For those who love Halloween.

This morning I am updating the high risk equity only Copernicus, an investing model designed for young investors or someone who has at least 15 to 20 years of future savings. High risk is defined as investing only in equities (stocks) while shunning bonds and treasuries. Readers would be hard pressed to find a financial advisor willing to put a client into this type of portfolio. While the general consensus within the investment community concludes an all equity portfolio is high risk, there is some self-deception going on. Even basic 60/40 stock/bond ratio portfolios carry significant risk. If one is a doubter, follow the math explained in this Risk Parity calculation.

If you prefer not to carefully walk through the Risk Parity calculation, let me say that based on current volatility values of stocks and bonds one does not receive much draw-down protection by setting up a 60/40 stock/bond portfolio. This is why I favor a 100% equity portfolio for the young investor or someone who can weather several business cycles.

Now let’s examine the Copernicus portfolio.

Copernicus Investment Quiver and Holdings

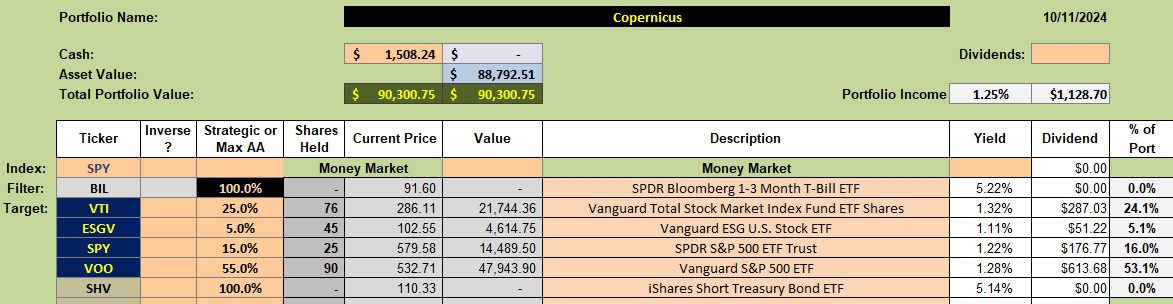

Below is the current makeup of the Copernicus portfolio. There is considerable overlap in the four primary holdings. In other words, stocks found in VOO will also be found in VTI, SPY, and ESGV. If starting this portfolio from scratch I would eliminate SPY as it is nearly identical to VOO. The expense ratio for SPY is three times higher than it is for VOO so holding SPY makes little sense.

VTI includes small- and mid-cap stocks not available in VOO so holding VTI can be justified. ESGV is a socially responsible ETF giving it a special designation for inclusion in the portfolio. Further, ESGV is priced well below any of the other ETFs. If one is running low in cash, purchase a share of two of ESGV so as to run the cash position as close to zero as possible. Keep in mind we want to remain fully invested at all times.

I have limit orders in place to purchase more shares of VOO and ESGV so as to use up the available $1,500 in cash.

Copernicus Performance Data

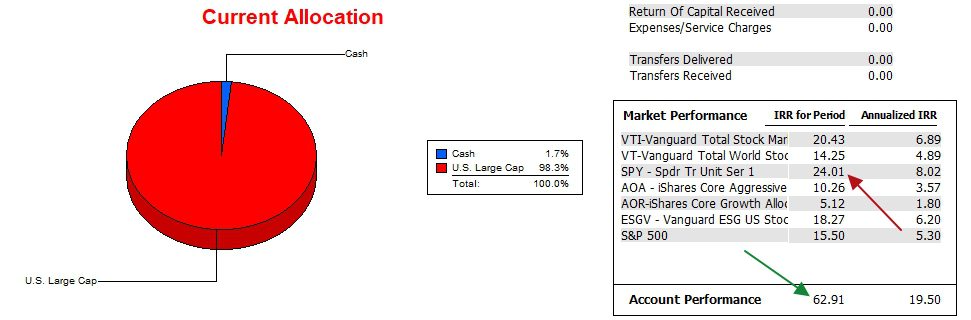

How has the Copernicus performed since 12/31/2021? We are closing in on three years of operation. 2022 was a poor year for stocks followed by a very good year in 2023. Overall, the Copernicus has gained 62.9% while the S&P 500 index gained 15.5% and the SPY ETF moved up by 24%. The right-hand column in the following data shows the annualized Internal Rate of Return (IRR). This data comes from the commercial software program, Investment Account Manager, and all data matches broker data.

The remarkable difference in performance brings up another important point for young investors. The owner of the Copernicus continued to save during good and bad markets. Dollars invested in 2022, a poor year, benefited mightily during the bull market of 2023 and 2024. This is known as dollar-cost-averaging.

Copernicus Risk Ratios

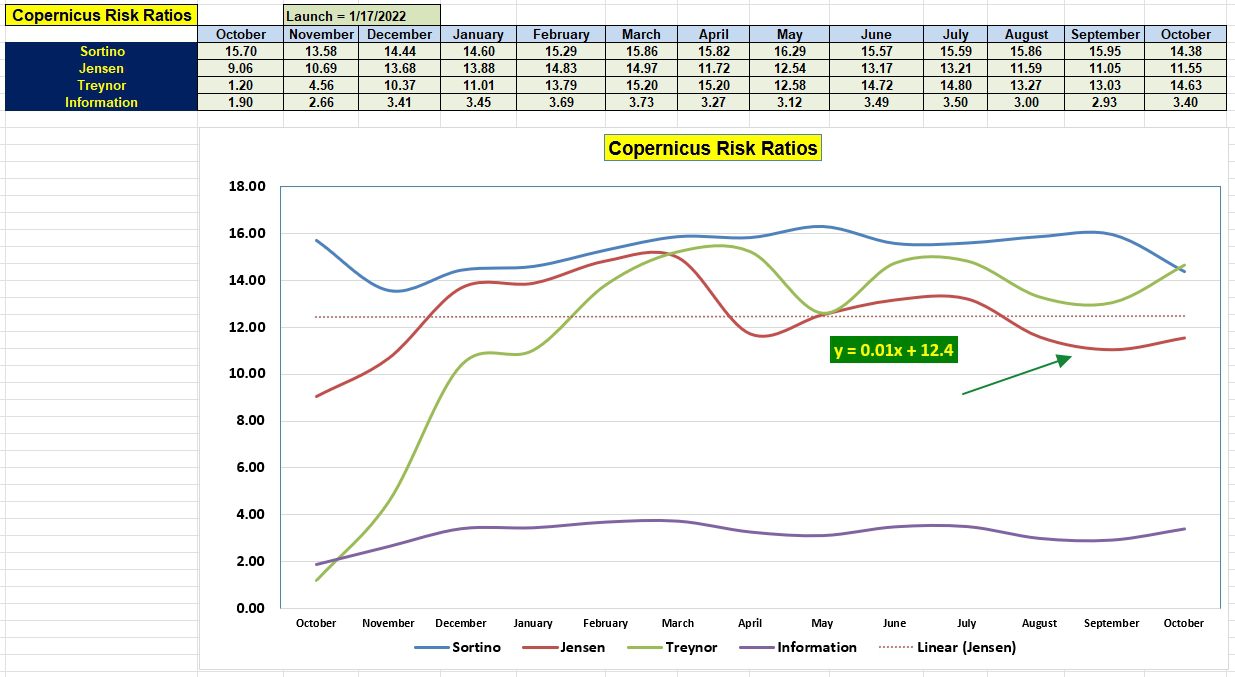

My favorite risk measurements is the Jensen Alpha or Jensen Performance Index. The current Jensen value is running around eleven (11) or extremely high. Check the Jensen Alpha values in this blog post.

The slope of the Jensen is flat as it is most difficult to maintain such a high value. Once more, an all equity portfolio is considered to be high risk, yet when one runs the mathematical calculations, the Copernicus comes out on top.

Share the URL [ https://itawealth.com ] with friends and family if you find this information useful to individuals preparing for retirement.

Returning To Investing Roots: 5 August 2024

Cautionary Note: This blog post is not investment advice, but rather an explanation of what one investor is doing in preparation for retirement.

Capital Protection Comment: While the Copernicus is set up never to sell until assets are needed in retirement, some investors may wish to protect capital. One method is to place an 8% Trailing Stop Loss Order (TSLO) under each holding anytime the market reaches a new high. There are some negatives to this move. If shares are sold when the TSLO is struck it creates a taxable event. That is one problem. A second problem is that the market may quickly rebound leaving one sitting in cash. If one has a number of years to go before retirement and the market dips, invest in more shares or what is known as buying low.

Comments and questions are always welcome. Place them in the Comment section provided with every blog post.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Leave a Comment or Question