Fat City at Christmas

Next to the Schrodinger the Copernicus is the easiest portfolio to manage as it is an all equity account using VOO and VTI as the primary investment securities. By focusing on equities such as VOO the goal is to keep pace with the S&P 500 index or SPY, the index ETF. Thus far the portfolio is exceeding its goal. By mid-January of 2025 we will have three years of data so we are beginning to see how this investment model works when risk is taken into account.

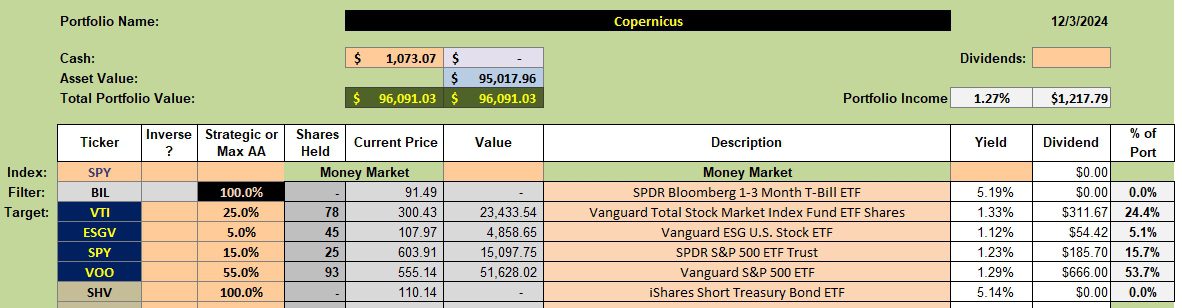

Copernicus Investment Quiver and Holdings

While I am currently using four equity ETFs, if I were to begin again I would limit the securities to VOO and VTI. One reason for including ESGV, other than it is a socially responsible ETF, it is priced significantly lower than either VOO or VTI. As such, when a little cash remains I am able to place an order to pick up a single share of ESGV in order to hold as little cash as possible.

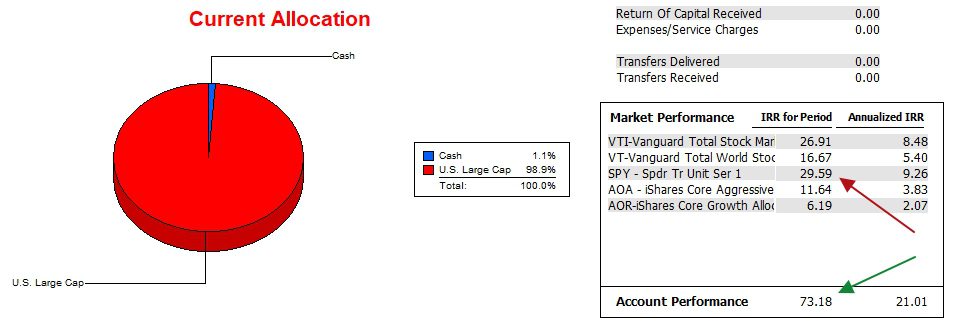

Copernicus Performance Data

Since 12/31/2021 the Copernicus holds a substantial lead over the SPY or S&P 500 index. The arrows point to the IRR for the past three years of performance.

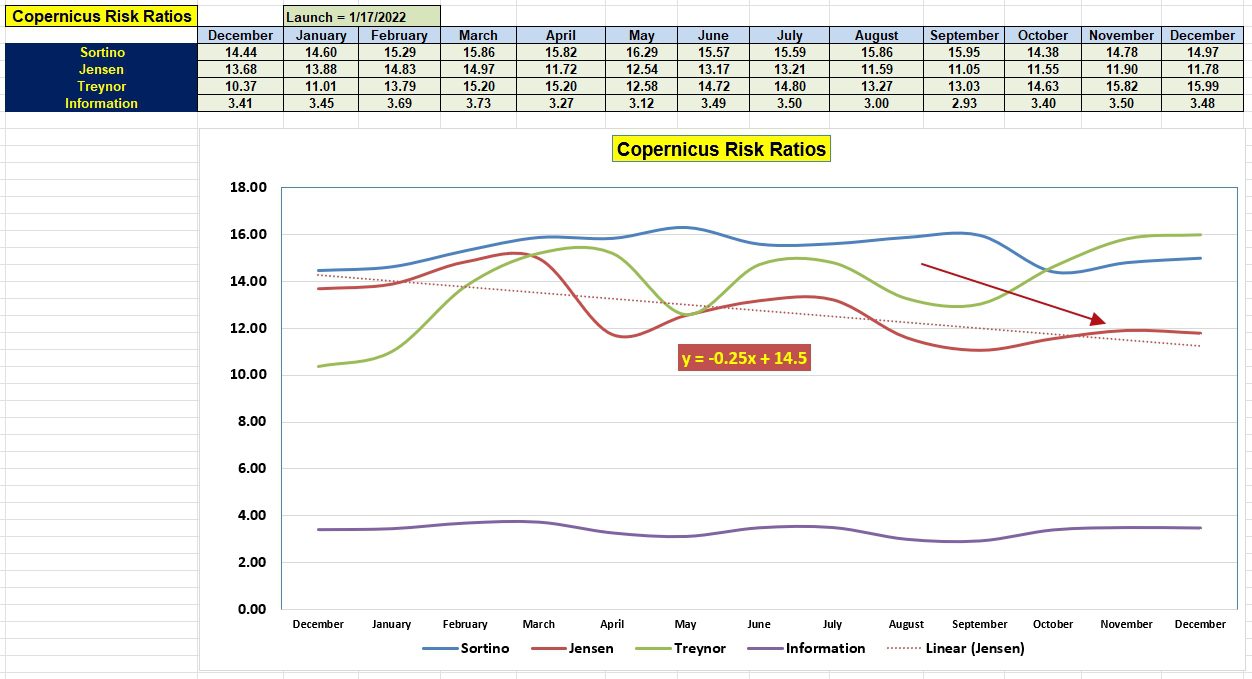

Copernicus Risk Ratios

All risk values are quite high indicating this is a low risk portfolio despite investing heavily in equities. The Copernicus performance is counter to the “accepted” opinion that stocks are quite risky investments.

To fully appreciate how well the Copernicus performs will require this account to survive a deep recession. Thus far I have not used Trailing Stop Loss Orders (TSLOs) with the Copernicus. That reasoning was before all political norms are in jeopardy. As the market continues to hit new highs I may place TSLOs under the ETFs in order to protect capital. While not a huge fan of TSLOs, they are a reasonable way to avoid significant losses. If I use TSLOs I will most likely set them at 8%.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Leave a Comment or Question