Spring comes to Canby.

Market action over the past few days has been sufficient to push ITA portfolios to a higher level than they were on March 31, 2025. This recent push only elevates the Buffett Indicator and Shiller PE Ratio.

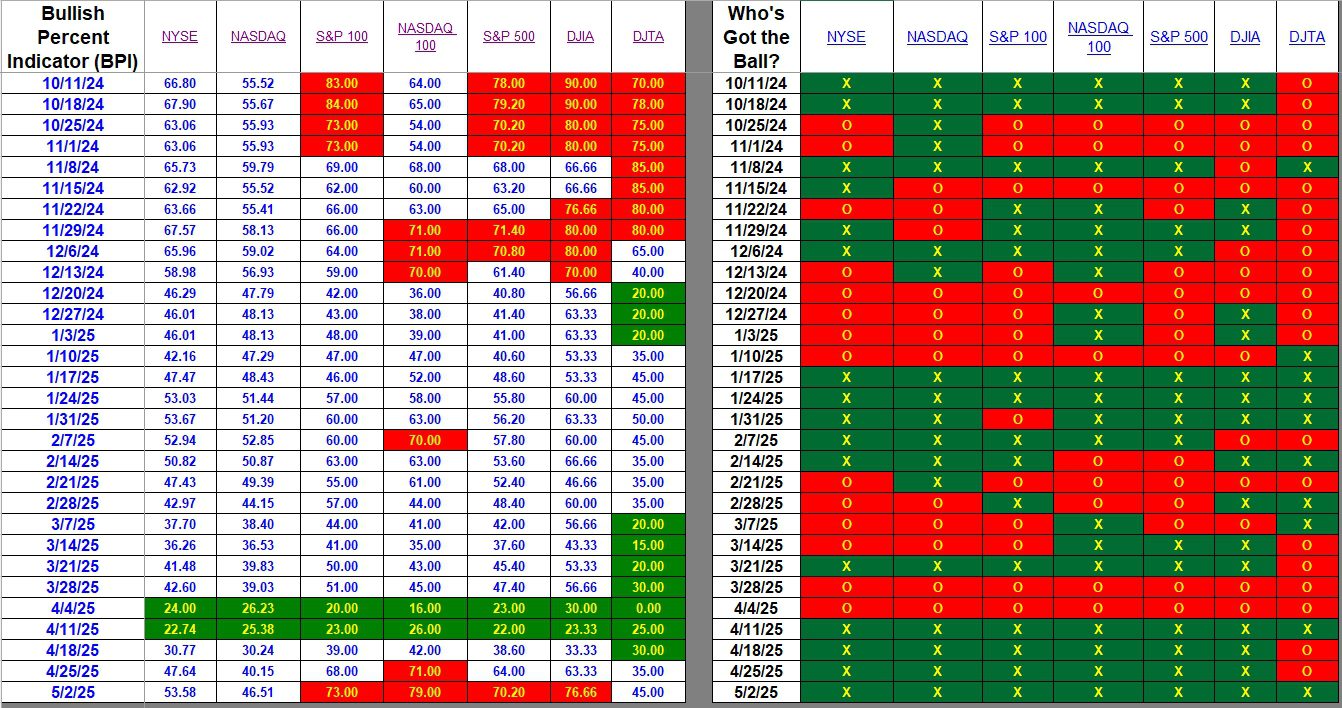

Index BPI

All indexes are currently bullish and four are in the overbought zone. Note that the two broad indexes, NYSE and NASDAQ, are hovering around the 50% level while the S&P 500 and DJIA are above 70% bullish. This tells me that small- and mid-cap stocks are not participating in this recent upsurge. At least not to the same level as the large- and mega-cap stocks.

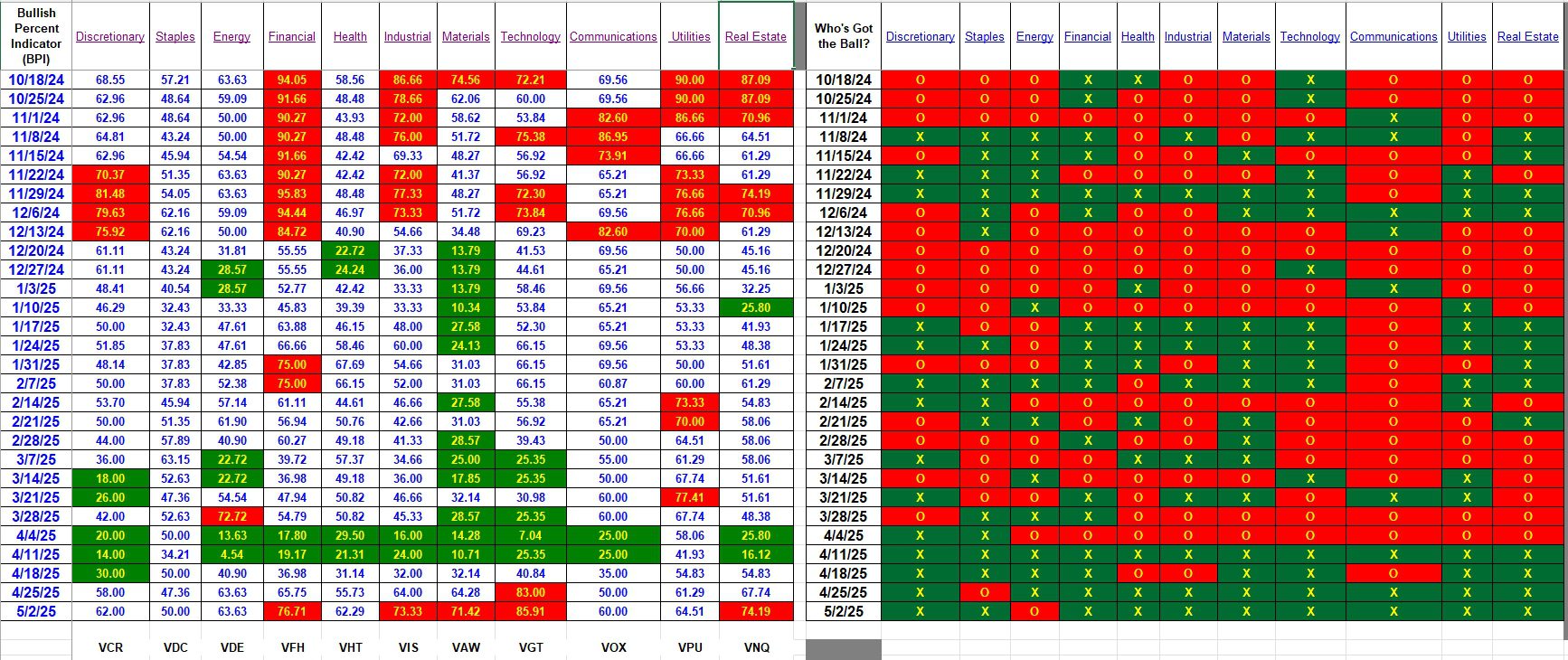

Sector BPI

Now we come to the sectors which we use to manage the three Sector BPI portfolios. Five of the eleven sectors are overbought so we will be placing TSLOs under these sectors. I think Technology (VGT) was sold a few weeks ago, but will need to check each portfolio.

The basic rule is to place a 3% TSLO under the overbought sectors. If one wishes to be a bit more precise, here is what I plan to do with the sector holdings.

- Financial (VFH): Place a 2.3% TSLO.

- Industrial (VIS): Place a 2.7% TSLO.

- Materials (VAW): Place a 2.9% TSLO.

- Technology (VGT): Place a 1.4% TSLO if still in any portfolios.

- Real Estate (VNQ): Place 2.6% TSLO.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

All TSLOs are set within the three Sector BPI portfolios. Now we wait and see what happens in this volatile market.

Lowell

Discretionary (VCR) sector moved into the overbought zone today. I set TSLOs for VCR in all three Sector BPI portfolios.

Lowell

If you are managing a Sector BPI portfolio the Health sector moved into the overbought zone. As a result of this move I will be placing a TSLO under VHT. The BPI percentage is 72.13 so I will either use a 3.0% TSLO or 2.8%.

Lowell

All sectors with exception of Staples, Utilities, and Real Estate are currently overbought. This information should not impact any Sector BPI portfolios as we either sold overbought ETFs representing these sectors or have TSLOs in place for overbought sectors.

We now patiently wait for one or more sectors to drop into the oversold zone. In the meantime hold either shares in VOO or SHV.

Lowell

No changes recommended for Sector BPI portfolios this week (7/11/25).

Lowell

No changes this week (8/22/2025) as no sectors are oversold. Therefore there are no buying opportunities.

Portfolios up for review this week are: Bethe and Einstein. I may slip in another one as we are near the end of the month.

Lowell