Bodie House

It has been months since I last published Bullish Percent Indicator (BPI) data as little changed until the last several weeks. This past week we had sufficient volatility to where several sectors dropped into the oversold zone and we purchased sector ETFs to take advantage of the decline. I expect to see more sectors move below the 30% bullish line sometime in 2026.

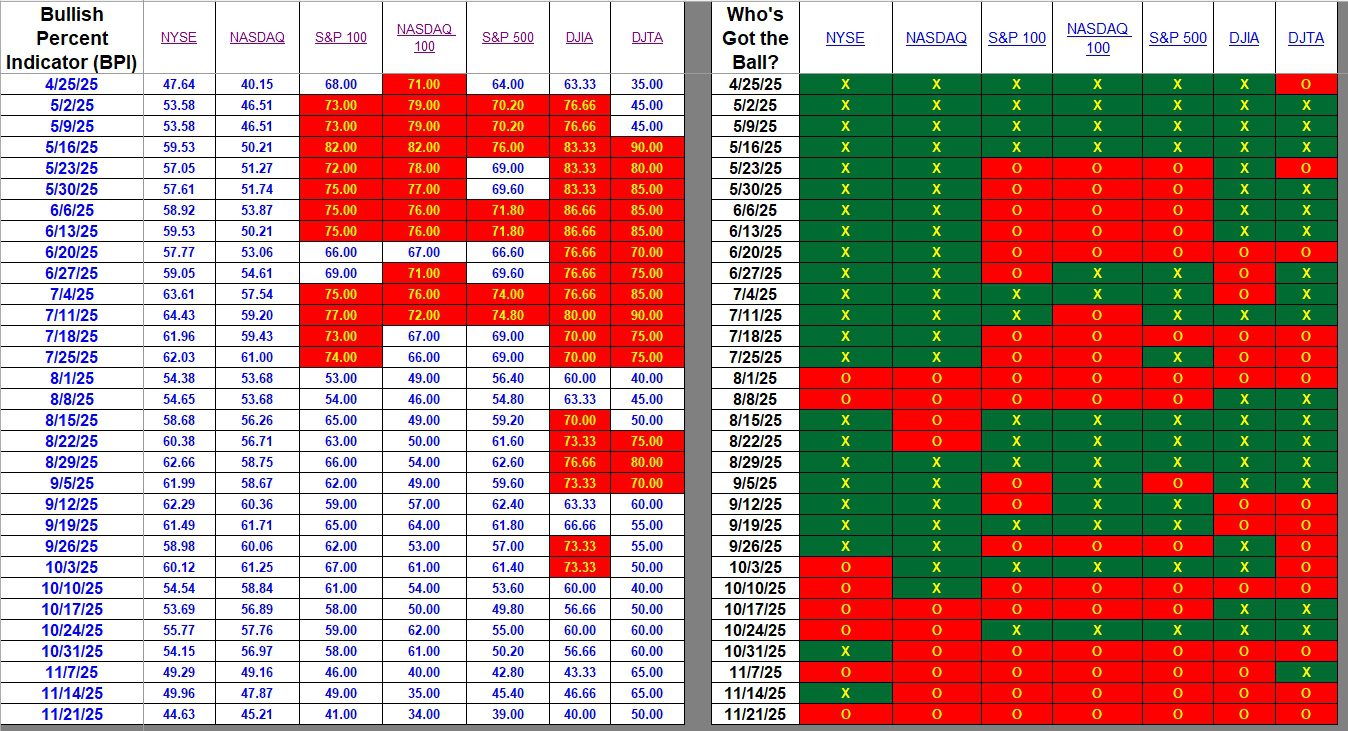

Index BPI

All the primary indexes are currently bearish. On the right side of the screenshot we see nothing but X’s indicating all markets are bearish.

Over on the left side of the table we find the percentage of bullish stocks within the specific index. If you look back to April you will see that many are down even below the time of the “tariff announcement.” Overall, this is a weak market, but still being held up by a few hi tech stocks.

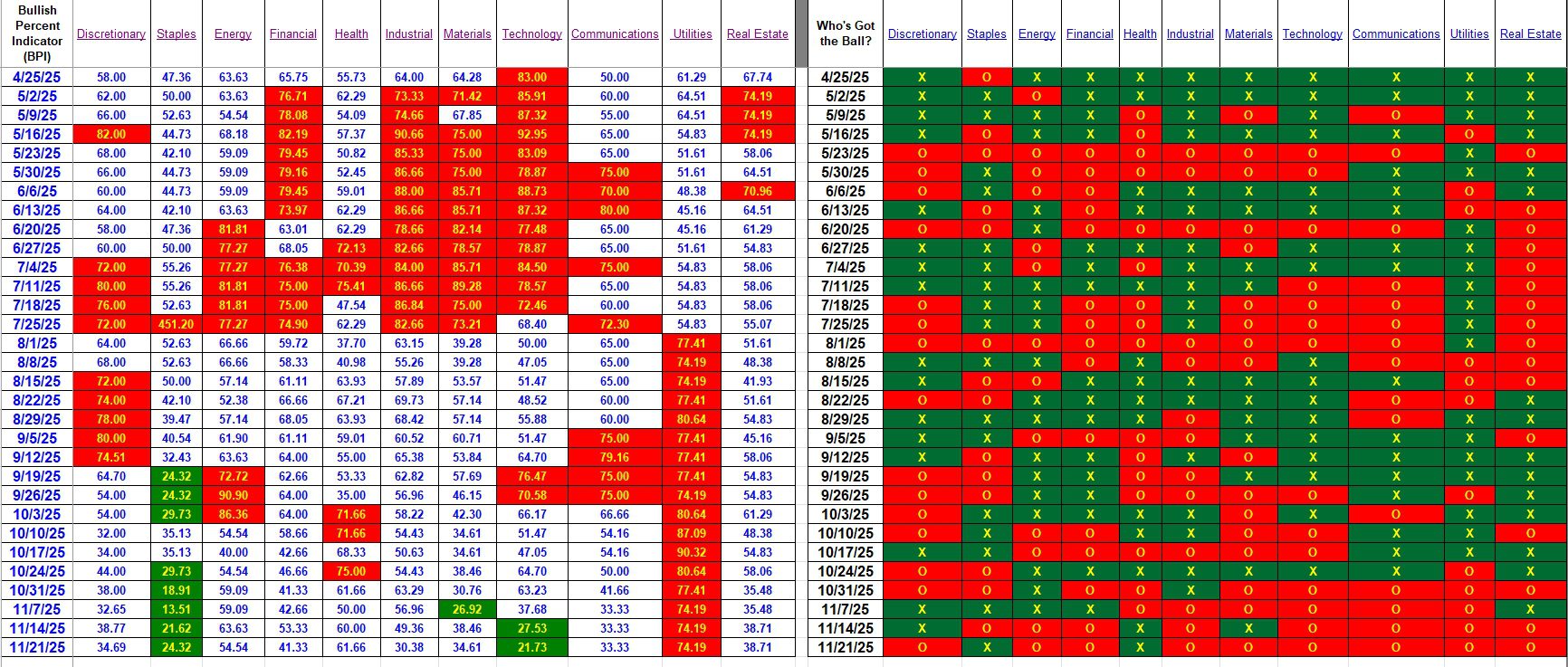

Sector BPI

Now we come to the sectors or the information used to manage the Sector BPI portfolios, Carson, Franklin, and McClintock. Currently, only Staples and Technology are oversold. During this past week the Industrial sector was oversold so shares of VIS were added to the three Sector BPI portfolios.

If a sector drops into the low thirties such as Communications, I will place a limit order close to the current price so if the sector ETF drops in price mid-day, shares of that sector are added to Carson, Franklin, and McClintock.

As an example, the Carson currently hold shares in Materials (VAW), Discretionary (VCR), Staples (VDC), Technology (VGT), Real Estate (VNQ), and Communications (VOX).

As mentioned in another blog this week, the Sector BPI investing model is at its core a reversion to the mean approach to portfolio management.

Comments and Questions are always welcome.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Leave a Comment or Question