Time to go home.

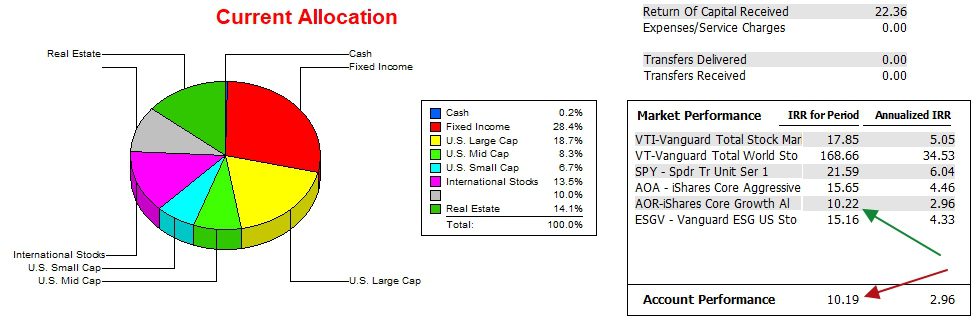

Huygens is one of two portfolios using an expanded Asset Allocation (AA) management model. The other is the computer managed Schrodinger or Schwab’s Intelligent Portfolio. Over the past month the Huygens lost a bit of ground to its benchmark, the AOR security. Most likely the AOR is tilted a tad more toward equity holdings whereas the Huygens is more conservative when it comes to the stock/bond ratio.

This portfolio has been using the AA model for a year so it is early when it comes to drawing conclusions.

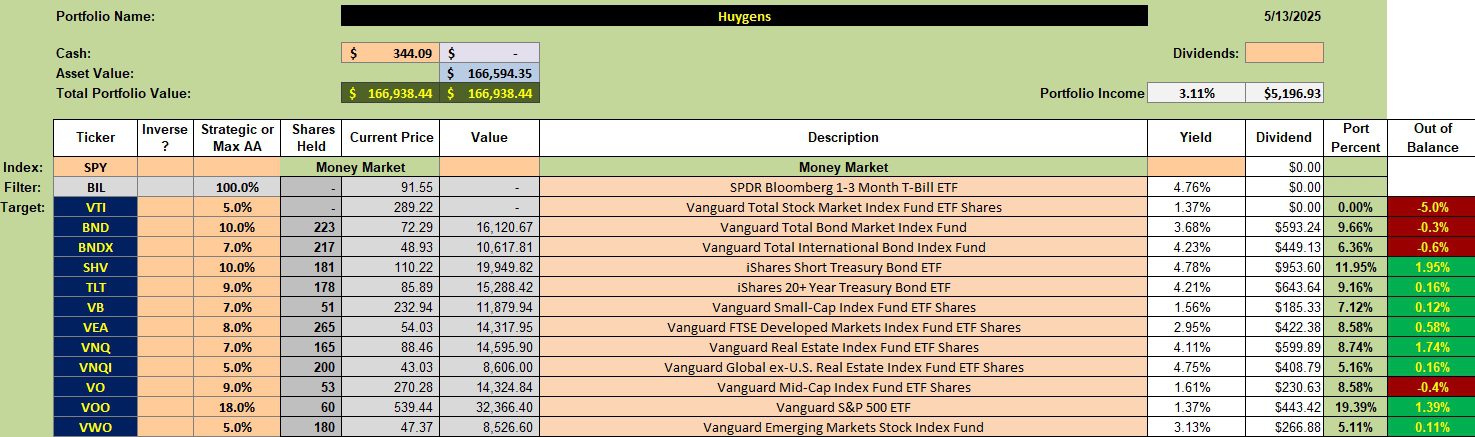

Huygens Asset Allocation

Below is the current Asset Allocation breakdown for the Huygens. The primary asset class most out of balance is U.S. Equities or VTI. I am not all that concerned as VB, VOO, and VO are also U.S. Equity ETFs.

The annual income is a respectable 3.1%.

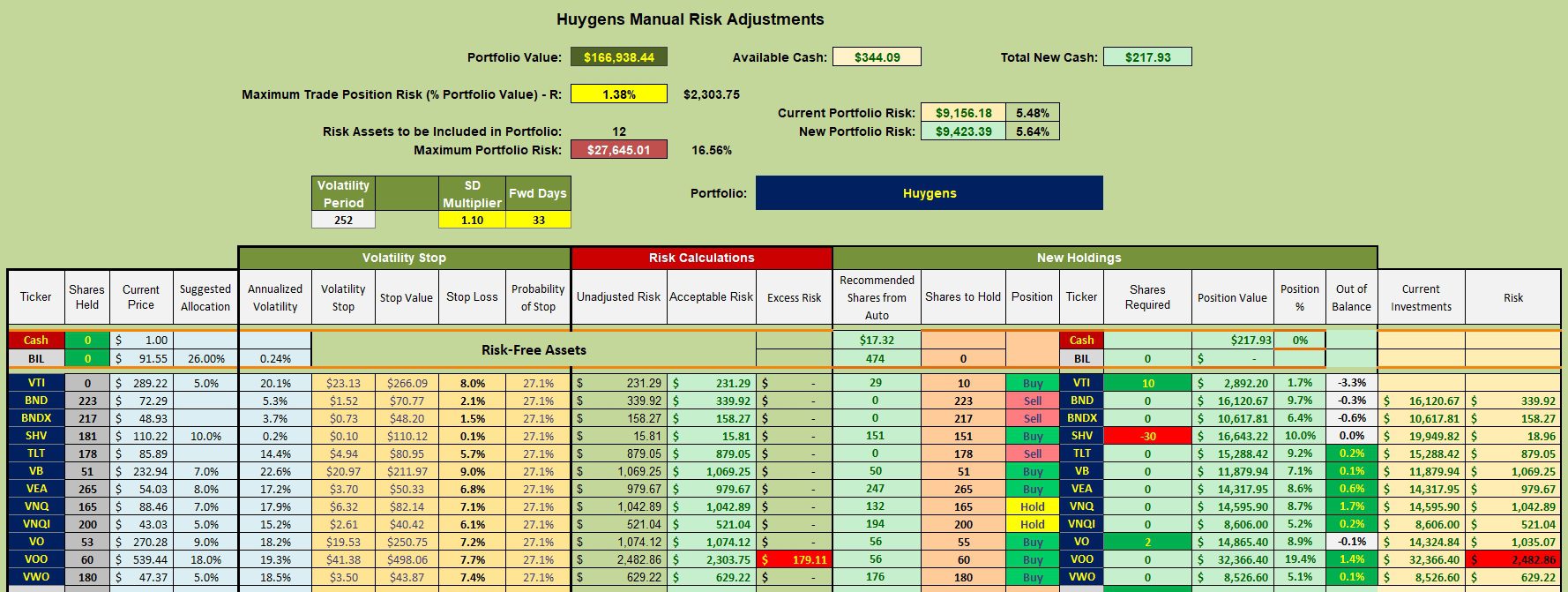

Huygens Rebalancing Recommendations

To rebalance I plan to sell 30 shares of SHV and use that money to set limit orders for 10 shares of VTI and 2 shares of VO. Several asset classes indicate a Buy, but only VTI and VO are below target. When dividends generate additional cash it will be used to bring VTI closer to target.

Huygens Performance Data

Since 12/31/2021 the Huygens is in a dead heat with the AOR benchmark. Since the last review this portfolio lost ground to the AOR benchmark. See the link at the bottom of the page for this information.

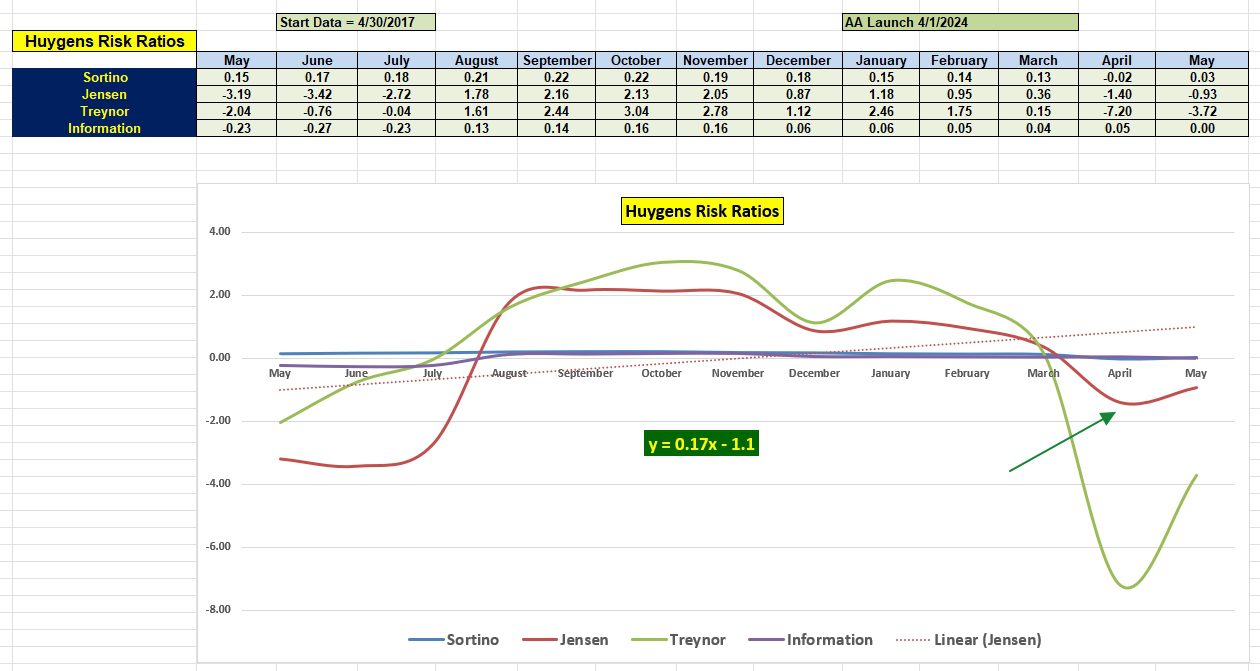

Huygens Risk Ratios

The two most important ratios, the Jensen Performance Index and Information Ratio, are ahead of where they were a year ago. The positive slope for the Jensen is another positive sign for this Asset Allocation portfolio.

As I update portfolios, the Huygens actually gained during the month of April. Most ITA portfolios lost money last month.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Leave a Comment or Question