Orchid, Botanic Gardens, Singapore

The Kahneman-Tversky Portfolio is a simple Dual Momentum (DM) Portfolio that needs little adjustment/management. The choice is to invest in only one of three ETFs or move to Cash (or SHY). The only “complexity” comes from the fact that the portfolio is split into two portions that use different look-back periods to measure Momentum.

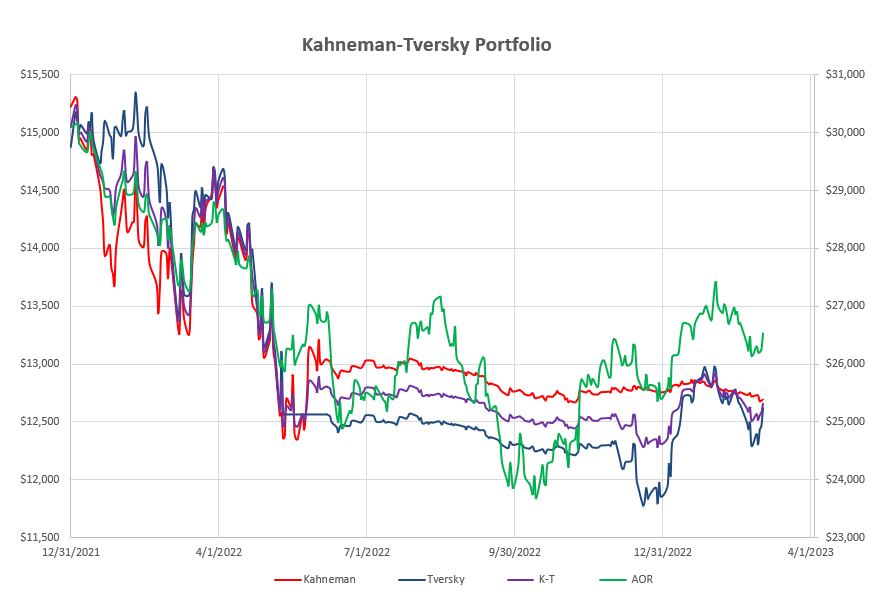

Performance of the Portfolio since 1 Jan 2022 to present is shown below:

For most of the time since mid 2022 both portions of the portfolio were holding shares in SHY (1-3 Year Treasury Bonds) with the faster reacting Tversky portion of the portfolio moving to VEA (Developed (ex-US) Market ETF) at the beginning of 2023.

For most of the time since mid 2022 both portions of the portfolio were holding shares in SHY (1-3 Year Treasury Bonds) with the faster reacting Tversky portion of the portfolio moving to VEA (Developed (ex-US) Market ETF) at the beginning of 2023.

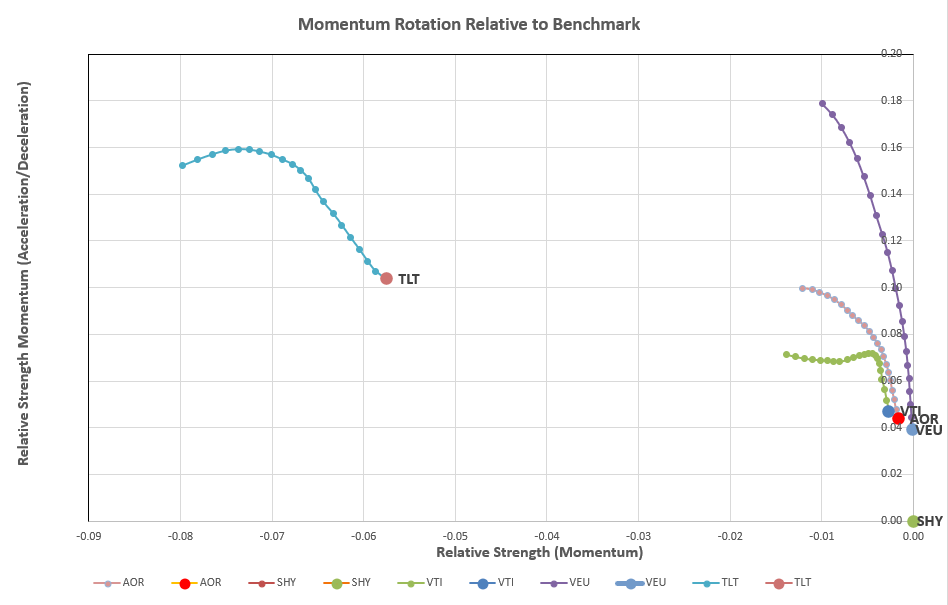

Taking a look at momentum rotation for the slower moving Kahneman portion of the portfolio we get the following picture:

with everything lying in the top left quadrant of the graph showing negative long-term momentum and positive, but weakening (moving down vertically) short-term momentum.

with everything lying in the top left quadrant of the graph showing negative long-term momentum and positive, but weakening (moving down vertically) short-term momentum.

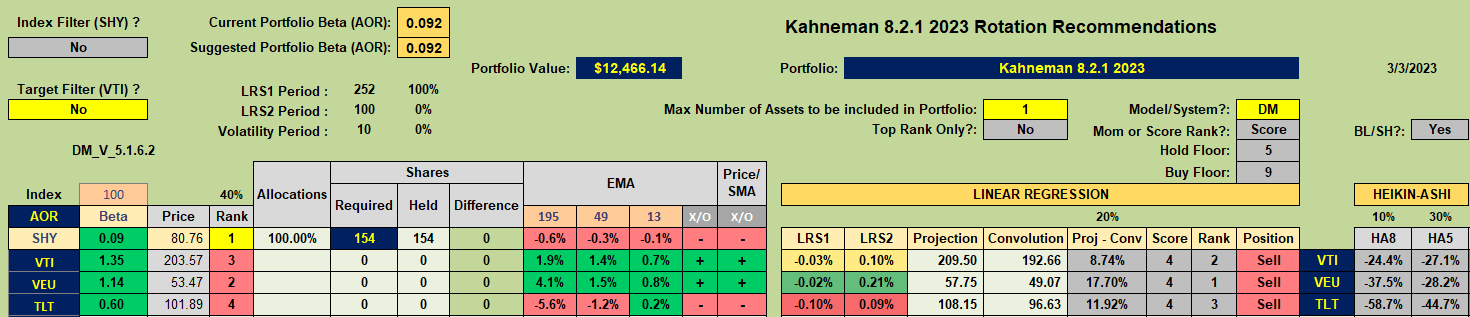

Dual momentum “rules” suggest that this portion of the portfolio remain invested in SHY:

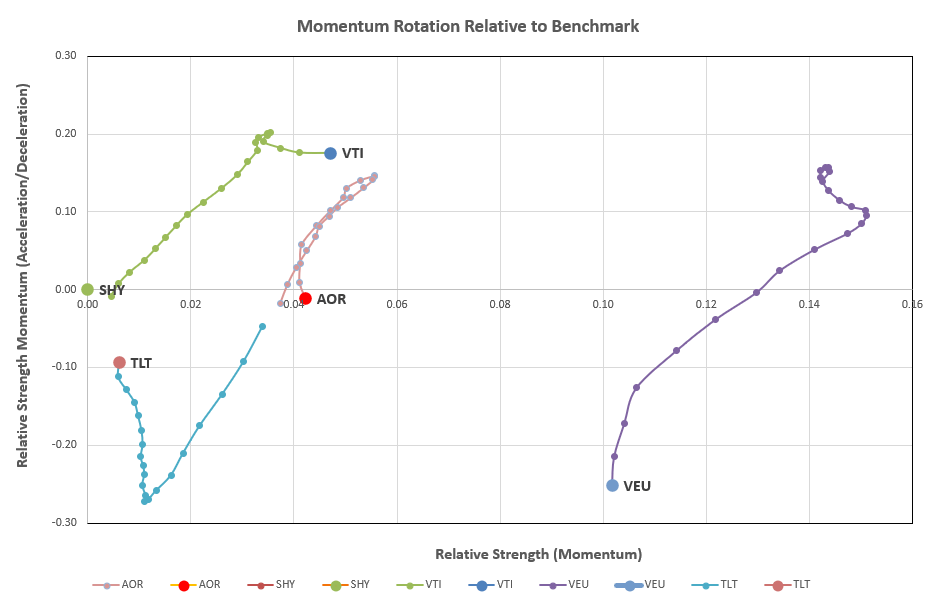

Moving to the faster moving Tversky portion of the portfolio shows significantly different (and more positive) rotation graphs:

Moving to the faster moving Tversky portion of the portfolio shows significantly different (and more positive) rotation graphs:

Here we see all assets to the right of the vertical axis (positive longer-term momentum on this time scale – 60- 100-days) but negative shorter term momentum for everything except VTI.

Here we see all assets to the right of the vertical axis (positive longer-term momentum on this time scale – 60- 100-days) but negative shorter term momentum for everything except VTI.

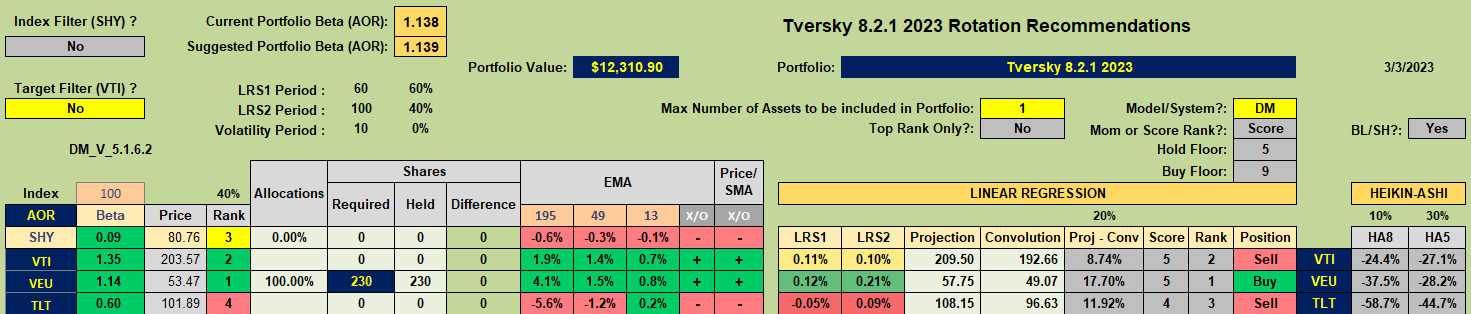

What does this mean for the model recommendations? Well, the DM model uses only longer term momentum signals – so, the recommendation is to invest in VEA (the asset further to the right in the rotation graphs):

Accordingly, there will be no adjustments to this portfolio for at least another month.

Accordingly, there will be no adjustments to this portfolio for at least another month.

David

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.