Preparation for New House

The following Bethe update is not so much where the portfolio is currently. Rather, it is the direction the portfolio is moving in the future. Currently, the Bethe holds a high percentage of the portfolio in income generating CEFs. While I have many limit orders in place to sell off the CEFs, the limit orders are currently placed at a high value so as to lower the sell probability until after the second quarter dividends are in. Once we move into July I plan to reset the limit orders. Cash from the sale of CEFs will be used to add to ESGV.

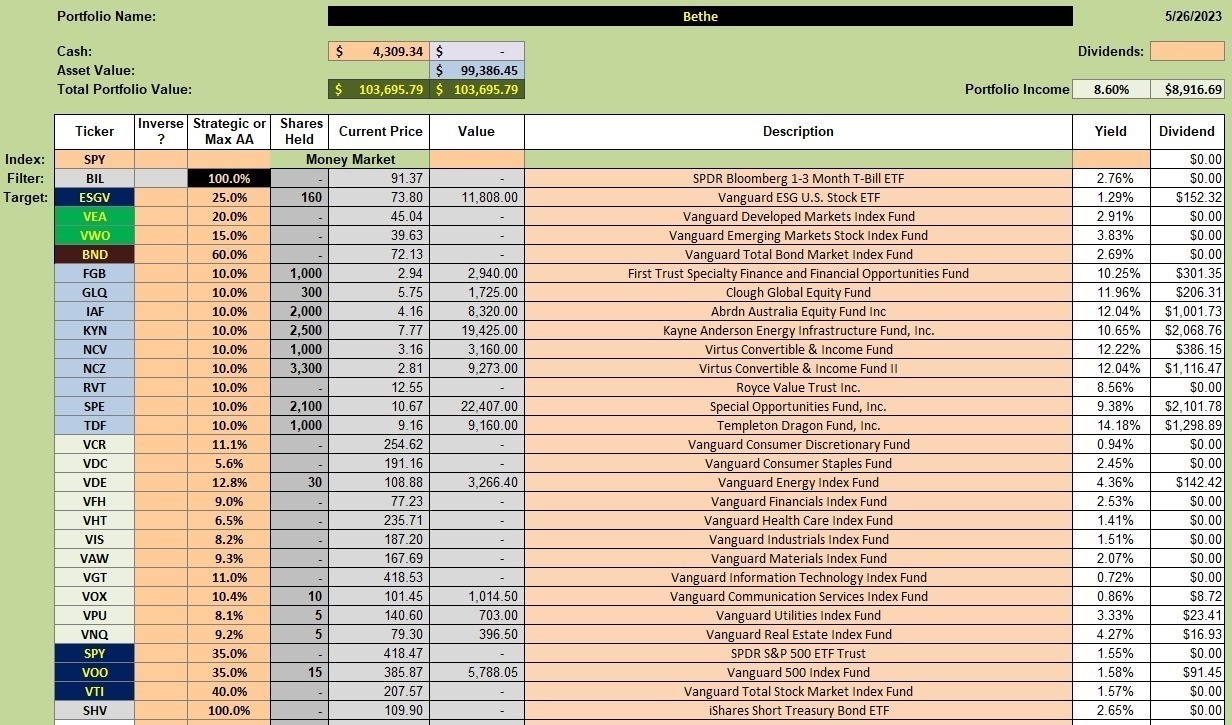

Bethe Investment Quiver

Below is the current investment quiver and holdings in the Bethe portfolio. Over the next several months the goal is to move the Bethe toward a Sector BPI Plus investing model. This will reduce the reliance on CEFs and concentrate more on U.S. Equities and Sector ETFs.

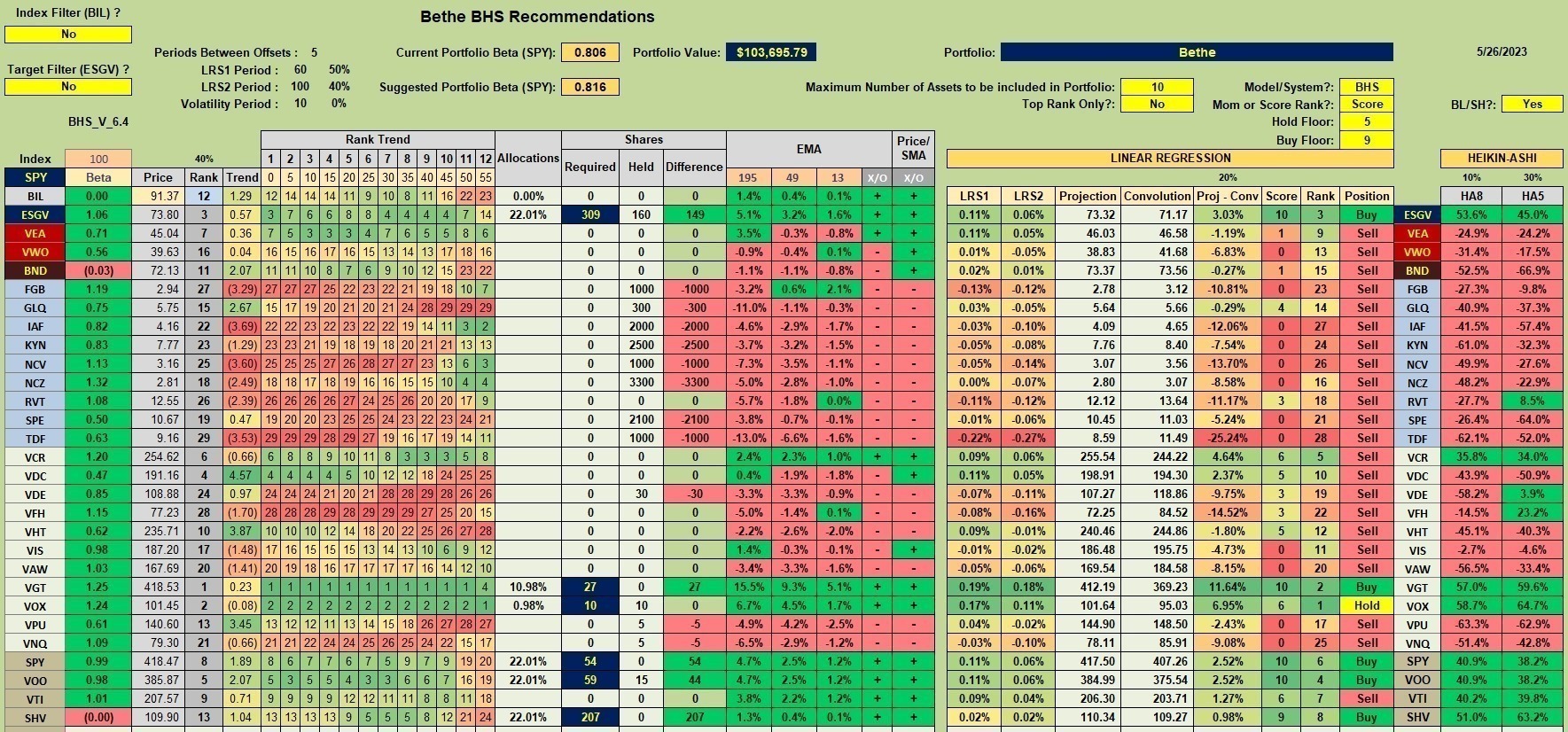

Bethe Security Recommendations

Using the default look-back periods of 60- and 100-trading days combined with the BHS investing model, the recommendation is to first fill ESGV followed by VOO and SPY. No sectors are in the Buy zone so we pass by any sector ETFs.

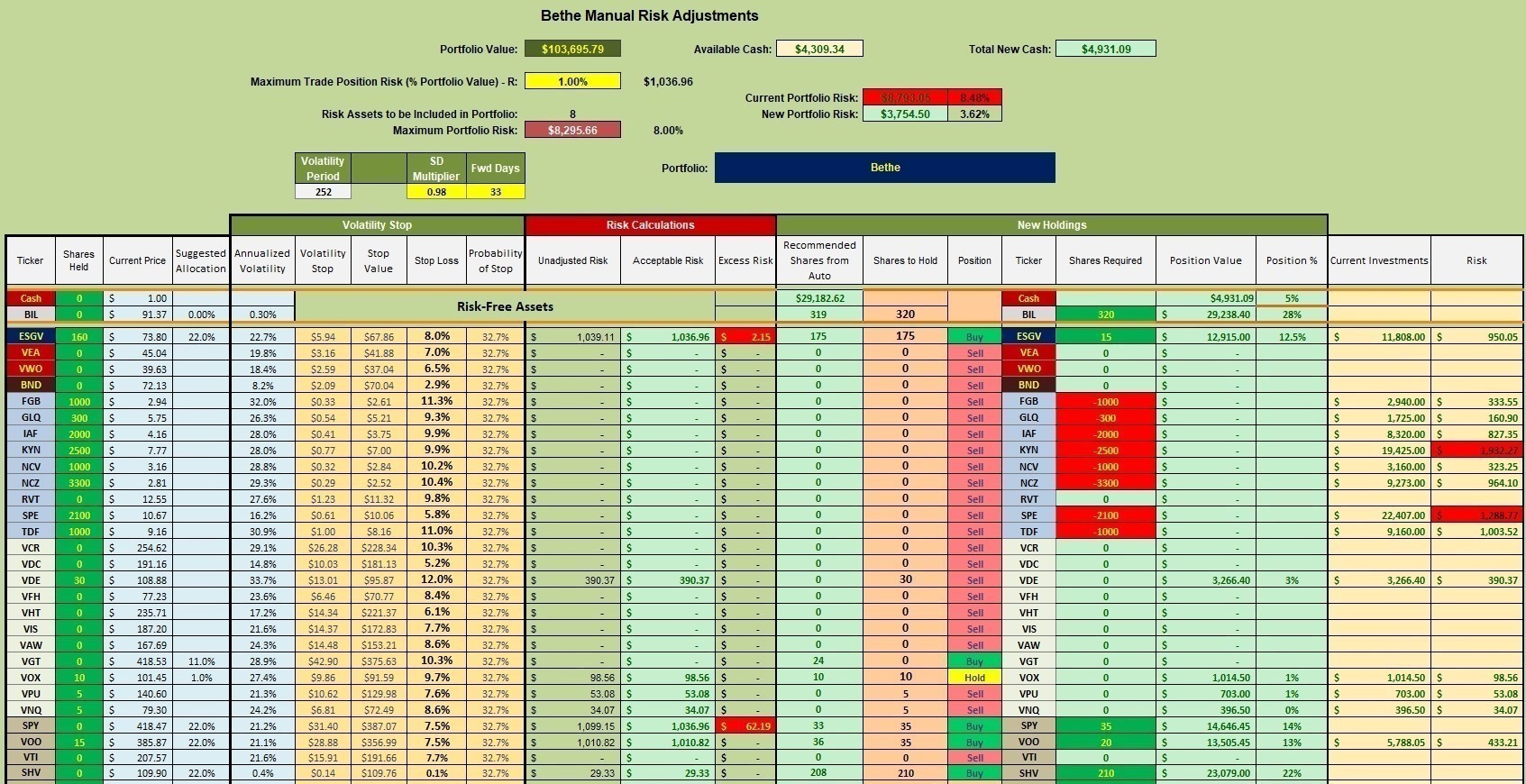

Bethe Manual Risk Adjustments

The Bethe currently holds 160 shares of ESGV and another 15 will fill the recommendation of 175 shares. If and when sufficient cash becomes available I will move on the VOO to fill that recommendation.

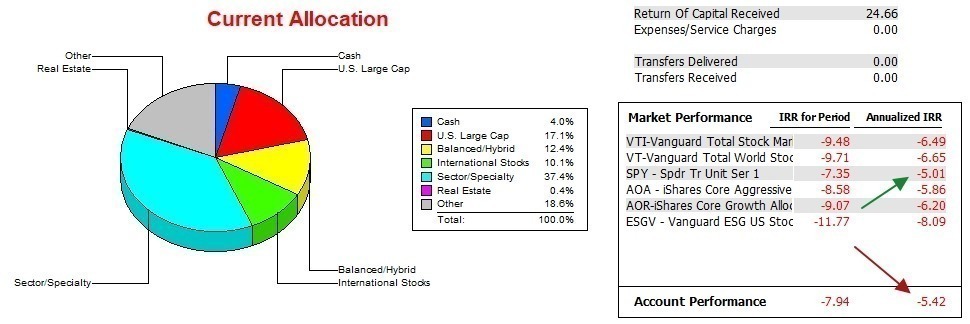

Bethe Performance Data

Over the past 18 months the Bethe is slightly behind the IRR of SPY, but it is out performing all other possible benchmarks. That is not too shabby a record for return. What about risk when that enters the equation? Move down to the last slide for that information.

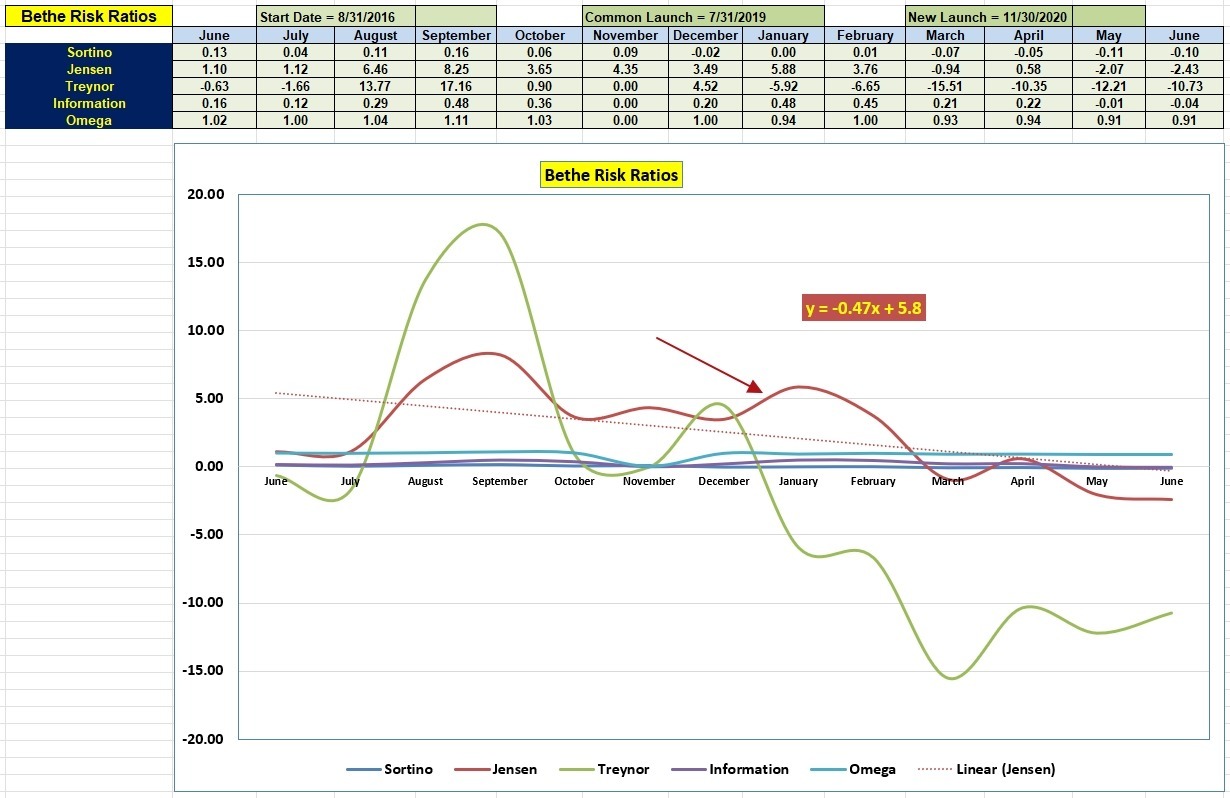

Bethe Risk Ratios

Rising interest rates for the risk-free short-term treasure is putting downward pressure on the Jensen. For the second month in over a year the Bethe lost ground to the SPY benchmark. Shifting the investing model slightly is an effort to turn this around and move the negative slope for the Jensen back into positive territory. This will take a few months to accomplish and we also need a strong equities market.

ITA is now free to all who register as a Guest. Give me a few days to move new readers from Guest to the Platinum level.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.