Newport Bay Bridge – One of many beautiful bridges on Route 101.

Passive investing is the name of the game with the Copernicus portfolio. The philosophy of the Copernicus is to purchase U.S. Equity ETFs when cash is available and to never sell unless there is an emergency. One major advantage to a no-sell model is that it has definite tax benefits.

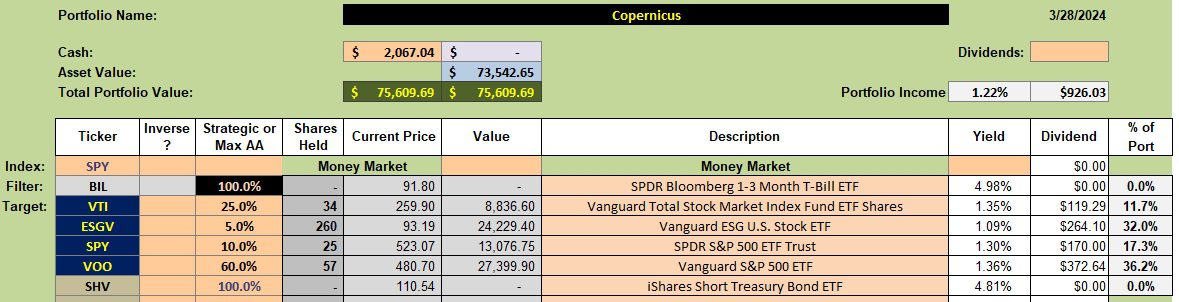

Copernicus Security Holdings

Below is the current investment quiver and holdings for the Copernicus. Were I to launch this portfolio today I would likely confine the investment quiver to VTI and VOO as ESGV and SPY overlap the two Vanguard ETFs.

As the portfolio is currently constructed, ESGV holds 32% and I prefer it be only 5% of the portfolio. If fresh cash is added and as dividends are paid, available cash will be invested in VOO and VTI. It will take time to rebalance the Copernicus without selling shares of ESGV.

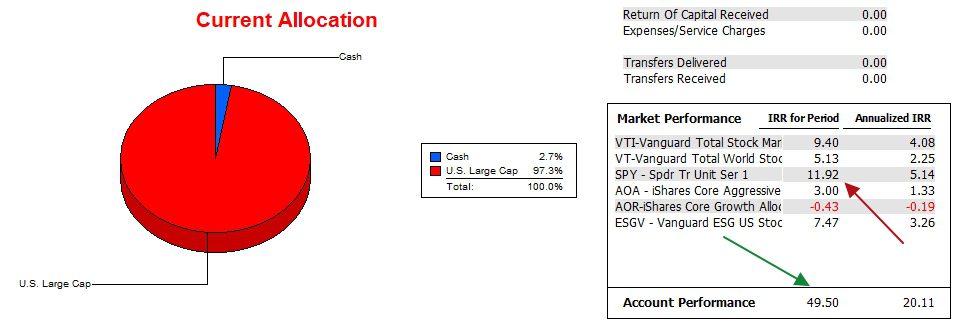

Copernicus Performance Data

Over the past 27 months the Copernicus has outperformed the SPY benchmark by a wide margin. Shares purchased during the weak market in 2022 are now paying off.

When cash is available I place limit orders below the going price and when the market retreats those limit orders are struck. This management method is the primary reason the Copernicus is performing so well compared to the S&P 500 (SPY) benchmark.

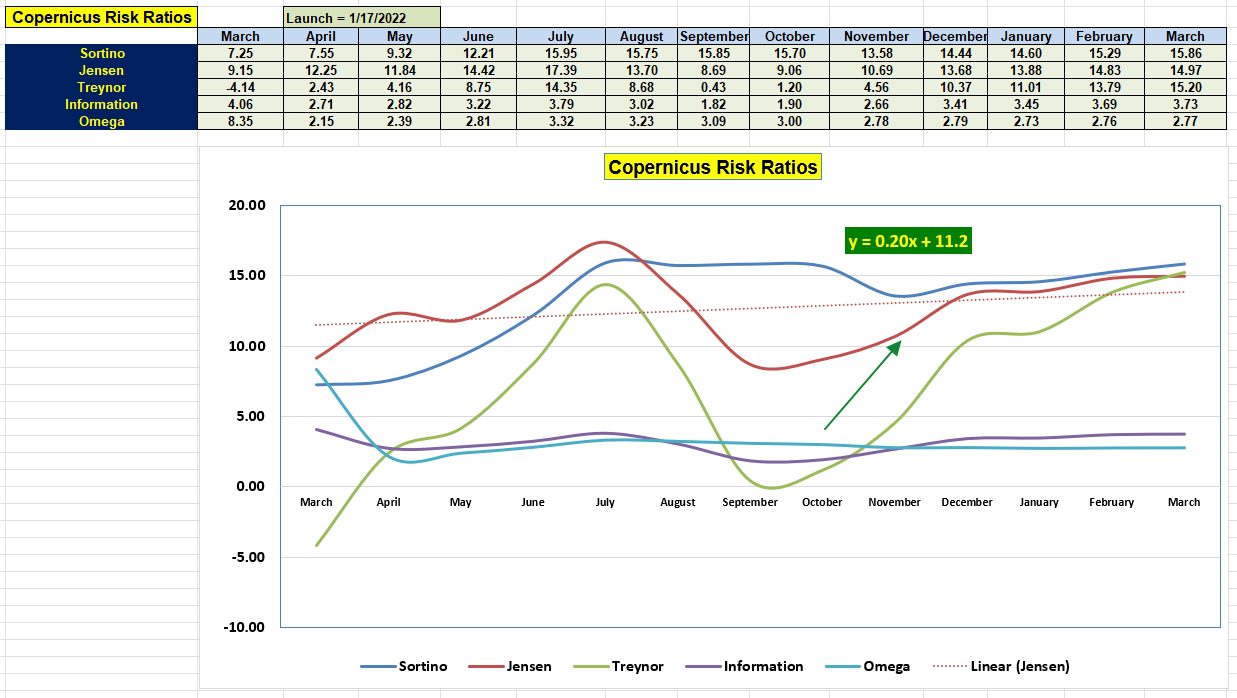

Copernicus Risk Ratios

While the Internal Rate of Return (IRR) is quite high, how is the portfolio performing on a risk adjusted basis? Measuring risk is quite important as this is an equity only portfolio. The general thinking is – if one is not holding bonds or non-equity asset classes a portfolio is very risky.

On a risk adjusted basis the Copernicus improved from February to March as measured by the Jensen Performance Index. While the gain is minor, the slope of the Jensen is positive (0.20) over the past year. Perhaps a total equity portfolio is not as risky as the general opinion would have one believe. If investors following this model are nervous when it comes to holding only equity ETFs, place either stop loss limit orders or Trailing Stop Loss Orders (TSLOs) to preserve capital.

A second positive signal is the improvement in the Information Ratio.

Copernicus Portfolio Review: 29 December 2023

Pass this ITA website link on to your friends and family members.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.