Nativity scene in a wagon

Gauss is the portfolio up for review this morning and it is undergoing a few asset allocation adjustments. Gauss is one of the better performing portfolios, due in part to no withdrawals since inception a number of years ago. In addition to no withdrawals new cash is added from time to time. This method of dollar-cost-averaging is one of the best ways to build a retirement portfolio.

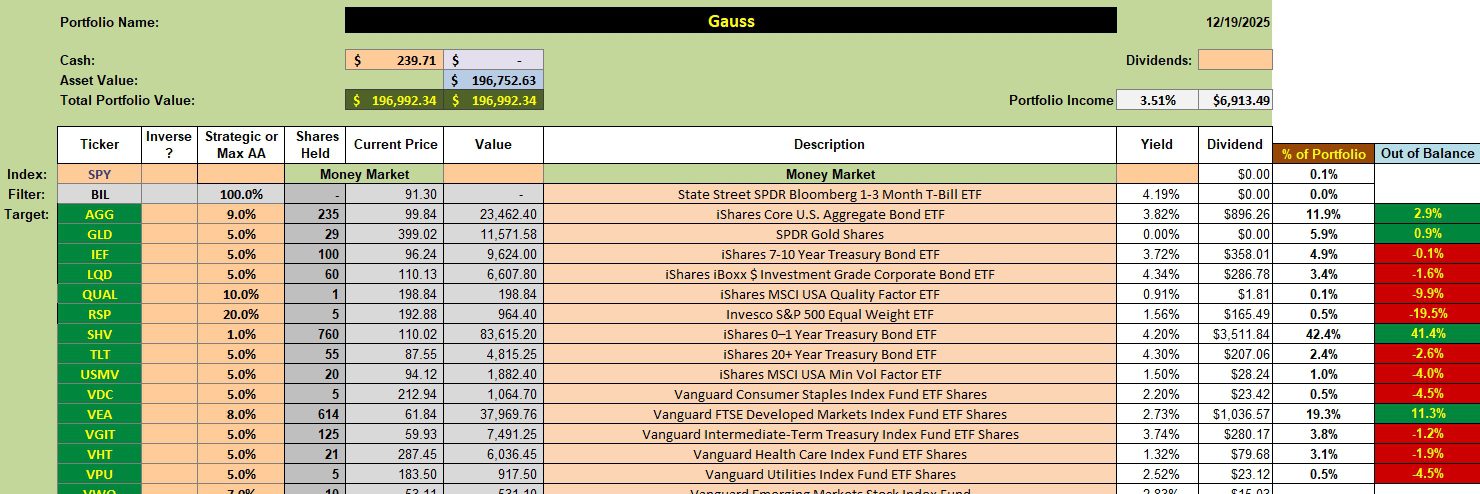

Gauss Asset Allocation Holdings

Below are the current holdings for the Gauss. I made an error of purchasing too many shares of VEA and that asset class will be reduced by the next review in January. Note that VOO is not part of the Gauss. Instead I will begin to build up shares of RSP, the equal-weight ETF designed to mirror the S&P 500. This move from VOO to RSP reduces exposure to the seven to ten mega-cap stocks that continue to dominate U.S. Equities.

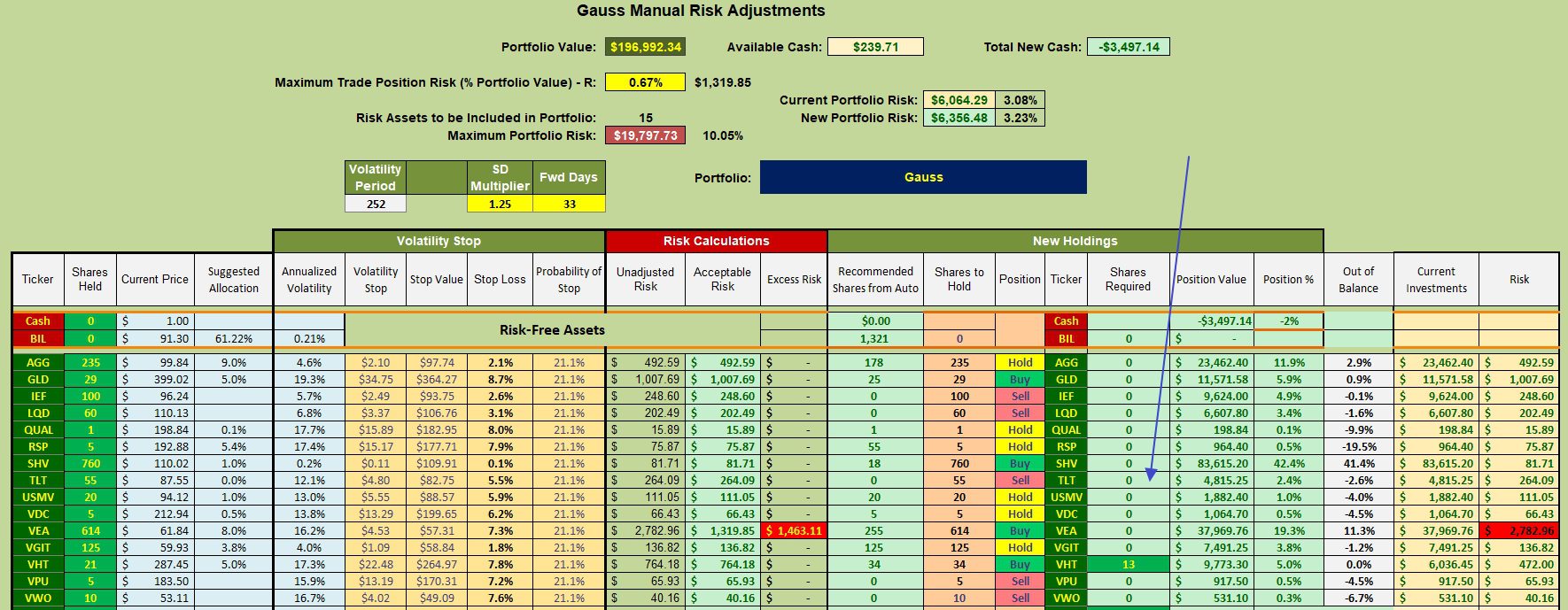

Gauss Rebalancing Recommendations

Below are the recommendations to bring the Gauss into balance based on the Manual Risk Adjustments worksheet. As mentioned above, VEA is far outside the target recommendations to the upside so I will sell shares and use the cash to bring GLD and VHT into balance. If there is still cash available I will increase shares of RSL and QUAL.

Going forward in 2026 I intend to use dividends to keep asset classes with a Buy recommendation in balance and let the other asset classes run. One goal is to not sell any shares out of asset classes other than SHV, and only use SHV when cash is required.

With all the bond and treasury holdings the Gauss will throw off dividends in excess of 3.0%. Cash from dividends will keep the various asset classes in balance.

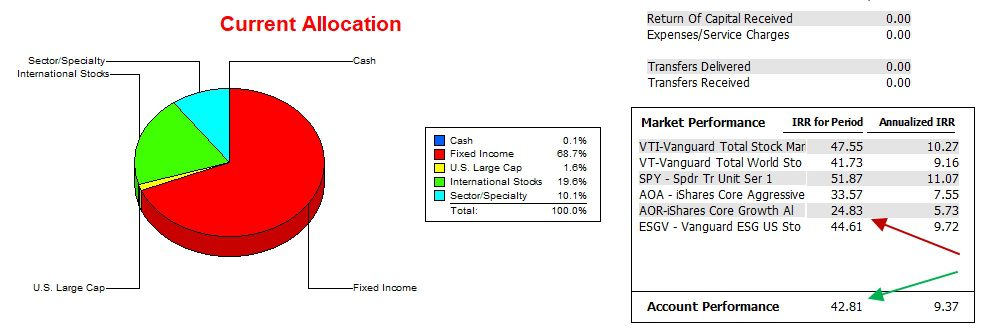

Gauss Performance Data

Since 12/31/2021 the Gauss has far outperformed the AOR benchmark. Based on the current asset allocation model it will be most difficult to keep pace with the stock market if it continues to rise. Since I expect to see a correction sometime in 2026 the Gauss is well positioned to take advantage of such a correction.

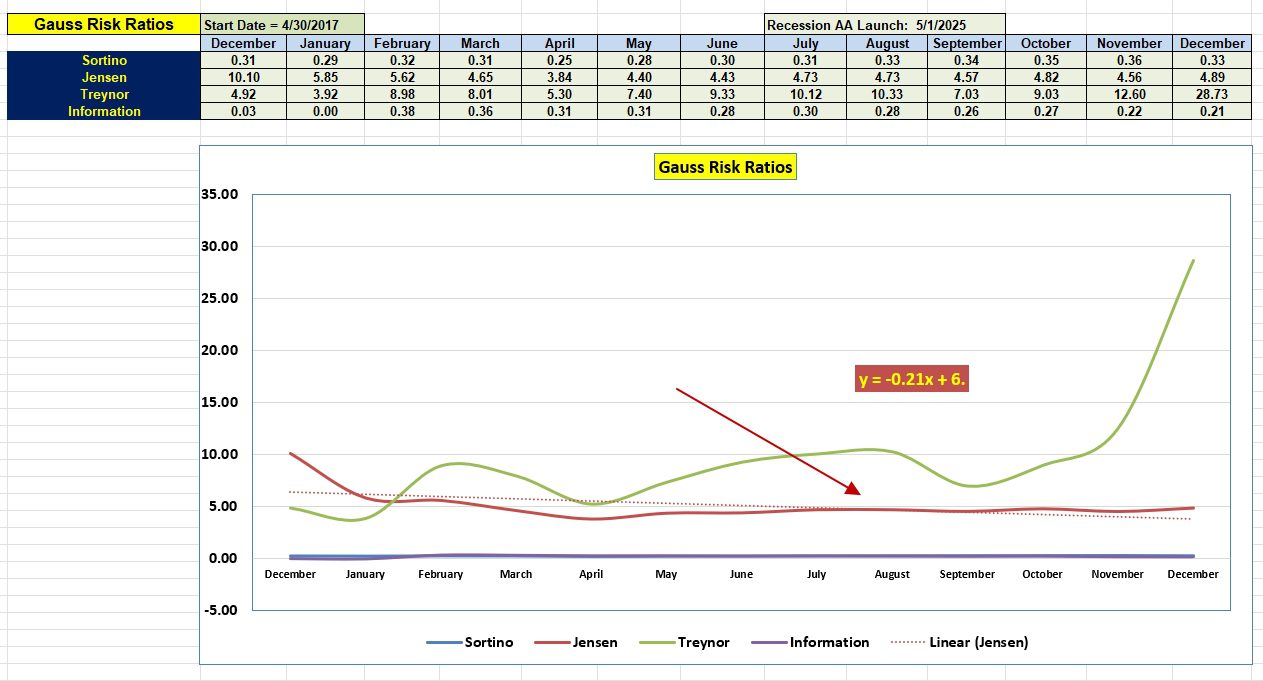

Gauss Risk Ratios

Over the past year the Gauss generated a rather consistent Jensen Alpha. The value is hanging around the 4 t0 5 range or a very high level. Anything above zero is quite positive. We also see slight increases in the Sortino and Information Ratios since last December.

Once we clear December there is a possibility the slope of the Jensen will turn positive.

Comments are always welcome.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Leave a Comment or Question