Monument Valley

It has been several weeks since I posed BPI data as there were no changes that merited posting static information. This past week it was different as Discretionary, Energy, and Technology all moved into the oversold zone. With the market rebound after the dramatic draw-down, only Energy remains in the oversold zone. This coming week I will go through the five Sector BPI portfolios to see where each stands as some limit orders may still be outstanding.

The five portfolios using the Sector BPI investing model are: Carson, Franklin, Gauss, McClintock, and Millikan. Carson is the oldest so check it out if interested in seeing how the BPI model is performing.

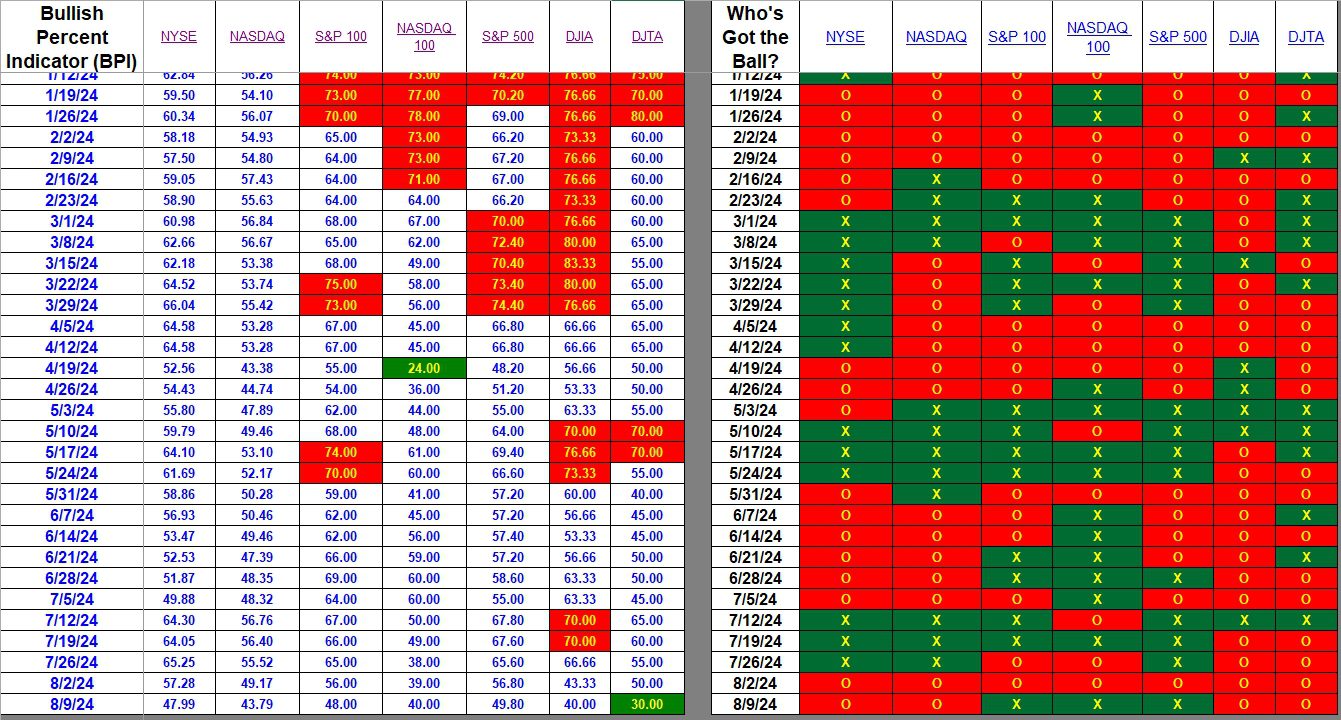

Index BPI

The three indexes that moved from bearish to bullish this week all contain a high percentage of large-cap stocks. Note that the transportation average dropped into the oversold zone. Small- and Mid-Cap stocks are not participating to any significant degree in this market environment. I look to the NYSE for that information as it is a broad index.

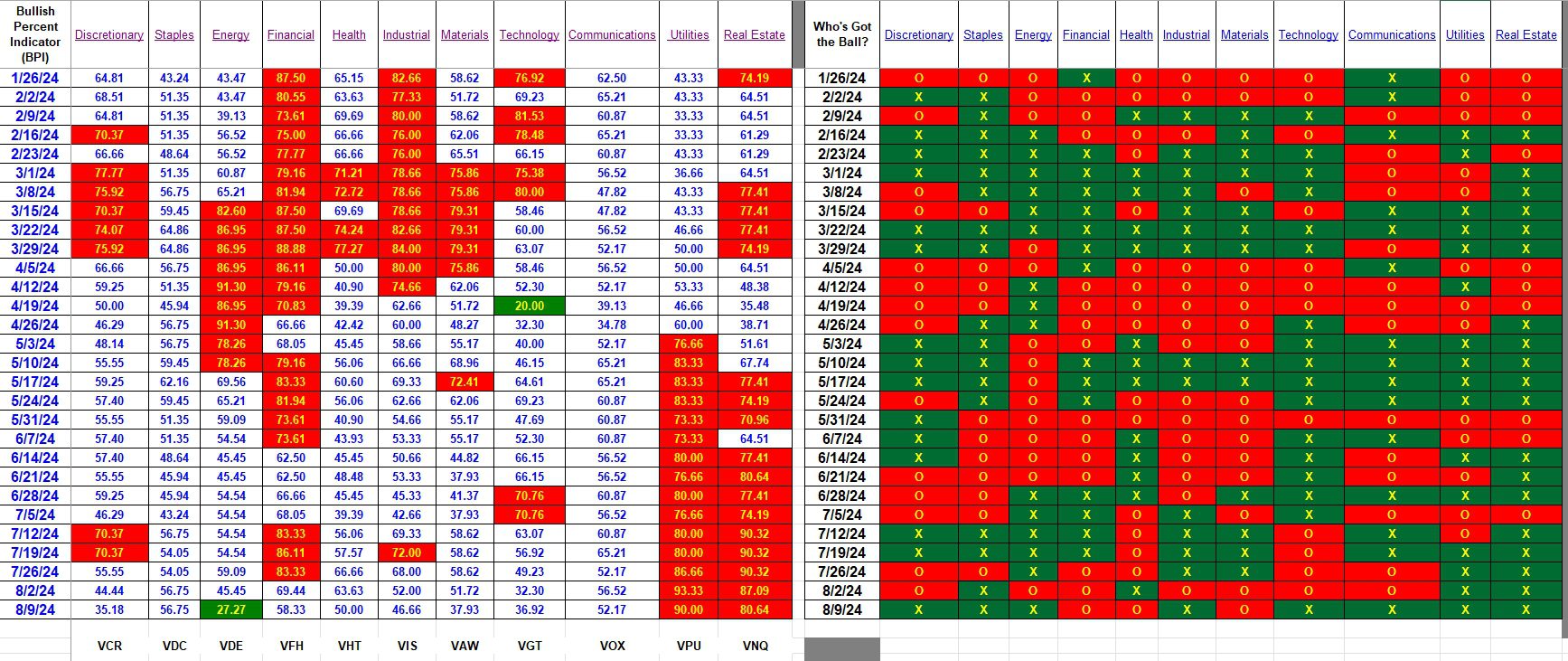

Sector BPI

Energy remains as the sole oversold sector. Discretionary, Materials, and Technology are still hovering close to the oversold zone. Overall, we are in the middle of anything other than a bull market. Investors are waiting for the Federal Reserve to lower interest rates.

When we run out of sectors as investing options we turn to VOO and VTI. The best way to see how I employ VOO and VTI is to track one or more of the Sector BPI portfolios.

In addition to checking in on all five Sector BPI portfolios this week, I will be updating the Bethe and Bohr portfolios. Both are holding large positions in cash as the owners need available cash over the next six months.

Explaining the Hypothesis of the Sector BPI Model

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

I am not posting a new BPI blog (8/16/2024) as no sectors are oversold. Utilities and Real Estate are overbought, but no ITA Sector BPI portfolios hold these sectors.

All indexes and sectors are bullish, something we have not seen for a number of weeks.

Stay the course and no changes are required at this point.

Lowell

Staples (VDC) and Technology (VGT) both moved into the overbought zone this morning so I set TSLOs for both sectors in all five Sector BPI portfolios.

Lowell