European River Cruise

For some reason I keep thinking the Sector BPI model is close to two years old. In fact, the Carson Sector BPI model was launched a little over a year ago. A number of ITA portfolios held shares in Real Estate (VNQ) nearly from the very first day this blog began back in 2008. This is why you will see VNQ held over $86,000 in Real Estate in the first screenshot below.

What I’ve done in the following eight data tables is to extract the eleven sector ETFs so see how they performed from a particular starting date through 11/26/2023. It is really through 11/24/2023 as that is the last business date for which I have prices.

All the data tables include the performance from eleven portfolios I report on month to month. This is “bundled” data rather than data from a single portfolio.

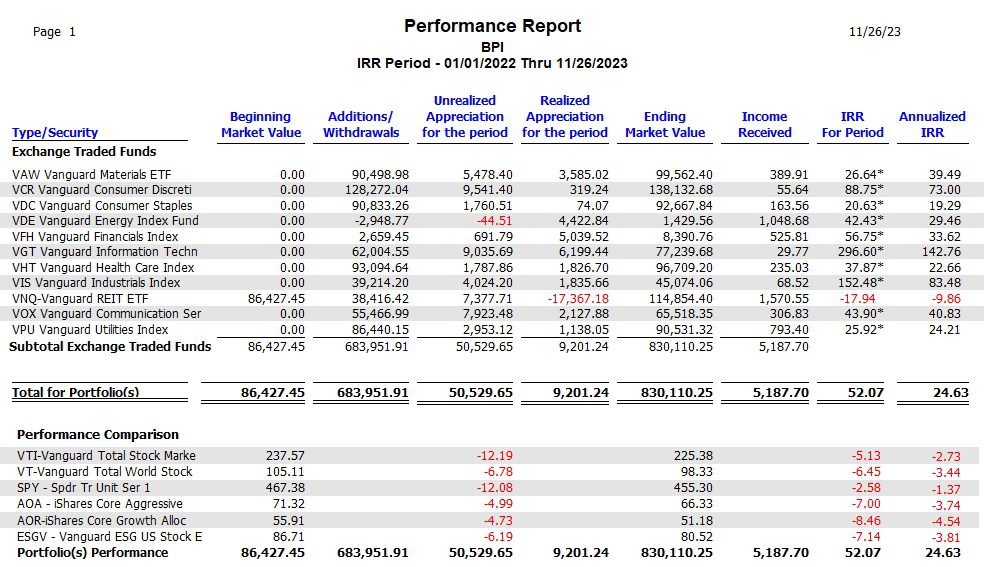

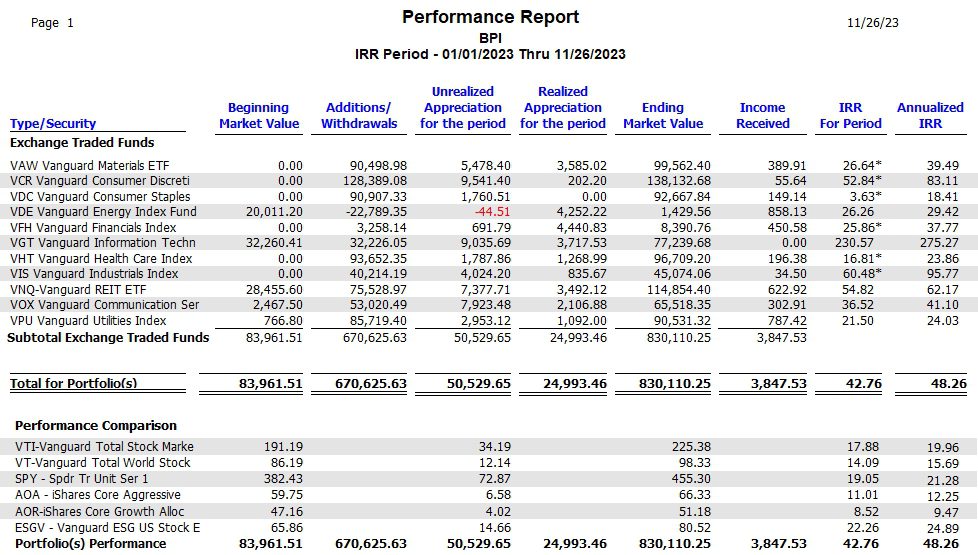

Performance Period 1

Each of the following data tables show the performance of sector ETFs for a particular period of time. I’ve broken the periods down quarter by quarter. This first table runs for nearly two years. Again, this is combined data from 11 portfolios.

Pay attention to both the Annualized IRR and the IRR For Period.

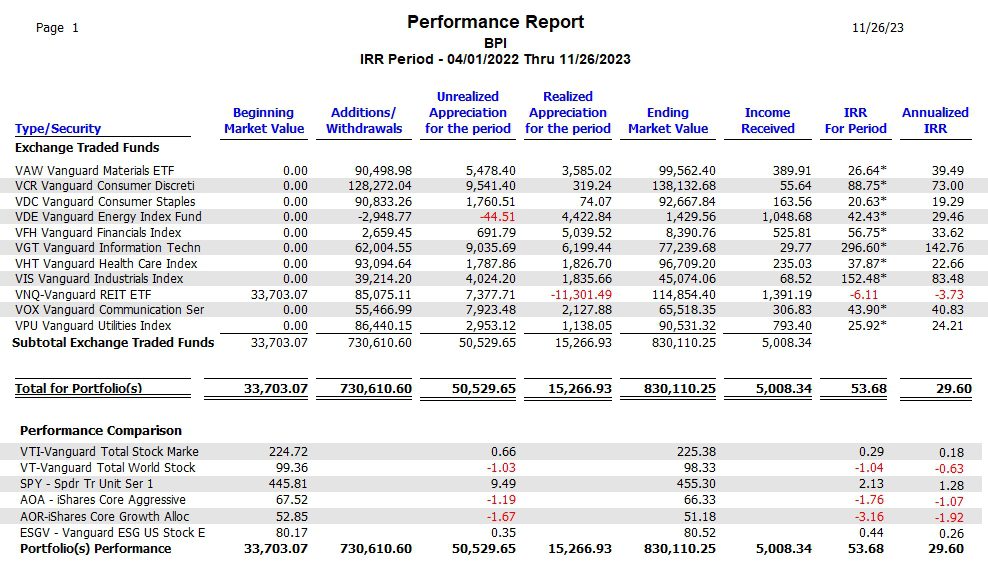

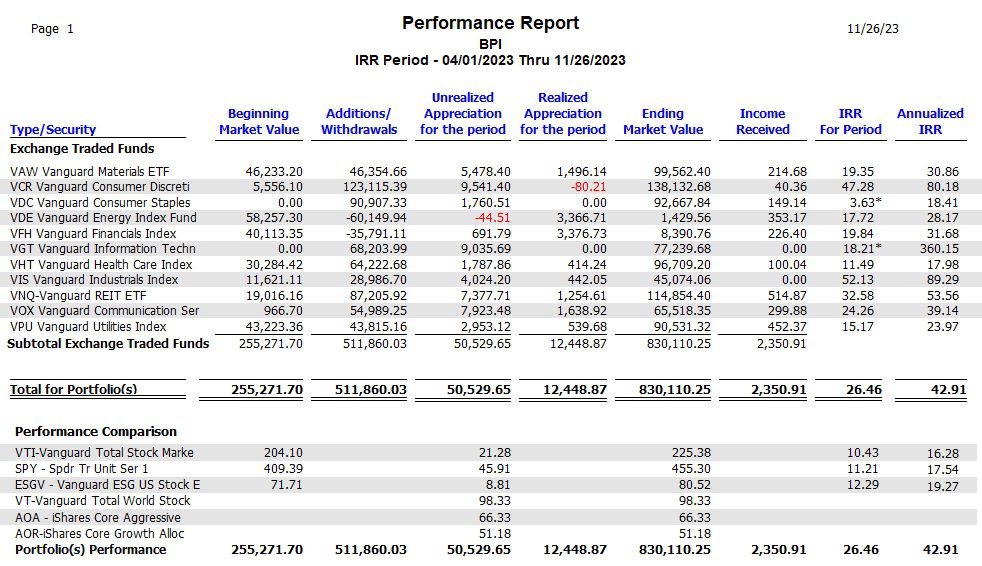

Performance Period 2

This second table operates from the first quarter of 2022 through last Friday.

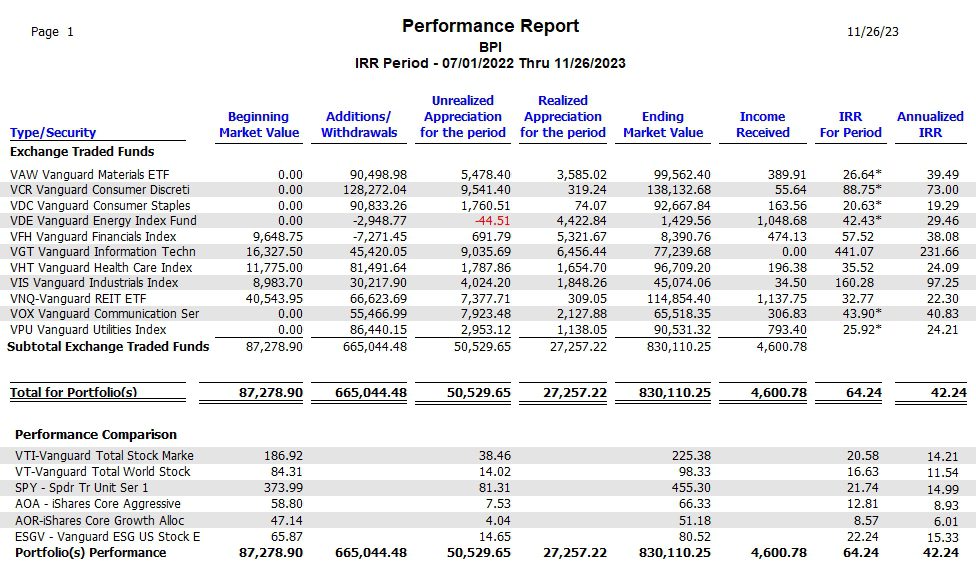

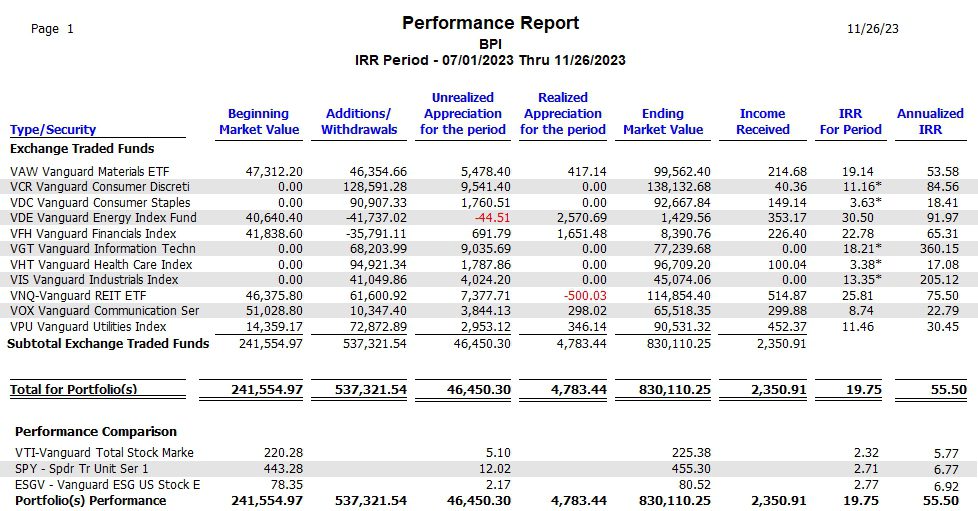

Performance Period 3

Table 3 includes data from the second quarter of 2022 through last Friday (11/24/2023). I began to invest in a few more sector ETFs.

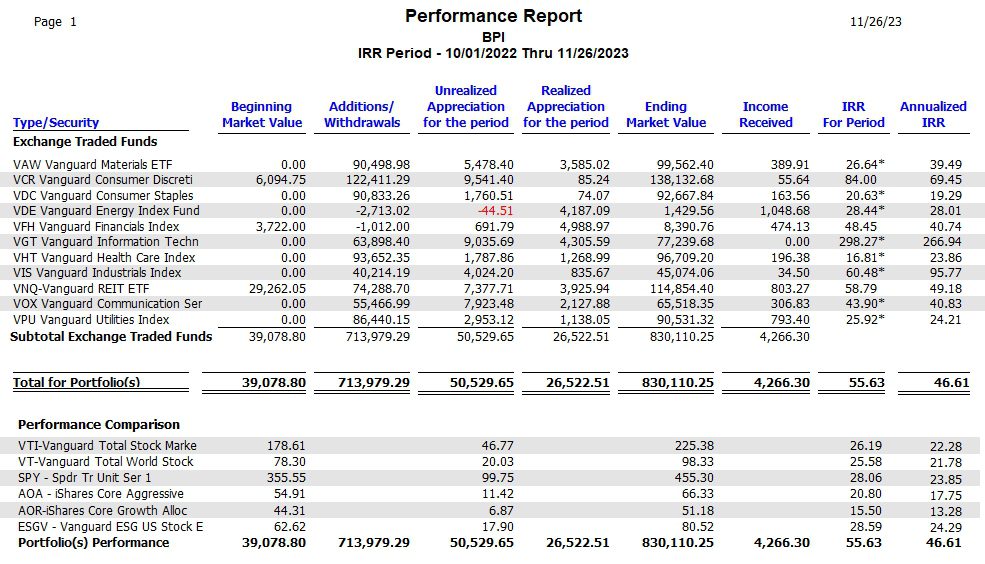

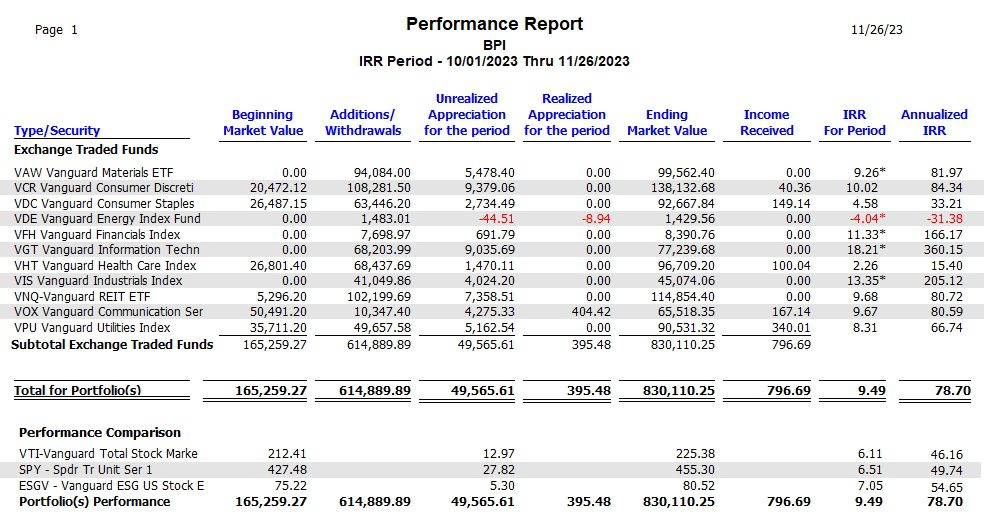

Performance Period 4

Period 4 runs from the third quarter of 2022 through 11/24/2023. Pay attention to how well the sector ETFs performed compared to the six potential benchmarks. SPY is nearly always the top performing benchmark and the one I use as it is the most difficult to outperform.

Performance Period 5

Period 5 shows the sector ETFs performing at double the rate of SPY. Think of this as Year-To-Date performance.

Performance Period 6

Here in Period 6 I’m not sure what happened to VT, AOA, and AOR as those benchmark data values were lost in the calculation. The sector ETFs hold a commanding lead over SPY and by this time I was using the Sector BPI model with several portfolios.

Performance Period 7

Each quarter more ITA portfolios were using the Sector BPI model giving added credence to this investing approach.

Performance Period 8

Period 8 is a very short time frame. Therefore it carries less importance. Nevertheless, the sector ETFs continue to outperform SPY.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.