I am pushing the Copernicus review ahead of schedule as I want to see what damage or impact Friday’s selloff had on this equity oriented portfolio. Low unemployment numbers and the coming tariffs are roiling the U.S. Equities market. I expect this to continue into next week. Political uncertainty, threats to institutions, and the general lack of leadership is not going to settle the stock and bond markets.

Rather than make predictions I continue to attempt to follow the numbers. Right now the Bullish Percent Indicator percentages are telling us this is an average or fairly valued market. That might change this coming, but we need to wait to see if the market stabilizes.

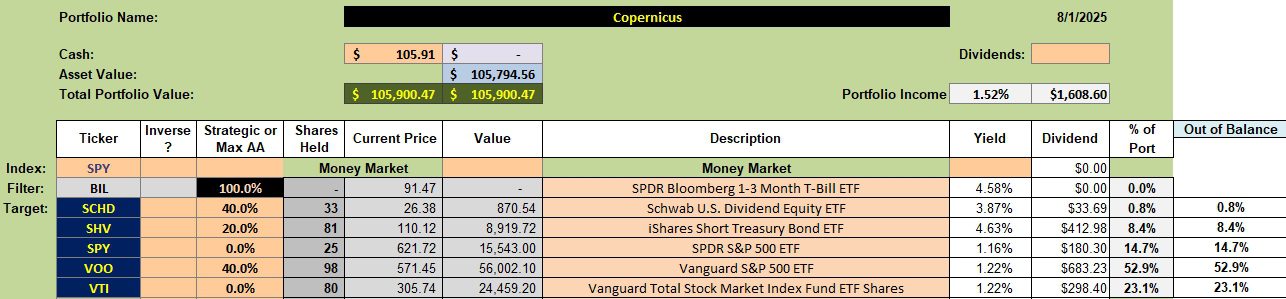

Copernicus Security Holdings

Below are the current holdings for the Copernicus. If the market declines next week I will sell shares of SHV and invest in VOO. Over the last few years the Copernicus has performed very well by adding shares of VOO on market dips.

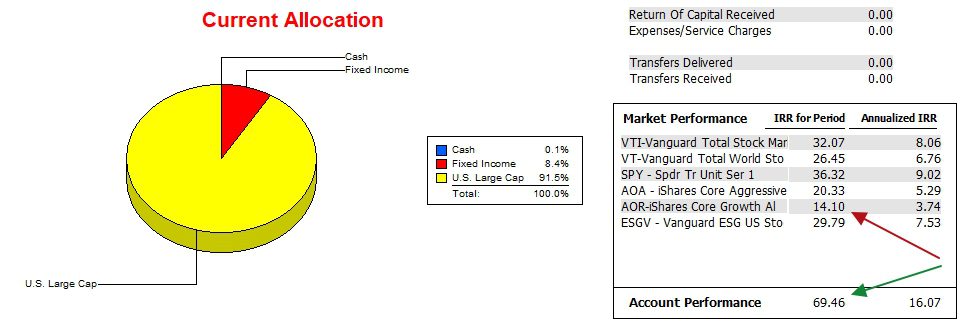

Copernicus Performance Data

Since 12/31/2021 the Copernicus has outperformed all potential benchmarks by a wide margin. This is a classic example of dollar-cost-averaging as many equity shares shares were purchased when the market was in the 2022 dumps.

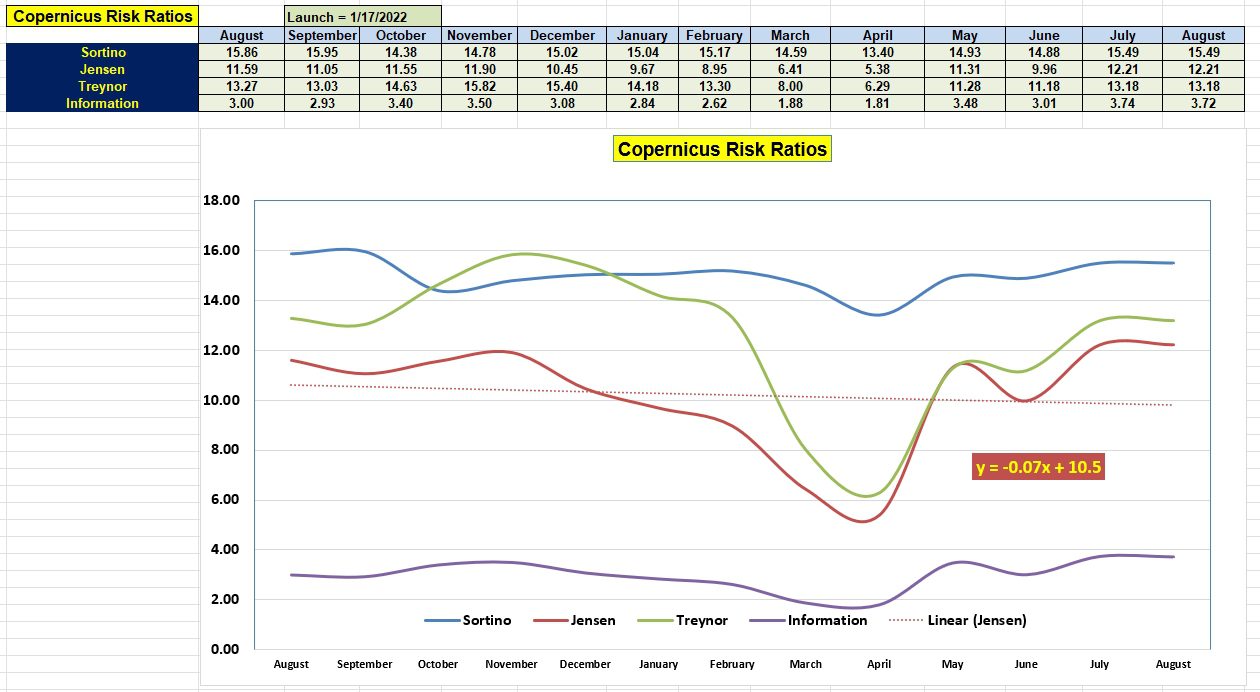

Copernicus Risk Ratios

Pay attention to the July 2025 numbers, not August as one day does not make a trend.

- Sortino Ratio is up from June to July. This indicates the portfolio is more valuable.

- The Jensen Performance Index is up and this is the most important of the four risk measurement.

- The Treynor Ratio is higher, but not all that important.

- The increase in the Information Ratio is quite important as it indicates the Copernicus picked up ground over the benchmark.

In a few months the slope of the Jensen should turn positive.

Comments are always welcome.

Questions To Ask Your Money Manager

Buffett Indicator & Shiller PE Ratio

Copernicus Portfolio Review: 24 February 2025

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

The ITA Wealth Management blog has been free to all readers for well over a year. If you wish to view or read all blog posts, register as a Guest and wait for me to elevate you to the Platinum level. Platinum members (free) can read all blog posts.

Lowell