Beach Parking/Taxi Stand for Longboats, Krabi, Thailand

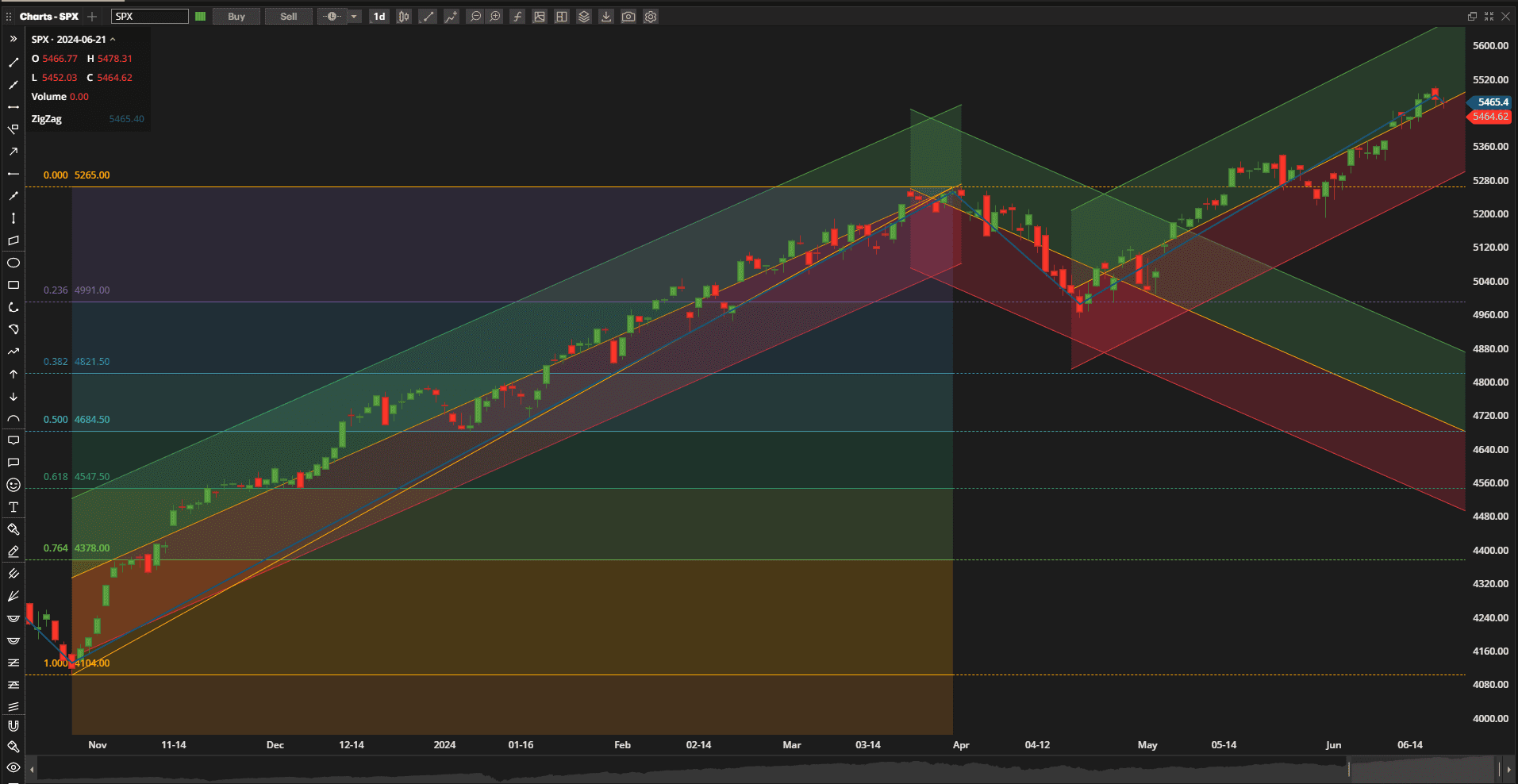

US Equities hit new all-time highs again this week as the SPX (S&P 500 Index) continued in it’s upward trend:

However, the index seemed to find resistance at the psychological 5500 “round” number level – so we will have to wait to see whether this level holds and we take a breather with a pullback towards the lower boundary of the channel or whether the trend continues and we see more new highs as we go into the later stages of the historically strong “election season”.

However, the index seemed to find resistance at the psychological 5500 “round” number level – so we will have to wait to see whether this level holds and we take a breather with a pullback towards the lower boundary of the channel or whether the trend continues and we see more new highs as we go into the later stages of the historically strong “election season”.

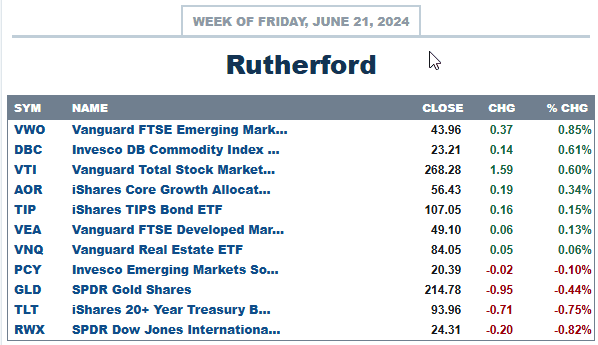

In terms of performance compared with other major asset classes:

VTI (representing US Equities) came out near the top of the list but beaten out slightly by Emerging Market equities (VWO).

VTI (representing US Equities) came out near the top of the list but beaten out slightly by Emerging Market equities (VWO).

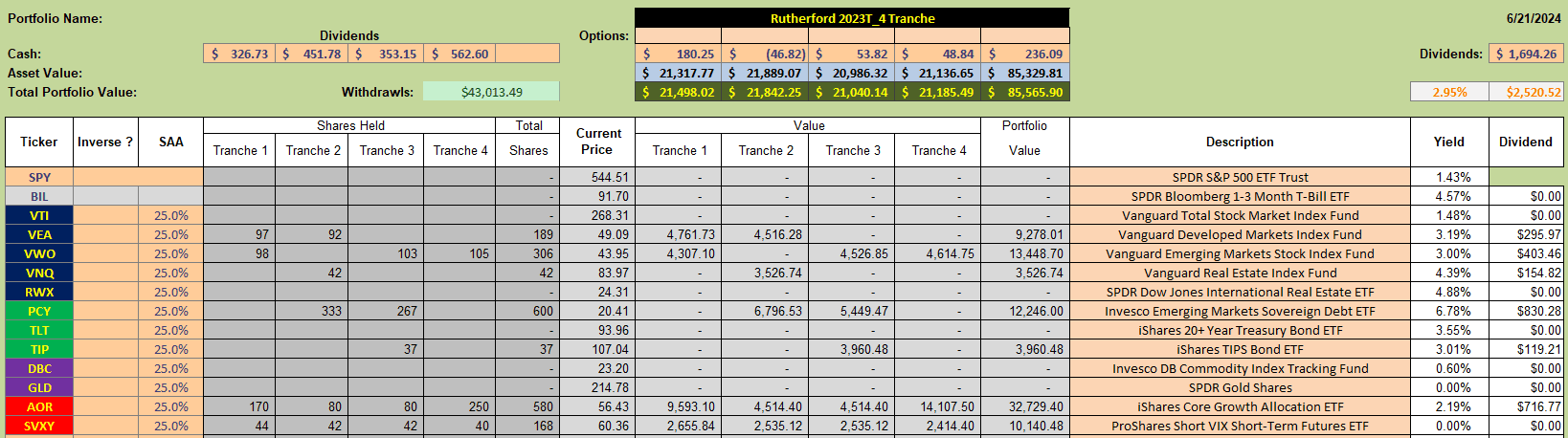

Current holdings in the Rutherford Portfolio:

include significant holdings in equities – but not directly in US equites except for allocations in the benchmark AOR fund.

include significant holdings in equities – but not directly in US equites except for allocations in the benchmark AOR fund.

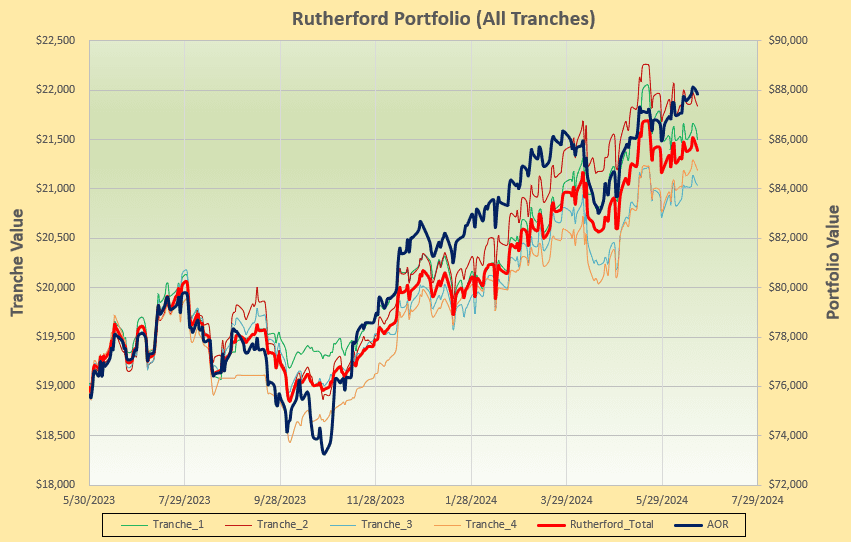

Recent performance of the portfolio looks like this:

slightly lagging the returns of the benchmark AOR Fund.

slightly lagging the returns of the benchmark AOR Fund.

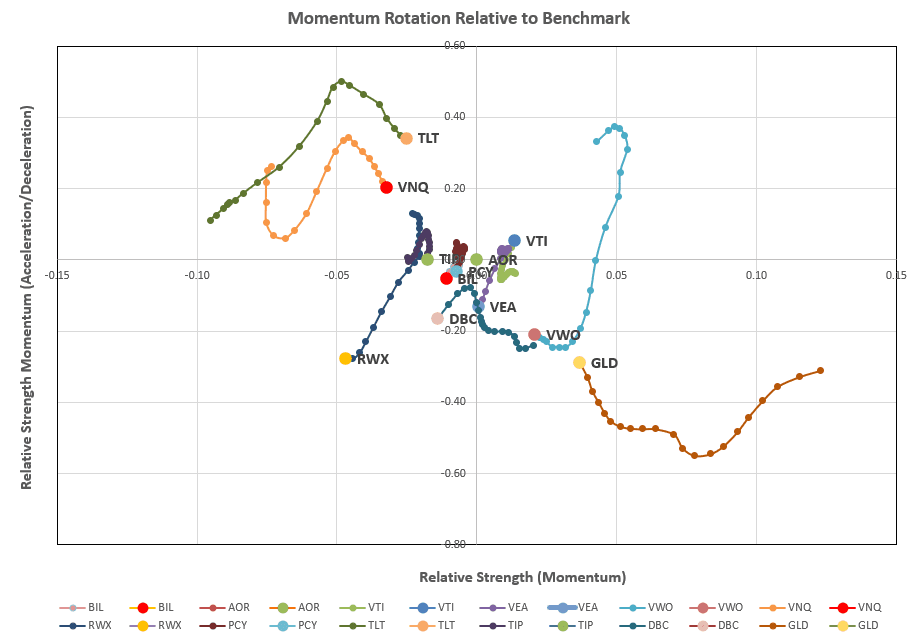

Tranche 4 (the focus of this week’s review) is holding positions in VWO and the benchmark AOR fund so we’ll check the rotation graphs to see whether any adjustments might be called for:

where we see that VTI is showing positive movement in the desirable top right quadrant (strong long- and short-term momentum/relative strength).

where we see that VTI is showing positive movement in the desirable top right quadrant (strong long- and short-term momentum/relative strength).

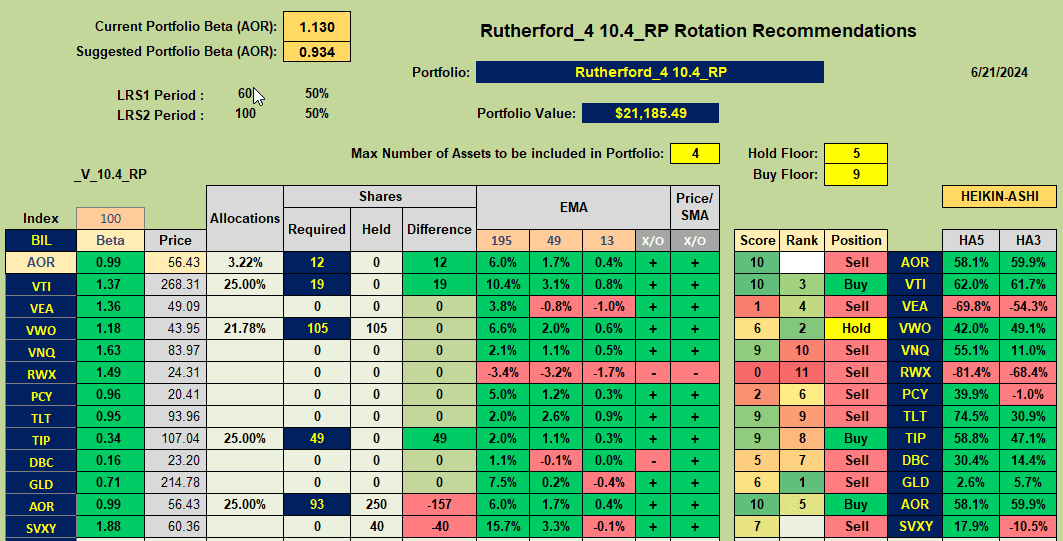

Rankings and recommendations from the Tranche worksheet look like this:

with Buy recommendations for VTI, TIP and AOR and a Hold recommendation for VWO.

with Buy recommendations for VTI, TIP and AOR and a Hold recommendation for VWO.

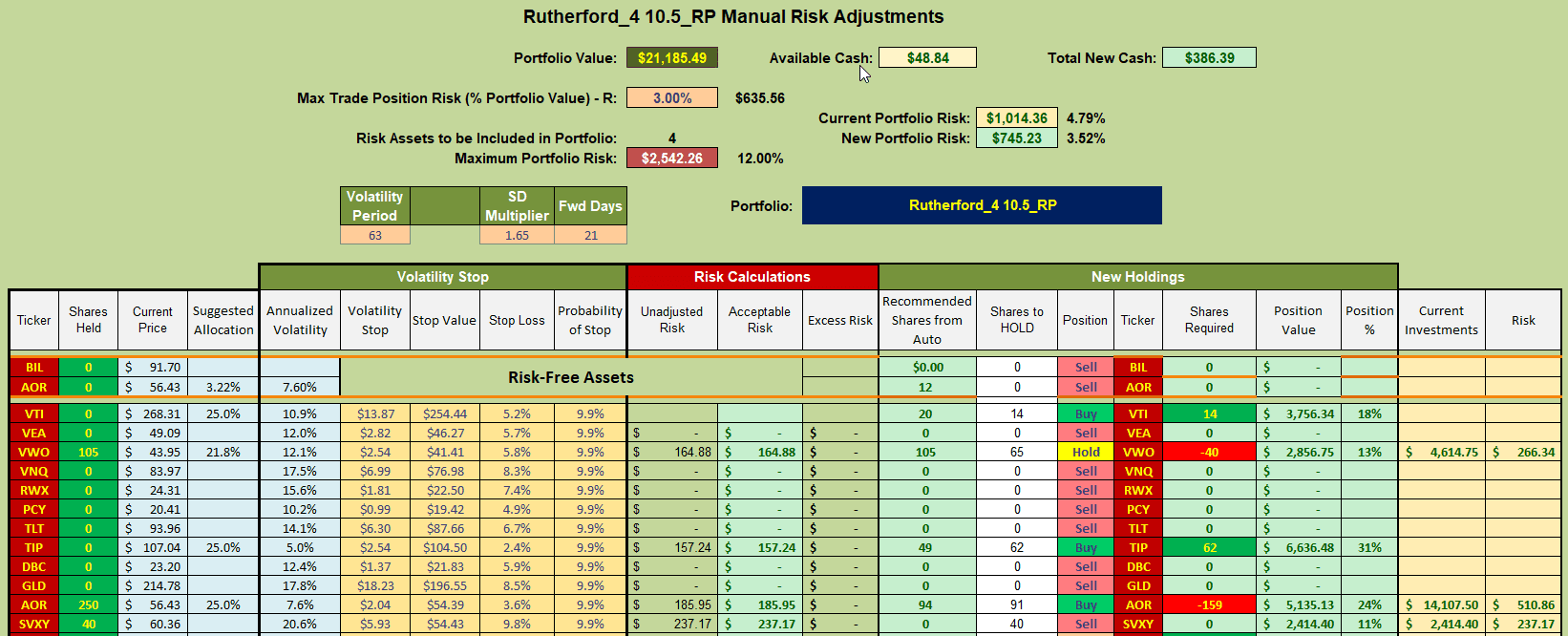

Following these recommendations adjustments for next week will look something like this:

where I shall be selling a portion of the current holdings in AOR (~160 shares) and using the funds generated to add new positions in VTI and TIP – yes, this bond ETF is showing up again after first appearing on the scene in last week’s review. I will minimize trading costs by ignoring the suggested adjustment to VWO.

where I shall be selling a portion of the current holdings in AOR (~160 shares) and using the funds generated to add new positions in VTI and TIP – yes, this bond ETF is showing up again after first appearing on the scene in last week’s review. I will minimize trading costs by ignoring the suggested adjustment to VWO.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.