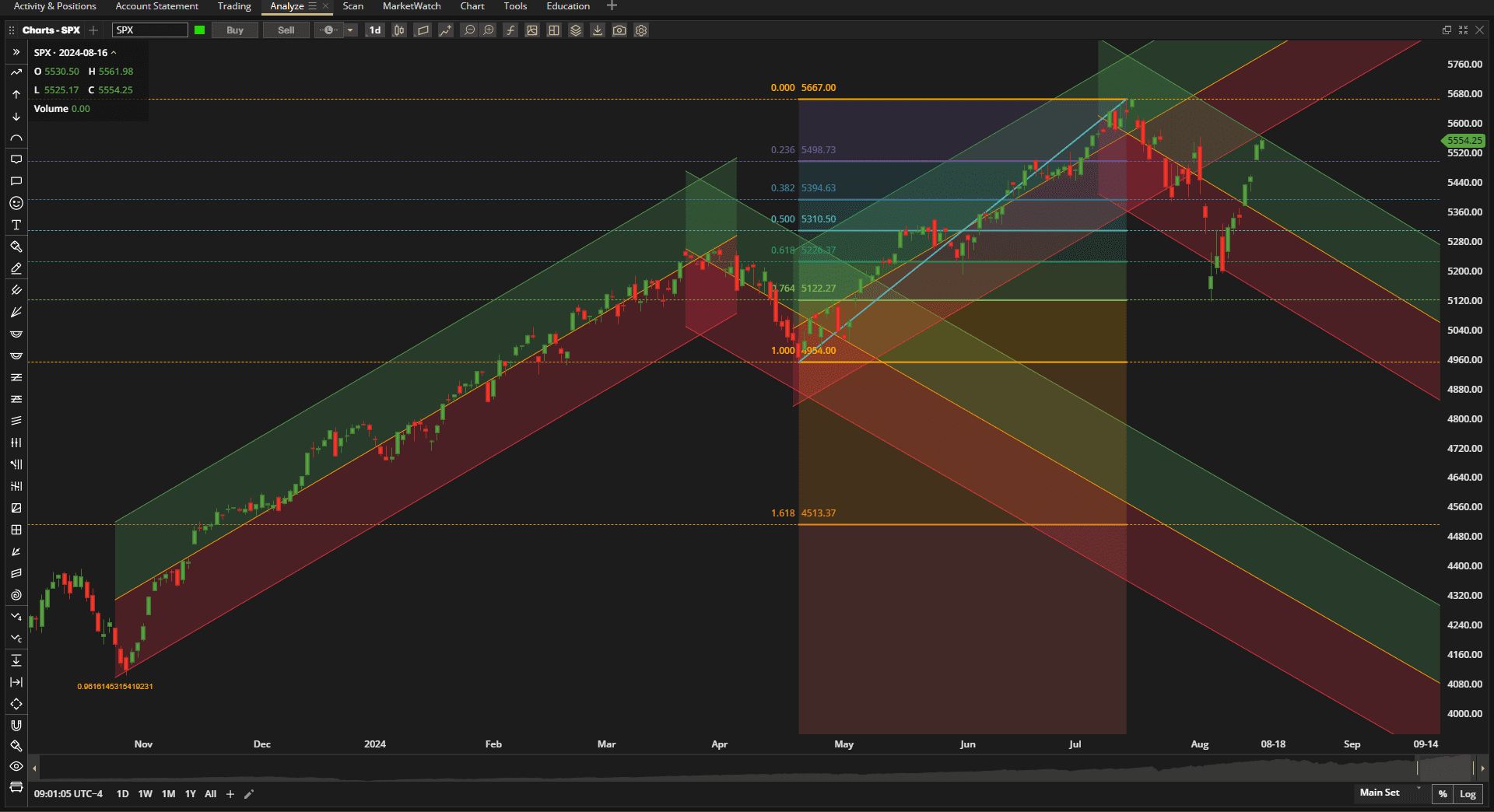

The bounce in equity prices continued this week as just about all the major asset classes continued to climb. US Equity prices hit the high end of the downtrend channel:

Now we wait to see whether there is any follow-through from here or whether we see some softening after after 9 days of higher highs.

Now we wait to see whether there is any follow-through from here or whether we see some softening after after 9 days of higher highs.

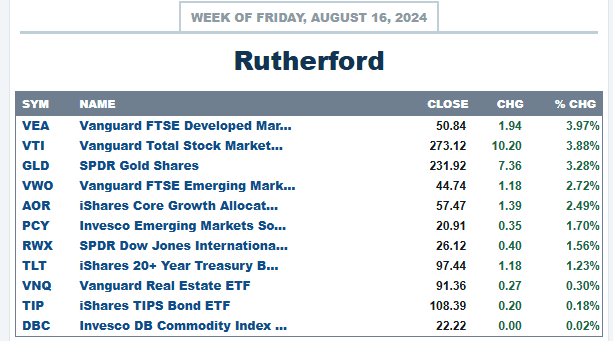

Relative to the other major asset classes, US Equities came out close to the top – although all asset classes had positive returns on the week:

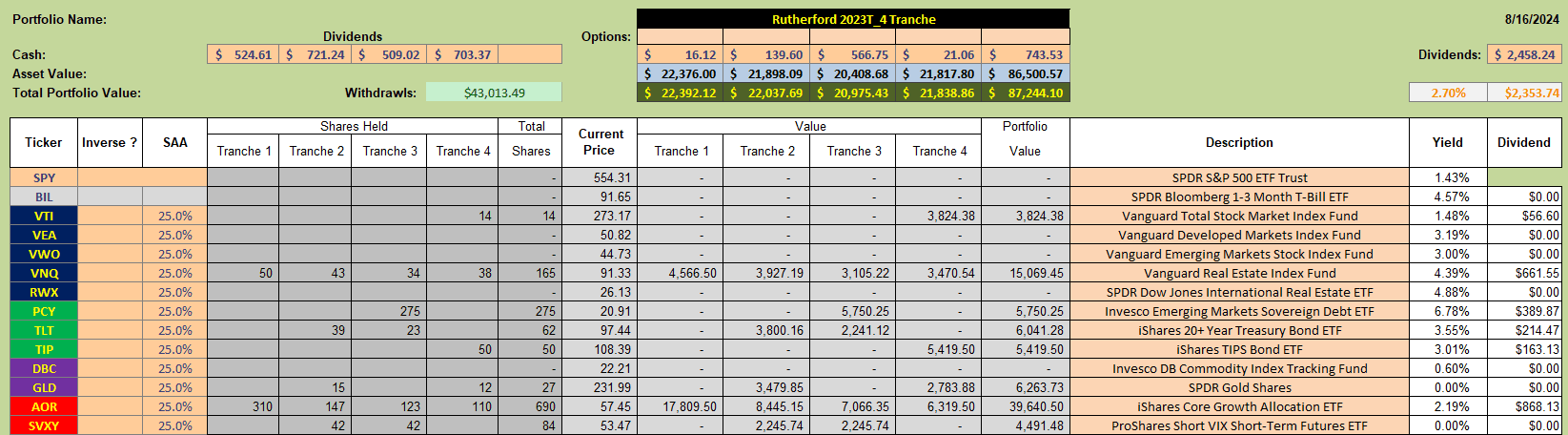

Current holdings in the Rutherford Portfolio look lke this:

Current holdings in the Rutherford Portfolio look lke this:

with VTI (US Equities), VNQ (US Real Estate), TIP (Inflation adjusted Bonds,) GLD (Gold) and AOR (the benchmark fund) presently being held inTranche 4 (the focus of this week’s review).

with VTI (US Equities), VNQ (US Real Estate), TIP (Inflation adjusted Bonds,) GLD (Gold) and AOR (the benchmark fund) presently being held inTranche 4 (the focus of this week’s review).

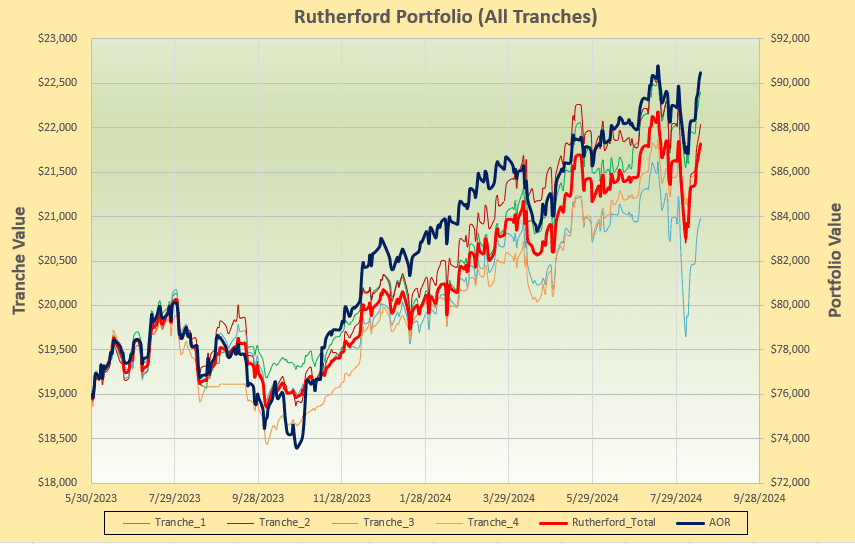

Portfolio performance to date looks like this:

with the total portfolio trailing the benchmark a little and the “timing” or review date luck being evident in the performance of the different tranches.

with the total portfolio trailing the benchmark a little and the “timing” or review date luck being evident in the performance of the different tranches.

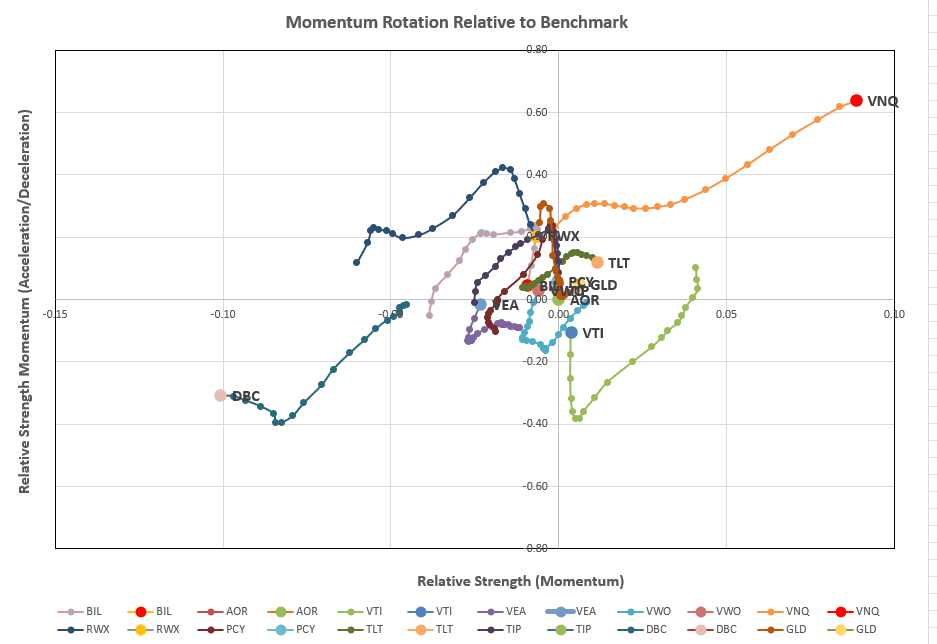

Checking the rotation graphs:

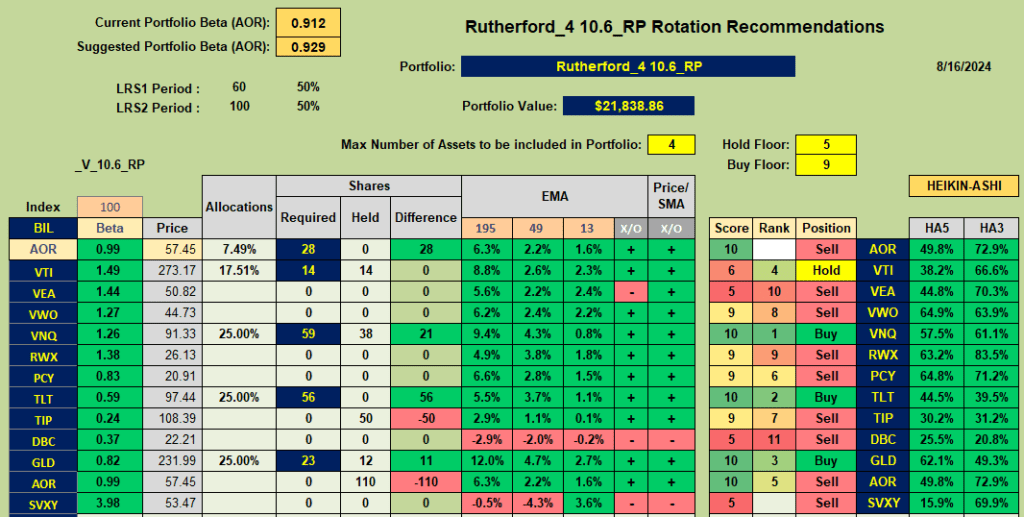

we still see VNQ (US Real Estate) as having the strongest Momentum (Relative Strength) and this is confirmed in the rankings/recommendations from the Kipling spreadsheet:

we still see VNQ (US Real Estate) as having the strongest Momentum (Relative Strength) and this is confirmed in the rankings/recommendations from the Kipling spreadsheet:

where, in addition to VNQ, TLT and GLD are recommended Buys and VTI gets a Hold recommendation.

where, in addition to VNQ, TLT and GLD are recommended Buys and VTI gets a Hold recommendation.

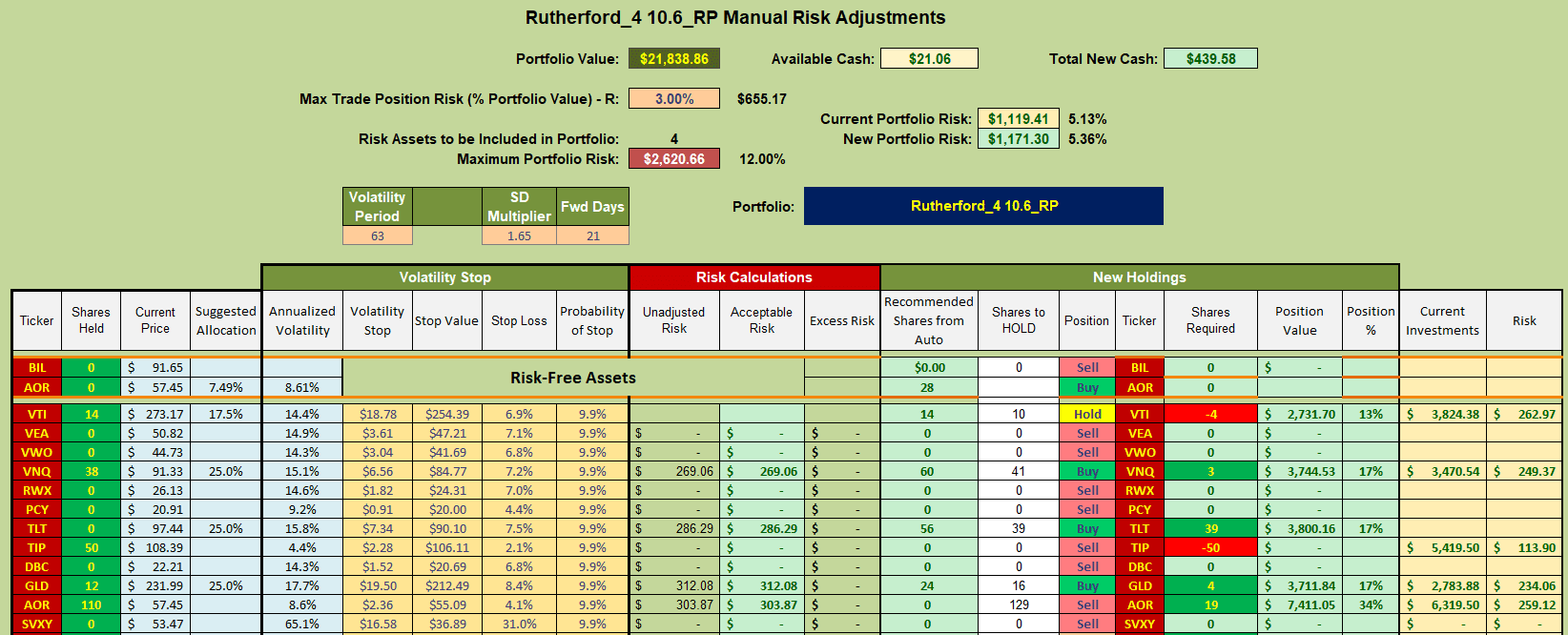

Adjustments to Tranche 4 for next week therefore look something like this:

where I shall be selling existing holdings in TIP and using the funds to buy shares in TLT. Any excess funds will be used to add shares of AOR but I will not worry about minor adjustments to VTI, VNQ or GLD so as to minimize trading costs.

where I shall be selling existing holdings in TIP and using the funds to buy shares in TLT. Any excess funds will be used to add shares of AOR but I will not worry about minor adjustments to VTI, VNQ or GLD so as to minimize trading costs.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

David,

Under New Holdings what is the difference between Recommended Shares from Auto and Shares to hold?

Thanks,

Bob W

Bob W,

Good question – because I probably haven’t gone into this in my posts.

The “Recommended Shares from Auto” numbers are the holdings as calculated from the equal weighting of shares from the recommended shares filter (4 assets max in this case). The “Shares to Hold” numbers are modified allocations of those (4) asset recommendations calculated on the basis of volatility with (in this case) a 3% volatility target.

This takes a little thinking about so please let me know if you need more explanation.

David