Log Cabin – Central Oregon

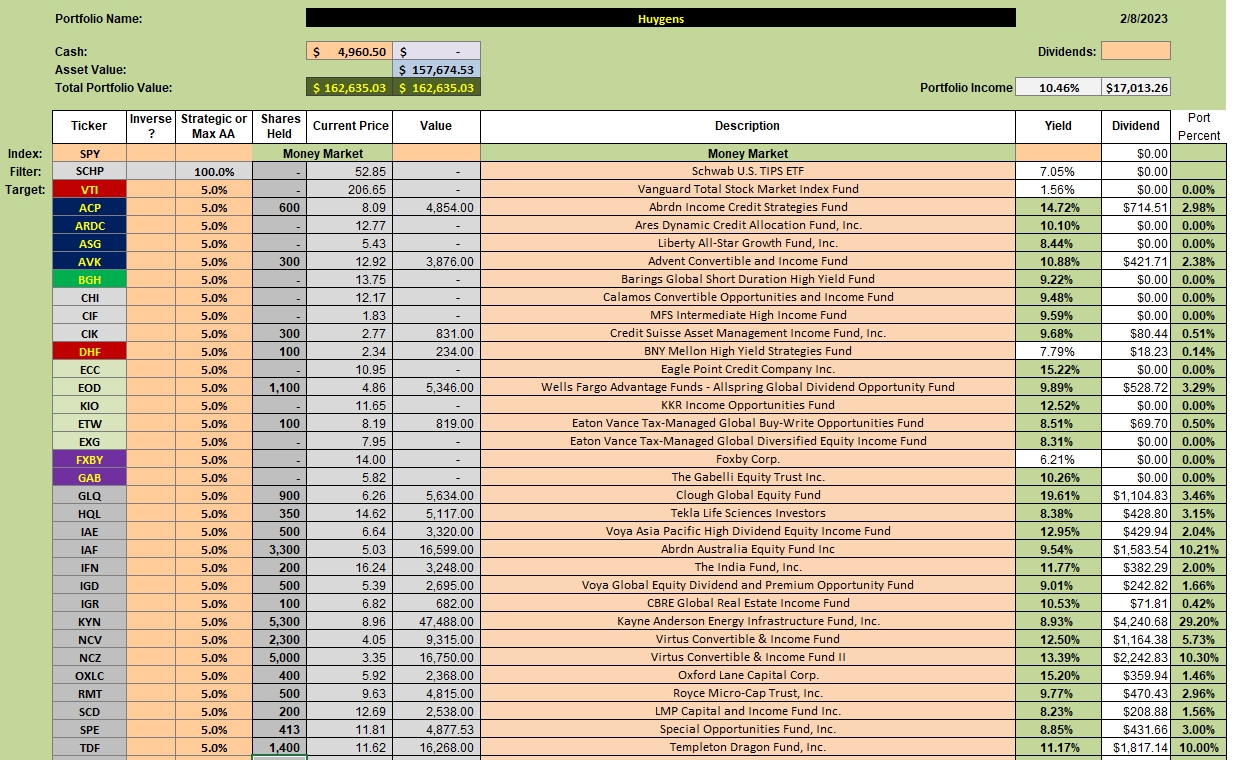

As one of three income oriented portfolios, the Huygens turned in an excellent January with a gain in excess of 11.0%. I don’t anticipate this increase will continue.

This review or update will show a few necessary changes as two Closed-End-Funds (CEFs) are not meeting the yield requirement.

Huygens Investment Quiver

Since the last review all shares of FXBY were sold out of the Huygens. My recommendation is to avoid FXBY as we pay commissions for this particular CEF.

A limit order is in place to sell 100 shares of DHF as the yield dropped below 8.0%. Shares of TDF were recently added using cash from dividends that flowed into the portfolio. The current yield is over 10.0%.

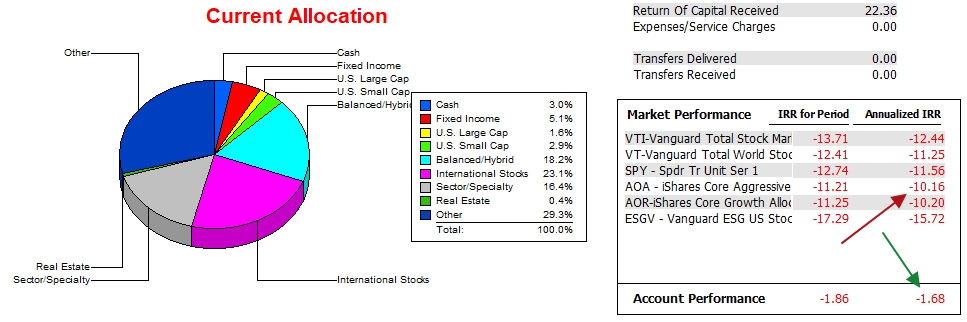

Huygens Performance Data

The Huygens has not quite broken into positive territory over the past 13 months, but it is far outperforming all six benchmarks tracked using the Investment Account Manager software. If the CEF managers can just maintain the current prices over the next month, the Huygens should move into positive territory once the first quarter dividends are recorded.

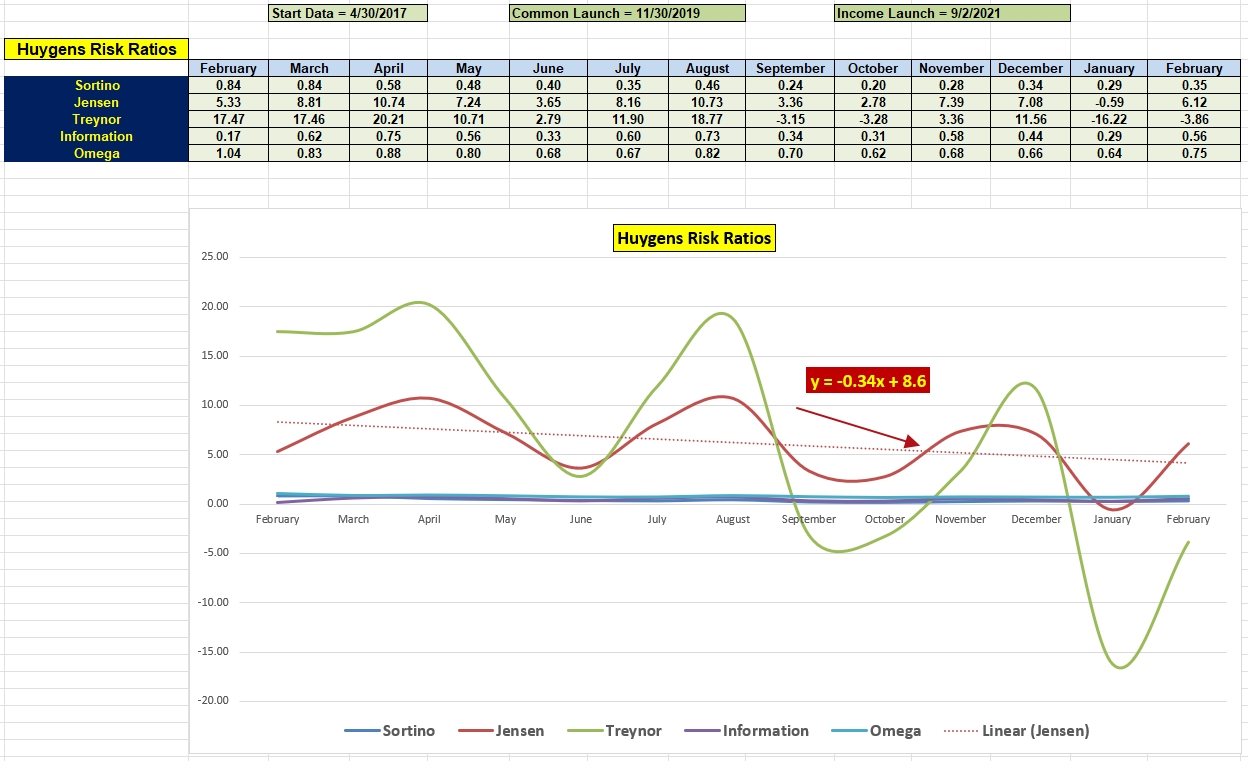

Huygens Risk Ratios

Both the Information Ratio and Jensen Alpha are higher than they were in February of 2022. However, it will take several months of higher Jensen values before we see a positive slope.

Of the five ratios, the Jensen is the most important.

Keep in mind the two principle requirements for these income oriented portfolios. 1) The yield must exceed 8.0%. 2) The price of the CEF is lower than the net asset value.

For this data, go to CEF Connect. If readers have questions, post them in the Comment section provided with each blog post.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Hi Lowell,

If I’m just starting out with Huygens, do you suggest adding to all 21 CEF’s at the start? Or, do you suggest some sort of layering process over time? I’m also wondering if there’s any overlap between all listed? In that case, any suggestions for diversification? Sorry for all the questions. I’m really enjoying learning from you.

TF

TF,

You might begin with five and then expand by another five each week. I don’t know if there are common stocks held in each. I don’t worry about that. You will find different countries or areas represented by many of the CEFs.

I pay most attention to the two criteria. NAV and yield.

Lowell

Lowell,

You commented above “Shares of TDF were recently added using cash from dividends that flowed into the portfolio”

I notice that 10% of the portfolio is in TDF. Why would you add to TDF if the Max AA is 5%? Also, would you sell CEFs for the purpose of not exceeding 5% or some other portfolio position exceeding your Max AA? I guess what I am asking is if you would ever trim your “winners.”

Finally, would you mind reminding readers what your rules are for buying and selling CEFs, or point to the blog where that is explained?

Thanks.

~jim

Jim,

First, I don’t pay too much attention to the 5% limit. I plan to elevate the limit to at least 10% and then reduce the number of CEFs in the portfolios where I am making some revisions.

There are the guidelines for selecting CEFs.

1. I want the yield to exceed 8%.

2. The CEF must be priced below its Net Asset Value (NAV).

3. Less important, but something I look at is leverage. I prefer it to be below 25%.

4. Last I look to see if the Kipling SS recommends a Buy. This is not a deal breaker. #’s one and two are critical.

Lowell