Spruce Goose Profile: McMinnville, Oregon

This morning the easiest portfolio to manage is up for review. Updating the Schrodinger, a Robo Advisor portfolio, is trivial as no buy-hold-sell decisions are required as this is all done by computer algorithms. The Schrodinger was set up seven years ago to answer the question: Who Will Manage the Family Portfolio When I Die?

Before I settled with Schwab, I tested two other Robo Advisor services. Each had their benefits. I settled on Schwab as this is a no-cost portfolio other than the customary expenses associated with all Exchange Traded Funds. Thus far I’ve been pleased with the results as readers will see in the following update.

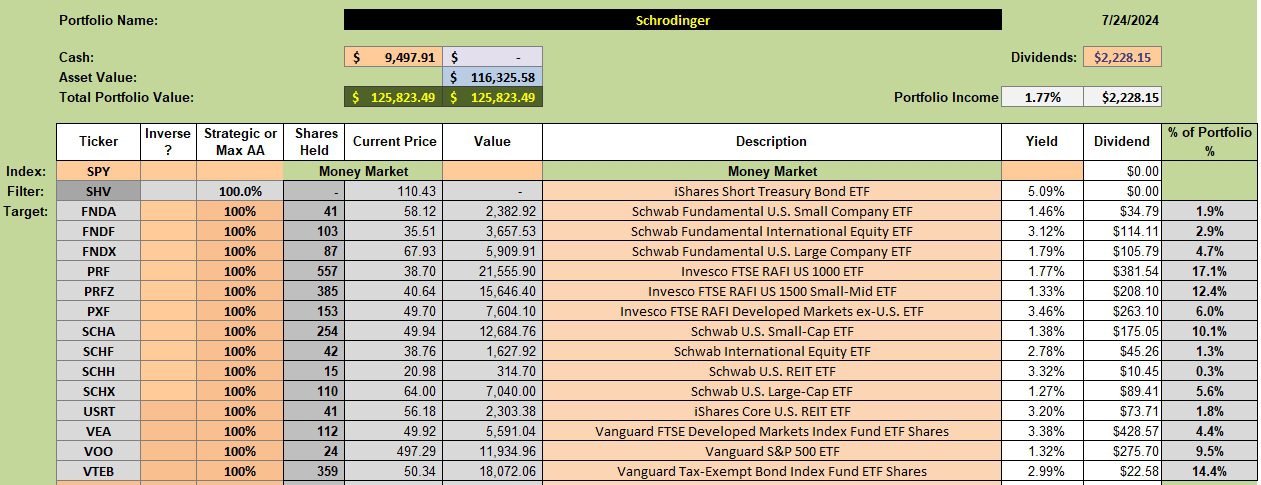

Schrodinger Asset Allocation Portfolio

Below is the investment quiver and ETF arrows that make up the Schrodinger or what Schwab calls an Intelligent Portfolio. The portfolio is of sufficient size to be tax managed. However, there are very few sell transactions in a given year.

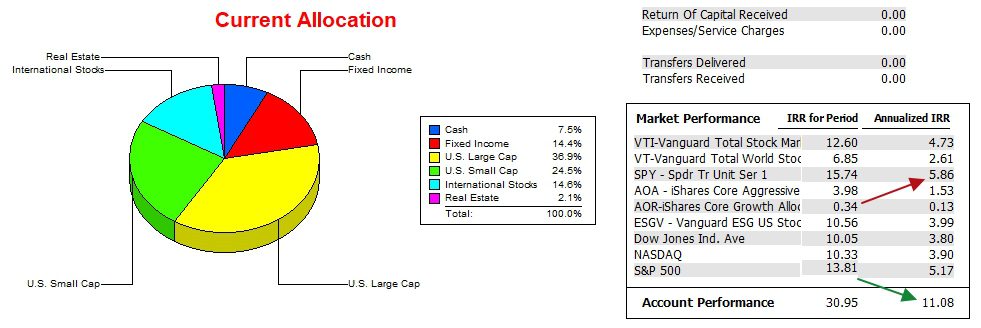

Schrodinger Performance Data

Since 12/31/2021 the Schrodinger has outperformed the S&P 500 (SPY) by a significant percentage. In fact, the return for this passive portfolio is nearly double the SPY benchmark. Other potential benchmarks and indexes are included for further reference.

This data comes from the Investment Account Manager software, a commercial product I recommend for all serious investors.

The Schrodinger stock/(bond-cash) ratio is 80/20 so it is considered to be quite aggressive. I also requested an emphasis be placed on U.S. Equities vs. International Equities.

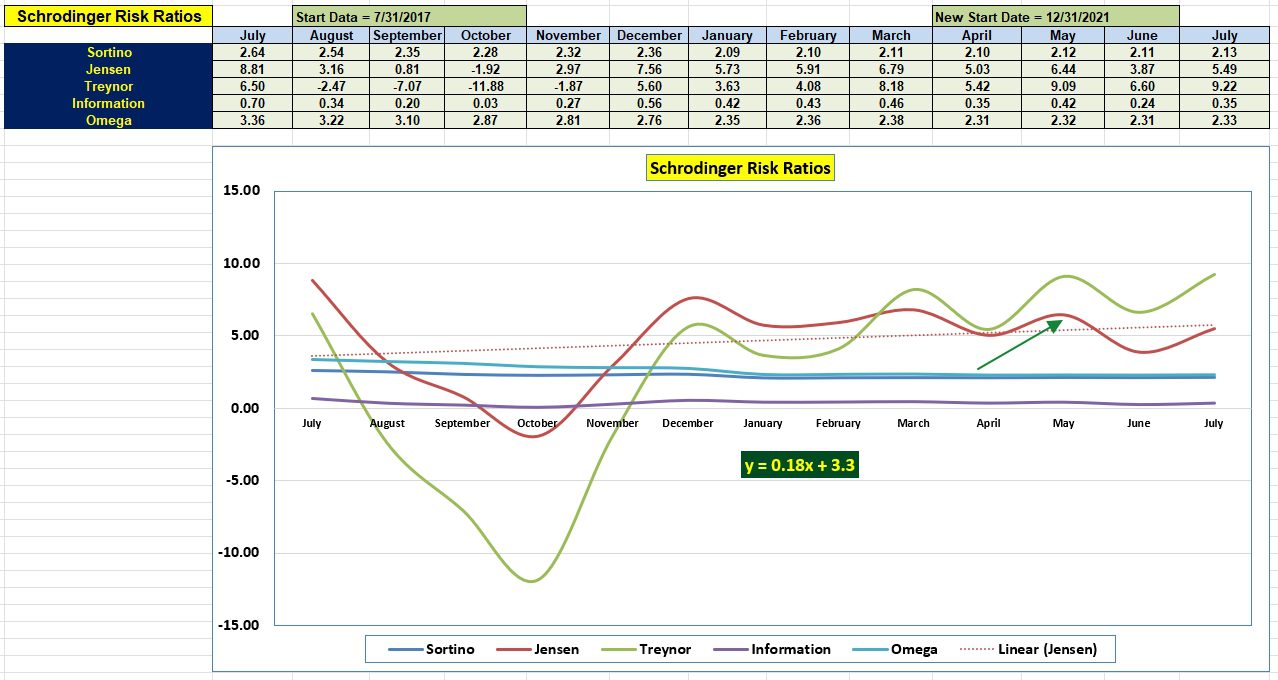

Schrodinger Risk Ratios

With an emphasis on equities rather than bonds, just how risky is the Schrodinger? To answer this question I monitor five risk ratios. By far the most important metric is the Jensen Performance Index, frequently known as the Jensen Alpha. Ranking next to the Jensen is the Information Ratio. The goal is to maintain a positive value for the Information Ratio and if possible, keep the slope of the Jensen as high as possible.

The Argument for Self-Management

If there are any questions related to the Schrodinger and how it is managed, place you comments or questions in the Comment space provided below.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Leave a Comment or Question