Temporary “Cardboard” Cathedral in Christchurch, New Zealand while original Cathedral, that was destroyed in an earthquake, is being rebuilt.

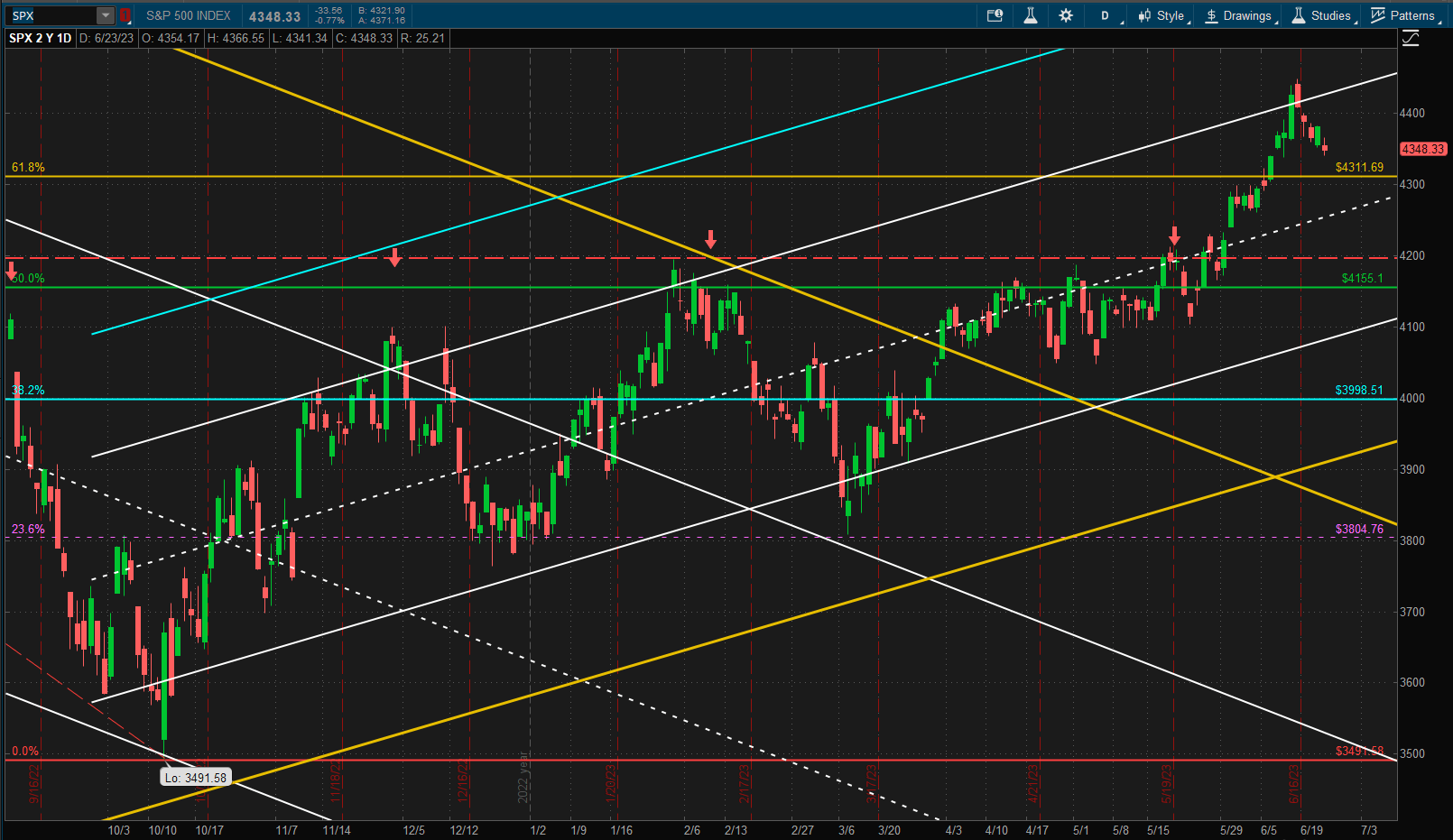

It wasn’t a great week for US equities with the S&P 500 Index pulling back from the 1SD upper boundary of the uptrend channel:

It still looks possible for US equities to pull back to the potential support zone at ~4300 but, in comparison with other major asset classes, this still leaves it in the top half of the relative performance list:

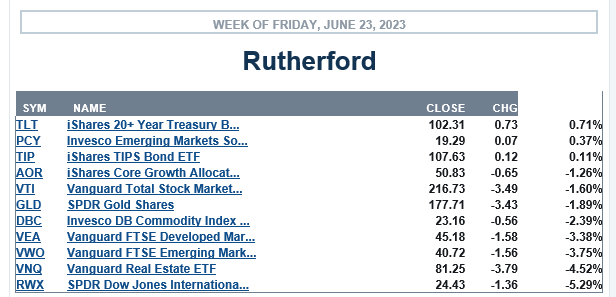

It still looks possible for US equities to pull back to the potential support zone at ~4300 but, in comparison with other major asset classes, this still leaves it in the top half of the relative performance list: The Rutherford portfolio is looking like this:

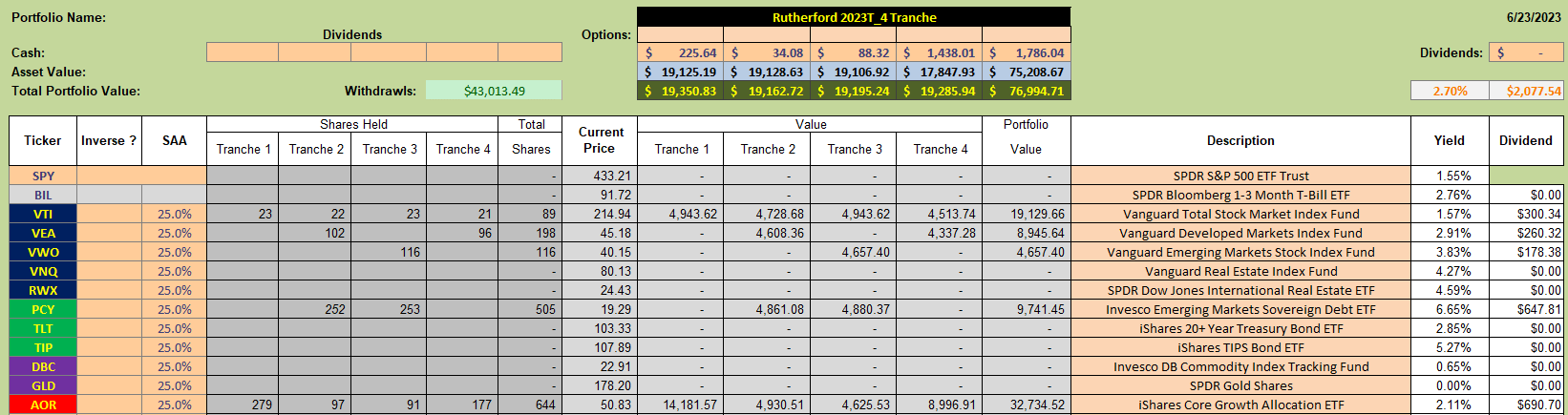

The Rutherford portfolio is looking like this:

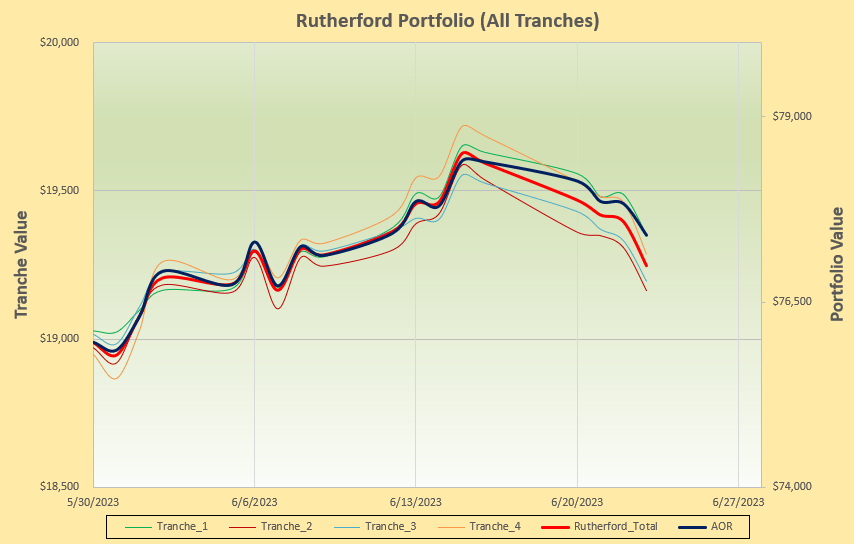

that resulted in the performance as shown below:

that resulted in the performance as shown below:

i.e. we lost a little ground relative to the benchmark AOR Fund.

i.e. we lost a little ground relative to the benchmark AOR Fund.

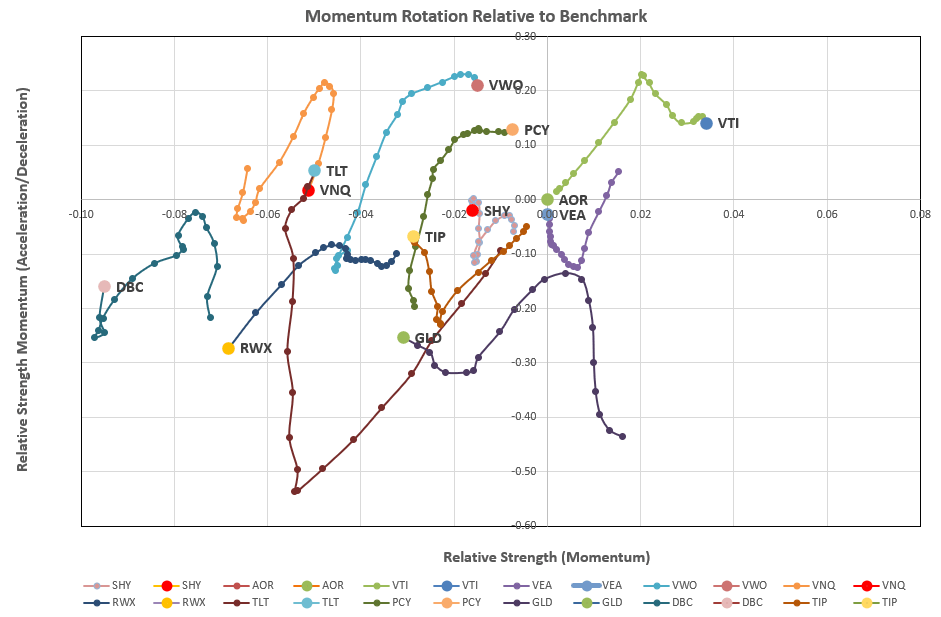

Taking a look at the rotation graphs:

we only see VTI as being strong in the desirable top right quadrant.

we only see VTI as being strong in the desirable top right quadrant.

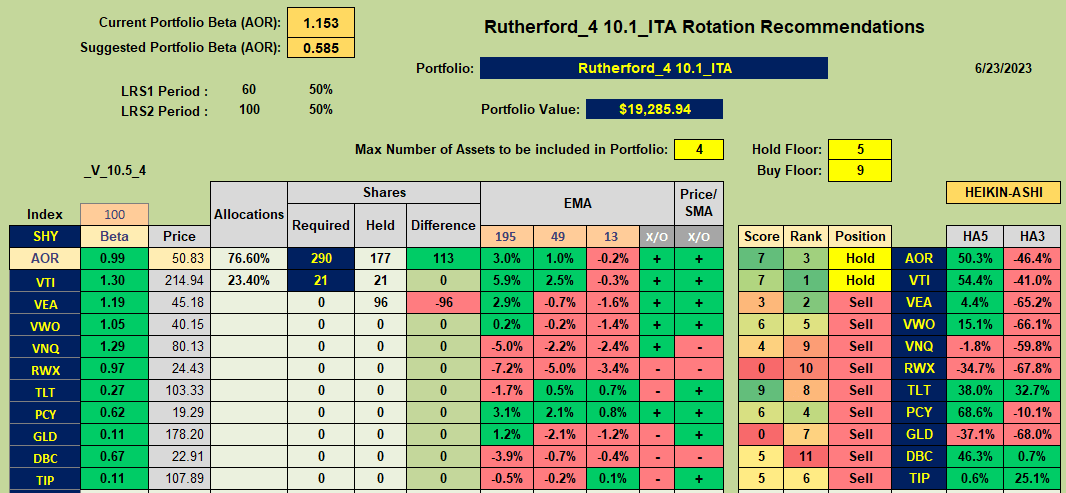

Checking recommendations from the rotation model:

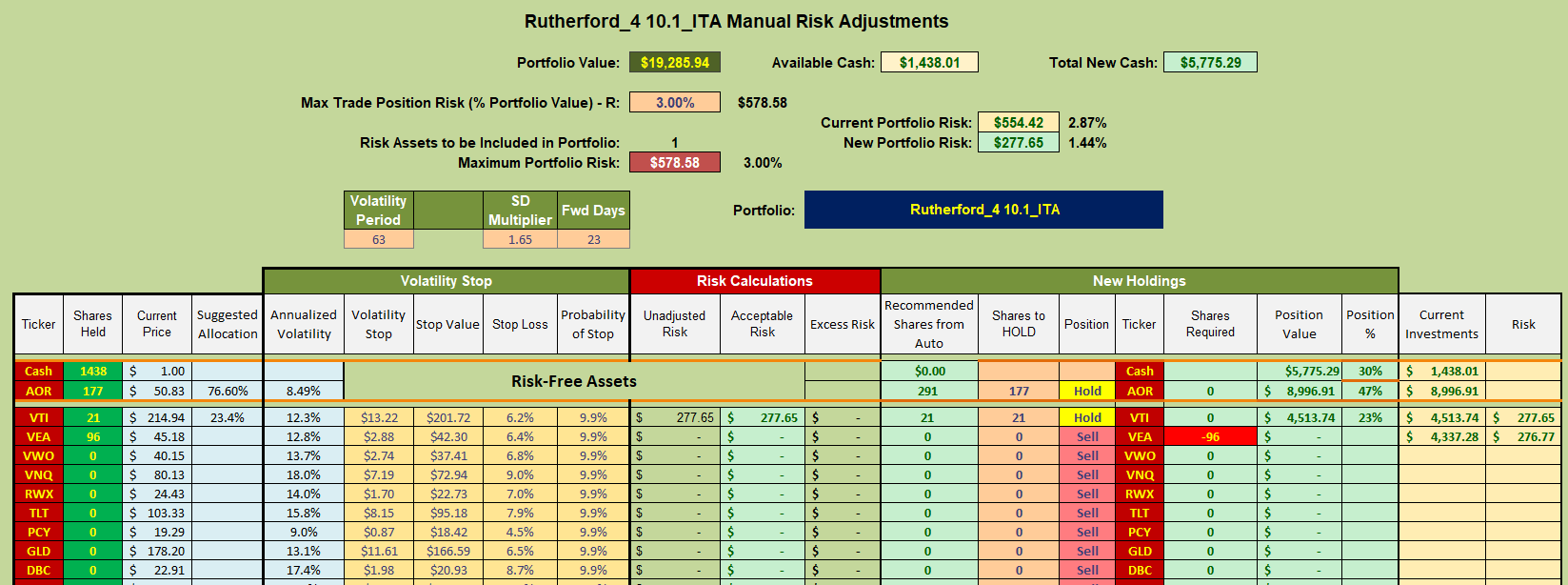

we only see Hold recommendations for VTI and the benchmark AOR Fund. with Sell recommendations on all other assets. This means that this week’s adjustments to Tranche 4 will look something like this:

we only see Hold recommendations for VTI and the benchmark AOR Fund. with Sell recommendations on all other assets. This means that this week’s adjustments to Tranche 4 will look something like this:

i.e. I will be selling current holdings in VEA and the proceeds will move to Cash.

i.e. I will be selling current holdings in VEA and the proceeds will move to Cash.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Amazing photograph. I assume the cardboard is treated in some fashion.

Lowell

Yes, very interessting structure – here’s the Wikipedia link for more info: https://en.wikipedia.org/wiki/Cardboard_Cathedral

David