Old logging equipment standing in a grove of Ponderosa Pine.

The Schrodinger is an Intelligent Portfolio based at Schwab. At least this is how Schwab identifies portfolios managed by computer. I think of this investing style as Robo Advisor portfolios. Regardless, this type of investment is as easy as it gets. After setting up the portfolio with Schwab (other brokers have similar offerings) all one does is save. For example, one could have an electronic transfer set up each month to send money to Schwab. Schwab will then purchase shares of different asset classes based on their computer model. The portfolio is based on the principles of asset allocation.

The Schrodinger now has over $50,000 invested so this portfolio will be “taxes managed.” It is rare for Schwab to sell shares. The Schrodinger was launched on 7/31/2017 so it has been through good (2021) and bad (2022) times and only a few times did Schwab sell shares out of the portfolio. The owner of this portfolio set up this account to answer the question – “Who will manage the family portfolio after I die?” While the Schrodinger is not a family portfolio, it is an example of how a spouse may work with Schwab (or another broker) to handle the family portfolio.

When I began investigating Robo Advisors back in 2016 and 2017 I set up several accounts so I could provide better advice to the person interested in this hands-off approach to investing. I selected Schwab as this is a “no fee” account.

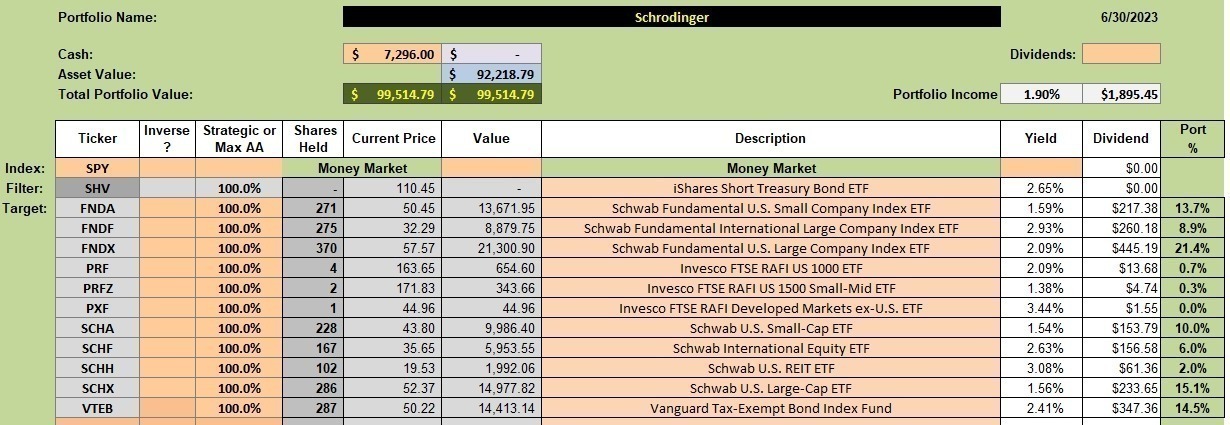

Schrodinger Investment Quiver and Holdings

Below is the current asset allocation portfolio. I question Schwab holding shares in PRF, PRFZ, and PXF as those few shares will not have any impact on the portfolio.

One other criticism I have of Schwab is the amount they hold in cash. It is my understanding Schwab uses this money to lend to borrowers at a higher rate and that is how they can afford to manage these Intelligent Portfolios without fees.

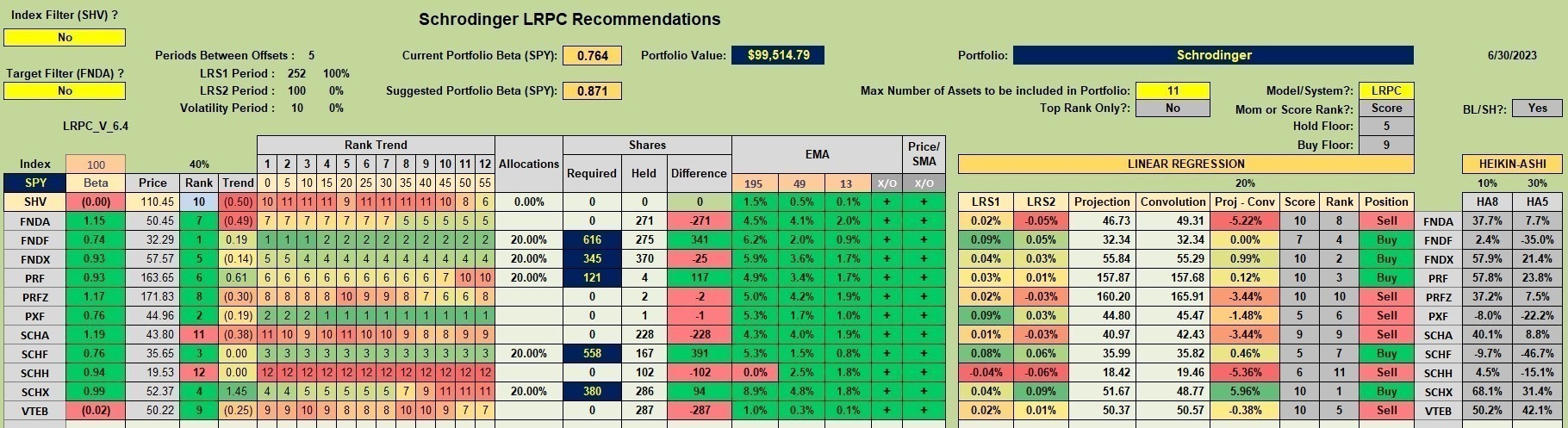

Schrodinger Investment Outlook

I only include this screenshot to show which ETFs are currently recommended when using the Kipling spreadsheet.

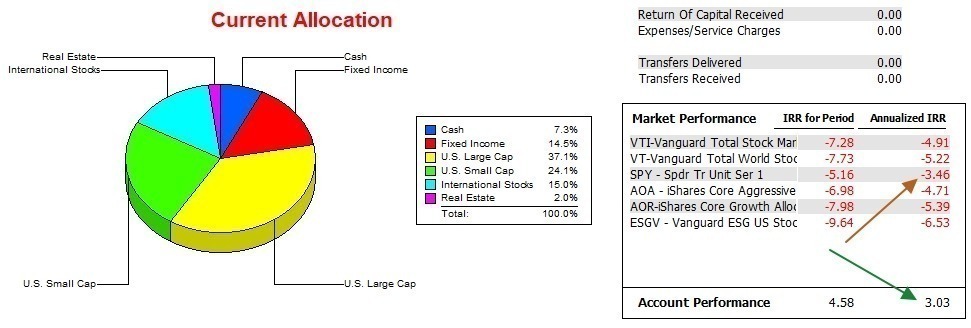

Schrodinger Performance Data

Now we come to the critical question. Does Schwab do a reasonable job with our money? Over the past 18 months the Schrodinger has a commanding lead over the S&P 500 (SPY) as you can see from the following data.

The picture is not as rosy since inception. We are one month away from six years of operation and over this period the Schrodinger rose 62.87% while the SPY increased by 97.6%. As I’ve stated many times, it is extremely difficult to outperform the broad U.S. Equities market. That is one reason for setting up the Copernicus portfolio as that owner is interested in matching the broad market.

The Schrodinger tends to outperform SPY in poor markets, but does not do as well in strong bull markets. This is understandable based on the principles of asset allocation.

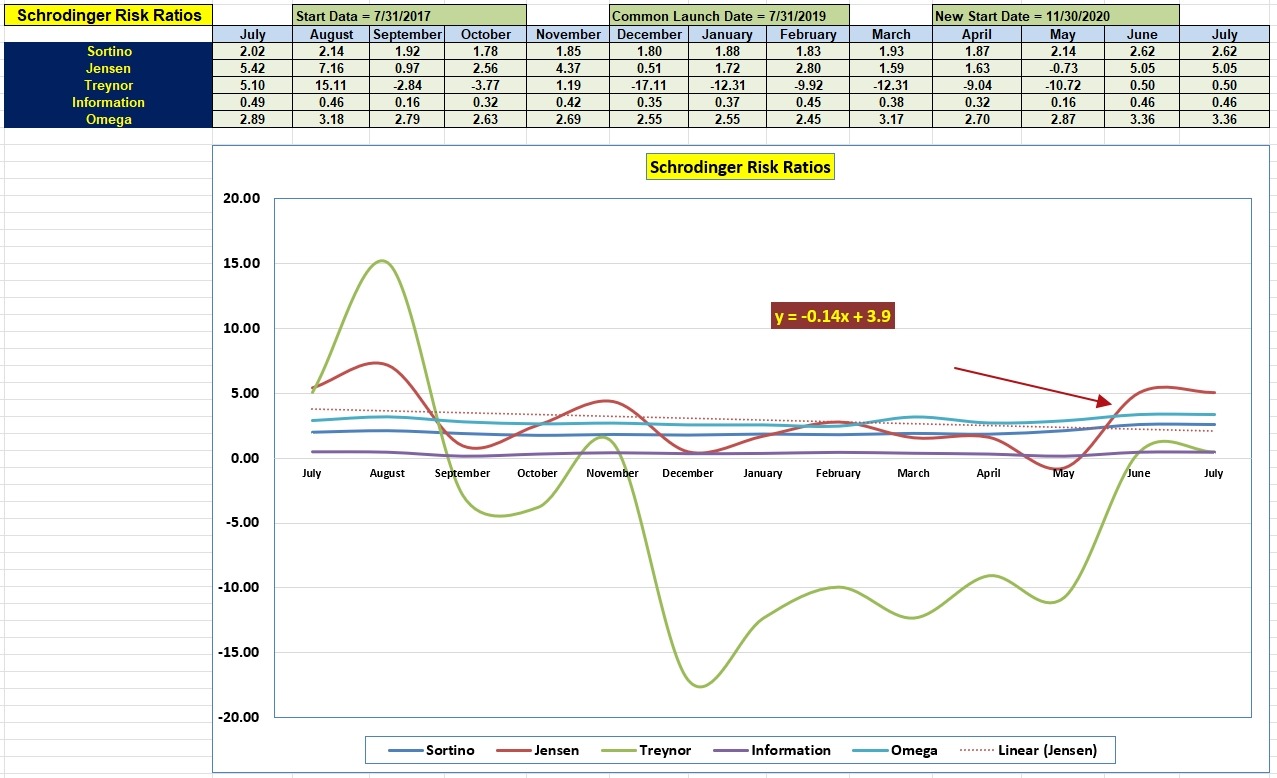

Schrodinger Risk Ratios

Below is additional performance information where risk enters the equation. If the Schrodinger continues on this performance level, once we clear August the slope of the Jensen will once more return to a positive value.

Pay most attention to the Jensen Alpha, Information Ratio, and Sortino Ratio – in that order. June and July values are identical as we don’t have any July numbers at this point.

Over time the Schwab asset allocation approach does an excellent job of managing portfolio risk.

Copernicus Buy & Hold Portfolio Review: 18 May 2023

Schrodinger Computer Manage Portfolio Update: 7 June 2023

The Elements of Investing: Part II

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.