Newport Bay Bridge

The oldest Sector BPI portfolio is up for review this morning. Carson is the best test of this unique investing model and there were changes this week as Technology (VGT) hit the 3% limit and was sold out of the portfolio. It was only a short time ago that Technology dipped into the oversold zone and when that happened we purchased shares of VGT as the tech “representative.” I think this is the quickest Buy-Sell turnaround since I’ve been testing the Sector BPI model.

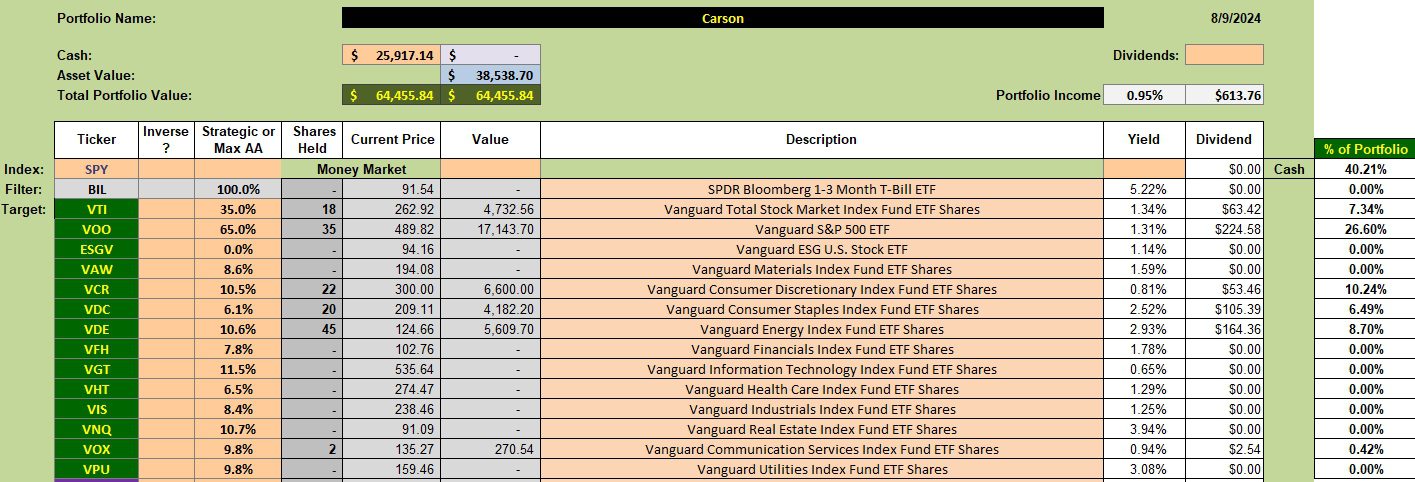

Carson Security Holdings

Below is the investment quiver and current Carson holdings. When sectors are out of favor or no new purchases are recommended and we have available cash, I look to U.S. Equities (VTI and VOO) as two places to put the cash to work. ESGV continues to be a possibility, but I favor VOO as the goal is to outperform the S&P 500 index (SPY).

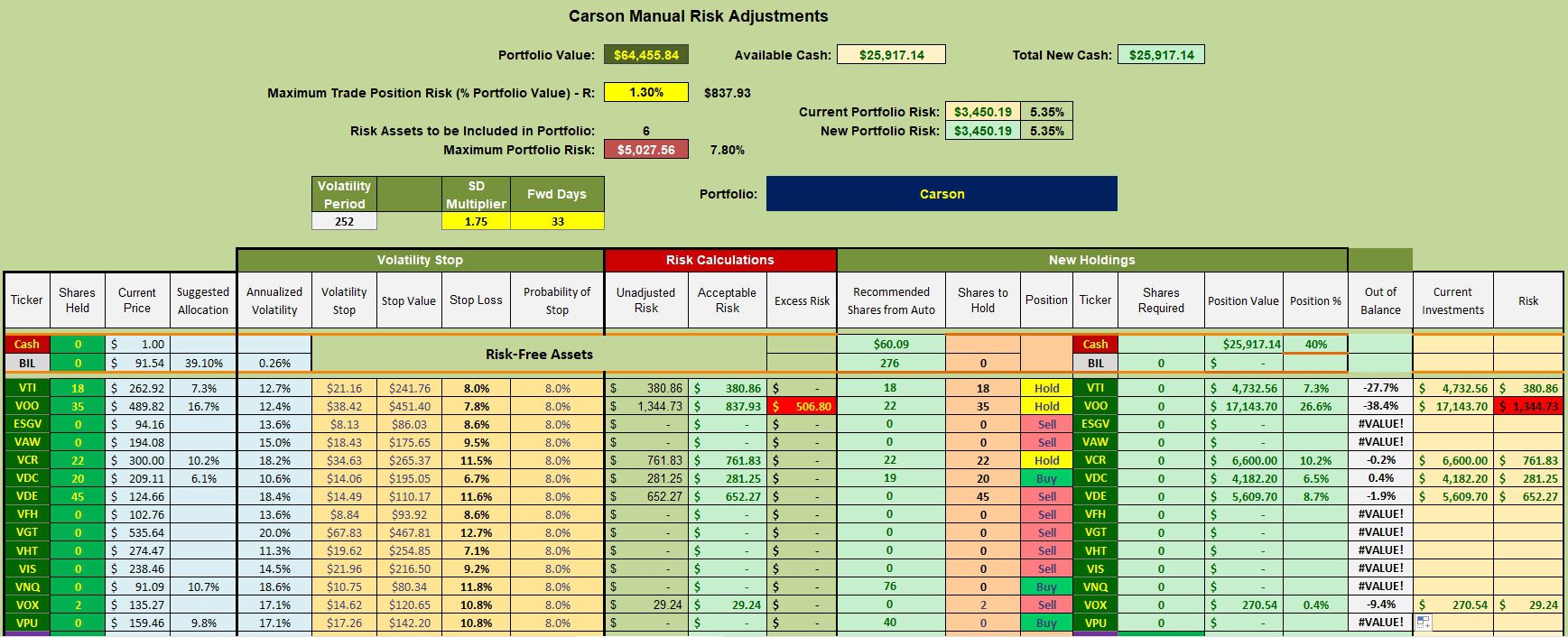

Carson Manual Risk Adjustments

No sectors are in the oversold zone and VTI and VOO are a Hold. Thus we do nothing this month. I have several limit orders in place to add shares of VTI and VOO, but the limit prices are set well below current prices so I don’t expect to see any transactions before the next review.

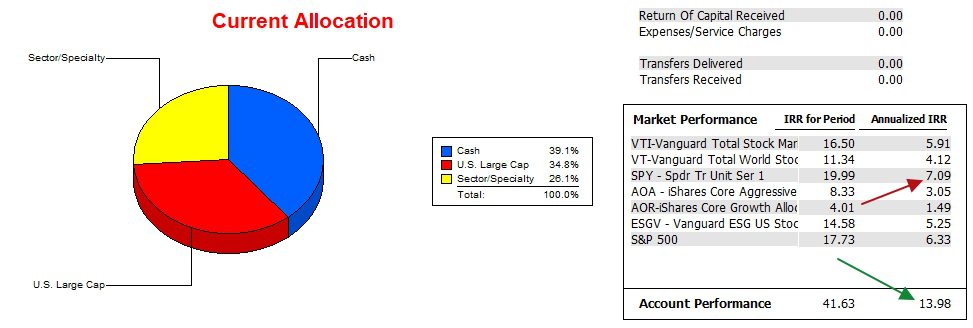

Carson Performance Data

Since 12/31/2021 the Carson has nearly doubled the SPY benchmark on an annualized basis. Over the entire period the results are quite amazing. Much better than I anticipated when I first launched the Carson in May of 2022.

Carson Risk Ratios

Based on the recent data the Carson lost a bit of ground in both the Jensen and Information Ratios. However, the positive values are still quite high and the slope of the Jensen is flat with a very slight positive slope.

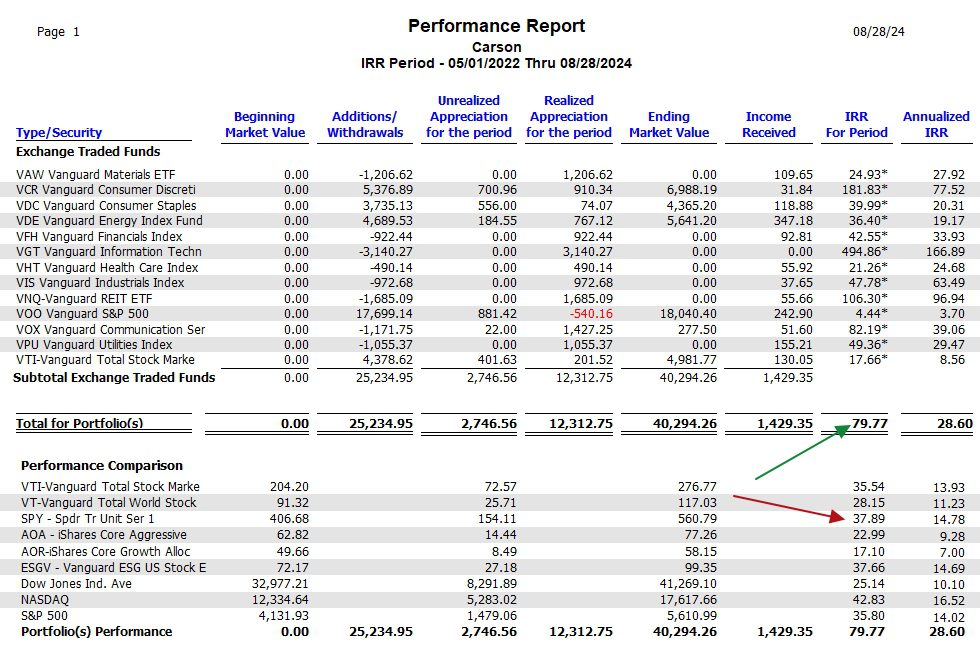

Carson Sector Portfolio Report

Now we come to the Sector Portfolio Report which covers the past 28 months. The Carson performance is more than double the SPY benchmark. Note how significant the performance of VGT has been over this period. VCR and VNQ are also not that shabby.

As we continue to add more history to the Sector BPI model it is looking better and better.

The ITA Wealth Management blog is free to all who register as a Guest. After registering, wait until I have time to elevate you to the Platinum level so all blog entries are available.

Please share this blog site with your family and friends.

Tweaking Sector BPI Plus Investing Model: Part II

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.