Portlandia

The purpose of this blog is to examine in more detail the performance of the eleven (11) Sector BPI portfolios by looking at performance over two quarter periods. Beginning at the end of the second quarter of 2022 and ending on the first quarter of 2024 we gain a better understanding of performance using these two quarter rolling periods.

Sector ETFs were first used in the second quarter of 2022 and not all eleven Sector BPI portfolio have been using this model over the entire period.

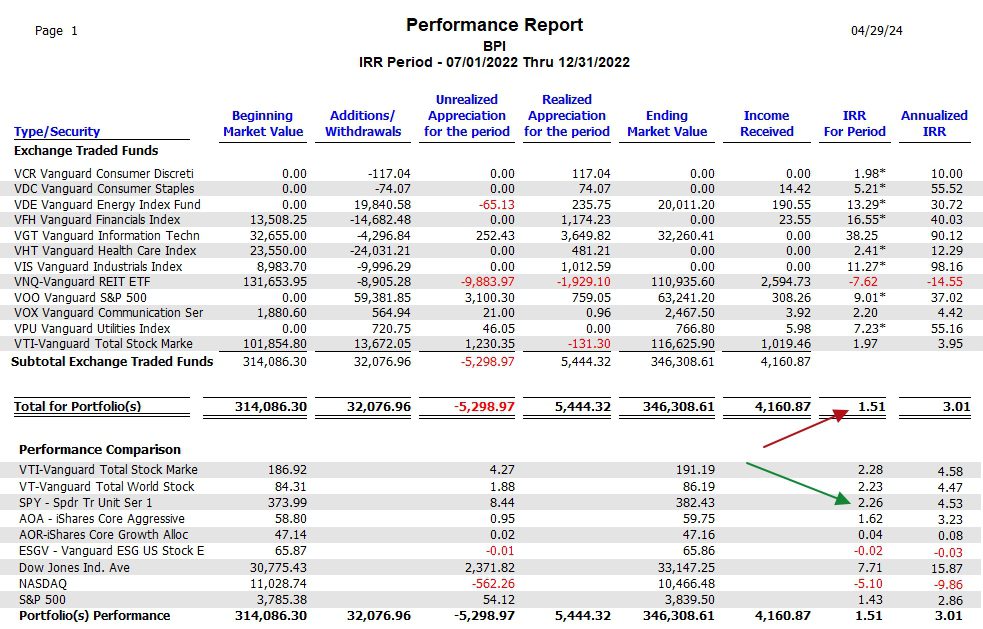

Period 1

The first period begins on 7/1/2022 (end of second quarter) and runs through the end of the fourth quarter of 2022. Checking the red and green arrows we see that the SPY benchmark outperformed the Sector BPI portfolios.

The asterisk adjacent to some IRR percentages indicate the security was not held over the entire time period for which there is data.

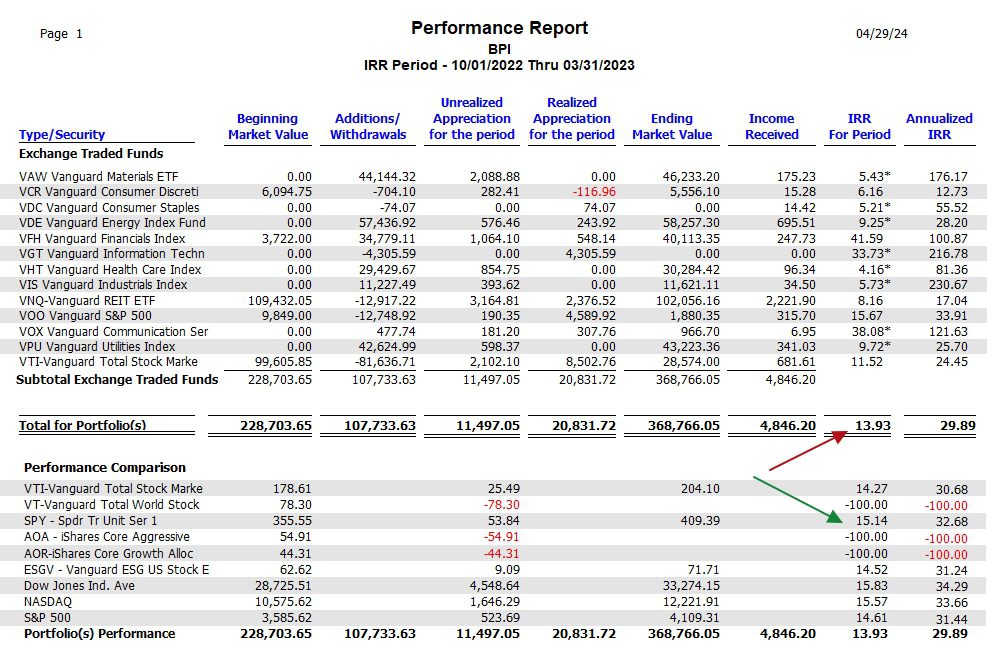

Period 2

The second period under examination runs from the end of the third quarter through the first quarter of 2023. Again, the SPY benchmark edges out the sector portfolios using this model. Only a few of the 11 portfolios were using the Sector BPI model at this point.

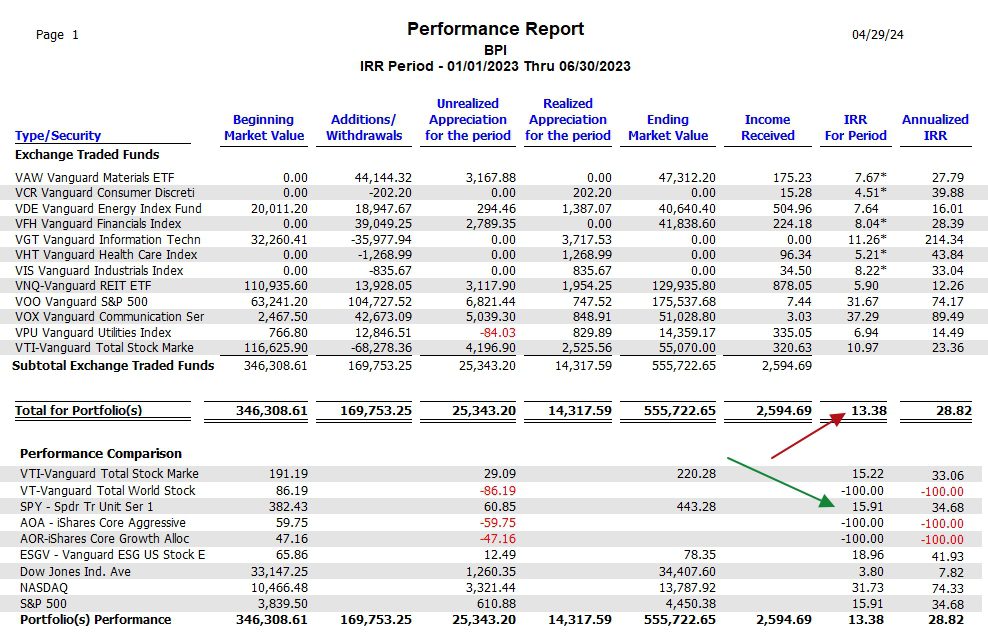

Period 3

The third period begins at the end of the fourth period in 2022 and turns through the second quarter of 2023. Little change from the prior two quarter period.

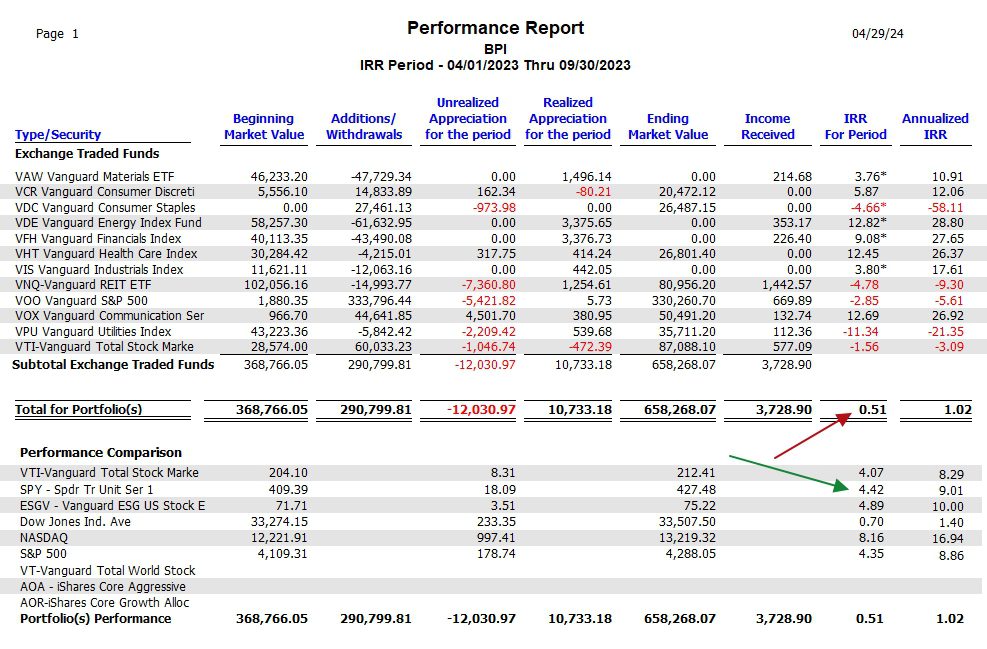

Period 4

Now we come to the end of the first quarter of 2023 and run through the third quarter of 2023. Not only does SPY outperform the Sector BPI portfolios, but it opens up a significant gap. Things are not looking up for the Sector BPI investing model.

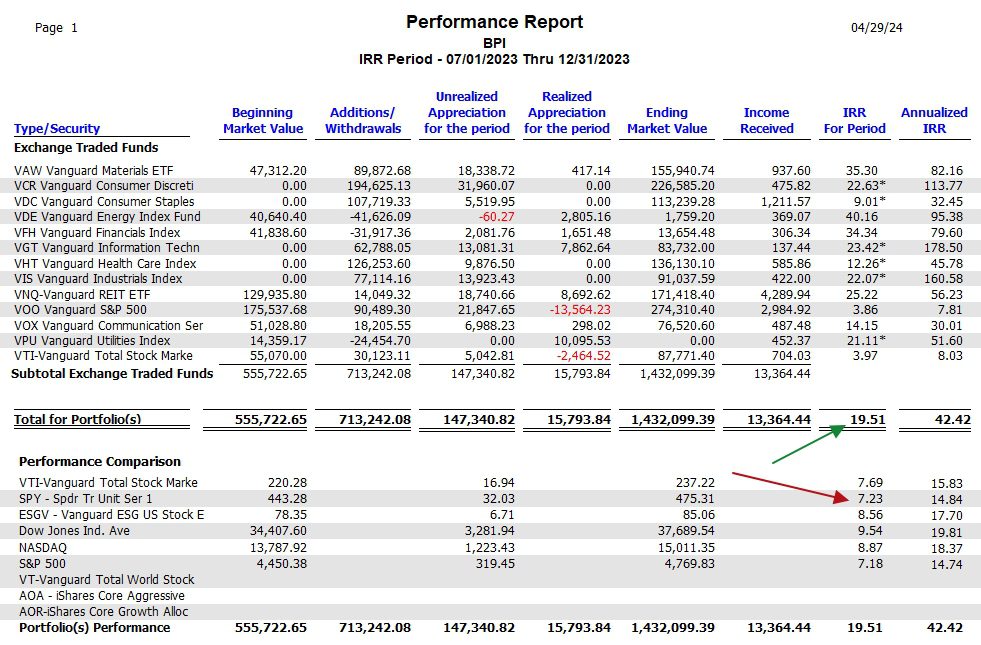

Period 5

Period 5 covers the third and fourth quarters of 2023. Here we see the Sector BPI model not only moves ahead of SPY, but opens up a rather wide gap on the S&P 500 ETF.

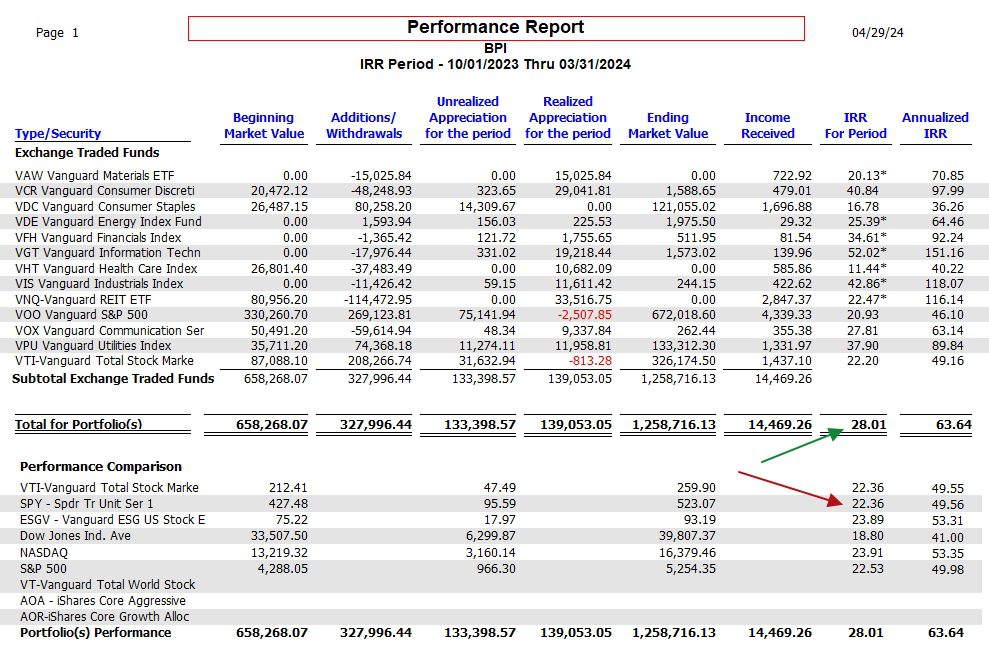

Period 6

The last two quarter periods runs from the end of the third quarter of 2023 and ends at the close of the first quarter of 2024. The Sector BPI portfolios cling to a lead over SPY.

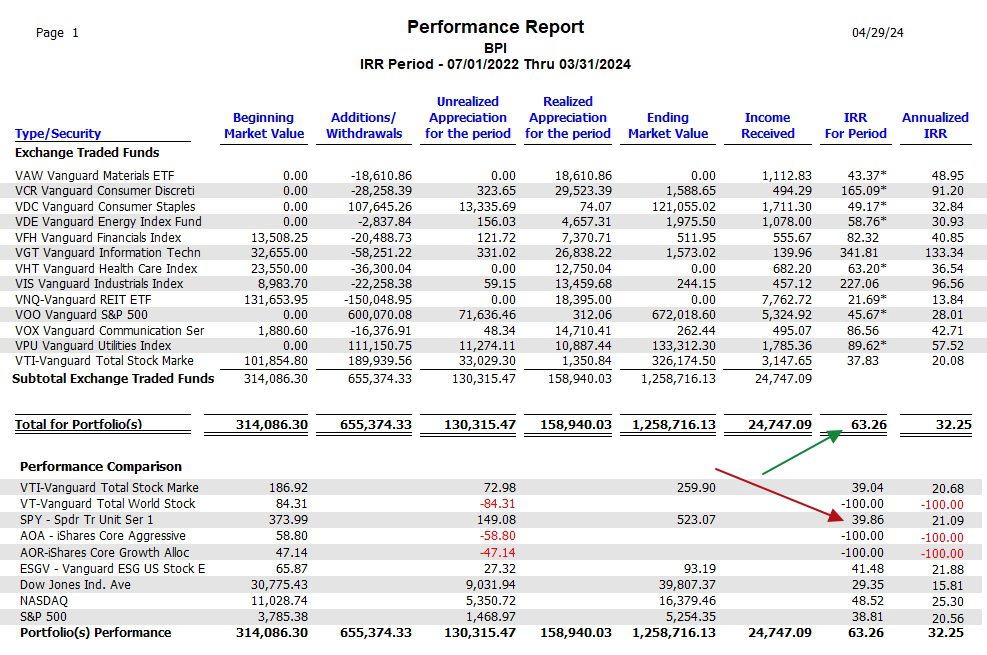

Total Period

Now we come to the total period under examination and it is somewhat of a surprise that the Sector BPI portfolios show up as well as they do as the investing model has an IRR return of 63.3% for the period vs. a 39.9% IRR for the investable benchmark, SPY.

Pay no attention to VT, AOA, and AOR as data did not come through for many of the two quarter periods. None of these are as high as the Sector BPI portfolios.

Share this URL with your friends and family members.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.