities) and AOR (Benchmark Fund) and a Hold recommendation for GLD.

VEA is not a recommended Buy due to the negative signal on the short term HA3 candle – but this could quickly flip (maybe even on Monday) to generate a Buy Signal. If this portfolio were not tranched I would be very tempted to override the recommendaton and to Buy shares in VEA. However, since I am already holding positions in VEA in other tranches I will follow the recommendations and just add VTI and AOR (that contains an allocation to Developed Market Equities).

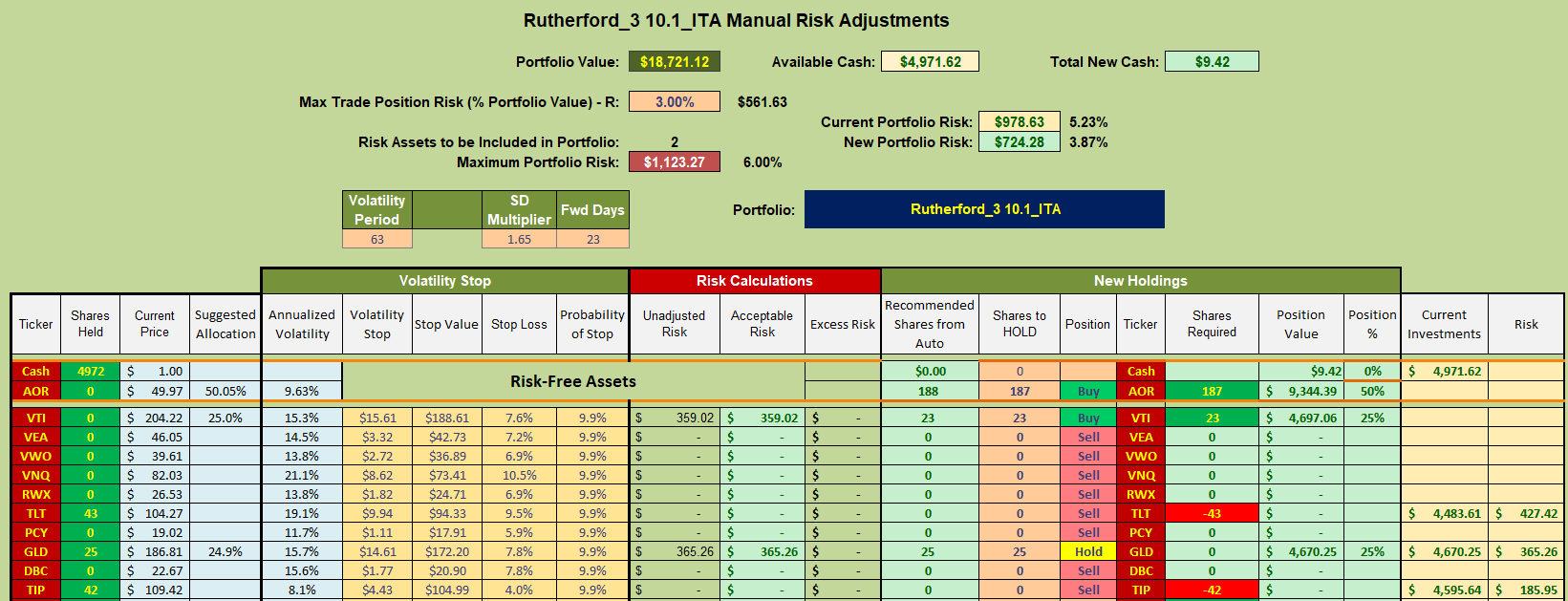

Consequently, this week’s adjustments look like this:

with the sale of shares in tLT and TIP Bonds to finance the rotation to equities.

with the sale of shares in tLT and TIP Bonds to finance the rotation to equities.

David

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.