Iris

Franklin is the Sector BPI portfolio I’m examining today. Before progressing further I need to warn readers that Yahoo once again fiddled with their downloading codes so the Kipling data is not current. In fact it is a week old. This problem poses a question of what to do if the Kipling were to fail completely? Here is my backup plan.

- Concentrate on the Buy & Hold model. Invest heavily in the portfolio modeled by the Copernicus. It is difficult to outperform the S&P 500 so this is an excellent off ramp were the Kipling to become useless.

- Continue to invest in a computer managed Robo Advisor portfolio such as the Schrodinger. Once the Schrodinger reaches $50,000, I will recommend to the owner they request Schwab “tax manage” the portfolio. The hope is the Schrodinger will reach the $50,000 level within a few months. Keep an eye out for an update next week.

- The third option is to use the Sector BPI model and for the Plus addition, invest only in SPY, VOO, VTI, or ESGV when excess cash is available.

The Kipling spreadsheet is not needed for any of the above three investing models and all three models are close to the top when Return and Risk are calculated.

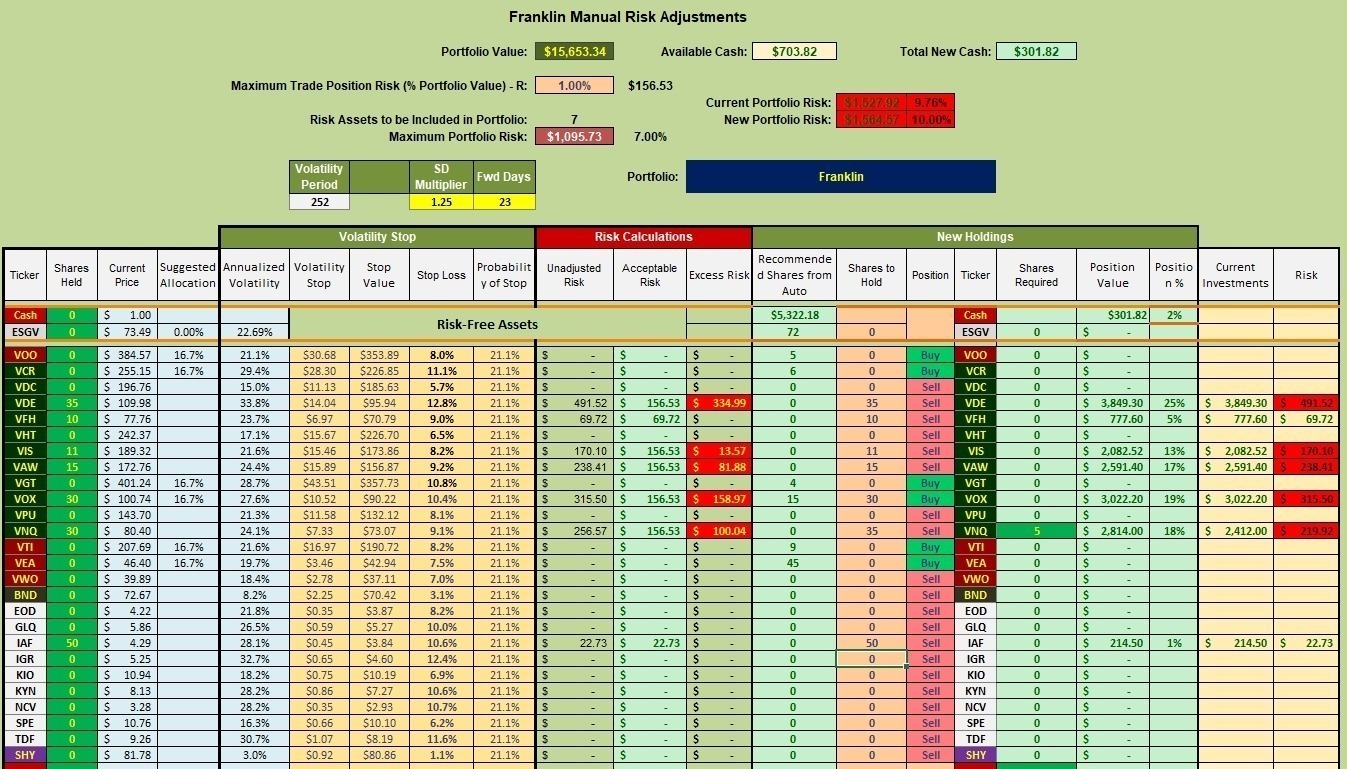

Franklin Security Recommendations

Based on BPI data publish earlier this morning, Real Estate and Energy are the two recommended sectors. The Franklin currently holds a full complement of VDE (25%) so nothing more needs to be done. As for Real Estate we need a few more shares to bring it up to the recommended 17.9%. Five more shares of VNQ will do it so I need to remember to place an order to purchase five (5) shares of VNQ when the market opens next Tuesday.

This leaves a small amount in the money market unless the owner adds more cash to the Franklin. Were sufficient cash available I would purchase a few shares of SPY.

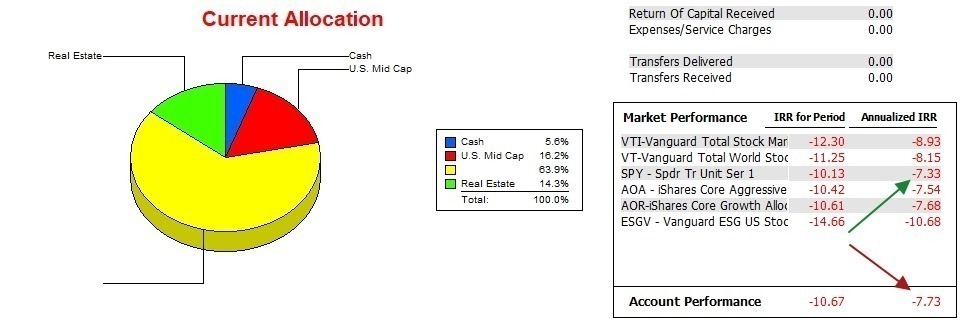

Franklin Performance Data

Over the past 17 months the Franklin is running slightly behind SPY, but ahead of both VTI and ESGV.

Franklin Risk Ratios

Over the past year the Jensen Alpha has shown improvement. With the SPY benchmark and the Franklin running nose to nose, the Information Ratio is zero (0).

The next seven months or until the end of 2023 will be critical for the Franklin as this portfolio is still in the “hypothesis” stage of testing. We have not been through enough Buy-Sell cycles to know if the Sector BPI is a useful investing model. Continue to check the performance of the Sector BPI portfolios with the Copernicus and Schrodinger. Those two are among the favorites here at ITA.

Buying Guidelines For BPI Model Portfolios: 9 December 2022

Tweaking Sector BPI Plus Model: 20 May 2023

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

The Yahoo business must drive U nuts. Hard enough without……. No comment is necessary. John