Melbourne Skyline, Australia

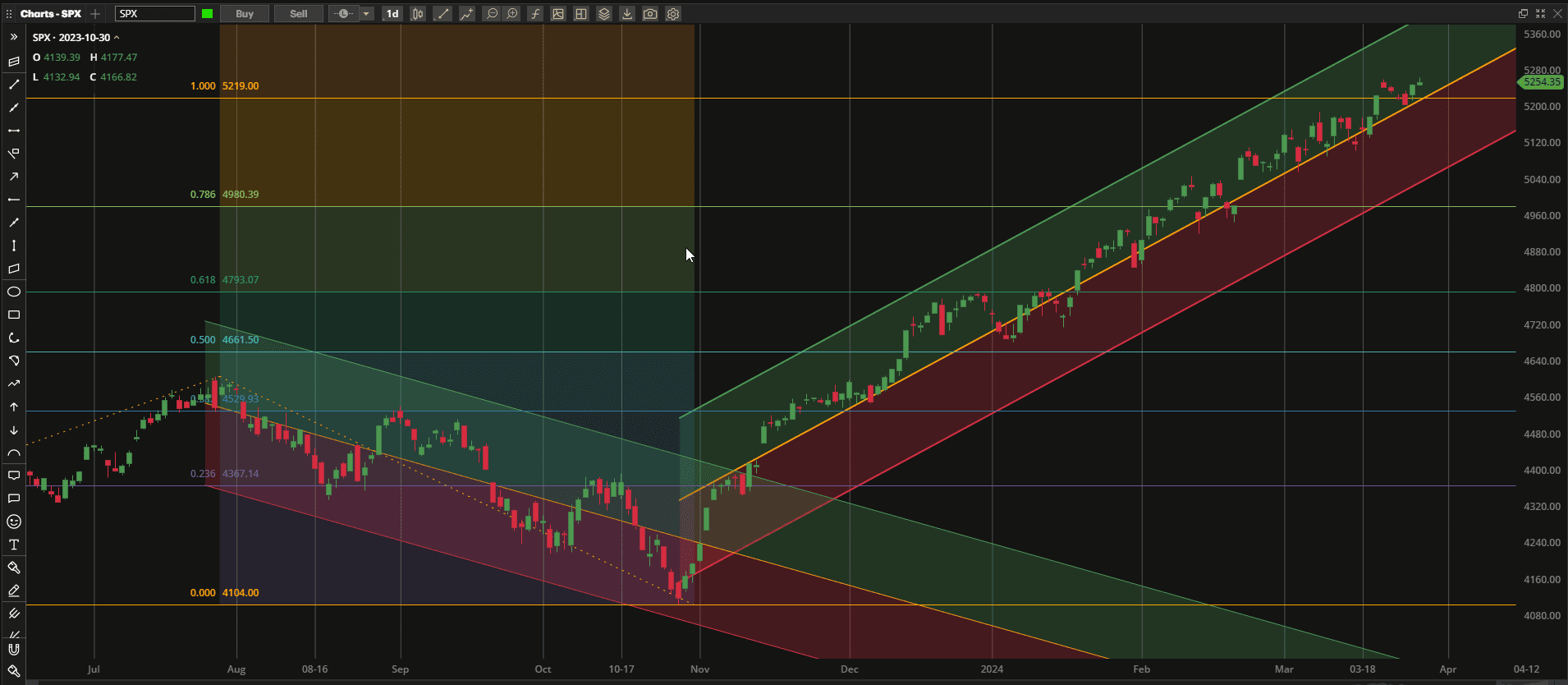

US Markets started the week slowly with a small pullback at the beginning of the week but finished the holiday-shortened week with a recovery and closing about 0.25% higher than last week’s close:

However, we are still hovering at that 5200-5220 level that is providing some resistance to possible moves higher – at least in the short term – but, it’s an election year and these years are historically bullish in a seasonal sense.

However, we are still hovering at that 5200-5220 level that is providing some resistance to possible moves higher – at least in the short term – but, it’s an election year and these years are historically bullish in a seasonal sense.

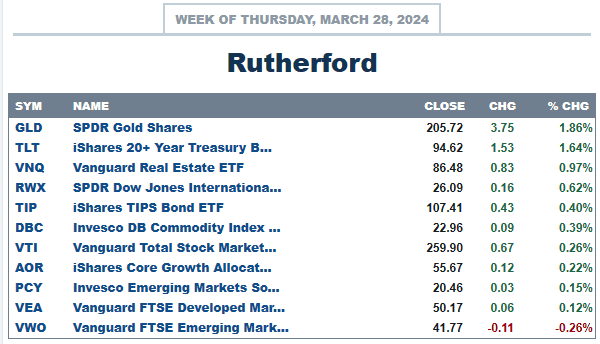

In terms of performance relative to other major asset classes:

US equities came out in the middle of the pack with defensive asset classes performing slightly better.

US equities came out in the middle of the pack with defensive asset classes performing slightly better.

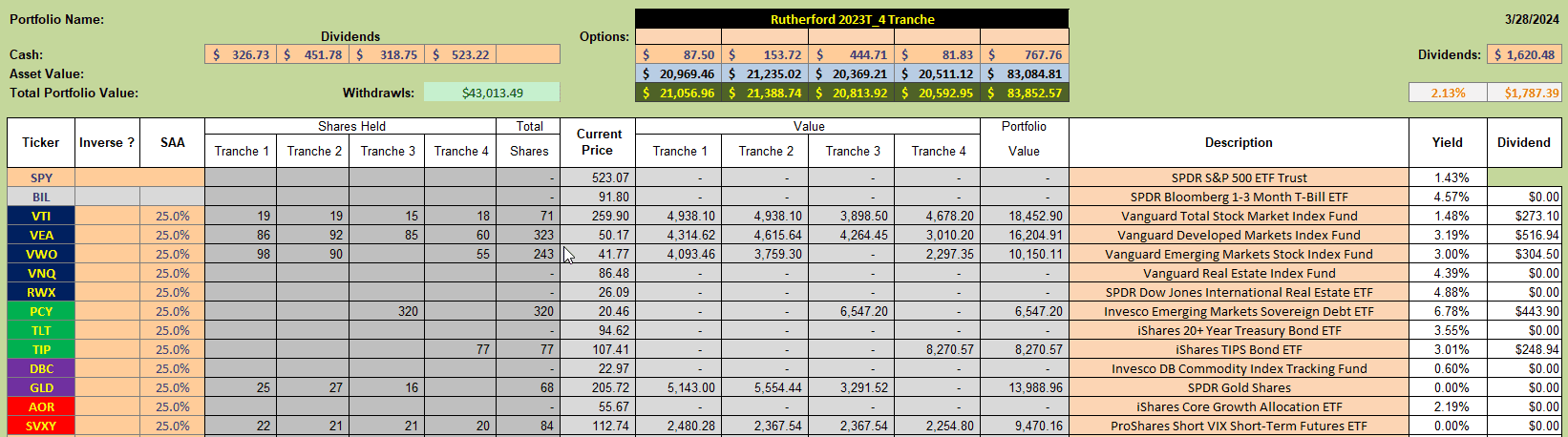

Current holdings in the Rutherford Portfolio look like this:

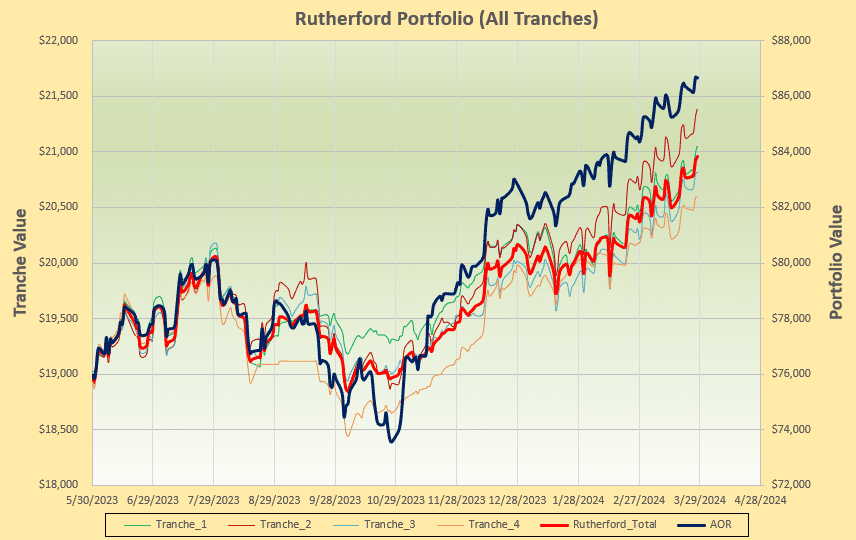

with performance pretty much in line with the benchmark AOR Fund (although lagging as a result of the slow recovery at the beginning of the year):

with performance pretty much in line with the benchmark AOR Fund (although lagging as a result of the slow recovery at the beginning of the year):

This week we focus on Tranche 4 that has approximately equal weightings in Equities and TIPs (inflation linked bonds).

This week we focus on Tranche 4 that has approximately equal weightings in Equities and TIPs (inflation linked bonds).

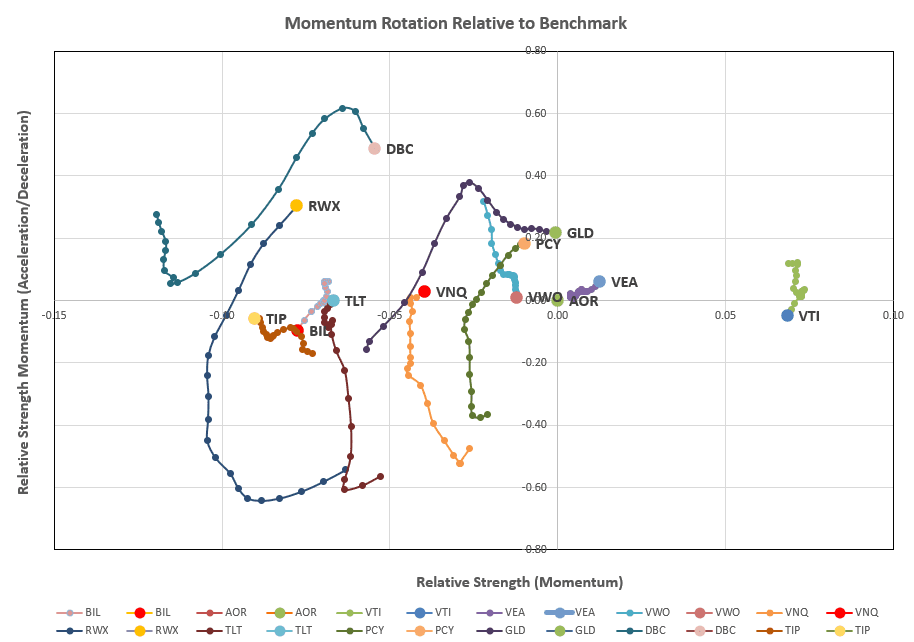

Checking the rotation graphs:

we note that VTI (US Equities), while still showing strength in terms of longer term momentum, has now dropped out of the desirable top right quadrant as a result of slowing momentum in the shorter term.

we note that VTI (US Equities), while still showing strength in terms of longer term momentum, has now dropped out of the desirable top right quadrant as a result of slowing momentum in the shorter term.

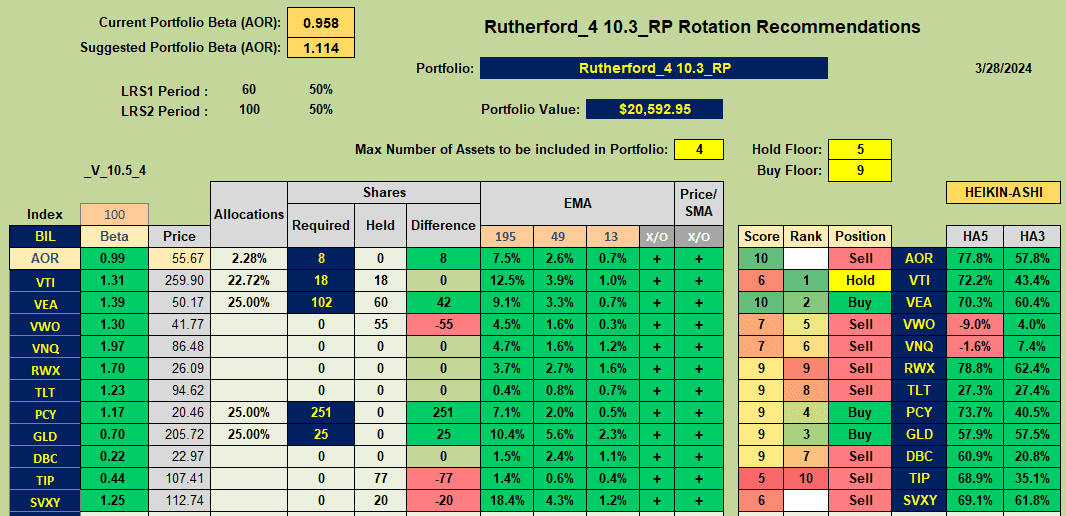

If we check the recommendations from the rotation model:

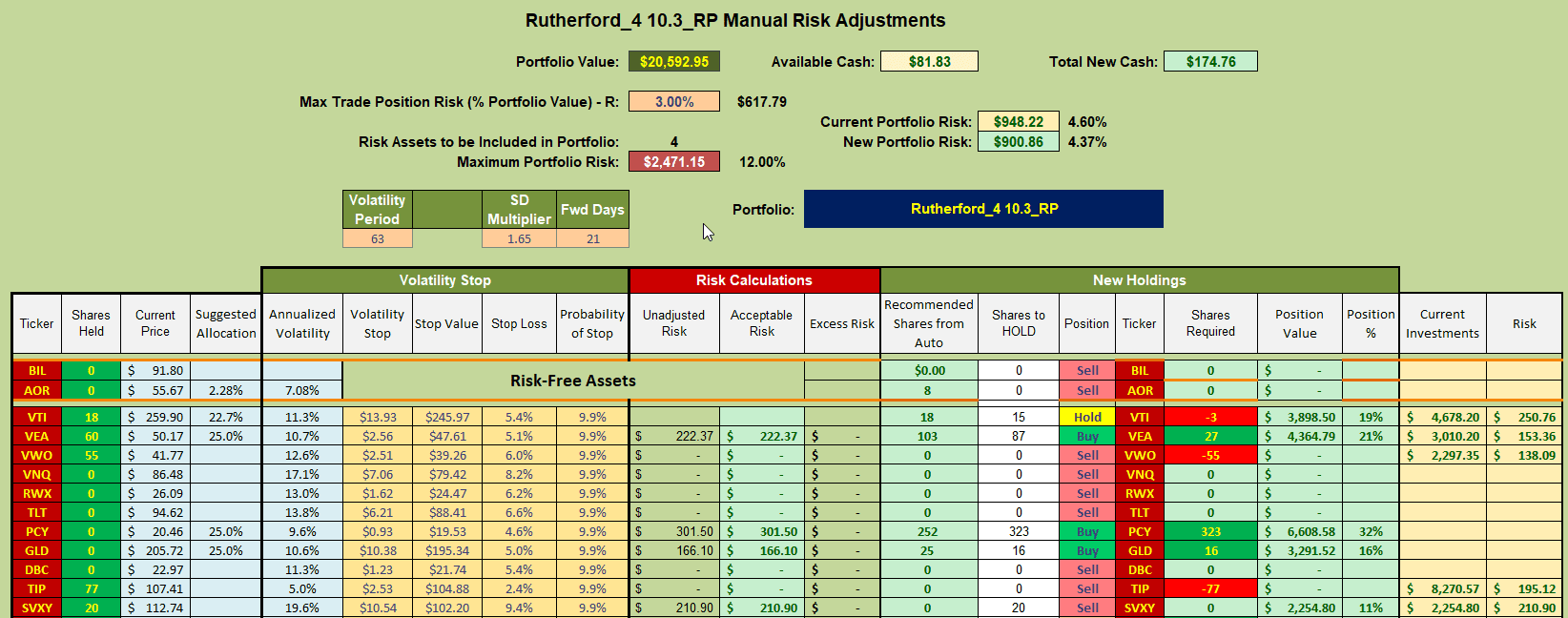

we see that VTI is now recommended as a Hold, rather than a Buy, with VEA (Developed Market Equities), PCY (International Bonds) and Gold (GLD) showing up as Buy recommendations. If we follow these recommendations, adjustments for next week look something like this:

we see that VTI is now recommended as a Hold, rather than a Buy, with VEA (Developed Market Equities), PCY (International Bonds) and Gold (GLD) showing up as Buy recommendations. If we follow these recommendations, adjustments for next week look something like this:

whereby I will be selling current holdings in VWO and TIP and adding positions in VEA, PCY and GLD.

whereby I will be selling current holdings in VWO and TIP and adding positions in VEA, PCY and GLD.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.