“Democracy is the theory that the common people know what they want, and deserve to get it good and hard.”

– H. L. Menckken

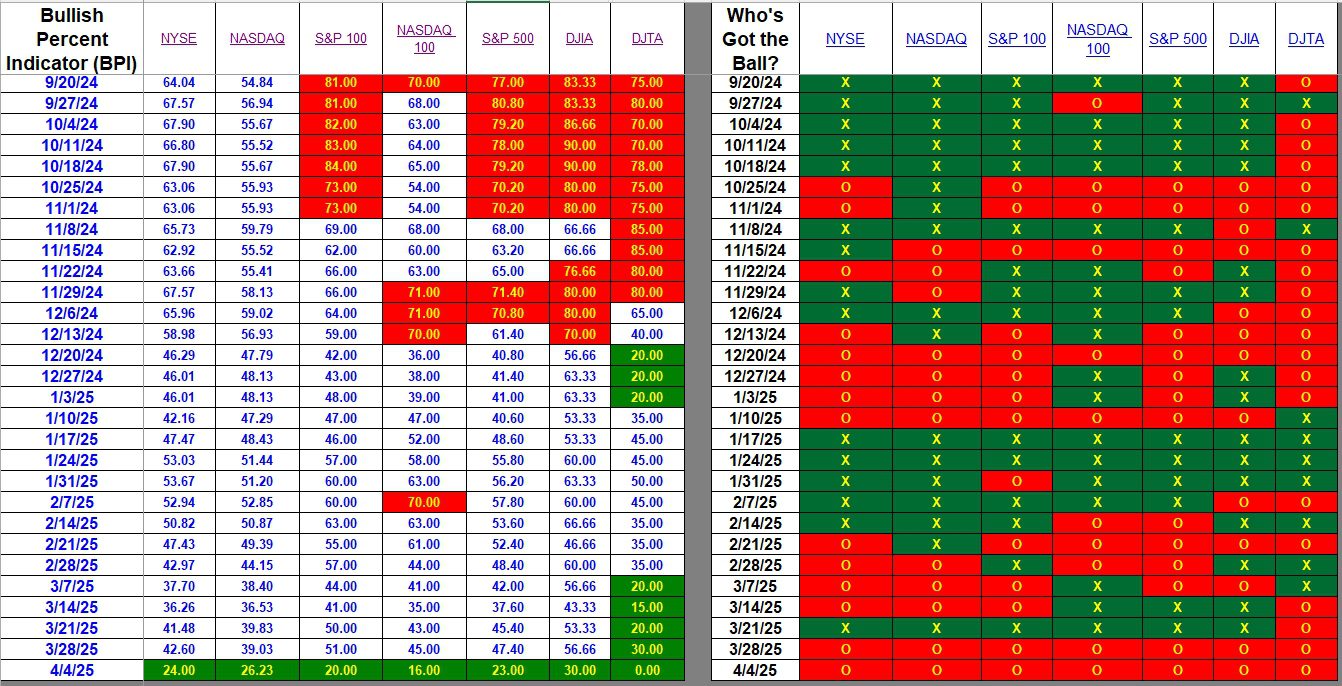

In all the years I’ve been tracking the Bullish Percent Indicators (BPI), as shown below, I never witnessed such a precipitous drop in prices as we experienced the last two trading days this week. No, I was not tracking BPI data in October of 1987. Prior market corrections contained some semblance of rational behavior. This debacle is self-inflicted and defies common sense reasoning.

Where does this leave us as investors? How does one negotiate chaos and uncertainty, something stock markets abhor? This is a real test for the Sector BPI investing model. While the three Sector BPI portfolios are not scheduled for reviews this coming week, I plan to update all as there are Buy signals flashing as readers will see in the following data tables.

Index BPI

All seven major indexes of the U.S. stock market are bearish. I have never seen one hit rock bottom as is the case for the Dow Jones Transportation Average (DJTA). Not one stock contained in this index is bullish. Nor do I recall all seven indexes positioned in the oversold zone at one time.

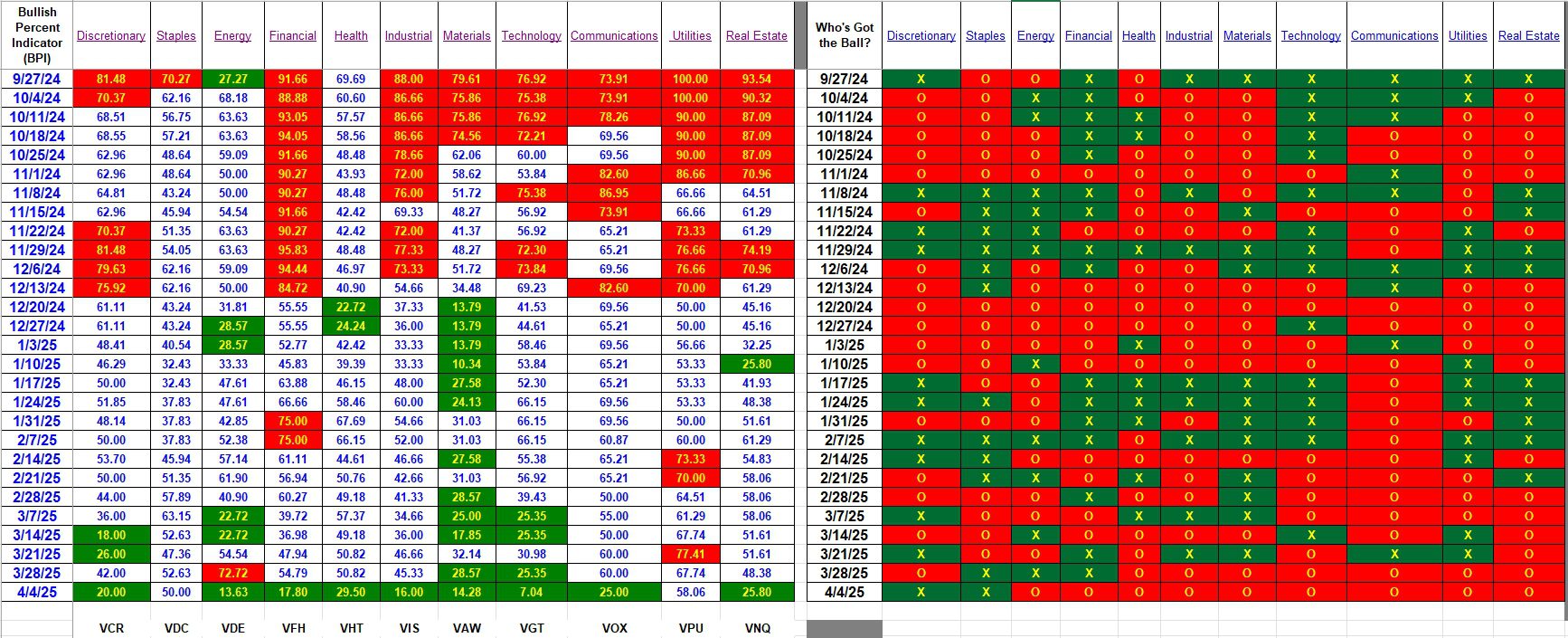

Sector BPI

Now we check the eleven sectors that make up the U.S. equities market. This is where we go for information and guidance for the Sector BPI investing model. Using the Carson Portfolio as an example, the Sector BPI portfolios already hold shares in seven of the eleven sectors.

Three more sectors dropped into the oversold zone this week and they are:

- Financial (VFH)

- Industrial (VIS)

- Communications (VOX)

It is important to separate a sector from the ETF that covers that sector. I use StockCharts to determine whether a sector is Bullish, Bearish, or Neutral. A bearish sector is when the percent of bearish stocks within that sector drop to 30% or below. In the following table, Discretionary is only 20% bullish or well below the 30% threshold. Therefore, Discretionary is considered oversold so we purchase shares of VCR. The percentage to hold is explained elsewhere on this blog.

To populate these three sectors shares of SHV will be sold. If insufficient cash is raised from this sale I will dip into VOO, painful as it may be to sell shares at lower prices. The argument is that sectors, when positioned in the oversold zone, will rise faster then the broad market when recovery arrives.

If you are a new reader and not familiar with the Sector BPI investing model, do a search for Sector BPI and follow the reviews of the Carson, Franklin, and McClintock.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

I am unsure if the Tariff fiasco was a true “Black Swan” or if it should be labeled something else. Here is why. It clearly was predictable. However, the speed, width, and intensity were shocking and not predicted. Given this context, a before and after set of ITA Portfolio Performance spreadsheets might provide some interesting insights.

Thank you for your consistent analysis. – Lee

.

Lowell,

I check StockCharts during the day when things are volatile. I bought VCR back in March. Similarly I sold VDE 4/3 after it had moved above 70%. Yesterday it surprised me and hit <30%, crazy times, never thought I'd be whipsawed using the sector model:^ ) I'm using it a portion of a 3 portfolios so I guess I'm on to buy these new signals Monday.

Bob W.

Lowell, et al,

I’m reluctant to use the BPI approach as a single buy/sell (trailing stops) criteria since we don’t really know how much further the market might go. Didn’t it go down over 50% during the 2007-2009 period? Because we have no idea what the market is going to do, or how far the decline might be, I’m thinking of adding 3/5 or the default 5/8 Heiken-Ashi indicators to the BPI settings as additional criteria for buying any of the sectors.

~jim

Jim,

Yes the market declined ~50% during the financial crisis of 2008. I will likely set several limit orders, each several percentage points below the previous setting. This week will be a very interesting one to watch how the market reacts to the tariffs. Will Trump negotiate his tariff percentages and/or will the FED lower interest rates?

Lowell

Lowell,

Good questions. Personally, I wouldn’t count on the Fed lowering interest rates. That would be a sign of capitulating to the President. Not sure Powell wants to go there. Besides, do you think a .50 or 1.0 percent change in the short-term interest rate is going to be much of a buffer to the extraordinary tariffs, or even a 2% reduction? My hope is that congress might start working together again (naive, I know), and reclaim some of the powers given to the executive branch over the last couple of decades (such as the setting of tariffs).

~jim