Loch Ness, Scotland – but no Monster Sightings

Not a lot of action here as this is essentially a Buy-And-Hold Portfolio with a re-investment of dividends ($2,000+ since the last review).

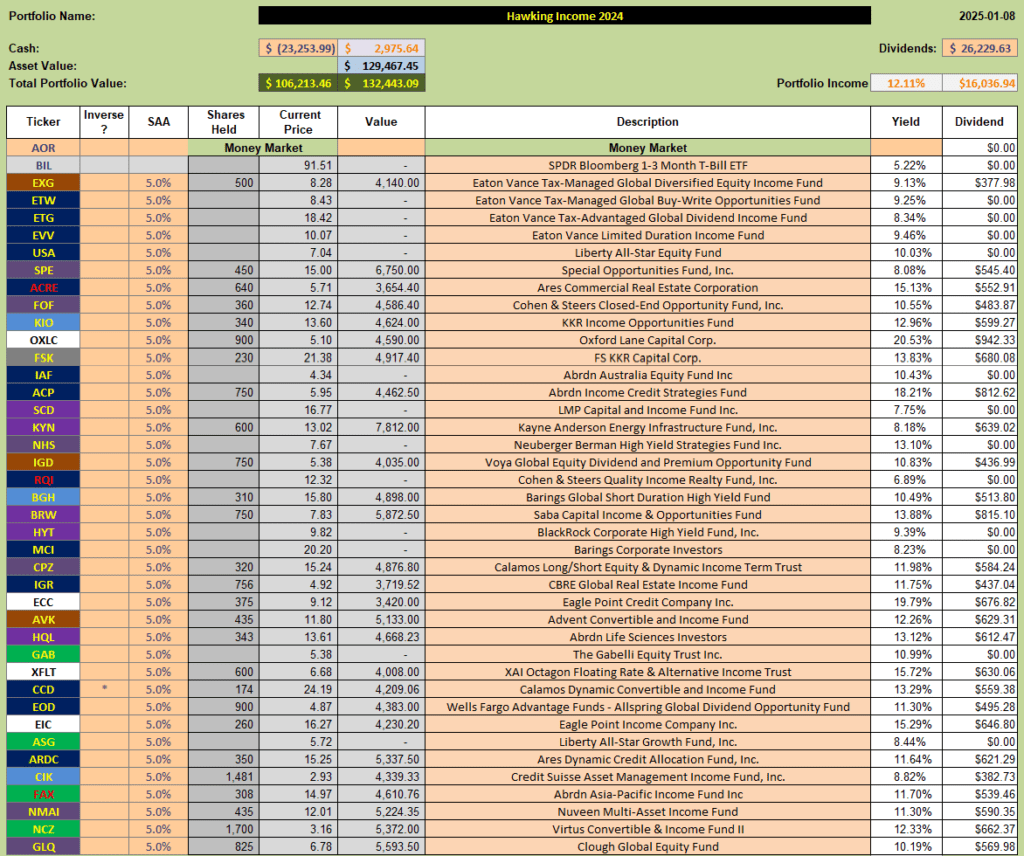

Current holdings look like this:

with an anticipated 12% annual yield – or over $1,000 per month “income” from dividends.

with an anticipated 12% annual yield – or over $1,000 per month “income” from dividends.

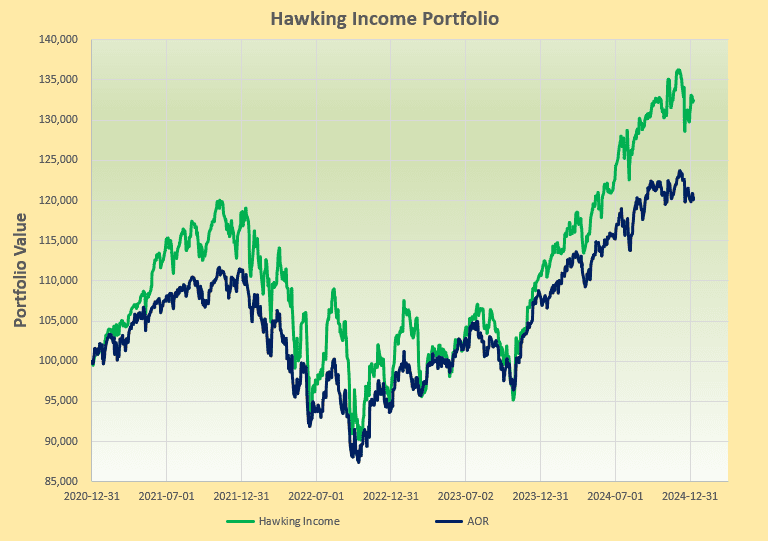

Performance of the portfolio since inception in December 2020 (4 years) looks like this:

with returns well above those of the benchmark AOR Fund.

with returns well above those of the benchmark AOR Fund.

One of the things to remember about Closed-End-Funds (CEFs), that pay out what look like very attractive distributions (8-12%), is that not all these funds generate enough income from Net Investment Income (NII) to cover the distribution payment. They therefore have to make up the difference from invested capital – i.e. the difference becomes a return of the investor’s own money, a resultant reduction in funds available for investment and a corresponding drop in share price. If the fund can generate value through “growth” in addition to “investment” then this does not matter and the fund remains attractive. However, if the fund cannot generate the “growth” to make up the difference then, at some point, the fund will have to reduce the distribution to match it’s total net income from investment and growth. This, then, often triggers selling and a reduction in market value as investors bail out.

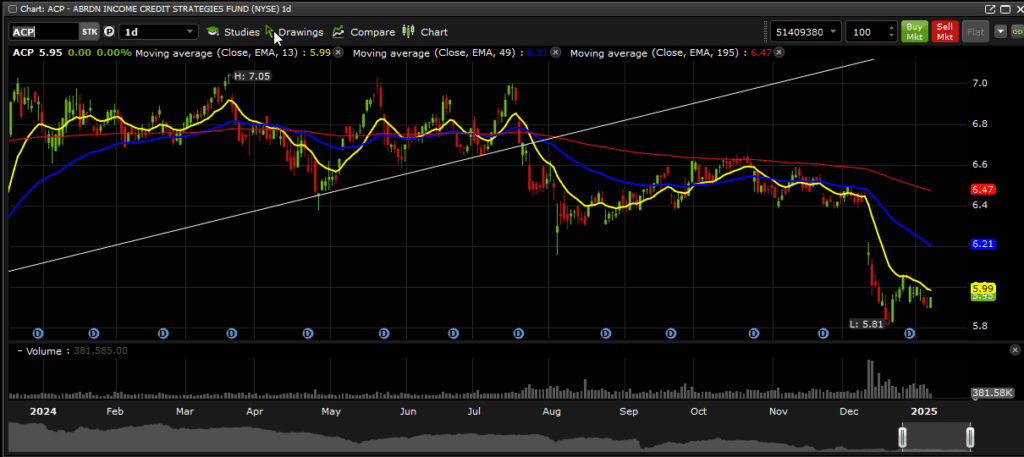

One fund that I’m watching right now is ACP (Aberdeen Income Credit Strategies Fund):

In July I drew a trend line thinking that price might break above the ~$7 resistance area that had been tested a number of times prior to that date. However, price broke down and is now trading at ~$6 – or ~14% below where it was 12 months ago. About half of this has been lost in the past month and ACP is not covering the 18% distribution, that it is paying out, from NII. Thus, although not disastrous, the net return from this fund over the past 12 months is only ~4%. If this distribution is cut and investor’s bail out then the investment does not look attractive until everything is balanced out again. I will be following this fund going forward and will sell if price drops below $5.80. This is one example of where I may sell something rather than just Buy-And-Hold (or Hope). Since the portfolio is presently holding 27 funds the impact is small. Diversity is how I am managing risk here.

In July I drew a trend line thinking that price might break above the ~$7 resistance area that had been tested a number of times prior to that date. However, price broke down and is now trading at ~$6 – or ~14% below where it was 12 months ago. About half of this has been lost in the past month and ACP is not covering the 18% distribution, that it is paying out, from NII. Thus, although not disastrous, the net return from this fund over the past 12 months is only ~4%. If this distribution is cut and investor’s bail out then the investment does not look attractive until everything is balanced out again. I will be following this fund going forward and will sell if price drops below $5.80. This is one example of where I may sell something rather than just Buy-And-Hold (or Hope). Since the portfolio is presently holding 27 funds the impact is small. Diversity is how I am managing risk here.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

David,

Following your posts, I developed a CEF portfolio a couple of years ago using a subset of your investment choices. I appreciate your comments about the distributions from ACP. I was not paying attention to the source of distributions prior to now. I still have alot to learn about evaluating CEFs.

Using the Kipling spreadsheet for data, I noticed that the yield of NCZ is currently around 3.5%, down from the 12.33% in your table above. Because of the difference I decided to look into NCZ to see where I could find the information on the source of monthly distributions. If I read the charts correctly (which is a very big assumption), all of the distributions from the last few months have been from capital. Have you been tracking NCZ like you have been with ACP? Any concerns?

~jim

Jim,

I don’t have any more dire concerns with NCZ than I have for any other high yielding CEFs.

The daily chart looks fairly nice from my point of view:

https://www.dropbox.com/scl/fi/i8mt1o7vwxtfz5oo5jn3q/NCZ-Daily-2025-01-19_13-33-48.png?rlkey=73400l1jlg4xjct6duz2s0avn&dl=0

and the distribution of ~12% (from CEFConnect) seems to be correct:

https://www.dropbox.com/scl/fi/b2qf7jjbv78npm8w72vte/NCZ_CEF-2025-01-19_13-37-37.png?rlkey=5pbw70nignadhp0esothgib2s&dl=0

Since NCZ is a leveraged fund (that can be either a good or bad thing – depending on how the manager manages the fund) I think the problems come when the fund is not able to meet regulatory requirements and assets have to be sold (reducing NAV) – maybe (and usually) at the worst possible time. I believe this happened to NCZ in 2022 when prices tanked:

https://www.dropbox.com/scl/fi/2waqge2vgechl86pd9k8m/NCZ-Weekly-2025-01-19_13-32-01.png?rlkey=b5kqamyr7rgxwubs8rw7440jc&dl=0

I (personally) don’t mind that a portion of the “income” may be a return of capital – if net income is in the 8-10% range I am quite happy.

I just try to keep up with any concerns that others out there might have as to how the managers are managing the funds – otherwise I’m content with letting them do their thing.

Here’s a pretty positive evaluation I found on NCZ:

https://www.dropbox.com/scl/fi/9q462hn2jr6egcxy7ljtk/NCZ_Fitch-2025-01-19_14-08-36.png?rlkey=teaom2xecg46nqv11xbb1hz0e&dl=0

David

David,

Thank you for the detailed response.

~jim