Gardens By The Bay, Singapore

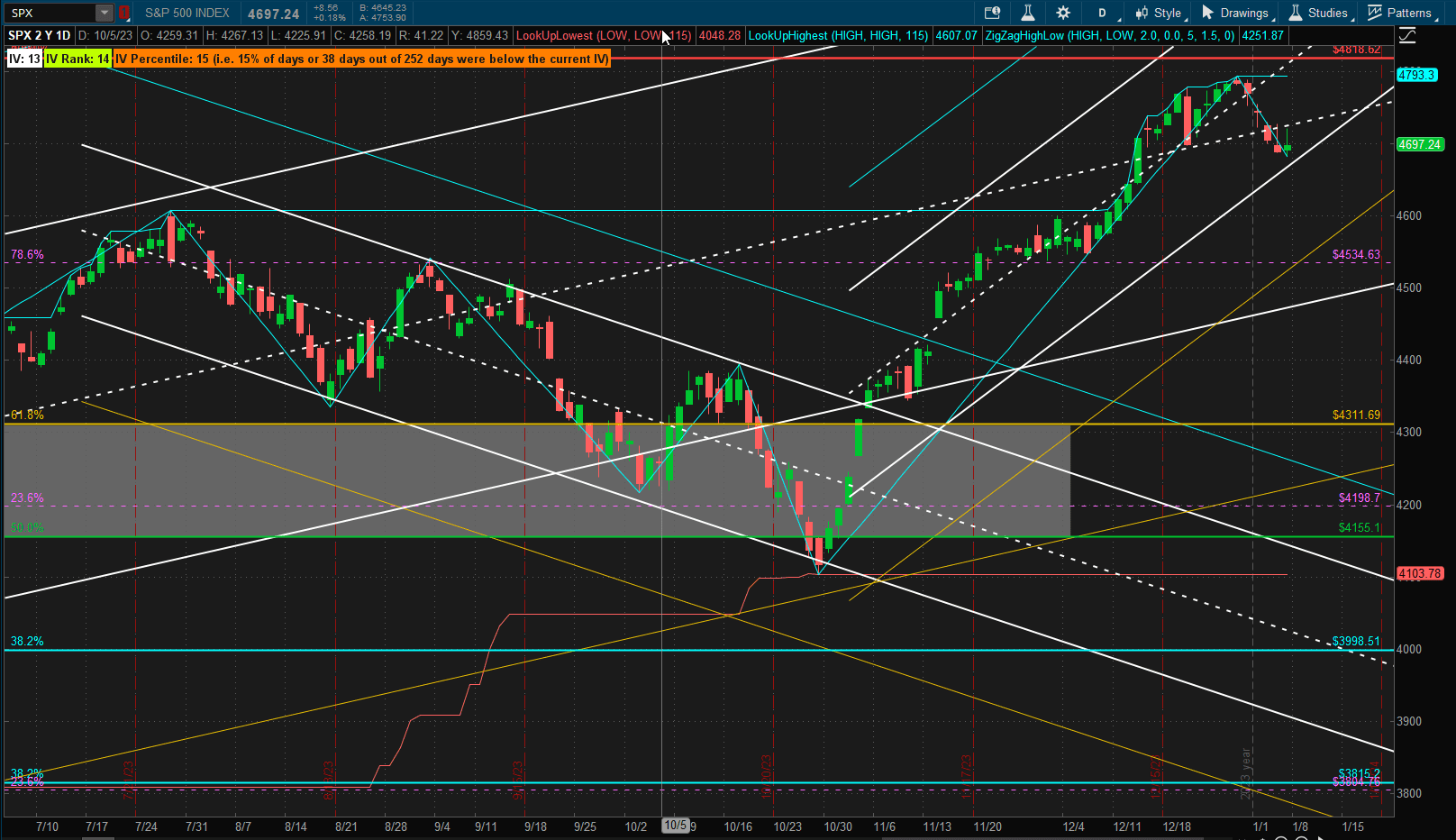

The first week of trading in 2024 was bearish with the SPX (S&P 500 Index) pulling back 2% from 2023 End-Of-Year highs:

We are now sitting at the lower boundary of the 1 Standard Deviation bullish channel that started in October of 2023 and leading into the strong End-of-Year performance that resulted in 25% gains for US equities in 2023. We will now wait to see if there is enough energy in the market to again challenge the strong resistance level of 4800 or whether we will see a deeper pullback.to the 4600 level where we might expect to see stronger support.

We are now sitting at the lower boundary of the 1 Standard Deviation bullish channel that started in October of 2023 and leading into the strong End-of-Year performance that resulted in 25% gains for US equities in 2023. We will now wait to see if there is enough energy in the market to again challenge the strong resistance level of 4800 or whether we will see a deeper pullback.to the 4600 level where we might expect to see stronger support.

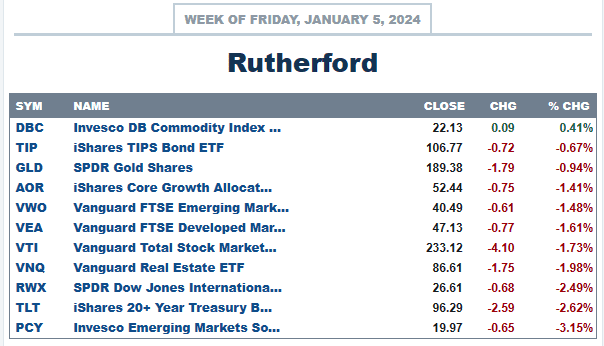

Not unsurprisingly, US equities did not top the list of best performing asset classes in the last week:

with Commodities being the only major asset class to generate positive gains.

with Commodities being the only major asset class to generate positive gains.

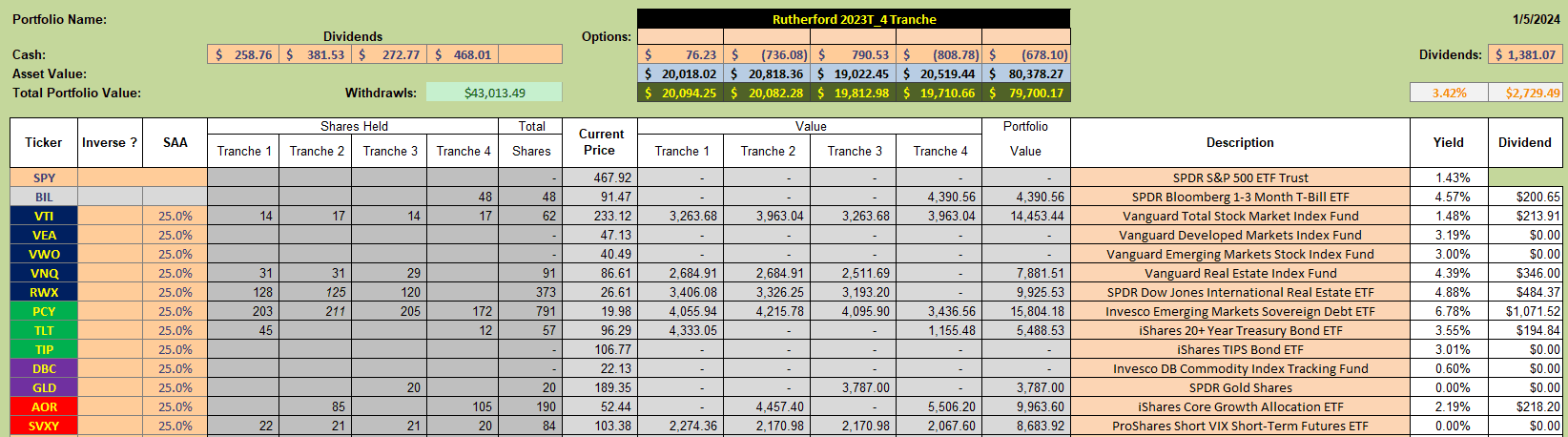

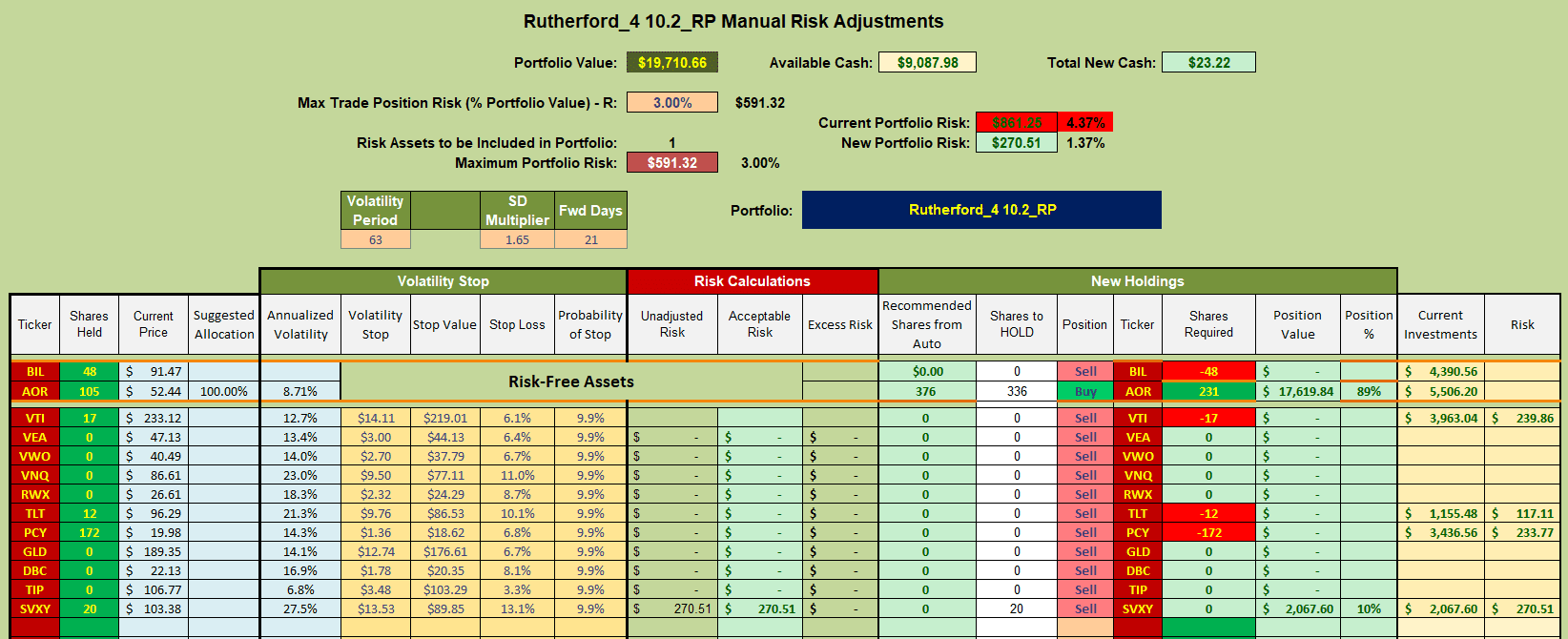

Current holdings in the Rutherford Portfolio look like this:

and, although I tried to adjust for the prior 2 weeks that I had not found time to make adjustments, I managed to get things slighty wrong and am a little bit out of balance in 3 of the tranches. This is not too significant and will (hopefully) be corrected as these tranches reach their next review dates. This starts with Tranche 4 (the focus of this weeks review) that is a little oversubscribed.

and, although I tried to adjust for the prior 2 weeks that I had not found time to make adjustments, I managed to get things slighty wrong and am a little bit out of balance in 3 of the tranches. This is not too significant and will (hopefully) be corrected as these tranches reach their next review dates. This starts with Tranche 4 (the focus of this weeks review) that is a little oversubscribed.

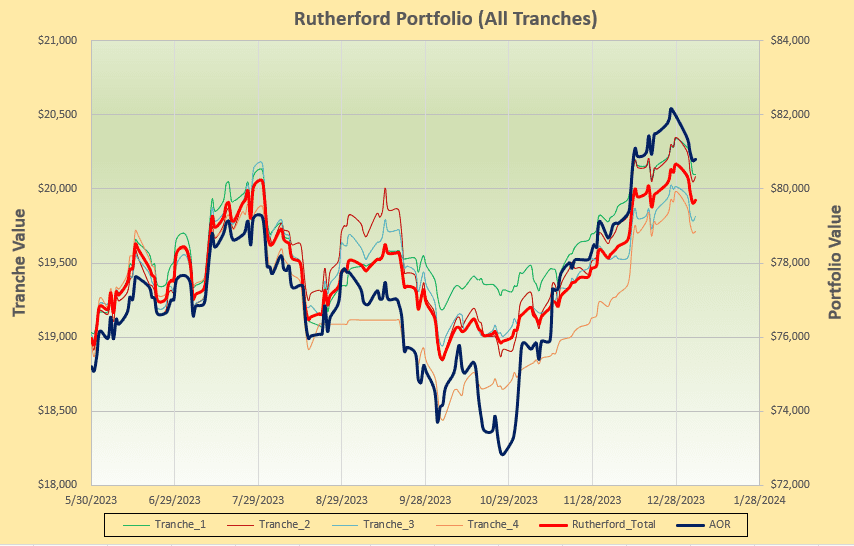

Performance of the portfolio to date looks ike this:

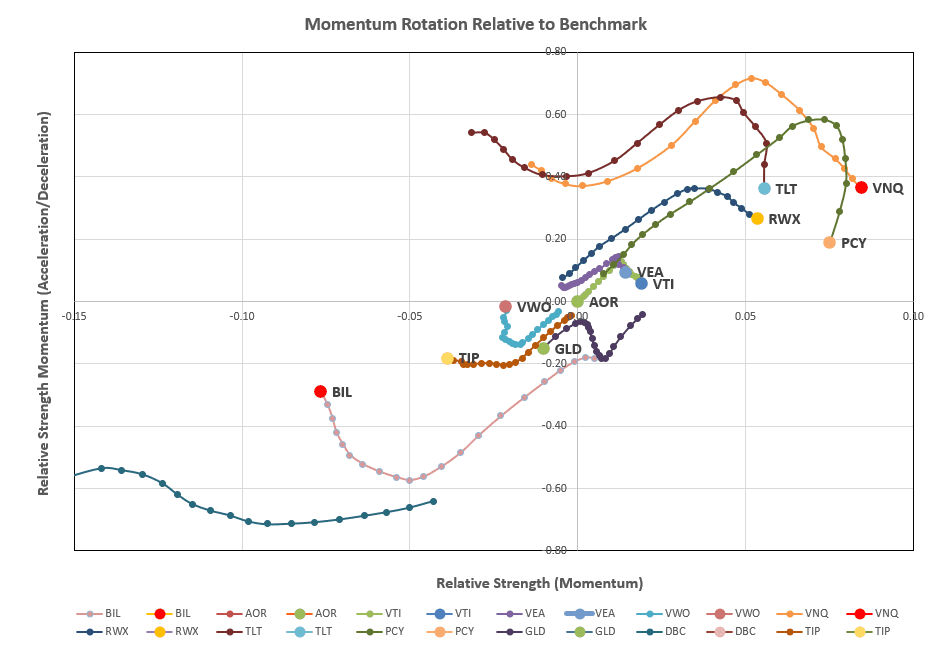

with the portfolio slightly trailing the benchmark AOR Fund, albeit with lower volatility. So, let’s take a look at the rotation graphs:

where we see a lot of action in that desirable top right quadrant (that indicates both positive short- and long-term momentum). However, there is maybe a warning signal in that the momentum is weakening – particuarly in the short-term (downward vertical movement) but also in the longer term momentum for PCY and TLT (right to left horizontal movement).

where we see a lot of action in that desirable top right quadrant (that indicates both positive short- and long-term momentum). However, there is maybe a warning signal in that the momentum is weakening – particuarly in the short-term (downward vertical movement) but also in the longer term momentum for PCY and TLT (right to left horizontal movement).

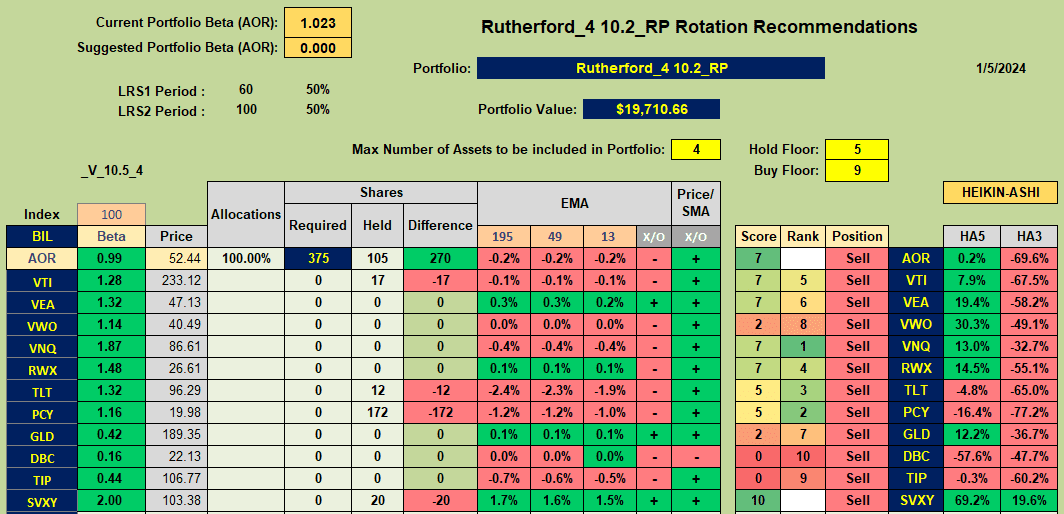

When we check the recommendations from the algorithm used for this portfolio we see what might be a little surprise:

– we have no Buy recommendations.

– we have no Buy recommendations.

I shall follow these recommendations by making the following adjustments:

i.e. I will sell out of all my current holdings (except BIL) and move into AOR. I am moving to AOR rather than BIL (in lieu of cash) since momentum is currently higher (on a reative basis). I will continue to hold my current shares in BIL to avoid trading costs.

i.e. I will sell out of all my current holdings (except BIL) and move into AOR. I am moving to AOR rather than BIL (in lieu of cash) since momentum is currently higher (on a reative basis). I will continue to hold my current shares in BIL to avoid trading costs.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.