Christmas (2022) in Christchurch, New Zealand

The Darwin Portfolio is a portfolio that I try not to adjust too often and it has been 3 months since I last posted a review of this portfolio so it’s time to take a look at how it has been performing in that time period.

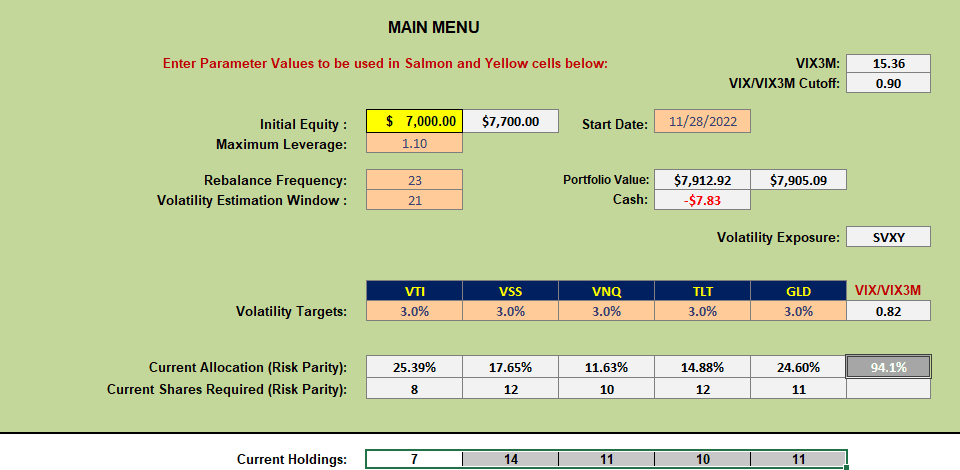

The Darwin Portfolio uses an “All-Weather” approach and remains invested in all assets in the portfolio quiver at all times – although the allocations may vary from time to time depending on the volatility of the assets. The portfolio uses a “risk parity” approach to control portfolio volatility within acceptable limits. The limits used for the Darwin portfolio are 3% volatility per asset as shown in the following screenshot:

with only 5 assets in the quiver the maximum portfolio volatility could conceivably reach 15%. However, due to the added benefit of diversity between asset classes the realized volatility is likely to be much less – more like ~8%. I also allow up to 10% leverage in this (taxable) account and add more diversity through the inclusion of a ~10% allocation to a volatility ETF (SVXY).

with only 5 assets in the quiver the maximum portfolio volatility could conceivably reach 15%. However, due to the added benefit of diversity between asset classes the realized volatility is likely to be much less – more like ~8%. I also allow up to 10% leverage in this (taxable) account and add more diversity through the inclusion of a ~10% allocation to a volatility ETF (SVXY).

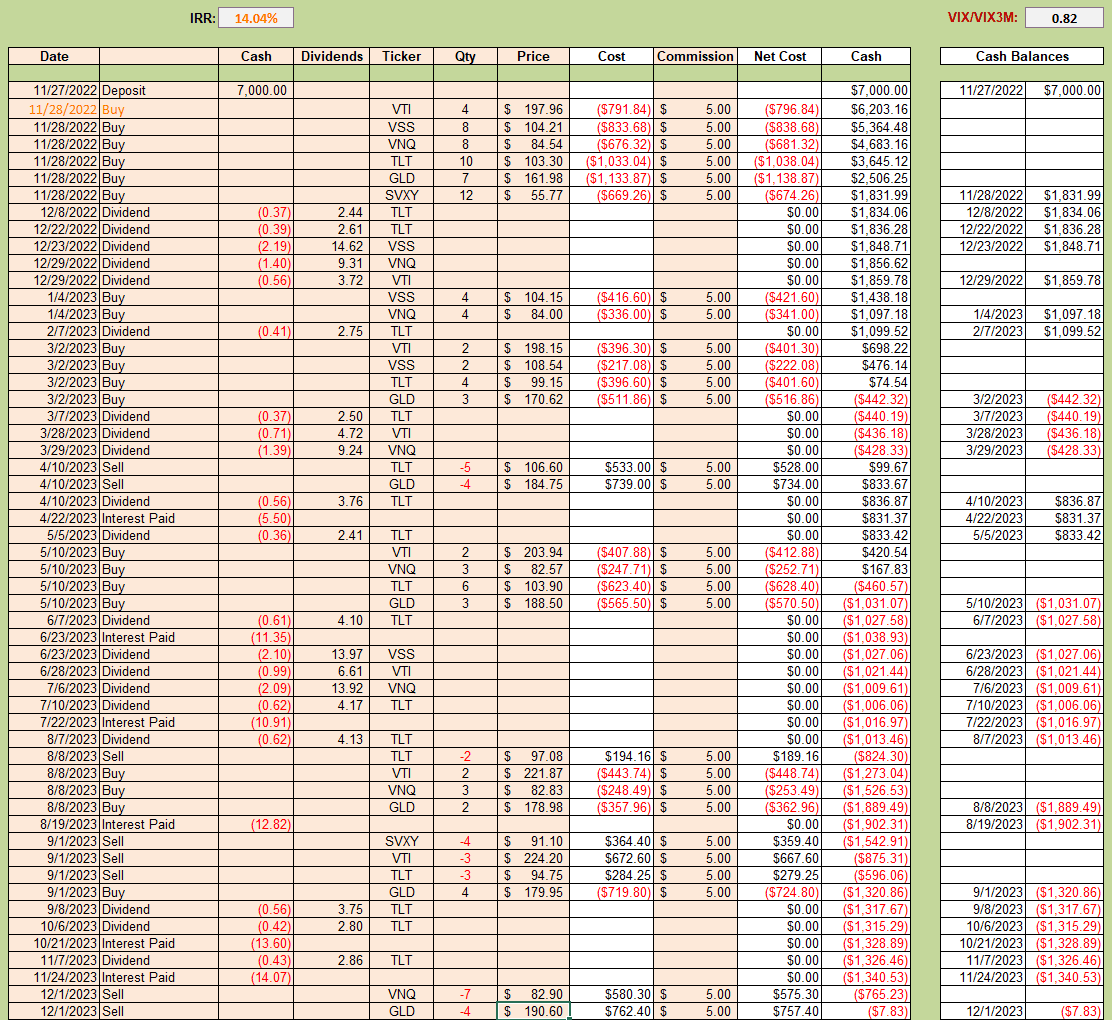

Siince the last adjustments in September I have not made any changes until Friday when I sold shares in VNQ and GLD to bring things back to close to recommended holdings and to eliminate the leverage that I had in place:

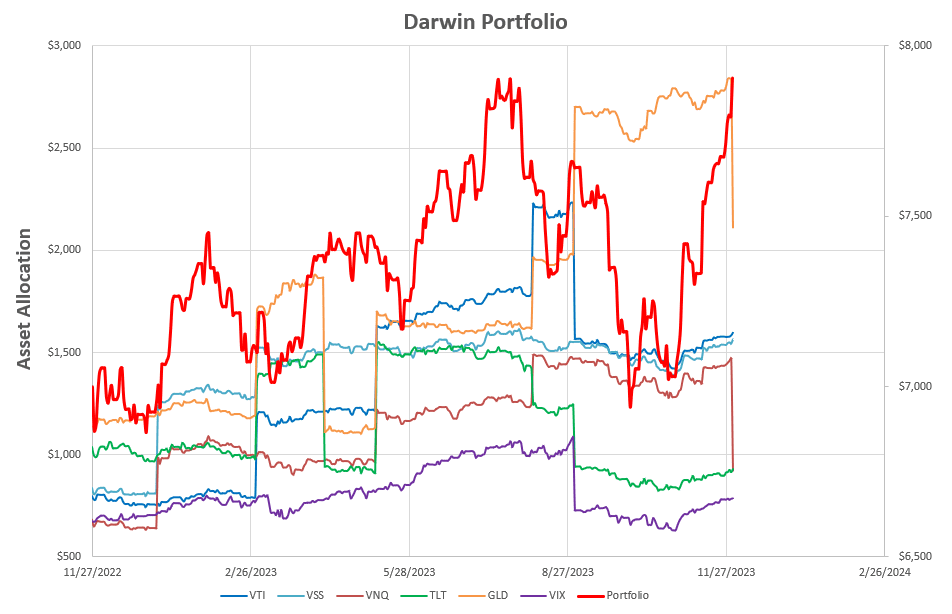

As we can see in the above screenshot, the Internal Rate of Return (IRR) on this portfolio is ~14% since inception ~12 months ago. This is acceptable for a diversified portfolio designed for low volatility – although the performance graphs do look a little hectic/volatile:

As we can see in the above screenshot, the Internal Rate of Return (IRR) on this portfolio is ~14% since inception ~12 months ago. This is acceptable for a diversified portfolio designed for low volatility – although the performance graphs do look a little hectic/volatile:

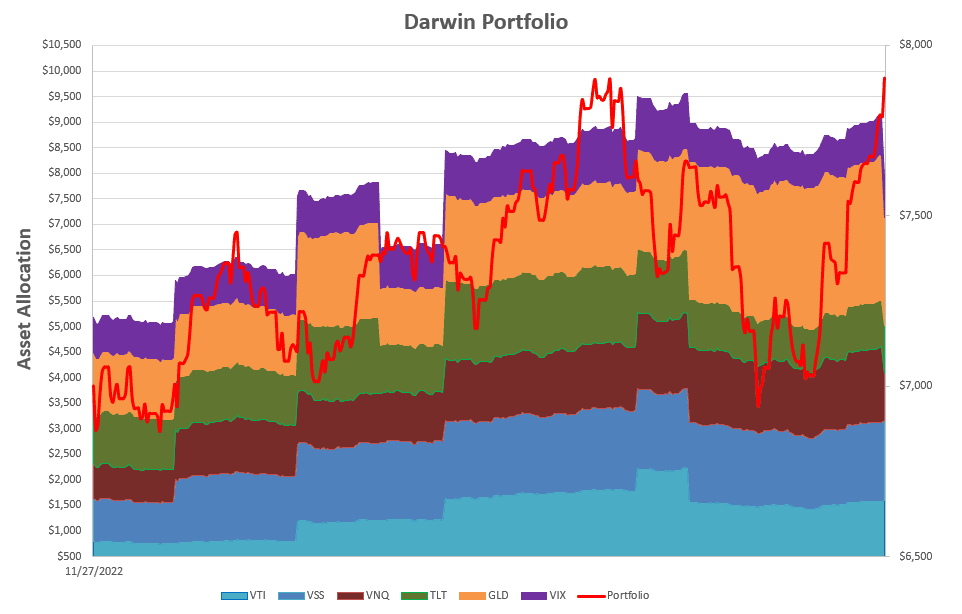

or, in stacked format:

or, in stacked format:

The red lines reflect the total portfolio performance and the discontinuities in the other lines/plots reflect the adjustments/changes in allocations between the asset classes. As can be seen from the above plots, Gold (GLD) has been a significant contributor to performance over the past 3 months.

The red lines reflect the total portfolio performance and the discontinuities in the other lines/plots reflect the adjustments/changes in allocations between the asset classes. As can be seen from the above plots, Gold (GLD) has been a significant contributor to performance over the past 3 months.

I will likely leave this portfolio for another 3 months unless there are significant changes in market behavior in any of the asset classes represented.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.