Total Eclipse 3:20 PM 8 April 2024 **

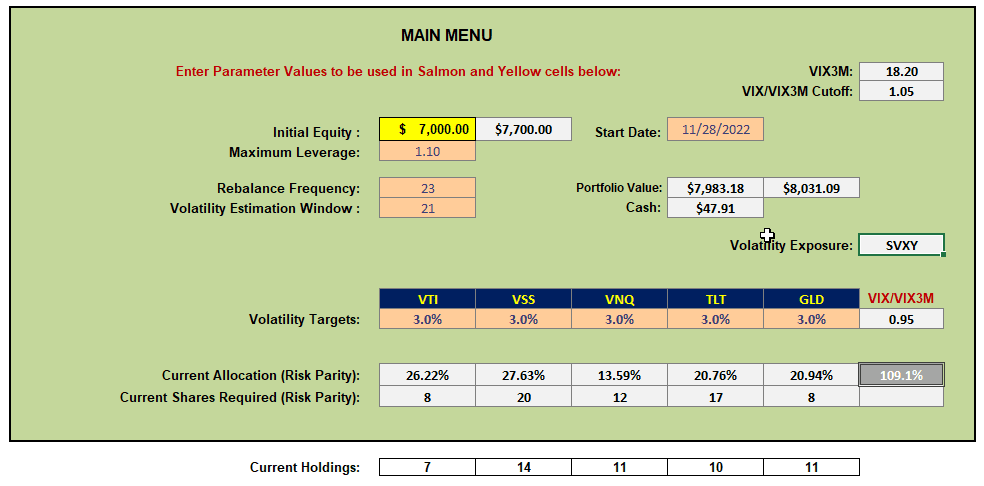

The Darwin Portfolio is an “All-Weather” portfolio of five ETFs representing the major asset classes of US Equities (VTI), International Equities (VSS), US Real Estate (VNQ), US Treasuries (TLT) and Gold (GLD). For additional diversity a 10% allocation is ascribed to an ETF that tracks volatility (usually the inverse SVXY ETF). Adjustments to this portfolio are infrequent and are determined by risk parity between the holdings. At present the actual holdings and recommended holdings look like this:

VSS, TLT and GLD are presently a little out-of-balance so, although against my native instincts (that are often wrong), I will make adjustments to these holdings to bring them back more into (risk parity) balance. In addition, as I mentioned last month, I am anticipating that volatility may increase as we approach elections in November. I have been watching the recommendations generated by my volatility algorithm – and it has been flipping between short and long volatility for over a month. At present it is still suggesting a short position (holding the inverse ETF) but volatility has been creeping up and I think that I am going to move to Cash here until after the election – it is difficult to succesfully hold a long position in volatility over a long period of time – and timing entry/exits is even more difficult unless watching it very closely.

VSS, TLT and GLD are presently a little out-of-balance so, although against my native instincts (that are often wrong), I will make adjustments to these holdings to bring them back more into (risk parity) balance. In addition, as I mentioned last month, I am anticipating that volatility may increase as we approach elections in November. I have been watching the recommendations generated by my volatility algorithm – and it has been flipping between short and long volatility for over a month. At present it is still suggesting a short position (holding the inverse ETF) but volatility has been creeping up and I think that I am going to move to Cash here until after the election – it is difficult to succesfully hold a long position in volatility over a long period of time – and timing entry/exits is even more difficult unless watching it very closely.

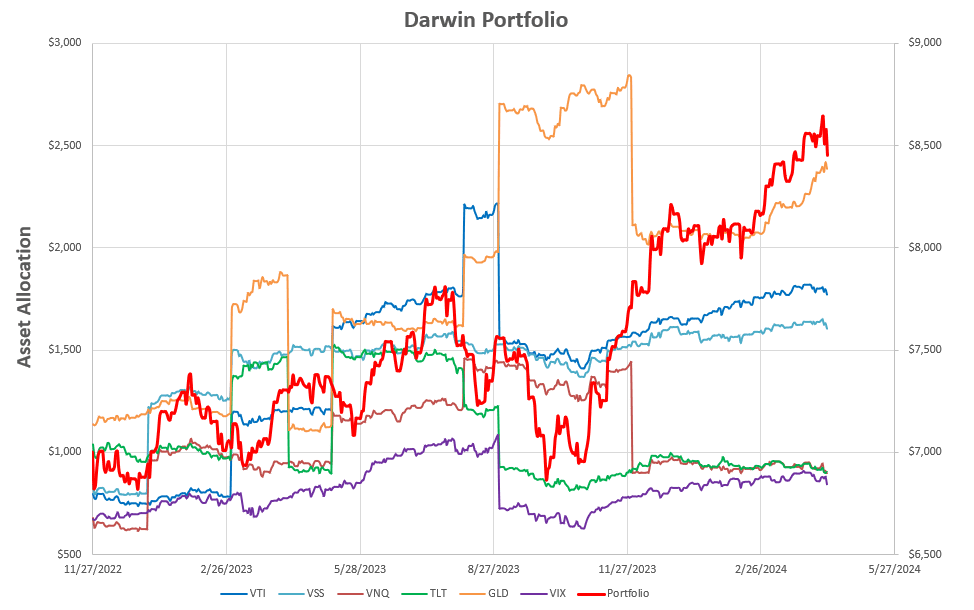

Performance of the Darwin Portfolio to date looks like this:

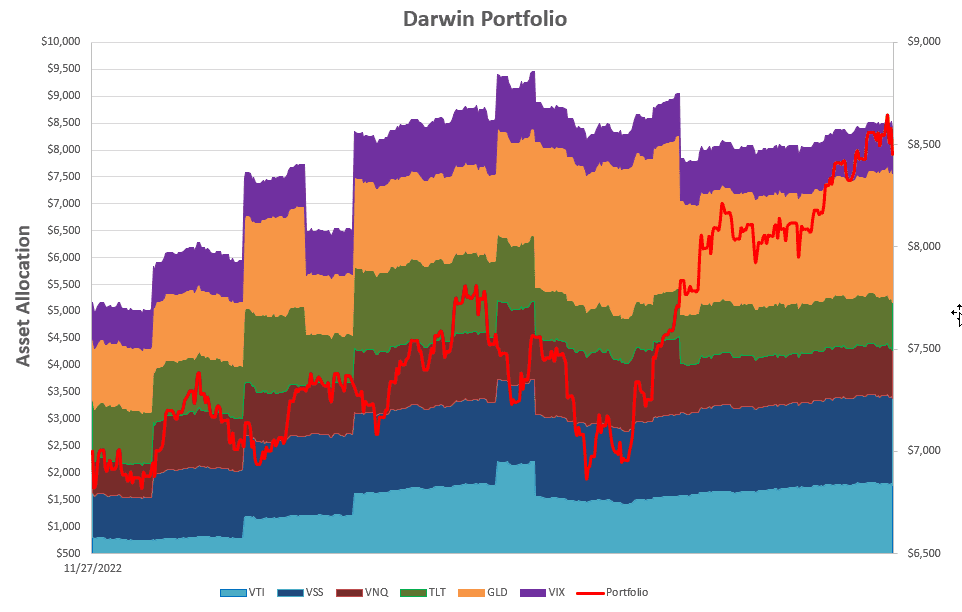

or, in stacked format:

or, in stacked format:

The portfolio is showing a respectable 15.82% annualized Internal Rate of Return (IRR) over this period.

The portfolio is showing a respectable 15.82% annualized Internal Rate of Return (IRR) over this period.

I will post my adjustments in the Comment section when I have made them next week.

** It was a very cloudy day in the Niagara Area and we got a ~10 sec clear view window of the total eclipse at ~3:18 – but I was slow with the camera and missed it. This image is a little late but was the best that I could get.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

The photo looks like a galaxy with all the colorful clouds. Good shot.

The following adjustments were made to the Darwin Portfolio this morning:

GLD -3 $216.00

SVXY -16 $ 53.28

VSS +6 $114.60

TLT +7 $ 88.98

David