Snow Sculpture

Bullish Percent Indicators are ending February in a downward trend. All major indexes are bearish, yet none are in the over-sold zone. We need to check on Sectors to pick up an over-sold condition.

Just a short word regarding the above photograph. This past week Portland experienced the largest snowfall since the 1940s. Measured at the airport, we had over 10 inches. In the hills the amount was even higher. We are still snow bound, but hope to be able to move around by tomorrow or Monday. At least snow is far superior to ice and loss of electrical energy. Portland, due to all the hills, is a mess when we have a few inches of snow.

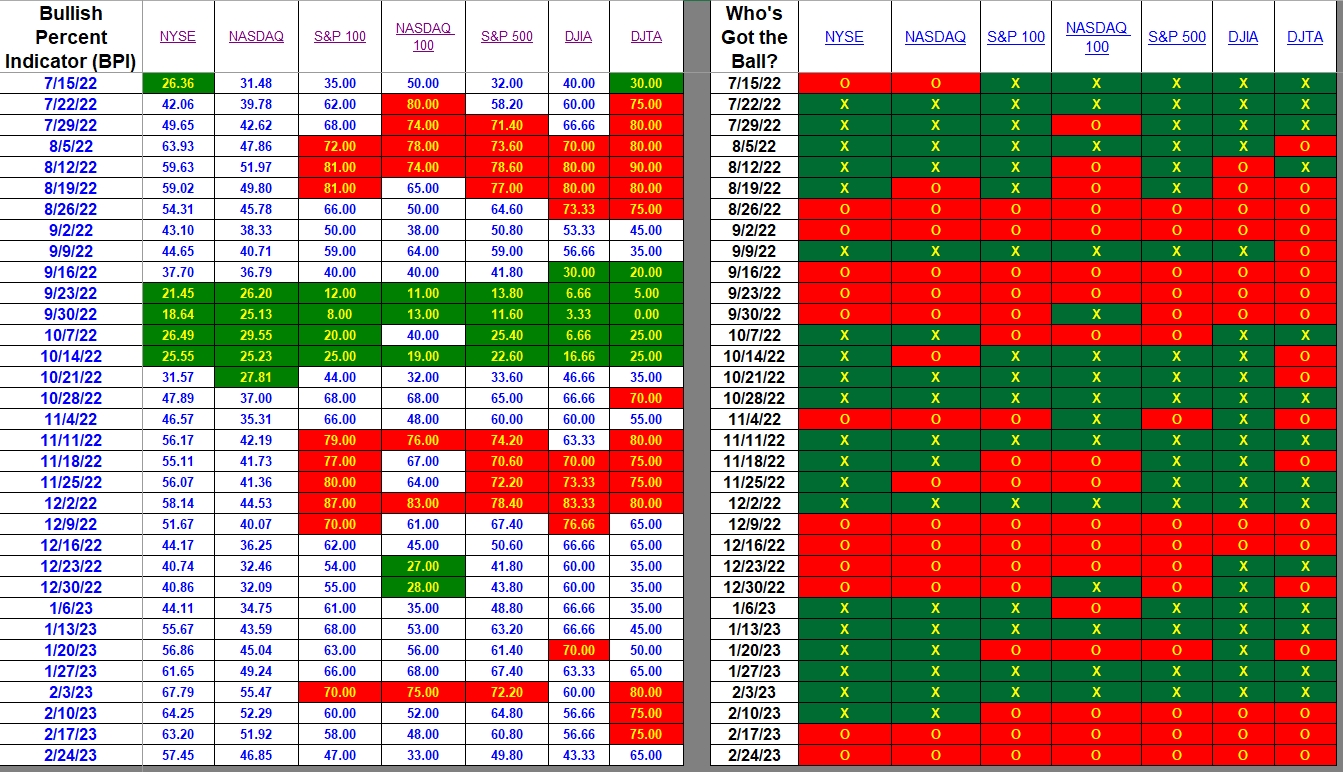

Index BPI

As readers can see from the percentage drops, this past week was a weak one for U.S. Stocks. All major indexes are bearish. Technology, as measured by the NASDAQ indexes, was particularly hard hit.

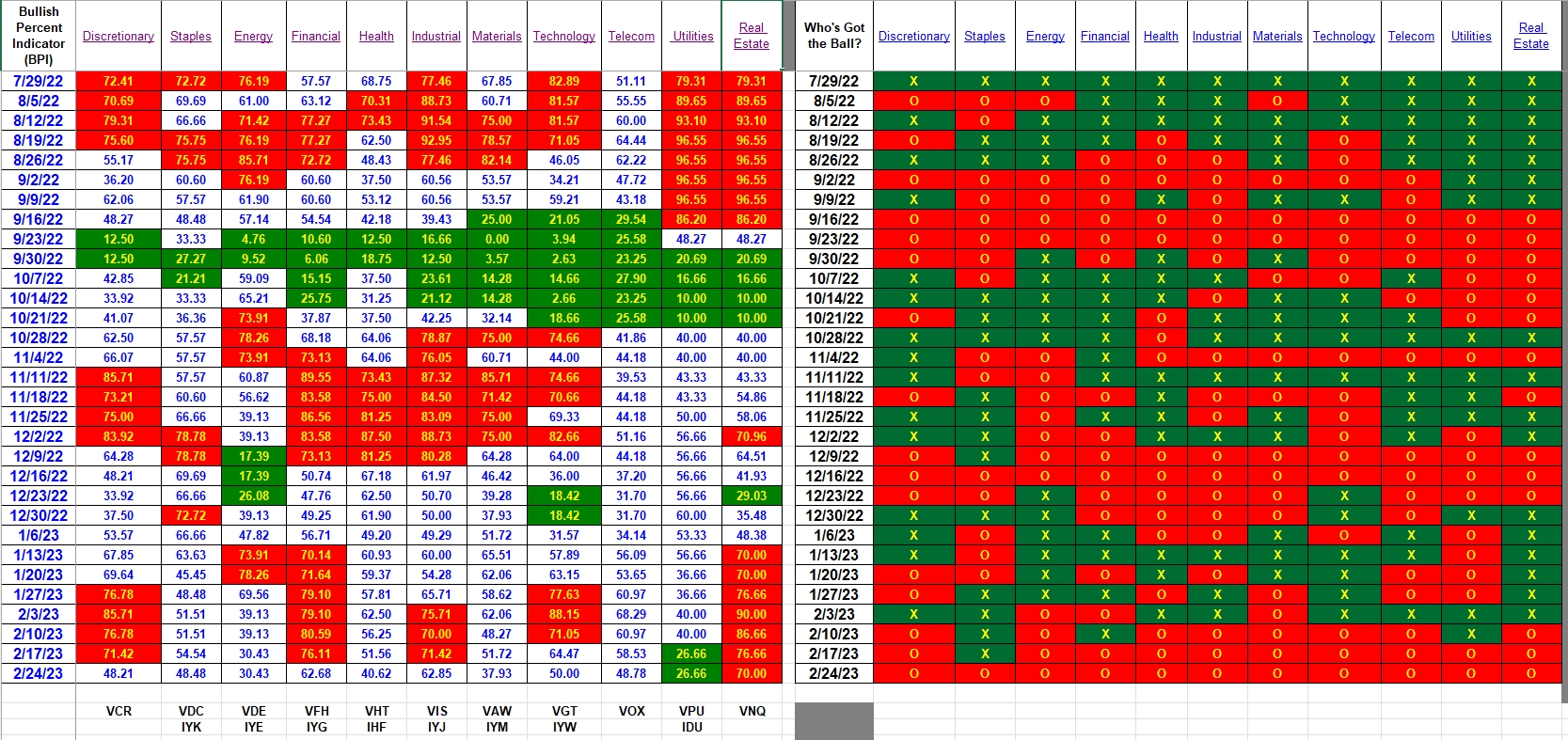

Sector BPI

Now we come to the eleven sectors that make up the S&P 500. Utilities continues in the over-sold zone and I think all the Sector BPI portfolios are now holding VPU shares. I thought Energy would drop into the over-sold zone as it is so close. If you have been following any of the Sector BPI portfolios you are aware that I am buying VDE for those portfolios and have limit orders set where the Energy sector is not fully populated.

Explaining the Hypothesis of the Sector BPI Model

Note: The ITA Wealth Management blog is now free to all readers who signup as a Guest. Be patient as I will elevate you to the Platinum level. Platinum members of the past have been elevated to the Lifetime level.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Lowell,

I have been doing a bit of an examination of your sector portfolio construction.

The critical buy and sell signals come from your use of the Bullish Percent data from StockCharts.com. This data is based upon the SPDR Select Sector portfolios, as are the affiliated ETFs, which in turn are based upon companies which are part of the S&P 500. The Vanguard ETFs, however, use a very different portfolio construction—the MSCI US Investible Indices 25/50.

Examination of each ETF beta in the S&P and Vanguard families demonstrate very similar values, which is important when considering portfolio volatility. The main difference, as I see it, is the number of holdings in the Vanguard ETFs versus the SPDR ETFs. The Vanguard ETFs routinely have several multiples of holdings, typically 3 to 7 (!), as compared to the SPDR ETFs.

Ordinarily, this would be an advantage for the Vanguard ETFs. Unfortunately, the Bullish Percent indicators are built on the SPDR philosophy, which changes the resolution of the indicators. In the worst case, the SPDR Energy Select ETF (XLE) has only 23 holdings versus the Vanguard Energy ETF’s (VDE) 112 companies. This means a change of just one company on X’s or O’s for the SPDR portfolio makes a step of 4.35% in the Bullish Percent indicator, versus a 0.89% step change for the respective Vanguard ETF.

Did you consider this mismatch, and the indicator resolution? Is this important?

Trying to figure this out when I build my own US sector portfolio.

Craig

Craig,

I don’t think it is a serious problem. To compare performance between the iShares and Vanguard sector ETFs, go to Yahoo and run comparisons. When set to the Max period, there are differences, but they tend to bounce around, sometimes favoring Vanguard and other times favoring iShares.

I am missing three iShares sector ETFs. If anyone knows what they are, let me know and I will insert them into the SS.

One options is to wait until a sector is over-sold and then see which ETF, Vanguard or iShares, is the better performer and go with that security.

Lowell

iShares Sector ETFs (from StockCharts.com and Morningstar)

Consumer Discretionary – IYC

Consumer Staples – IYK

Energy – IYE

Finance – IYF

Health – IYH

Industrial – IYJ

Materials – IYM

Information Technology – IYW

Communication Services – IYZ

Utilities – IDU

Real Estate – IYR

I think these cover the same sector ETFs as Vanguard, but the devil is in the details 🙂

Craig

Craig,

Thank you. Before I read your message I found the missing sector ETF from iShares or Blackrock. The next BPI publication will include the missing sector ETFs.

Lowell