Botanic Gardens, Singapore

Last month I switched my position in the faster moving Tversky portion of this Dual Momentum portfolio to International equities (VEU) from US equities (VTI). This proved to be a poor move since VTI has outperformed VEU over the past month and, as we will see below the recommendation is now to move back into US equities. This is a good example of timing/review date luck – in fact the signal switched back to US equities just a couple of days after the review and I was very tempted to switch back. But, a system is a system, and we need to stick with it in order to be able to asses it’s efficacy. I continue to contend that review date/timing luck is probably the most significant factor in determining the performance of any actively managed “system”.

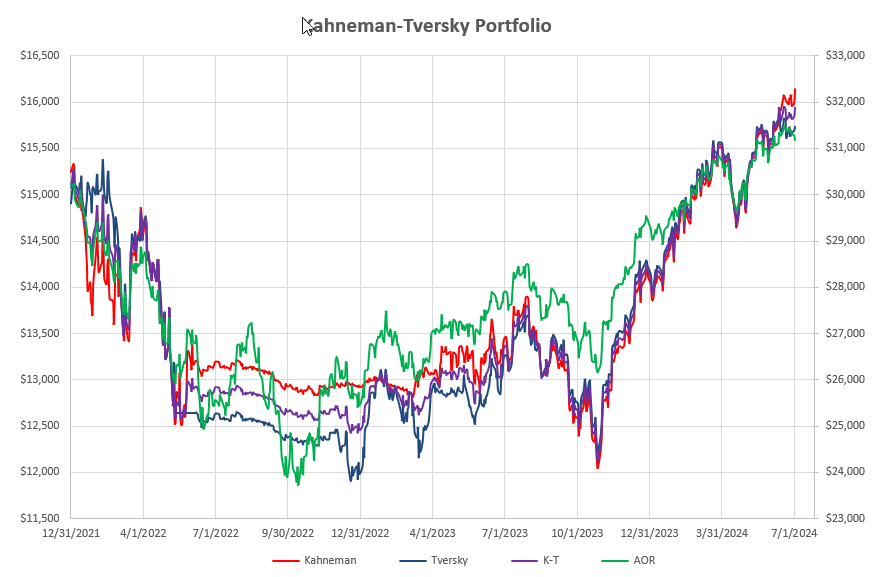

Performance of the Kahneman-Tversky Portfolio to date looks like this:

and we have now pulled ahead of the benchmark AOR Fund despite the dampening of recent performance by the switch of the Tversky portion (blue line) away from US equities (red line).

and we have now pulled ahead of the benchmark AOR Fund despite the dampening of recent performance by the switch of the Tversky portion (blue line) away from US equities (red line).

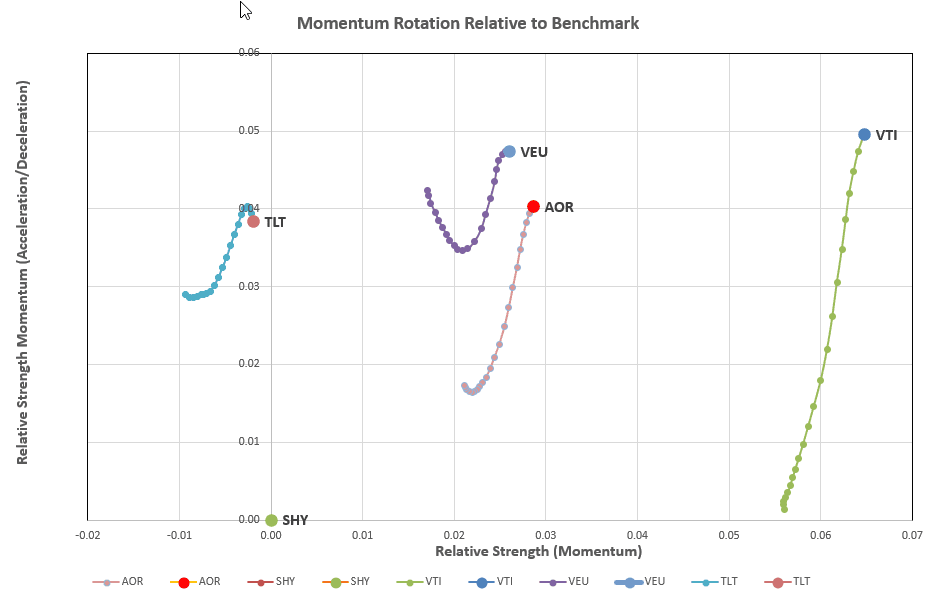

Checking the rotation graphs of the slower moving Kahneman portion (252-day momentum lookback period) of the portfolio:

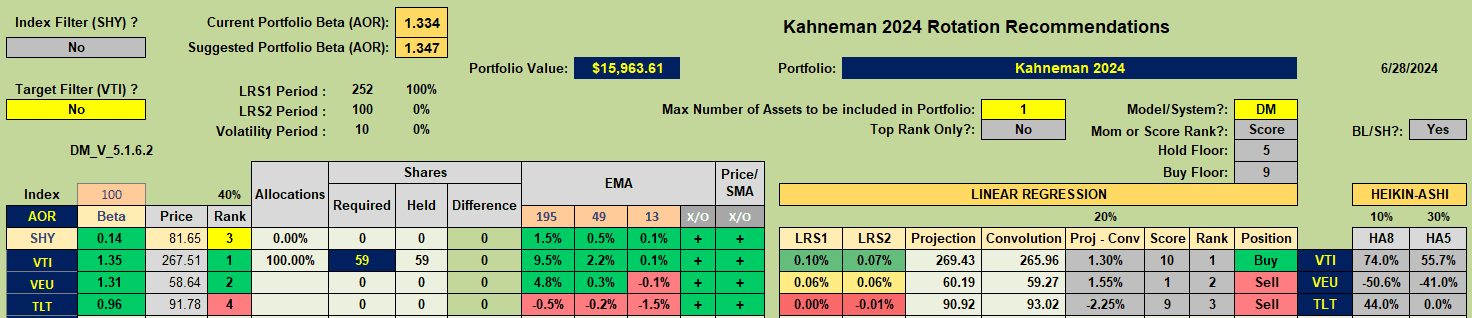

we see the continued strength of US equities (VTI) – so it is no surprise that this continues to be the recommended holding in this portion of the portfolio:

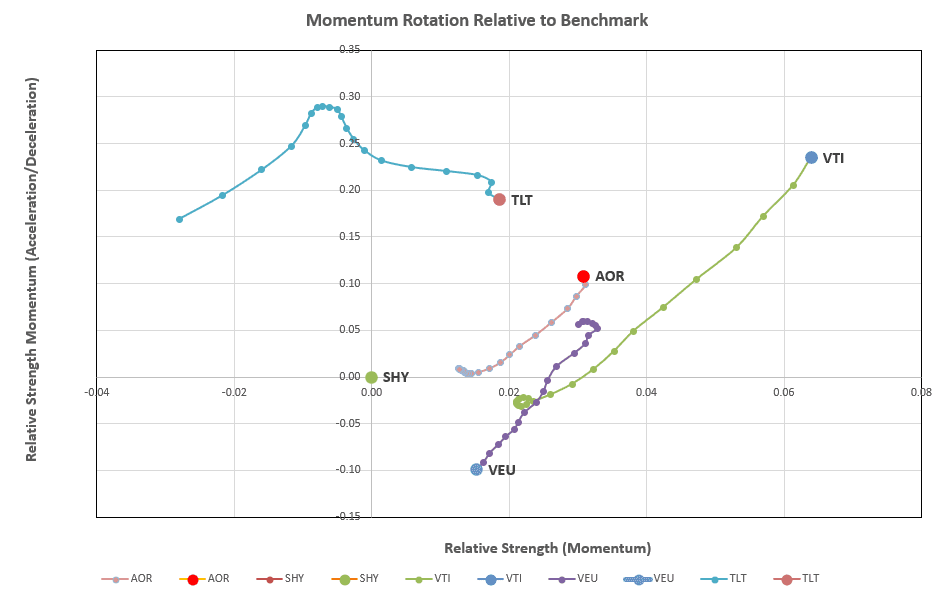

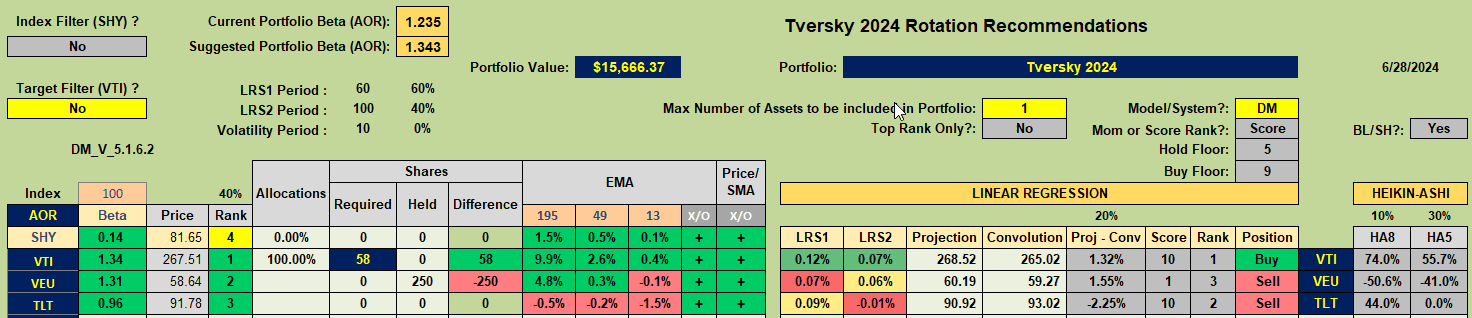

Moving to the faster moving Tversky portion of the portfolio (60- and 100-day momentum lookback periods) the rotation graphs look like this:

Moving to the faster moving Tversky portion of the portfolio (60- and 100-day momentum lookback periods) the rotation graphs look like this:

where VTI has strengthened over the past month and VEU has retreated. Recommendations for this portion of the portfolio now also favor VTI:

where VTI has strengthened over the past month and VEU has retreated. Recommendations for this portion of the portfolio now also favor VTI:

so I will switch back even though US equities closed near all-time highs today.

so I will switch back even though US equities closed near all-time highs today.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.