Fountain

Copernicus is the portfolio scheduled for review this morning. This is one of the easiest portfolios to update as there is nearly nothing to do other than save and invest in U.S. Equities. The Copernicus is designed for young investors or someone who has at least 10 years of investing ahead. A retiree might use this portfolio if they know they will not need to withdraw funds.

The purpose or philosophy of the Copernicus is to use dollar-cost-averaging and to never sell unless there is an emergency.

We now have approximately 32 months of history with the Copernicus and over this period it has been the top ITA performing portfolio.

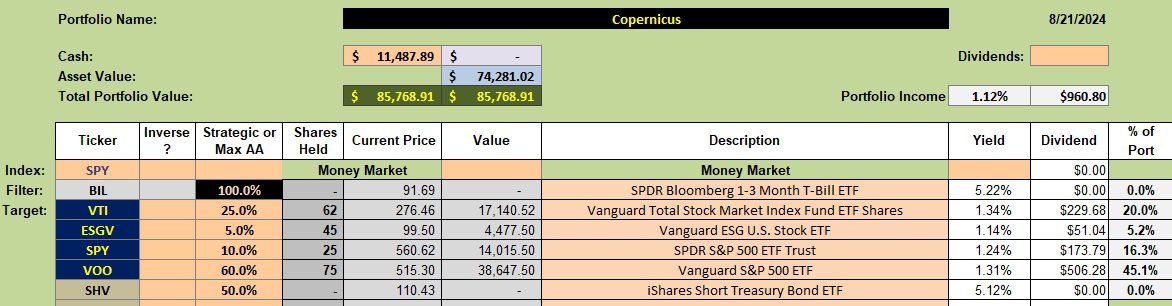

Copernicus Security Holdings

Below are the current holdings for the Copernicus. The portfolio was overloaded with ESGV so I sold off a few hundred shares. That sale accounts for the high level of cash. Limit orders are in place to purchase shares of VOO and VTI. I’m not in a big hurry to pick up more equity shares as these two ETFs are near all-time highs.

If one were to populate the Copernicus with only one ETF I would use VOO. If using two ETFs then add VTI. It is not necessary to use four ETFs as I’ve done with this portfolio. Keep is simple is my advise.

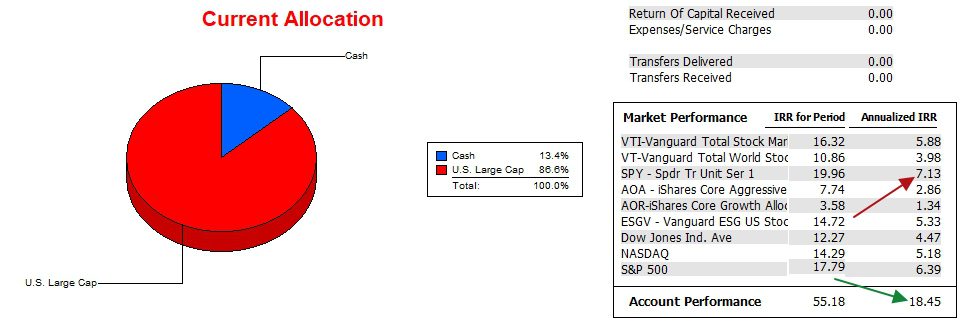

Copernicus Performance Data

Since 12/31/2021 the Copernicus has more than doubled the return of the SPY benchmark. Many shares were purchased during the poor market of 2022 and now those shares are close to all-time highs.

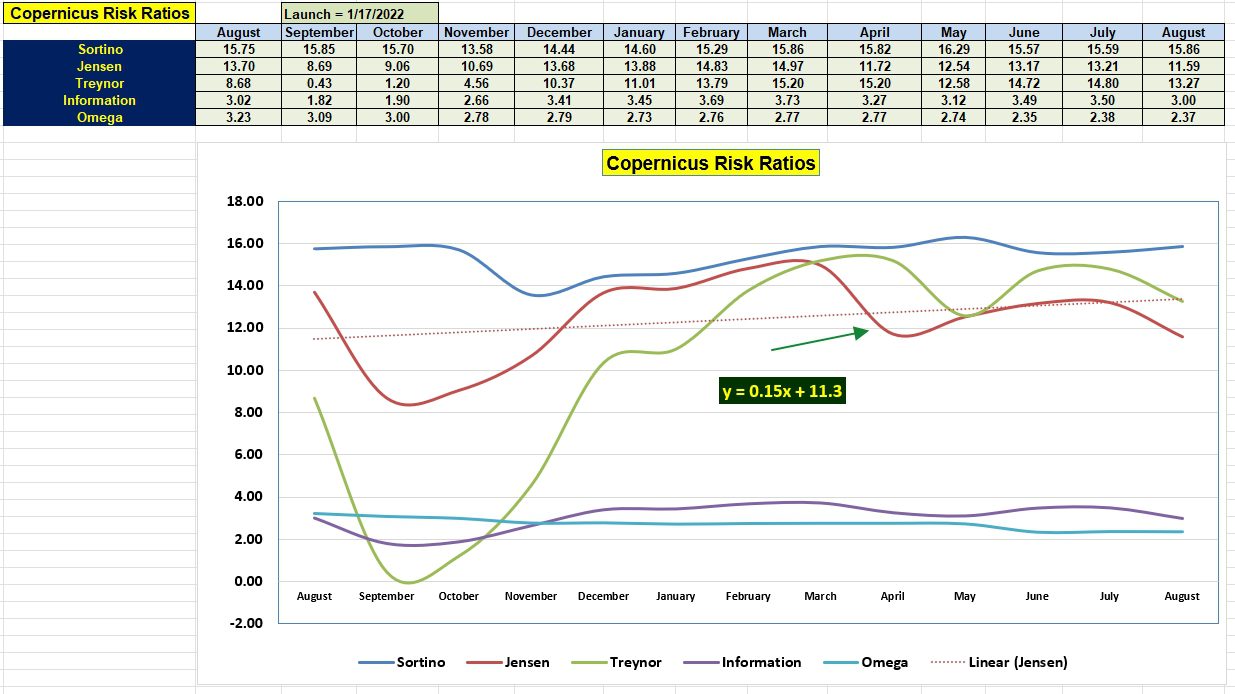

Copernicus Risk Ratios

All risk values are very high and the slope of the Jensen (0.15) is a respectable number.

Next to the Schrodinger the Copernicus is the easiest to manage and the returns are spectacular. Concentrating on the S&P 500 and dollar-cost-averaging is a winning combination.

Returning To Investing Roots: 5 August 2024

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.