It’s cold out there – but that doen’t stop the serious fisherman!

It was another bad week for US Equities with indices down ~3% on the week and now down over 5.5% from the highs at the beginning of the month.

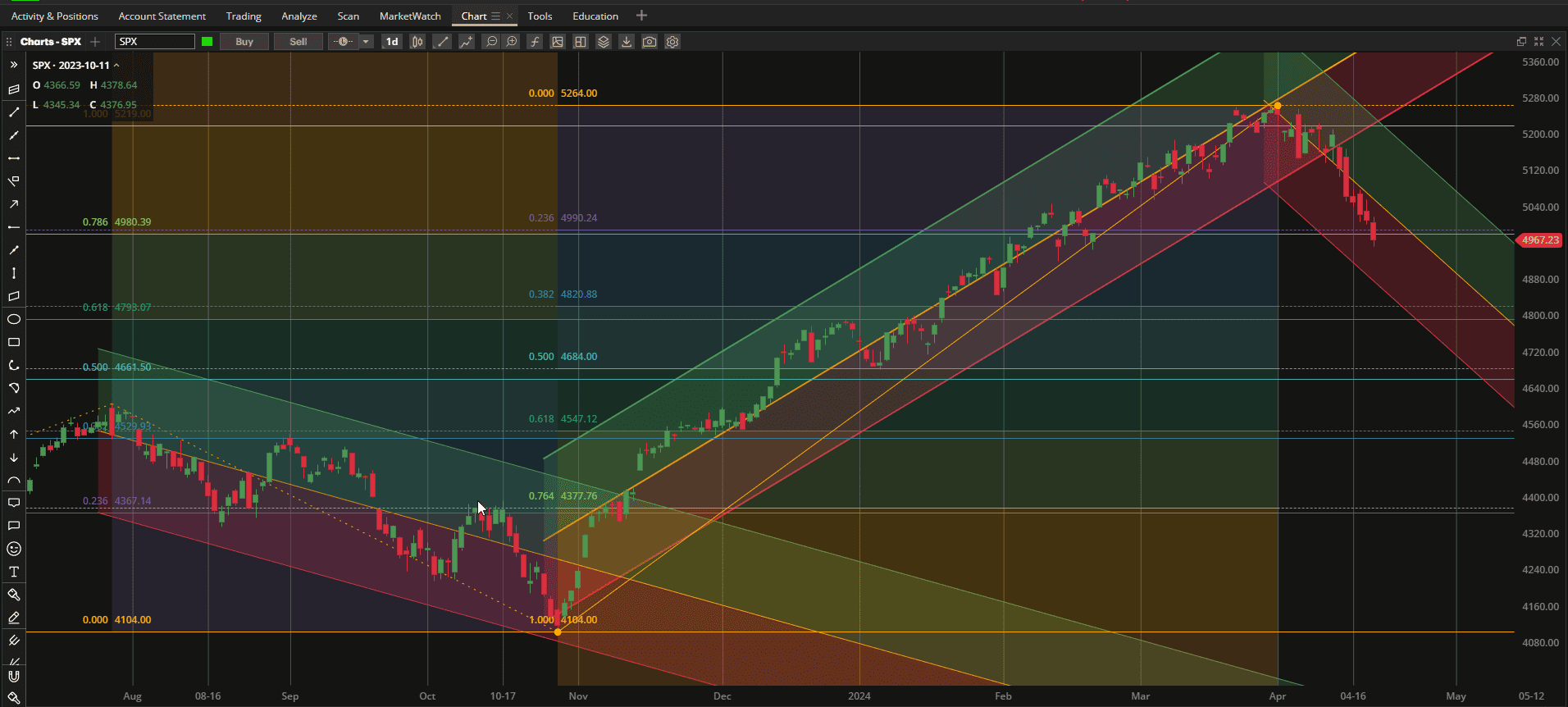

It may be a little early to be drawing bearish channels. but since we closed outside the bullish channel last week and have seen a continuation of the pullback (defined as a 5-10% move in the opposite direction) I have added a tentative channel to the chart. For what it’s worth we are now sitting at a 23.6% Fibonnaci retracement of the bullish upmove from November 2023. This isn’t considered a particularly strong potential support level but sometimes does show a little hesitation in price movement. Stronger potential support levels are at the 38.2%, 50% and 61.8% marks, or ~4800, 4700 and 4550 price levels. A “correction” in trend is commonly defined as a 10-20% change in direction of price movement – that would be somewhere below the 38.2% retracement level.

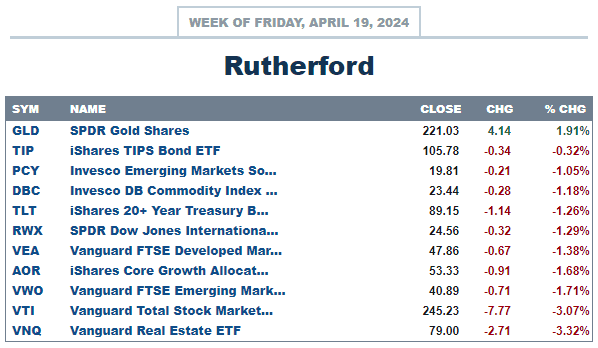

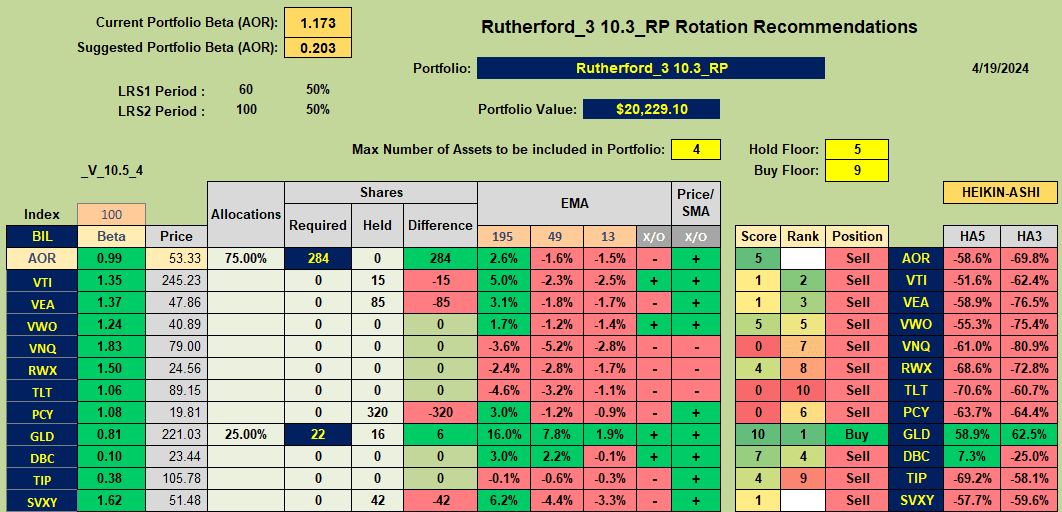

In terms of relative performance US equities closed the week close to the bottom of the list with only Gold (GLD) showing positive returns:

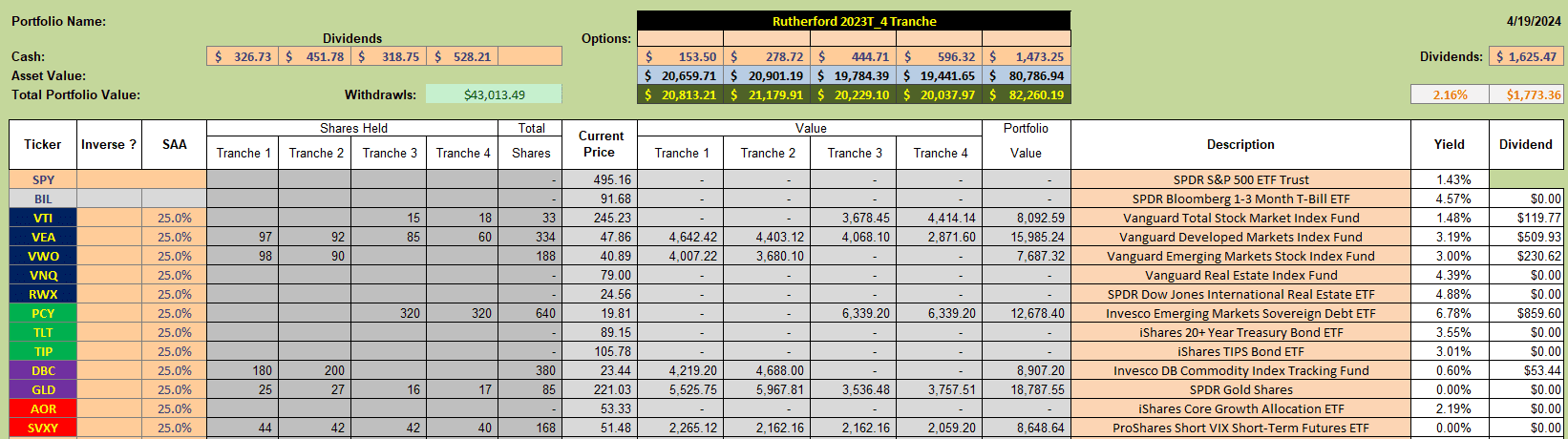

Current holdings in the Rutherford Portfolio look like this:

Current holdings in the Rutherford Portfolio look like this:

with Gold being well represented as we have been rotating into that asset class over the past few weeks.

with Gold being well represented as we have been rotating into that asset class over the past few weeks.

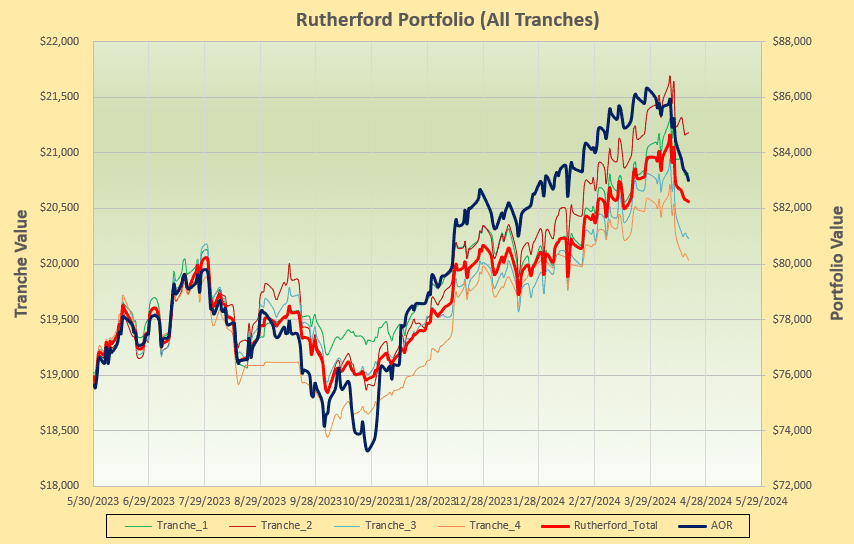

This has resulted in the following performance:

where we see a narrowing of the gap between the Rutherford portfolio and the benchmark even though both are in a pullback.

where we see a narrowing of the gap between the Rutherford portfolio and the benchmark even though both are in a pullback.

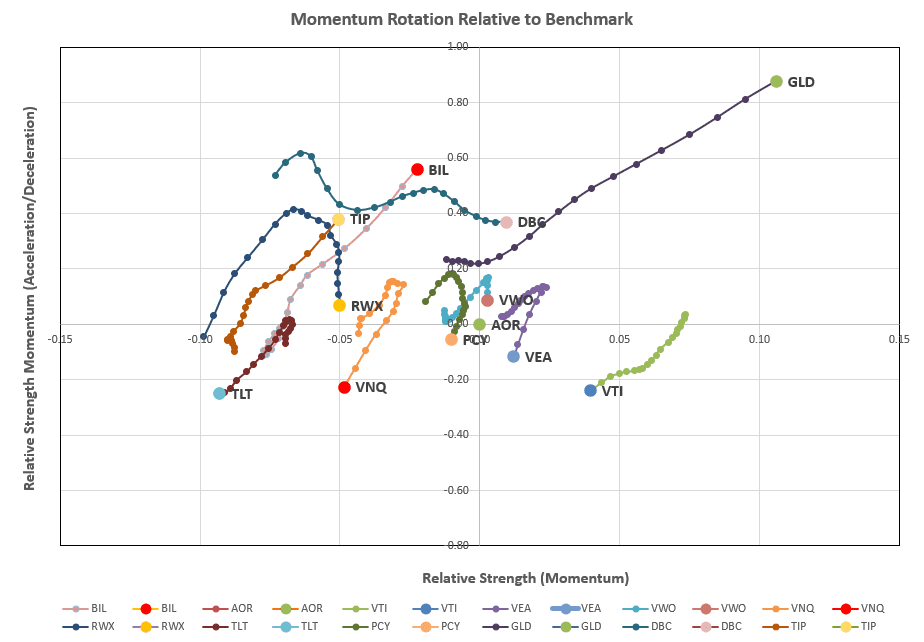

But let’s check on the rotation graphs:

where we get confirmation of the strength in GLD. DBC is still sitting in that desirable top right quadrant but has shown a little short-term weakening recently. So we’ll move to the ranking sheet to check current recommendations:

where we get confirmation of the strength in GLD. DBC is still sitting in that desirable top right quadrant but has shown a little short-term weakening recently. So we’ll move to the ranking sheet to check current recommendations:

Here we see a warning sign with only GLD being a recommended BUY and Sell recommendations for all other assets. DBC is borderline and, if using 5- and 8-day Heikin-Ashi (HA) signals would also show a Buy ecommendation. I am tempted, but I will show a little discipline and stick with 3- and 5-day settings that result in adjustments to Tranche 3 (the focus of this week’s review) that look something like this:

Here we see a warning sign with only GLD being a recommended BUY and Sell recommendations for all other assets. DBC is borderline and, if using 5- and 8-day Heikin-Ashi (HA) signals would also show a Buy ecommendation. I am tempted, but I will show a little discipline and stick with 3- and 5-day settings that result in adjustments to Tranche 3 (the focus of this week’s review) that look something like this:

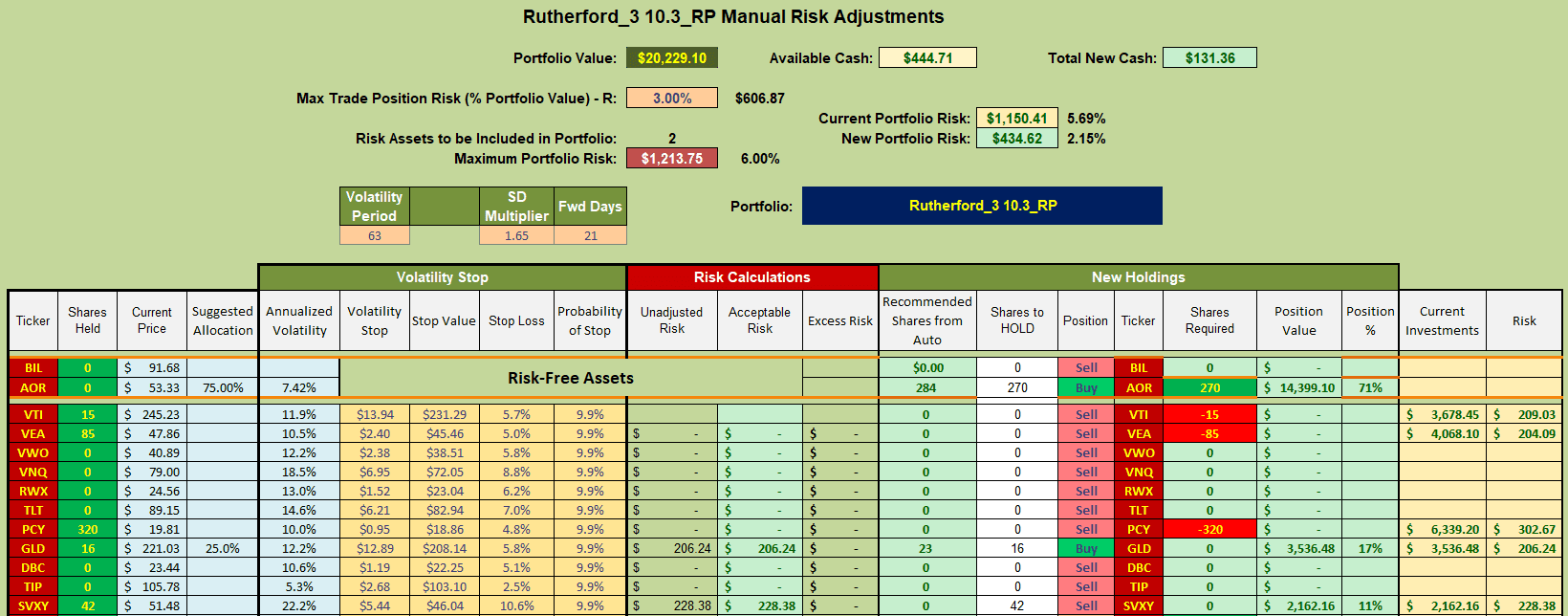

i.e. I shall be selling current holdings in VTI, VEA and PCY and using the cash generated to open a position in AOR (the benchmark fund). Although AOR shows as a Sell in the ranking sheet momentum/relative strength is showing as stronger than BIL (short-term T-Bills as a proxy for Cash) and so I will go with AOR over BIL in the event that we get a bounce from here. At least we won’t lose out to the benchmark if the decline continues 🙂 . I will not be reducing my holdings in GLD.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.