Hobart, Australia

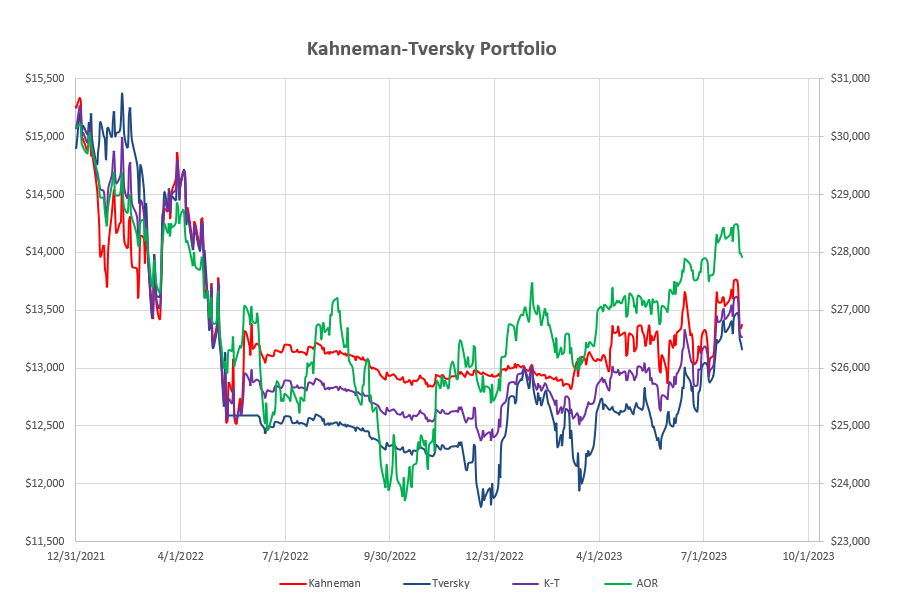

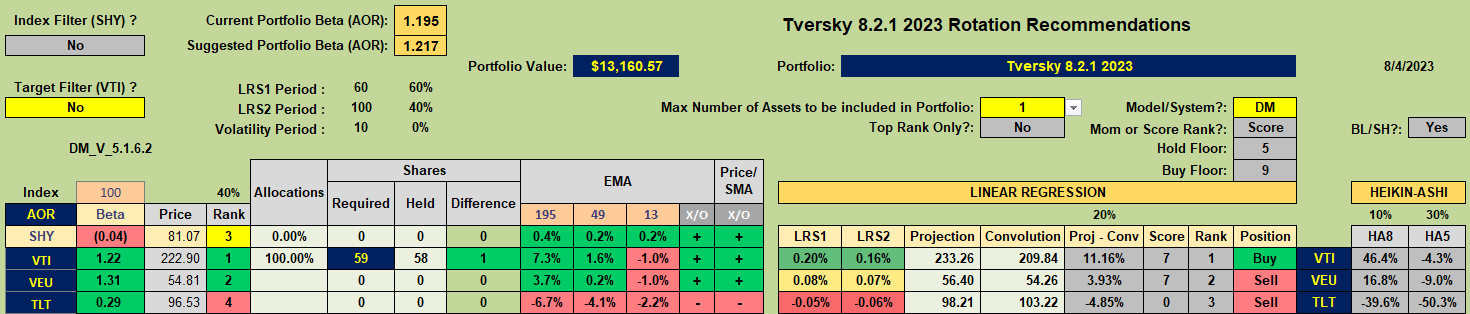

The Kahneman-Tversky Portfolio is a simple Dual Momentum Portfolio that requires few adjutments since it only has a choice of holding one of 3 assets. Here’s where the portfolio is sitting at present:

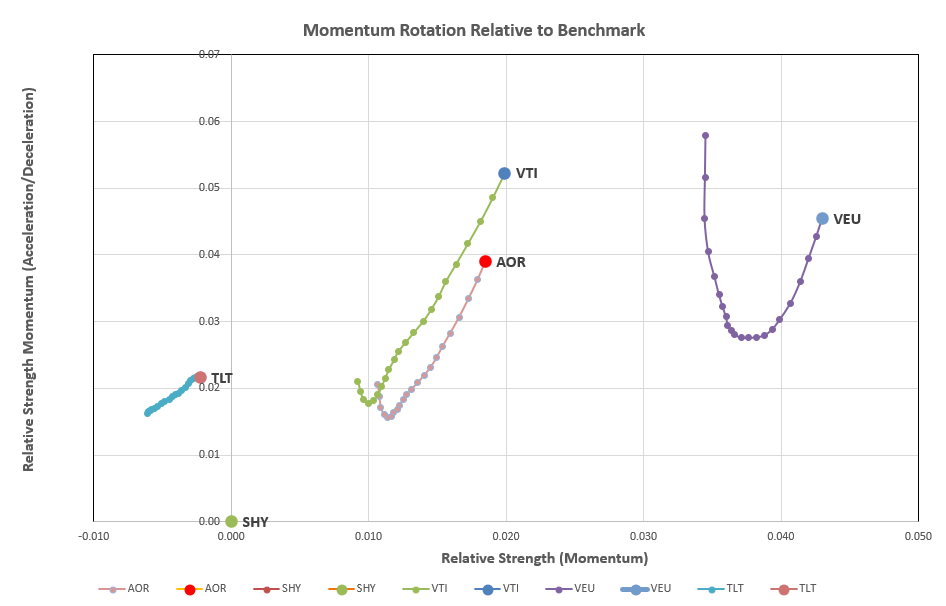

Checking the slower moving Kahneman portion of the portfolio that uses a single 252-day (12 month) lookback to measure momentum, the rotation graphs look like this:

Checking the slower moving Kahneman portion of the portfolio that uses a single 252-day (12 month) lookback to measure momentum, the rotation graphs look like this:

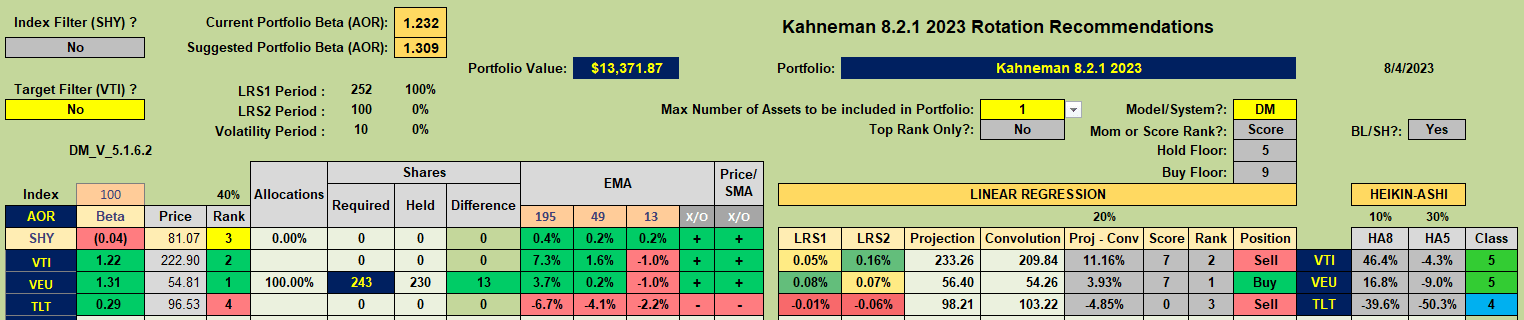

VEU is clearly the leader long-term (furthest to right) and is also showing short-term strength (moving up), so it is not surprising to see the recommendation:

VEU is clearly the leader long-term (furthest to right) and is also showing short-term strength (moving up), so it is not surprising to see the recommendation:

and, since we are already holding this ETF no changes are called for.

and, since we are already holding this ETF no changes are called for.

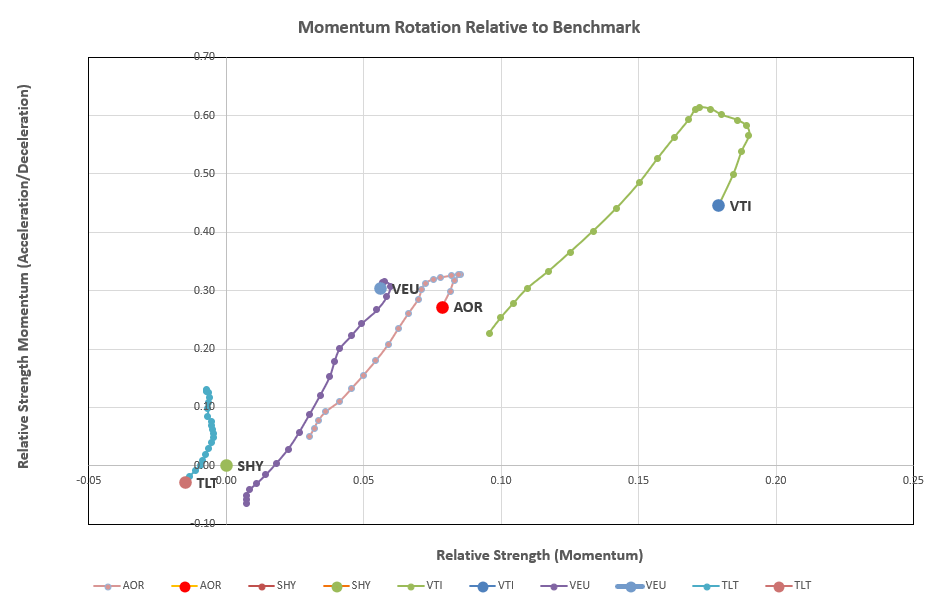

Moving to the faster moving Tversky portion of the portfolio, that uses the shorter-term 60- and 100-day lookback periods to measure momentum, we see the following rotation graphs:

with VTI leading the longer term strength and short-term weakness in all ETFs. However, the recommendation:

with VTI leading the longer term strength and short-term weakness in all ETFs. However, the recommendation:

is to hold on to the position in VTI that we currently hold.

is to hold on to the position in VTI that we currently hold.

No adjustments are necessary based on this month’s review.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.