Stalagmite display at Gardens on the Bay, Singapore

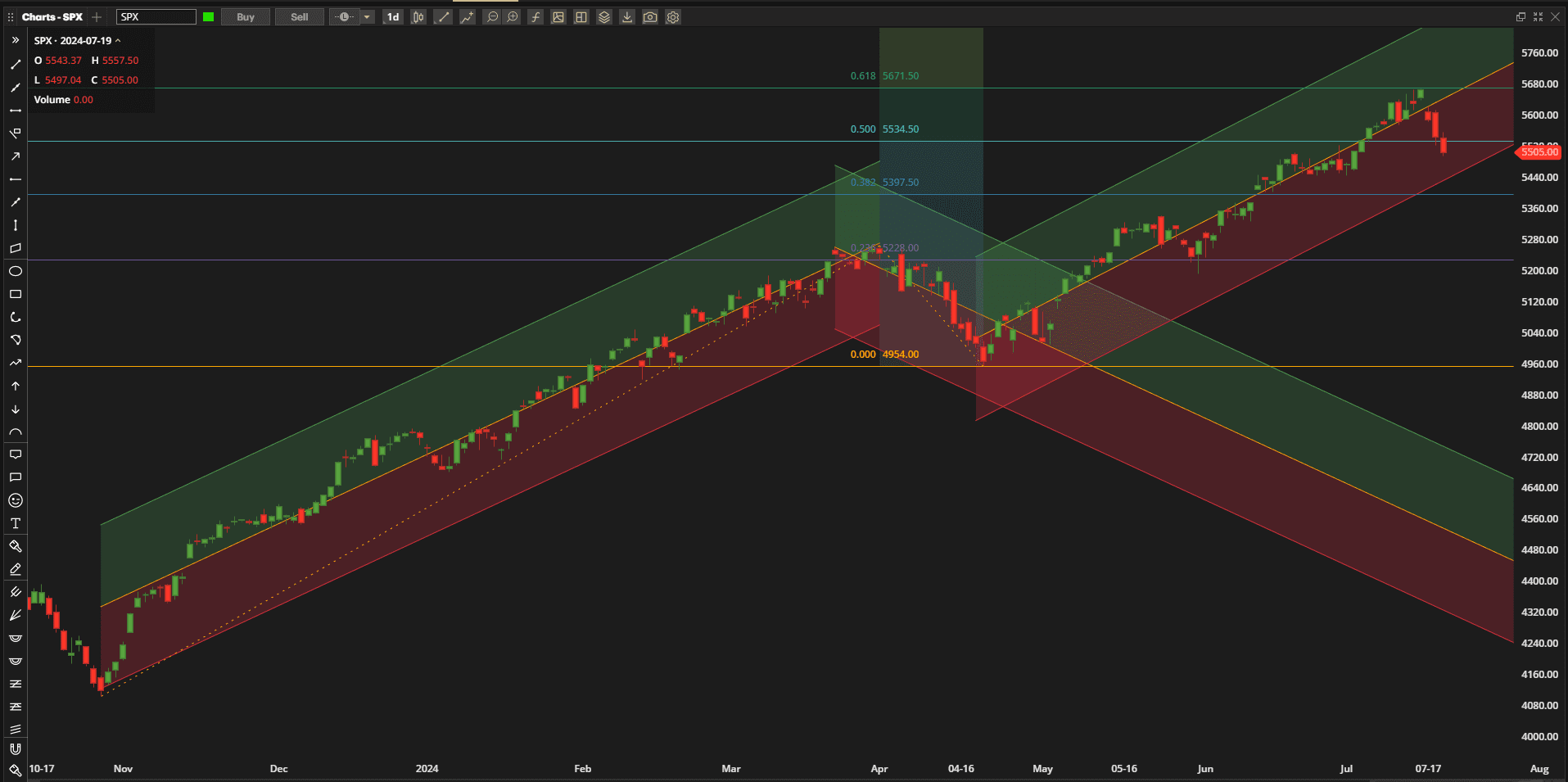

US Equities saw a (predictable?) pullback over the past week closing down ~2% from last week’s close:

As suggested in last week’s post the 5680 level in the SPX (S&P 500 Index) proved to provided significant resistance and we bounced off this level and moved towards the lower boundary of the bullish regression channel. We will now wait to see what the impact will be on President Biden’s withdrawl from the Presidential race and the impact that this will have on the markets. Things are likely to get even crazier as we head towards the November elections with political uncertainty.

As suggested in last week’s post the 5680 level in the SPX (S&P 500 Index) proved to provided significant resistance and we bounced off this level and moved towards the lower boundary of the bullish regression channel. We will now wait to see what the impact will be on President Biden’s withdrawl from the Presidential race and the impact that this will have on the markets. Things are likely to get even crazier as we head towards the November elections with political uncertainty.

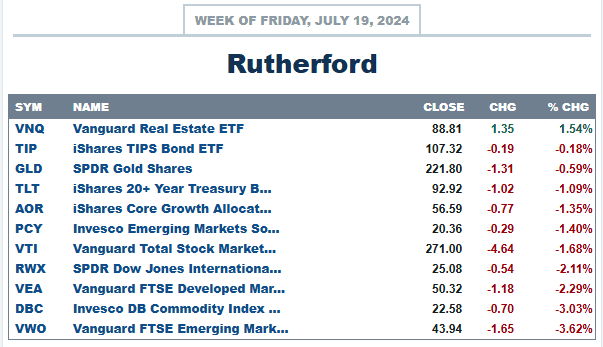

In terms of relative strength compared with other major asset classes, US equities (as represented by VTI) again fell into the lower half of the list:

with only US Real Estate (VNQ) showing positive returns on the week.

with only US Real Estate (VNQ) showing positive returns on the week.

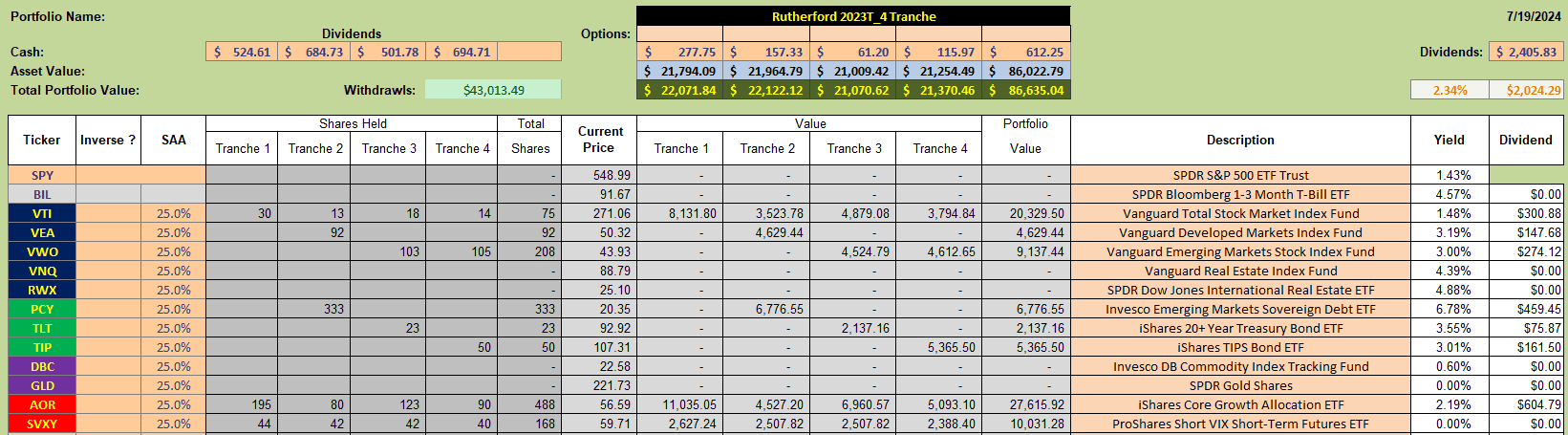

Current holdings in the Rutherford Portfolio look like this:

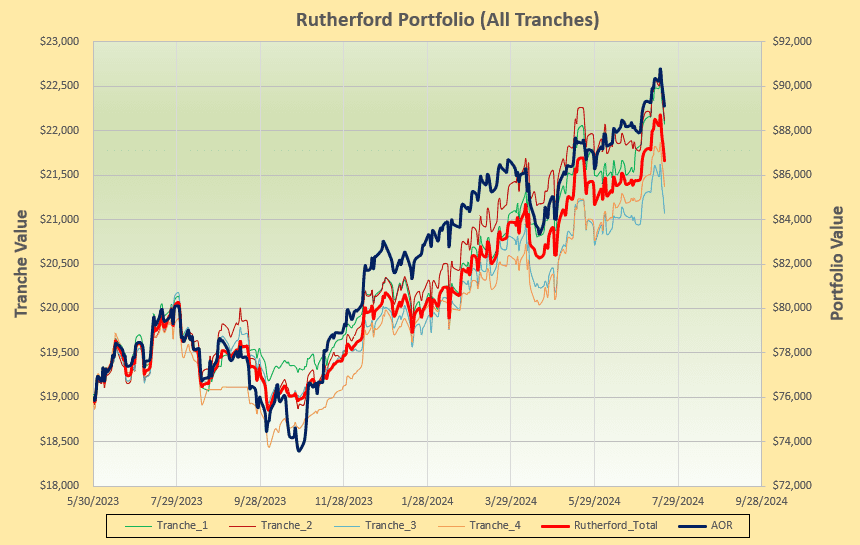

so it is not surprising to see negative returns over the past week:

so it is not surprising to see negative returns over the past week:

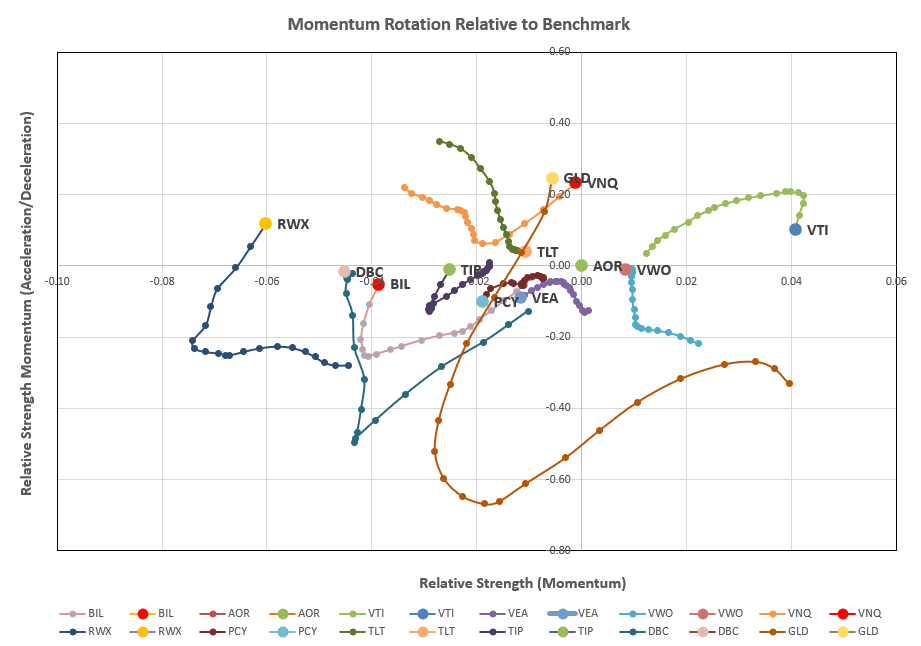

Holdings in Tranche 4 (the focuss of this week’s review) are in equities and bonds so we’ll take a look at the rotation graphs for possible candidates for adjustments:

Holdings in Tranche 4 (the focuss of this week’s review) are in equities and bonds so we’ll take a look at the rotation graphs for possible candidates for adjustments:

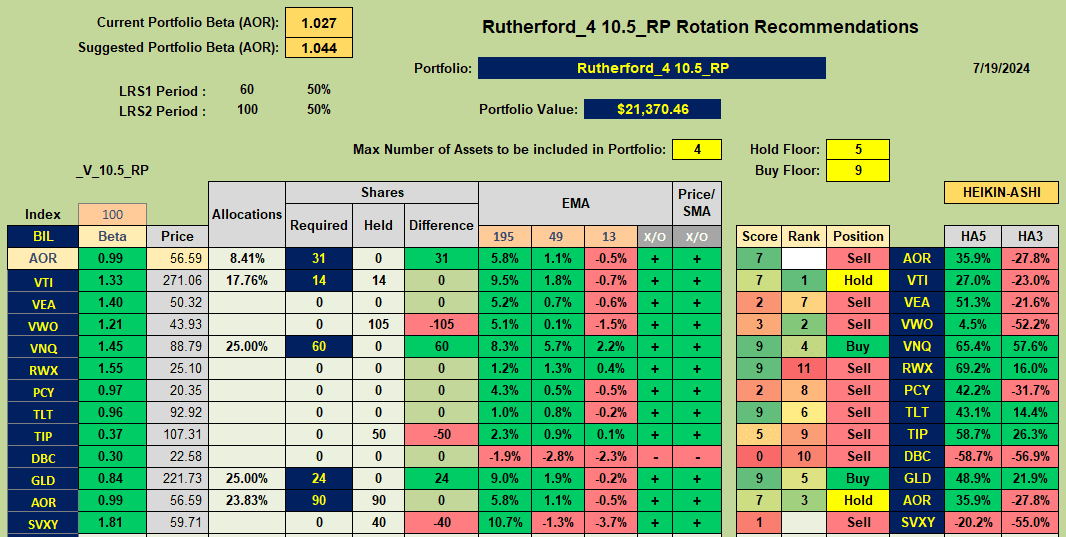

There is very little in the desirable top right quadrant of the graphs, with VTI retreating, particularly in the short term (downward vertical movement), but VNQ suggesting that it may soon move into that quadrant. Accordingly we’ll check the recommendation coming out of the algorithm used to manage this portfolio:

There is very little in the desirable top right quadrant of the graphs, with VTI retreating, particularly in the short term (downward vertical movement), but VNQ suggesting that it may soon move into that quadrant. Accordingly we’ll check the recommendation coming out of the algorithm used to manage this portfolio:

where we find Buy recommendations for VNQ and GLD (Gold) and Hold recommendations for VTI and AOR (the benchmark hybrid equity/bond fund).

where we find Buy recommendations for VNQ and GLD (Gold) and Hold recommendations for VTI and AOR (the benchmark hybrid equity/bond fund).

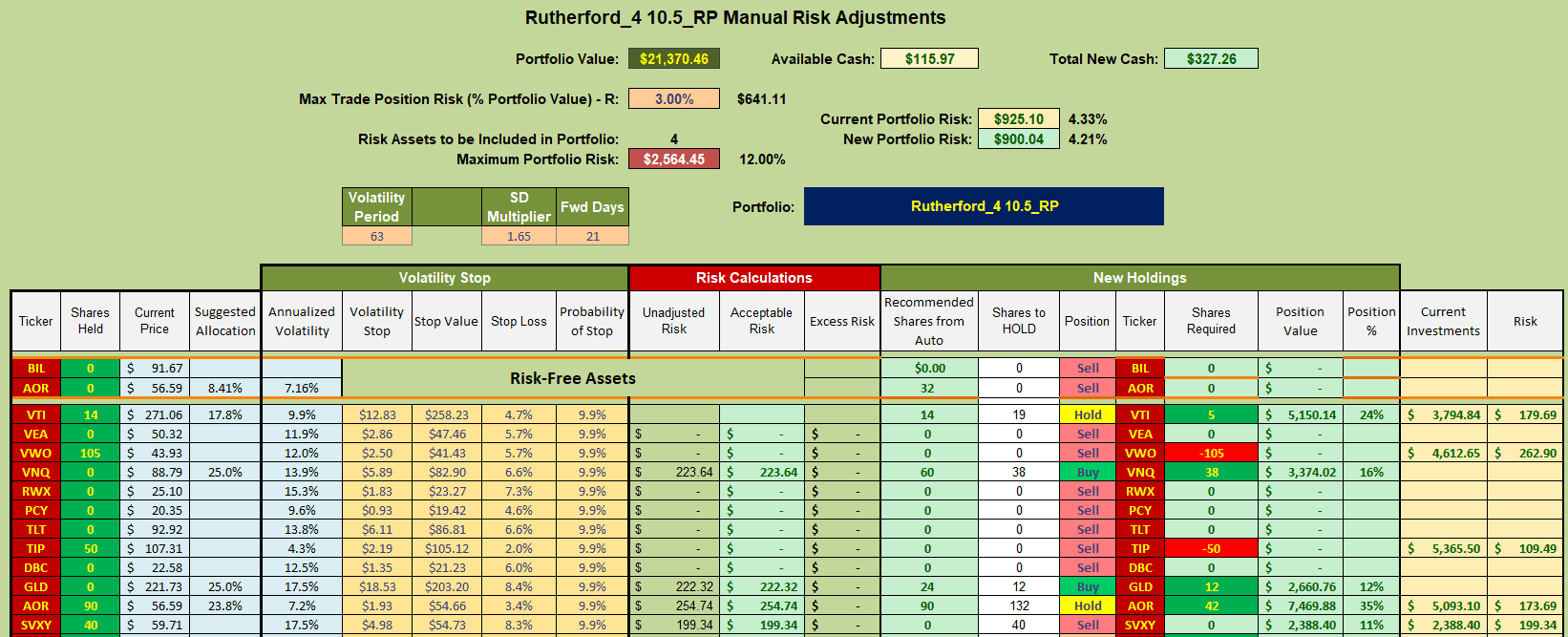

This means that my adjustments for next week will look something like this:

where I shall be selling current holdings in VWO and using the cash generated to add shares in VNQ and GLD. Although not a formal part of the rotation analysis I am also going to start to wind down my (~10% portfolio value) in SVXY. SVXY is my portfolio diversifier where returns are based on changes in volatility – increasing in value as volatility decreases – and, since I am expecting volatility to increase as we head towards the November elections I have made a discretionary decision to gradually leg out of these positions over the next month. This means that I will have the necessary cash to buy the recommended number of shares in VNQ and GLD without selling current holdings in TIP. Rather than incur trading costs associated with the sale of TIP and addition of a few more shares in VTI I will just use the left over cash to add to my current position in AOR (since this is an equity/bond fund).

where I shall be selling current holdings in VWO and using the cash generated to add shares in VNQ and GLD. Although not a formal part of the rotation analysis I am also going to start to wind down my (~10% portfolio value) in SVXY. SVXY is my portfolio diversifier where returns are based on changes in volatility – increasing in value as volatility decreases – and, since I am expecting volatility to increase as we head towards the November elections I have made a discretionary decision to gradually leg out of these positions over the next month. This means that I will have the necessary cash to buy the recommended number of shares in VNQ and GLD without selling current holdings in TIP. Rather than incur trading costs associated with the sale of TIP and addition of a few more shares in VTI I will just use the left over cash to add to my current position in AOR (since this is an equity/bond fund).

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Leave a Comment or Question