Recorder Valves

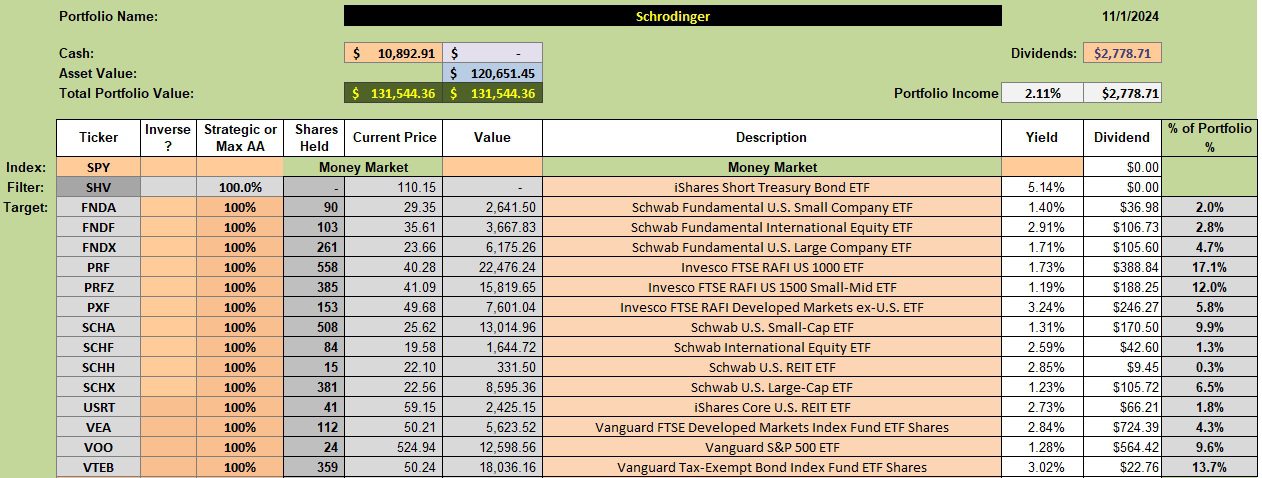

Schrodinger is a portfolio I continually tout for investors not interested in spending time on their investment portfolio. Schwab does it all using computer algorithms. Answer a few questions, invest your money and Schwab will set up an Intelligent Portfolio based on your answers. With the Schrodinger I’ve requested the computers emphasize U.S. Equities and reduce exposure to international equities and developing countries. Also, the Schrodinger is quite aggressive with the stock/bond-cash ratio. The current ratio is 80% stocks and 20% bonds and cash.

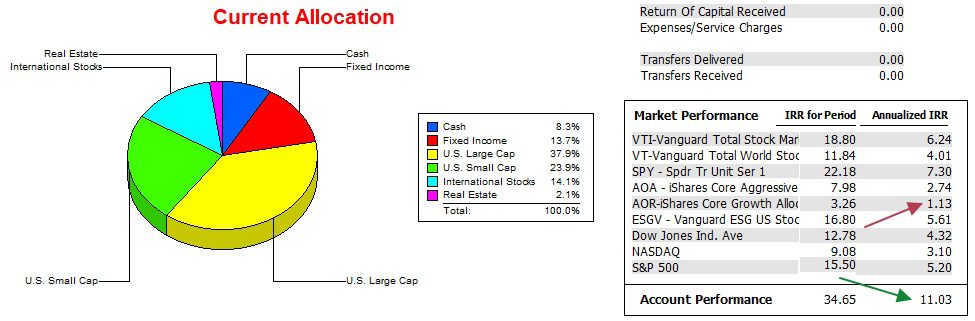

This portfolio was launched at the end of July 2017 so I have a respectable history with this type of portfolio. Since that July date the Internal Rate of Return (IRR) of the Schrodinger is 11.4%. The S&P 500 index has an IRR of 11.7% so the portfolio is performing close to a difficult index to outperform. The SPY ETF has an IRR of 13.7% while the IRR for AOR is 5.8%.

If looking for a portfolio to compete with the S&P 500 (SPY), check out the Copernicus. Of the portfolios I currently track, Copernicus is #1 while the Schrodinger has climbed into the #2 position.

Schrodinger Asset Allocation Model

Below is the current makeup of the Schrodinger. I’m a tad surprise the holding in SCHH is so low as 0.3% contributes little to the performance. Further, USRT is another Real Estate ETF so there seems to be some duplication.

Schrodinger Performance Data

The following performance data is from 12/31/2021 through 11/1/2024. During this period the portfolio is well ahead of all possible benchmarks. Checking the IRR for Period, the differences begin to become significant.

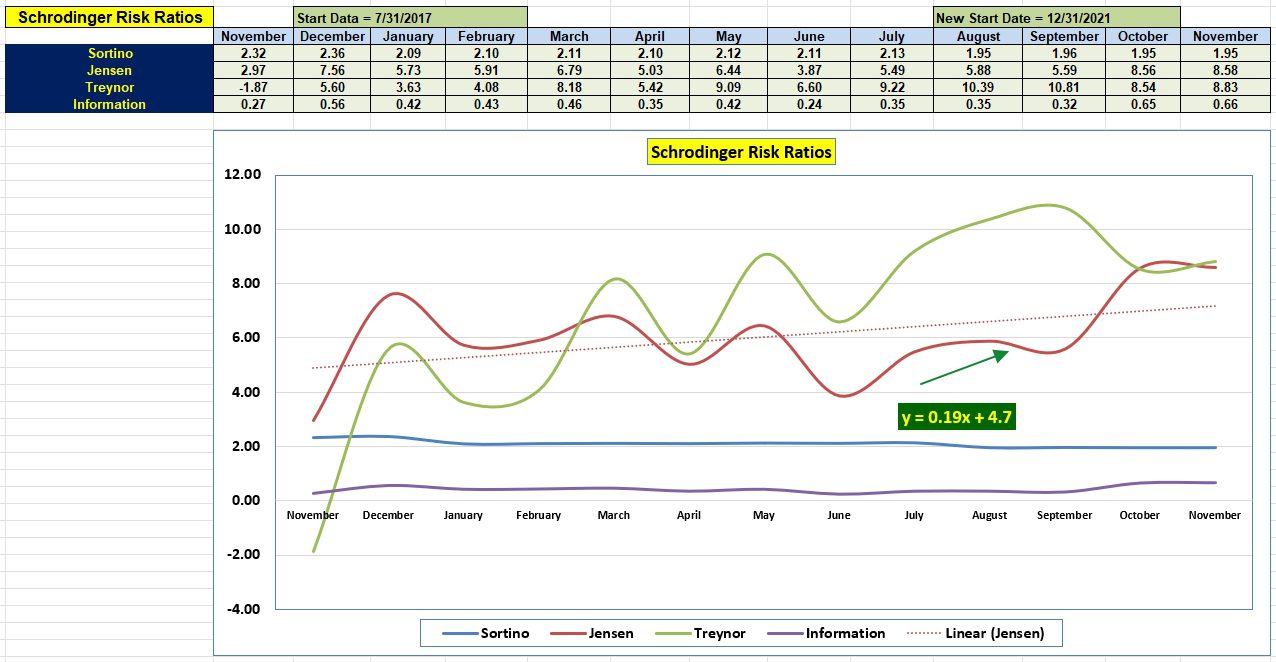

Schrodinger Risk Ratios

The November data is not important as it is still too early in the month. Pay more attention to the October data and the slope of the Jensen Alpha. The positive slope is a reflection of the strong equities market in 2024.

Place your Questions and Comments in the comment section provided.

Returning To Investing Roots: 5 August 2024

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Leave a Comment or Question