Gardens by the Bay, Singapore

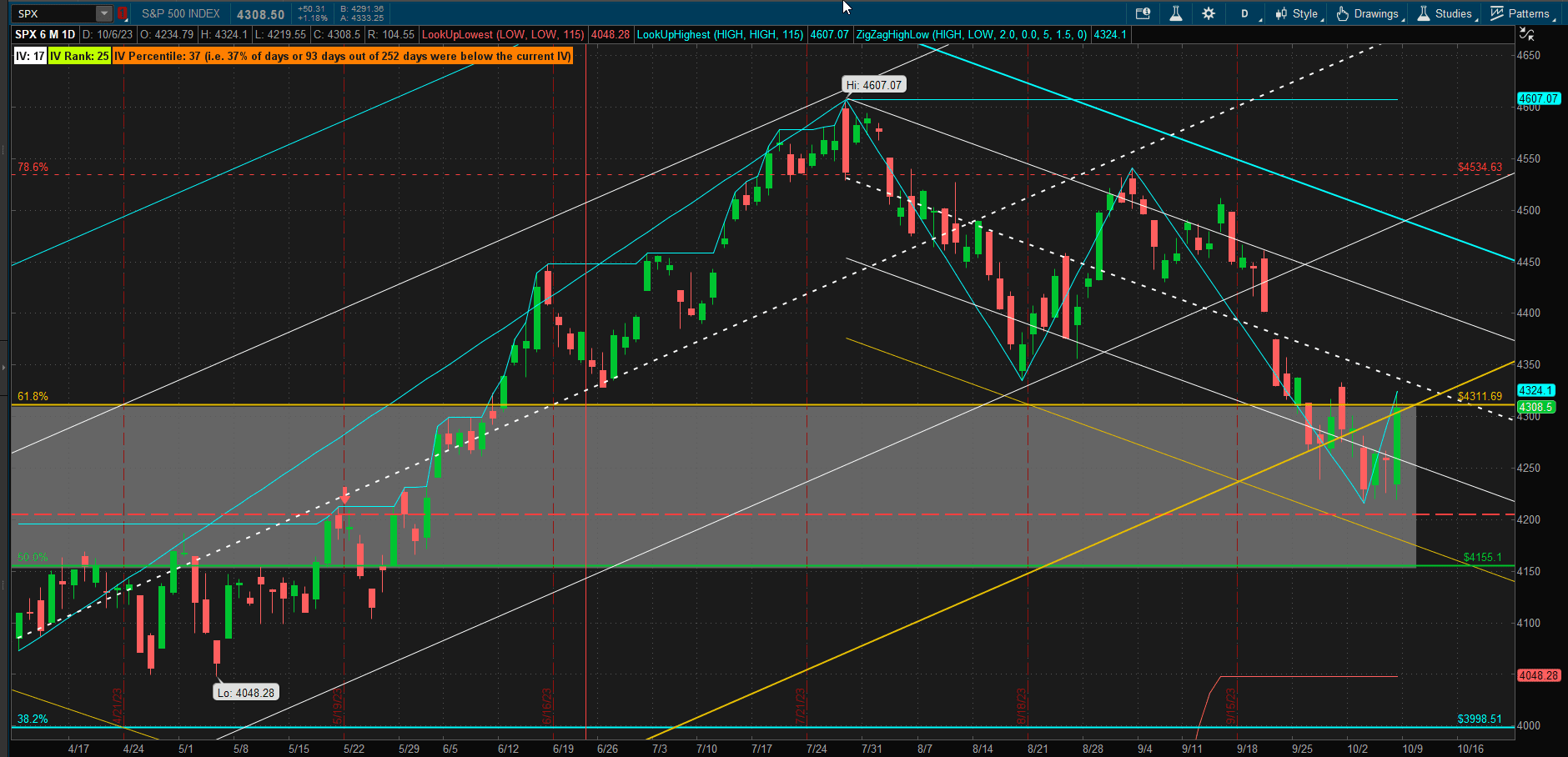

We started the week with a continuation of the recent bearish trend and a test of the 4200 support level in the SPX, but Friday’s strong bounce led to a ~0.25% higher close from last week’s close.:

However we are now re-testing the 4300 level – at the top of the support/resistance zone (shaded area) – and at the “neckline” of a head-and-shoulders pattern that has formed over the past ~4 months. It is not clear where we will go from here. If we see a continuation of the bounce, the next potential resistance might be at the top boundary of the downtrend channel and back into the longer term uptrend channel. However, we will need to close above the previous pivot high at ~4550 before we can feel comfortable that we are back in a bullish market. To the downside it gets a little scary, with the next area of support (below the neckline) at ~4000 – a significant “round-number” and 38.2% Fibonacci retracement level.

However we are now re-testing the 4300 level – at the top of the support/resistance zone (shaded area) – and at the “neckline” of a head-and-shoulders pattern that has formed over the past ~4 months. It is not clear where we will go from here. If we see a continuation of the bounce, the next potential resistance might be at the top boundary of the downtrend channel and back into the longer term uptrend channel. However, we will need to close above the previous pivot high at ~4550 before we can feel comfortable that we are back in a bullish market. To the downside it gets a little scary, with the next area of support (below the neckline) at ~4000 – a significant “round-number” and 38.2% Fibonacci retracement level.

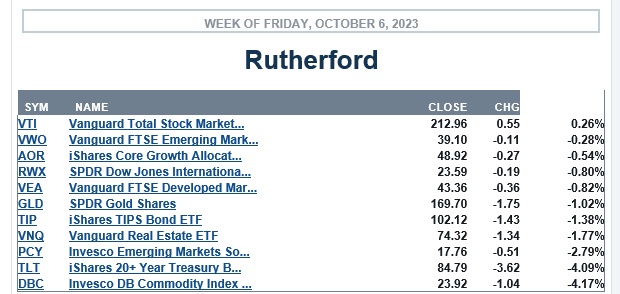

Despite the bearish feeling of the current market trend, US equities were still the best performing major asset class over the past week with Bonds and Commodities getting hit really hard:

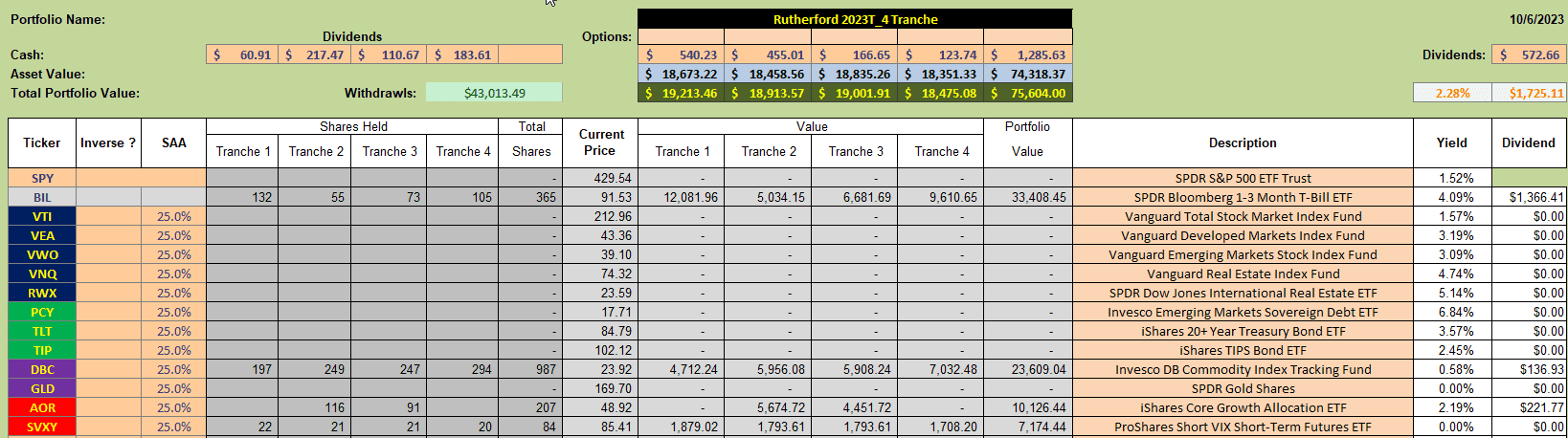

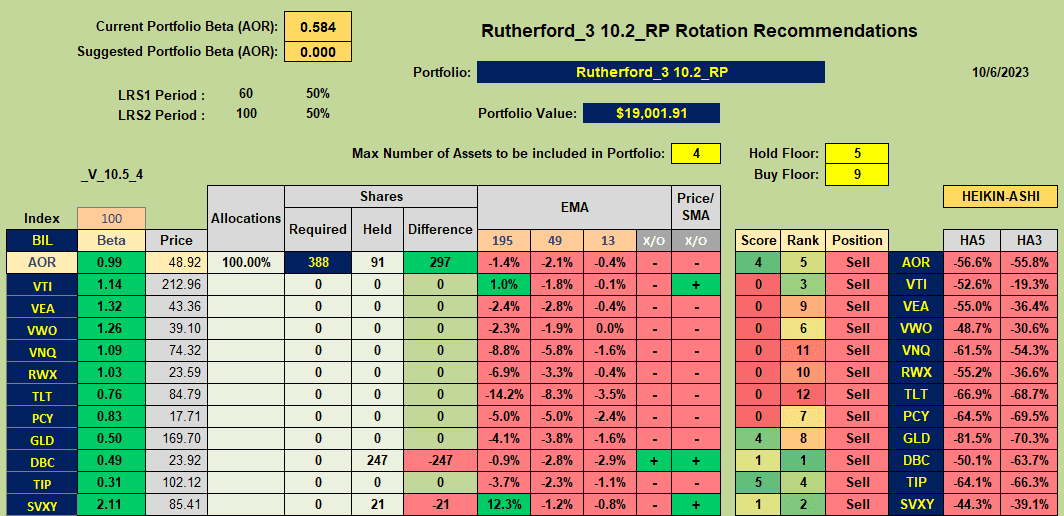

Current holdings in the Rutherford Portfolio look like this:

Current holdings in the Rutherford Portfolio look like this:

and the significant holdings in DBC (Commodities) has hurt performance over the past week:

and the significant holdings in DBC (Commodities) has hurt performance over the past week:

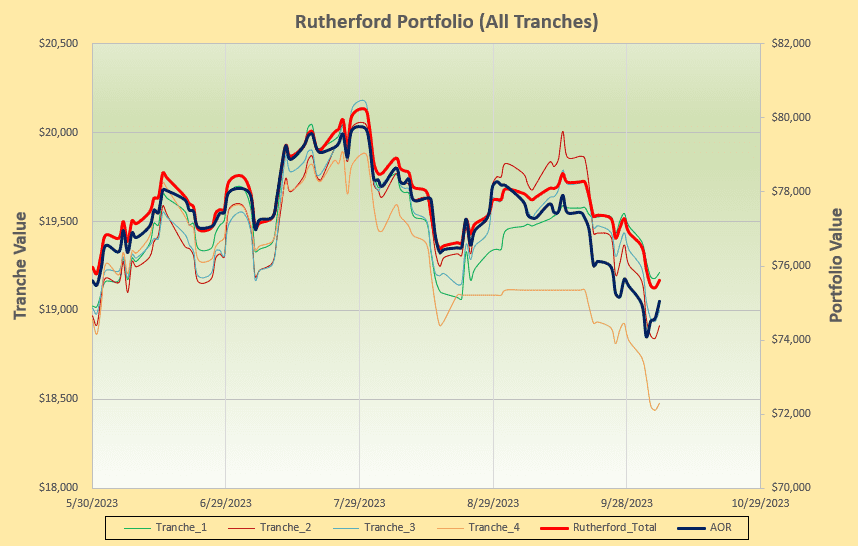

although we remain ahead of the benchmark AOR Fund.

although we remain ahead of the benchmark AOR Fund.

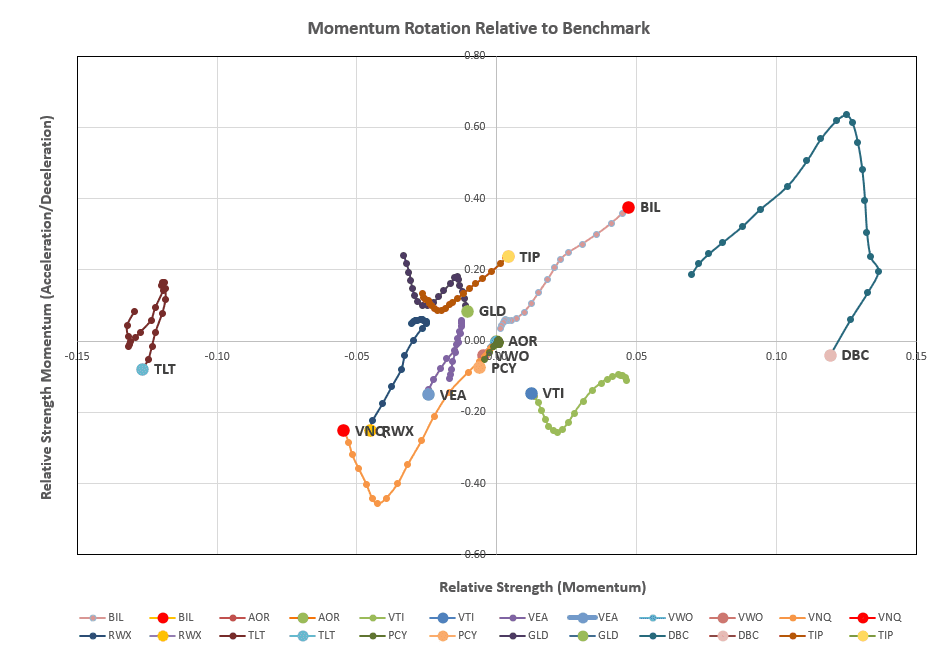

Checking the rotation graphs:

we see the demise of Commodities over the past 2 weeks and the “relative” strength of BIL (our low volatility base asset for establishing positive or negative absolute momentum).

we see the demise of Commodities over the past 2 weeks and the “relative” strength of BIL (our low volatility base asset for establishing positive or negative absolute momentum).

This inevtably leads to the following recommendations for Tranche 3 (the focus of this week’s review):

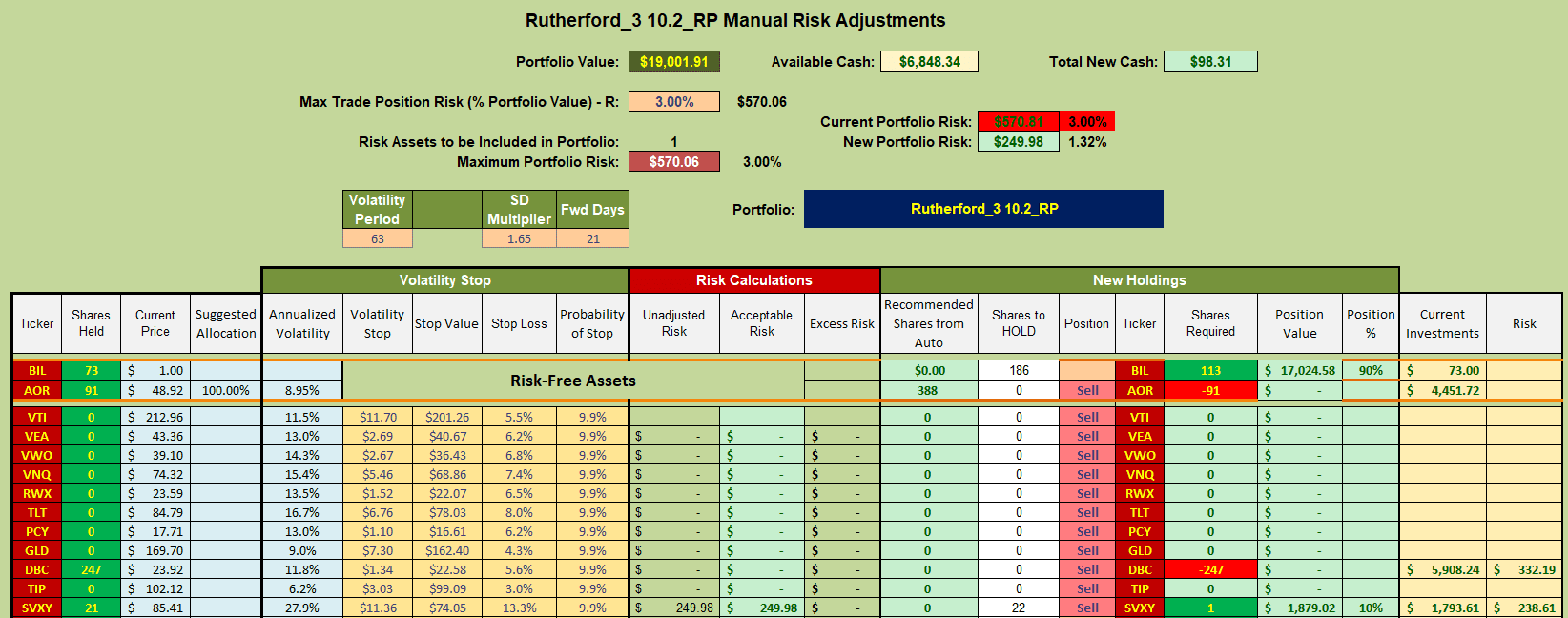

i.e. we see red almost everywhere and Sell recommendations across the board. This means that this week’s adjustments will look like this:

i.e. we see red almost everywhere and Sell recommendations across the board. This means that this week’s adjustments will look like this:

i.e. I will be selling shares in DBC and AOR and moving to BIL (Cash) with the exception of my holdings in SVXY (Volatility) that I will continue to hold.

i.e. I will be selling shares in DBC and AOR and moving to BIL (Cash) with the exception of my holdings in SVXY (Volatility) that I will continue to hold.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.