Mono Lake, California

Gauss is the portfolio up for review this morning. We are approximately eight (8) months into the Sector BPI investing model with the Gauss and thus far the sector approach is working as laid out in the hypothesis last winter. We still need a business cycle or two before we can draw any significant conclusions. Early signals are positive.

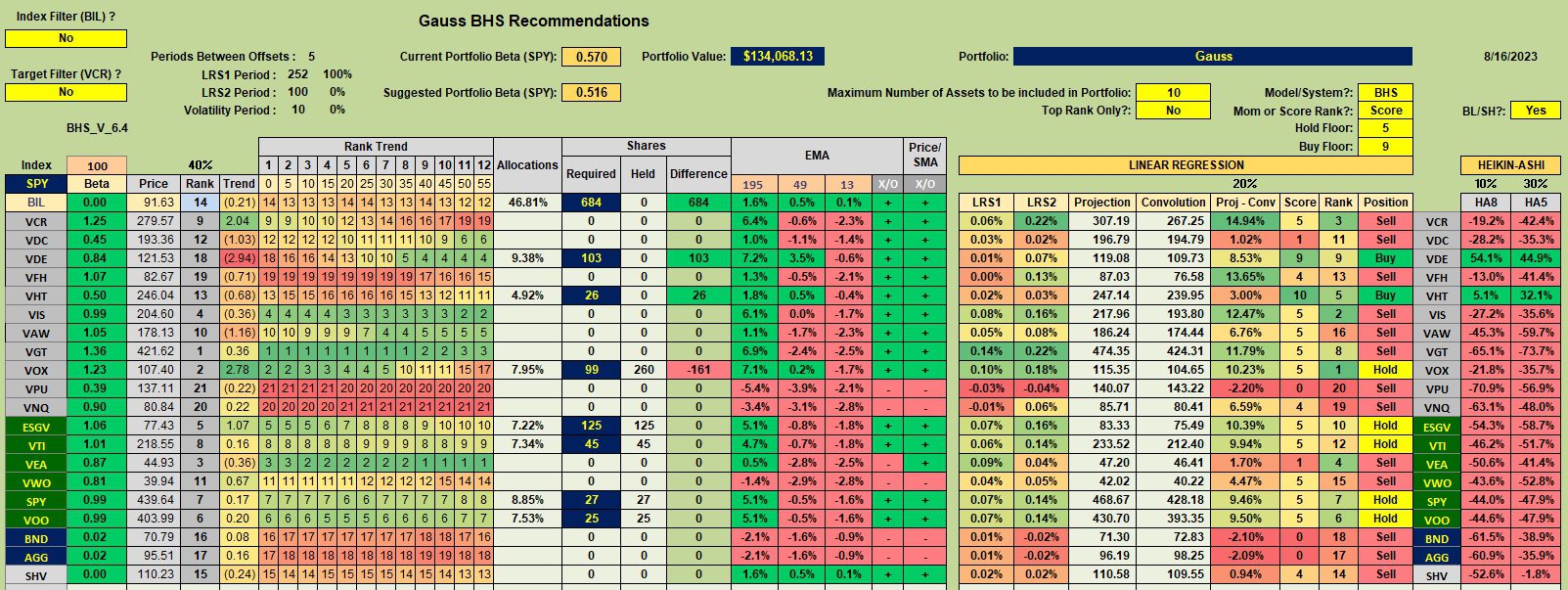

Gauss Security Recommendations

Below are the current holdings and recommendations. Since the last update several sector ETFs were sold out of the Gauss as the Trailing Stop Loss Orders (TSLOs) were struck. This leaves only Communication Services (VOX) as to sole sector ETF in the Gauss. In situations such as we are now in there is an abundance of cash so we move to ETFs such as ESGV down through SHV. Most of these ETFs are equity oriented, but we do have two bond ETFs (BND and AGG) and one treasury (SHV) to fall back on should the market go into decline.

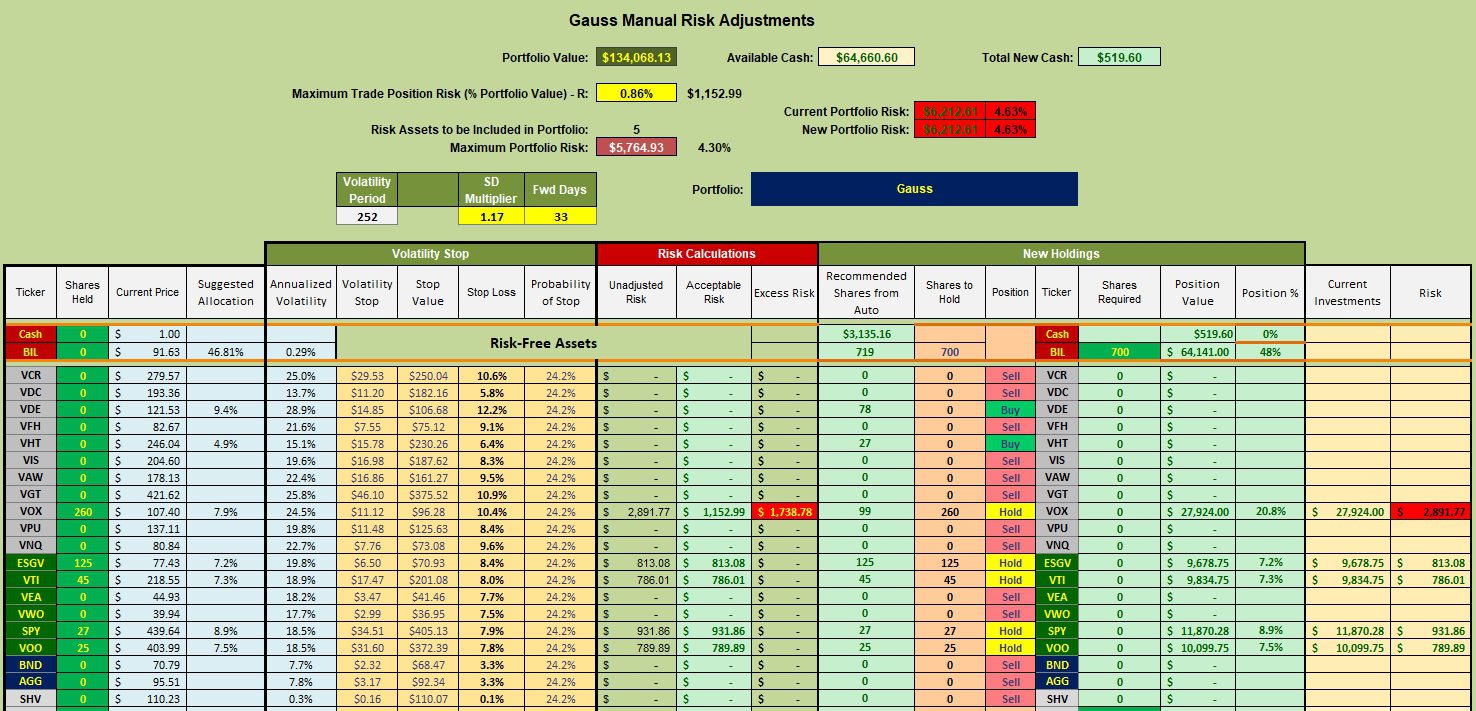

Gauss Manual Risk Adjustments

The following worksheet comes out of the Kipling spreadsheet and that goes for the above worksheet as well. None of the sectors are currently in the oversold zone so no action is called for. Check this blog on Saturday to see if there are any sector ETFs calling for a Buy.

The equity ETFs are recommending we Hold the current positions. When this is the case we move to BIL as a haven for the available cash. I have a number of limit orders in place to purchase shares of BIL. As I was writing this blog I see where a limit order to pick up 300 shares of BIL was struck. That transaction does not show up in this blog post.

I should mention that I have TSLOs set for holdings ESGV, VTI, SPY, and VOO. Those TSLOs are set anywhere between 8% and 10%. The reason for setting these TSLOs is to protect capital. All the Sector BPI Plus portfolios are set up in such a way as to protect capital. The Copernicus, for example, has no capital protection plan.

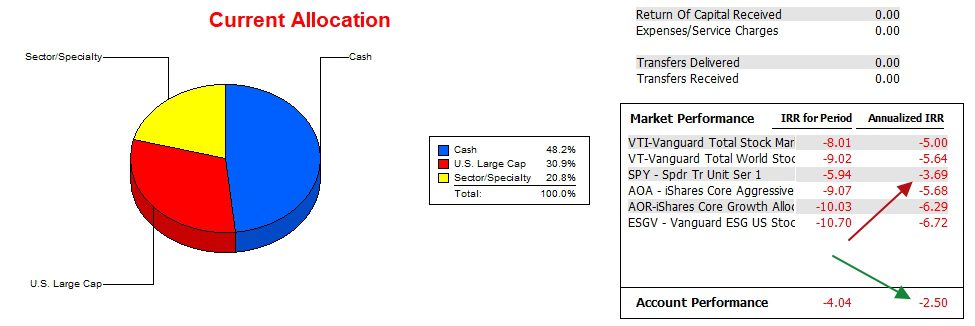

Gauss Performance Data

Since 12/31/2021 the Gauss has outperformed the S&P 500 (SPY) by a slight margin (1.2%) annualized. The margin is larger for all of the other five possible benchmarks. This data comes from the commercial software program, Investment Account Manager. I highly recommend serious investor use this software to track portfolio performance.

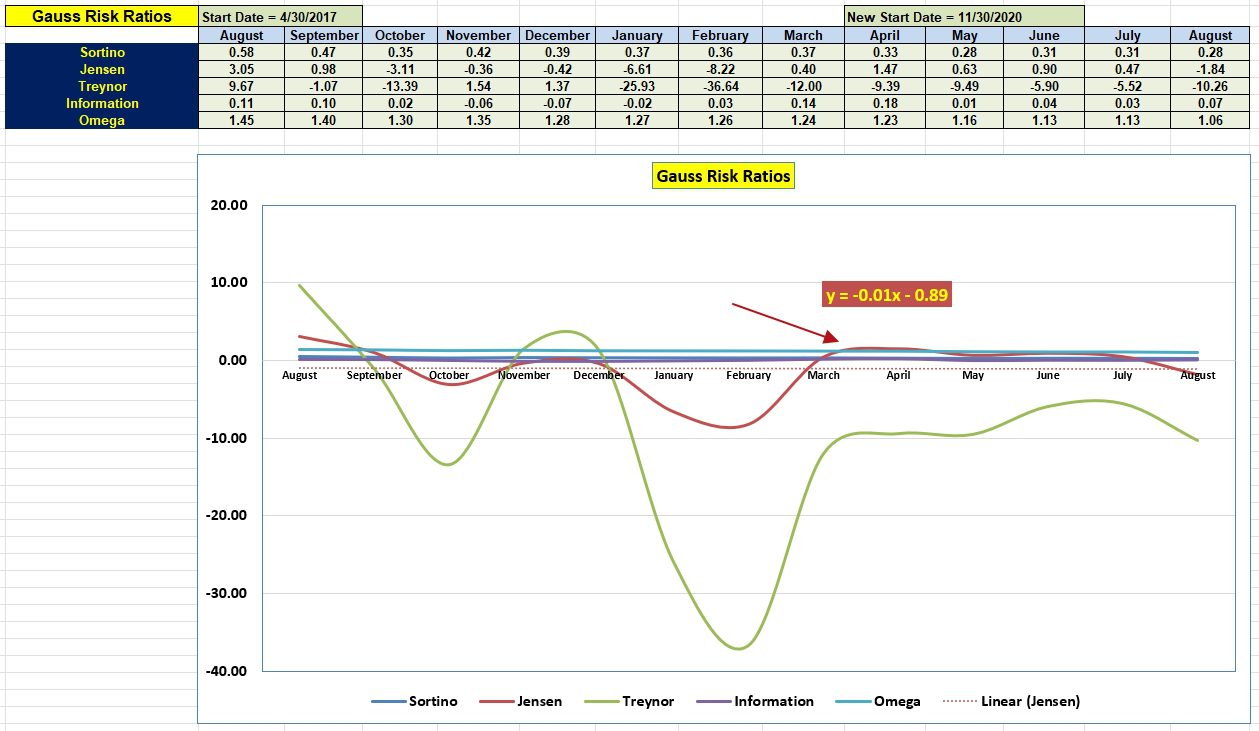

Gauss Risk Ratios

The following data is unique to ITA Wealth Management. The most important values in order of importance are: Jensen Alpha, Information Ratio, and Sortino Ratio.

The Information Ratio indicates the portfolio is besting the benchmark (SPY) by a slight amount. The Jensen is negative, partly due to the “risk-free” interest rate moving from 3% up to 3.5%. This increase is placing downward pressure on the Jensen Performance Index.

The August decline in the Jensen caused the slope (-0.01) to flip from positive to negative. Once we clear August and September Jensen data the slope will most likely revert back to positive.

Tweaking Sector BPI Plus Model: 20 May 2023

The ITA blog is now free to all who register as a Guest so send the link to your friends and relatives. If seeking easy to manage portfolios, search out the Schrodinger and Copernicus as both require almost no work on the part of the investor.

If you wish to read all blog posts, register as a Guest and give me 24 hours to upgrade you to the Platinum level.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.