Balinese Salesmen, Indonesia

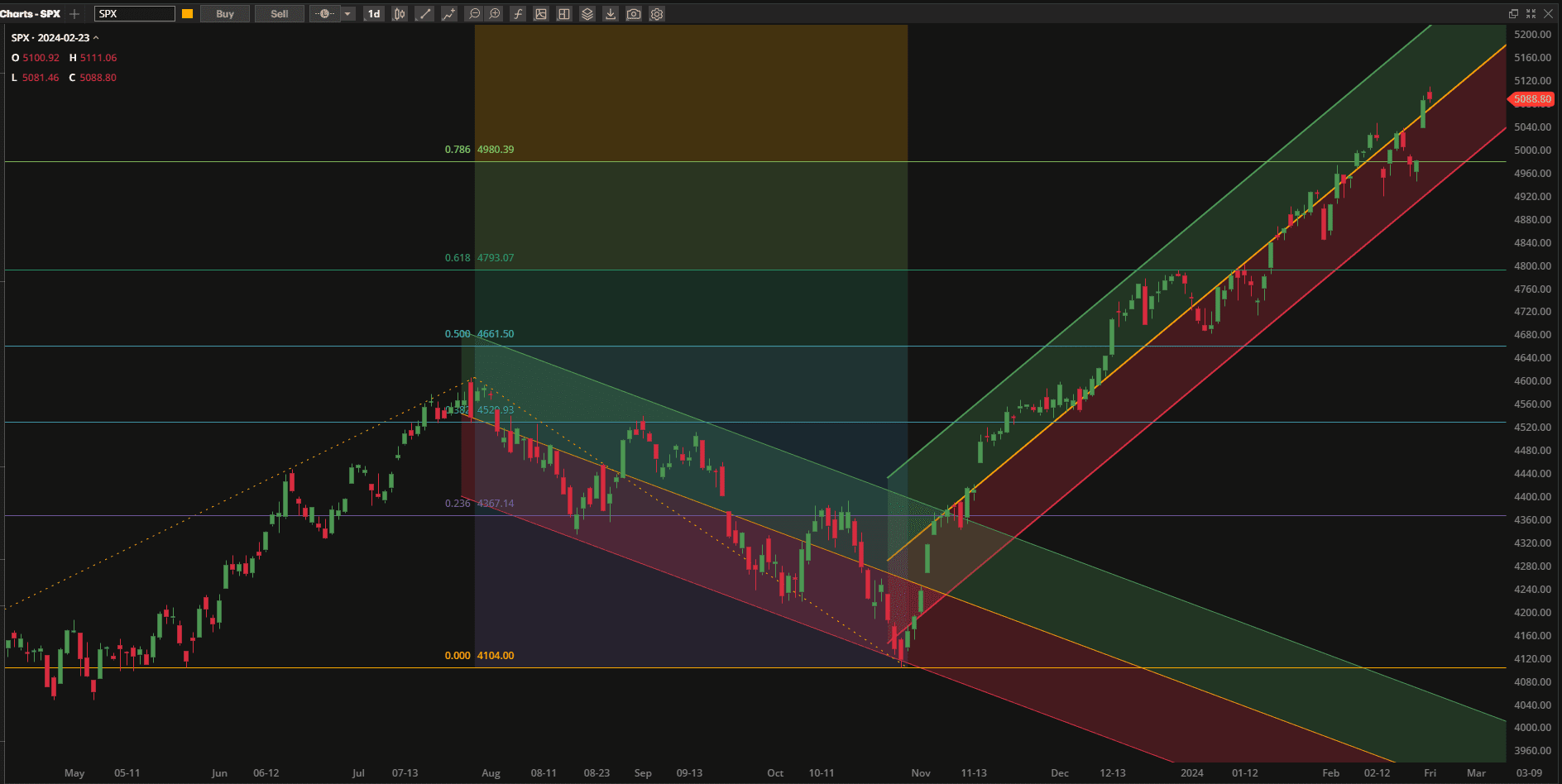

It was another positive week for US equities with the S&P 500 Index hitting new highs after a shaky start to the week. At the end of the week US equities closed ~1.4% higher than last week’s close:

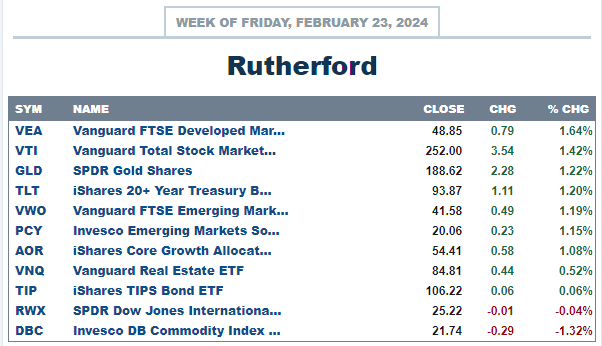

Relative to other major asset classes US Equities came in close to the top of the list:

Relative to other major asset classes US Equities came in close to the top of the list:

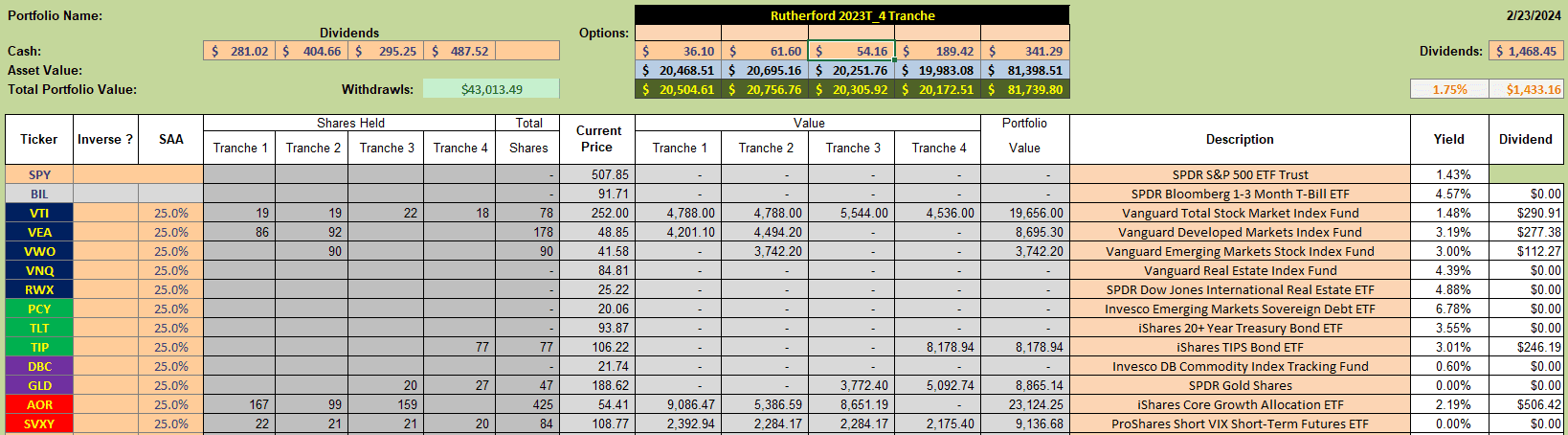

Holdings in the Rutherford Portfolio currently look like this:

Holdings in the Rutherford Portfolio currently look like this:

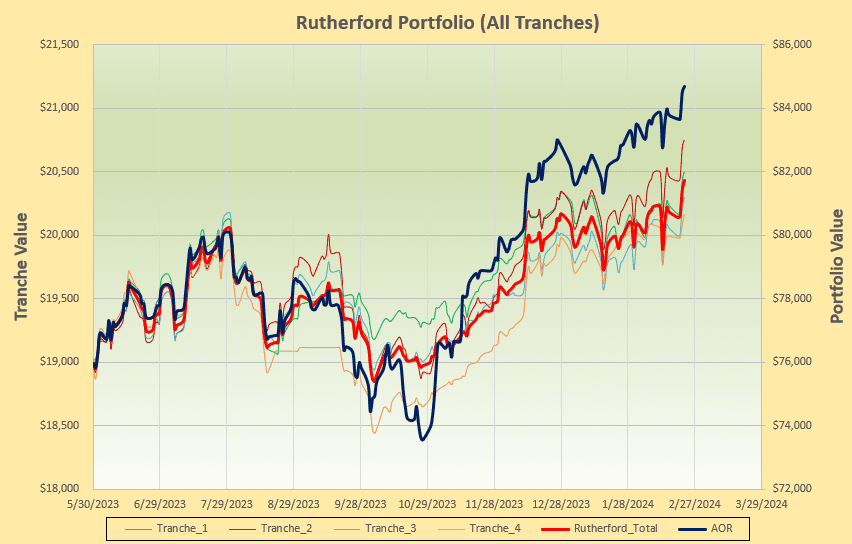

and is heavily weighted towards equities in general. Recent performance looks like this:

and is heavily weighted towards equities in general. Recent performance looks like this:

so is still lagging the benchmark AOR Fund as a result of the slow reaction to the recovery from the 2023 pull-back where the portfolio benefitted from being lightly weighted in the equity markets.

so is still lagging the benchmark AOR Fund as a result of the slow reaction to the recovery from the 2023 pull-back where the portfolio benefitted from being lightly weighted in the equity markets.

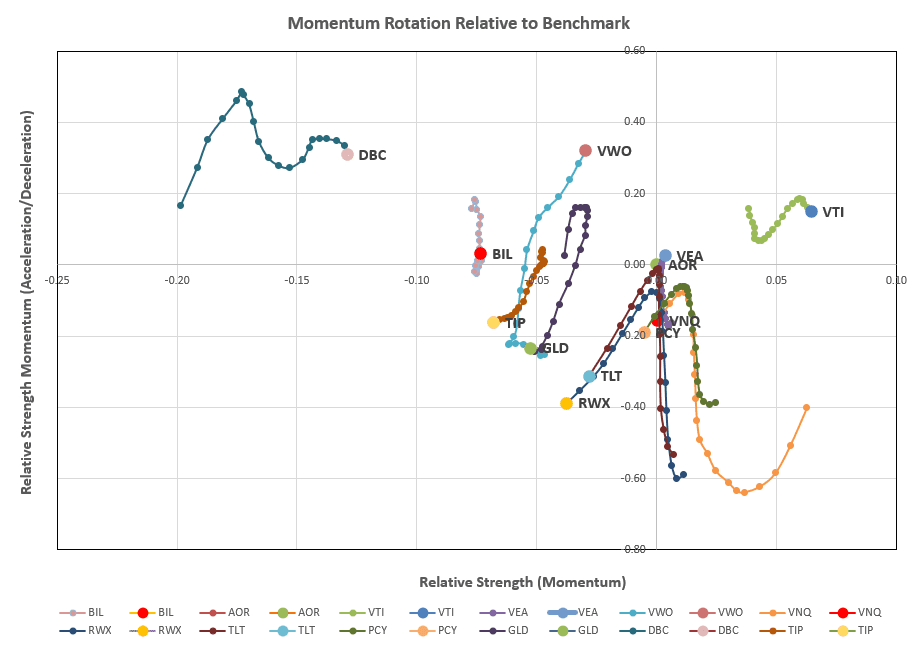

Let’s take a look at the rotation graphs to see if it looks as though we might need adjustments in Tranche 3 (the focus of this week’s review):

As in recent weeks we see only VTI (US Equities) as being well positioned in the desirable top right quadrant.

As in recent weeks we see only VTI (US Equities) as being well positioned in the desirable top right quadrant.

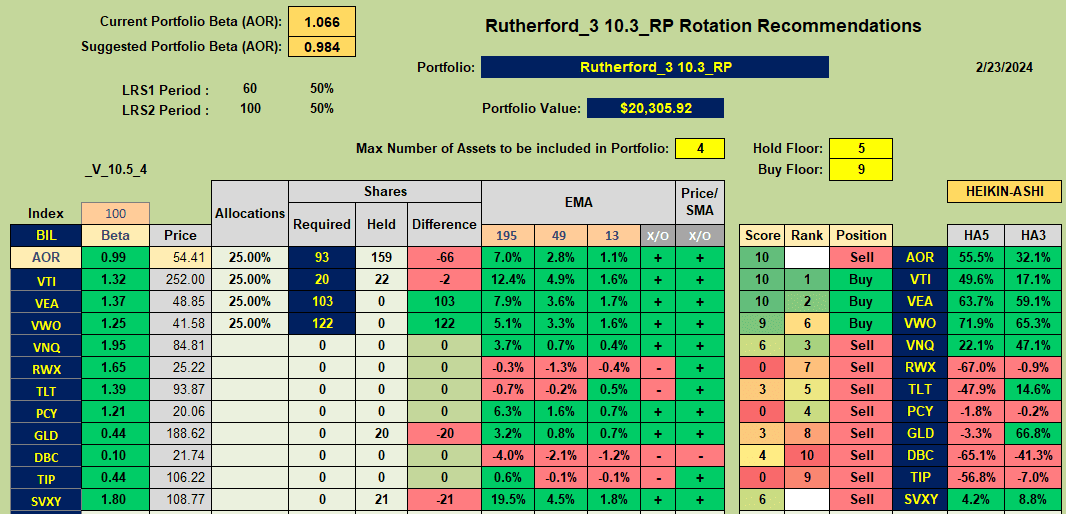

Checking the recommendations from the rotation model:

we see a repitition of last week’s recommendations – to move heavily into the global equity markets. Consequently, this week’s adjustments will look something like this:

we see a repitition of last week’s recommendations – to move heavily into the global equity markets. Consequently, this week’s adjustments will look something like this:

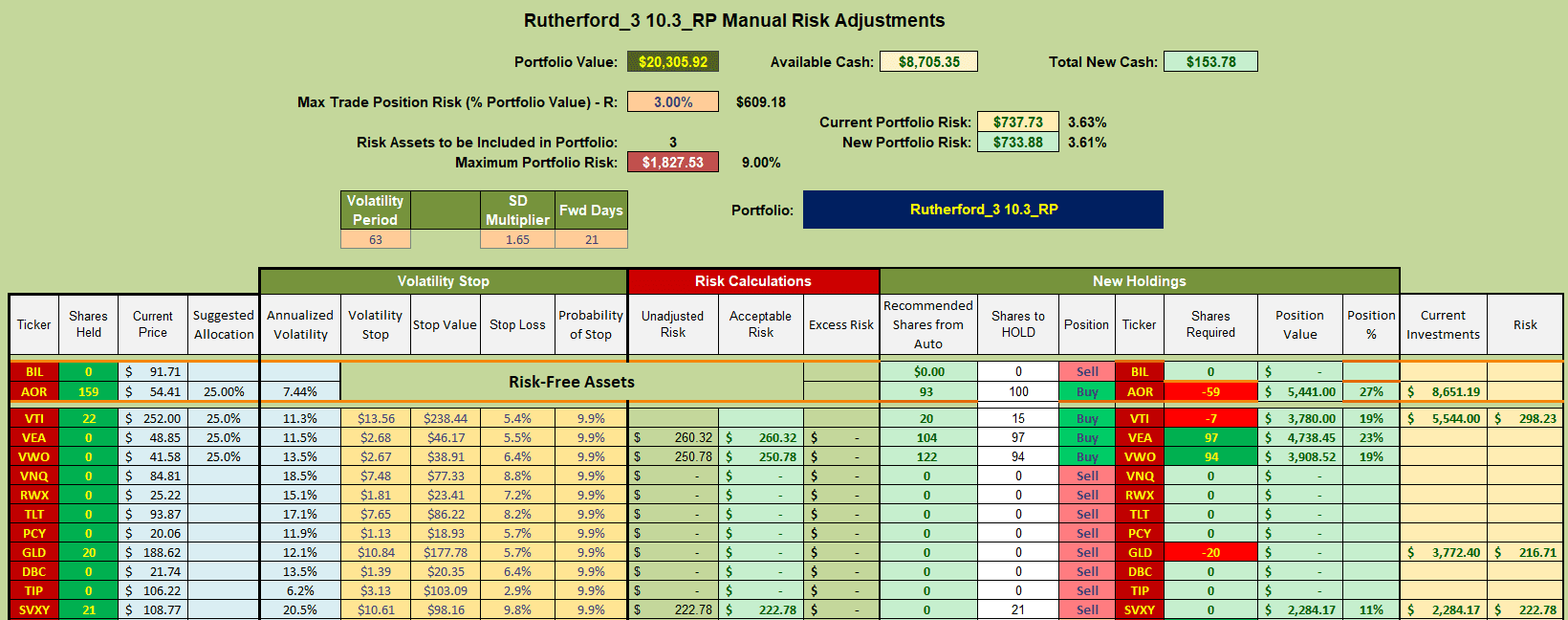

In order to save a little on trading costs I will just sell the current holdings in GLD (Gold) and use available cash to purchase shares in VWO. This will leave me roughly equally weighted in Developed Market and Emerging Market equities with additional exposure to all equity asset classes through current holdings in AOR, the benchmark fund.

In order to save a little on trading costs I will just sell the current holdings in GLD (Gold) and use available cash to purchase shares in VWO. This will leave me roughly equally weighted in Developed Market and Emerging Market equities with additional exposure to all equity asset classes through current holdings in AOR, the benchmark fund.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.