Macaw, Patong Beach, Thailand

The Kahneman-Tversky Portfolio is the simplest Dual Momentum Portfolio that I review here on this site and selects only one asset chosen from a choice between three of the major asset classes – VTI (US Equities), VEA (International Equities) or US Long-Term Trasury Bonds (TLT) – although the benchmark AOR Fund (Equity/Bond combination) may be held if this shows more positive momentum than the Treasury bond. The only wrinkle in this portfolio is that it is split into two sections using different look-back periods to measure “momentum”.

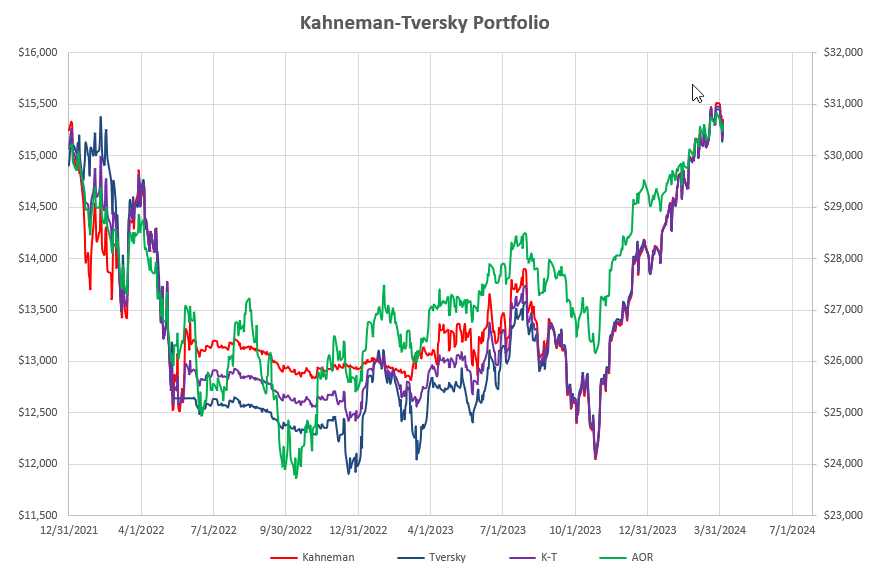

Performance of the Portfolio over the past 27 months looks like this:

where we can see that we have now caught up to the performance of the benchmark AOR fund after falling behind at the beginning of 2023. The above screenshot shows both the advantages and disadvantages of using this style of momentum investing – the system keeps us out of serious trouble in declining markets (the flat performance area through last six months of 2022) but can be a little slow in picking up the recovery (early part of 2023).

where we can see that we have now caught up to the performance of the benchmark AOR fund after falling behind at the beginning of 2023. The above screenshot shows both the advantages and disadvantages of using this style of momentum investing – the system keeps us out of serious trouble in declining markets (the flat performance area through last six months of 2022) but can be a little slow in picking up the recovery (early part of 2023).

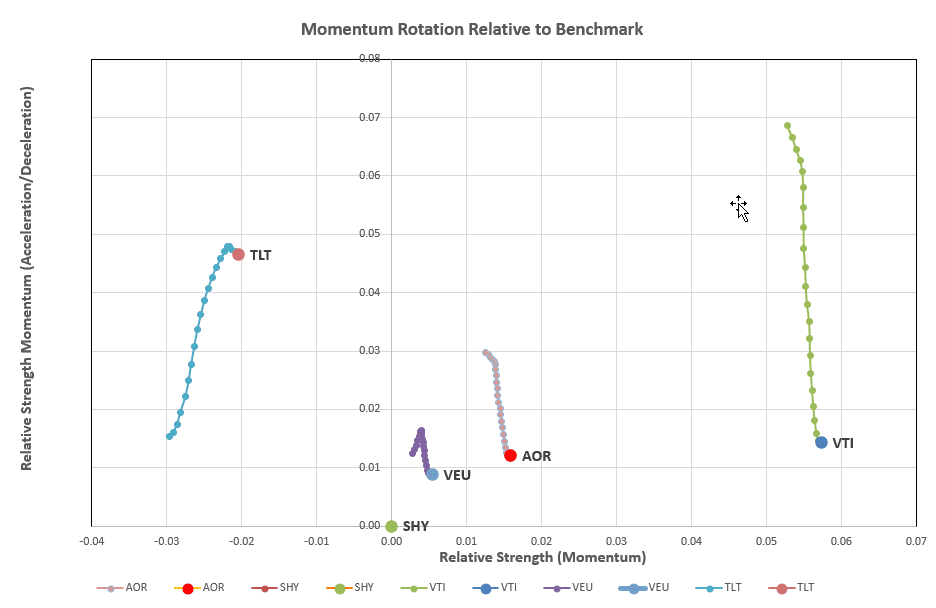

Checking on the rotation graphs of the slower-reacting (Kahneman) portion of the portfolio that uses a single 252-day (12-month) look-back period we see the following picture:

with just about everything in a nose dive in the short-term (top to bottom movement) but with US Equities (VTI) stronger in the longer term (further to the right along the horizontal axis).

with just about everything in a nose dive in the short-term (top to bottom movement) but with US Equities (VTI) stronger in the longer term (further to the right along the horizontal axis).

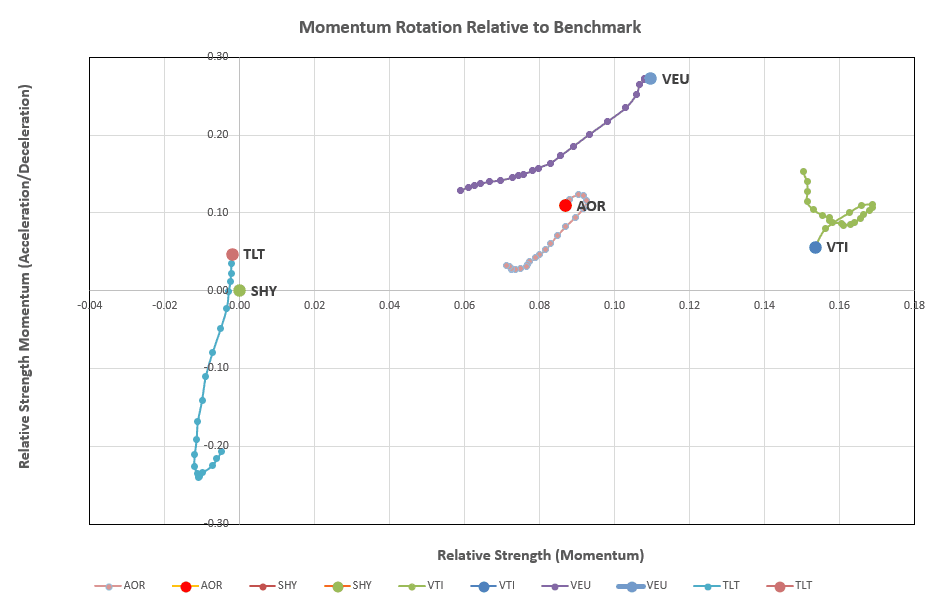

Using shorter-term look-back periods (a combination of 60- and 100 days) – the Tversky portion of the portfolio – that reacts faster to market changes, the picture changes slightly:

but VTI remains the asset with the highest momentum over the longer intermediate term although we note that VEU and TLT have shown relatively good short-term strength.

but VTI remains the asset with the highest momentum over the longer intermediate term although we note that VEU and TLT have shown relatively good short-term strength.

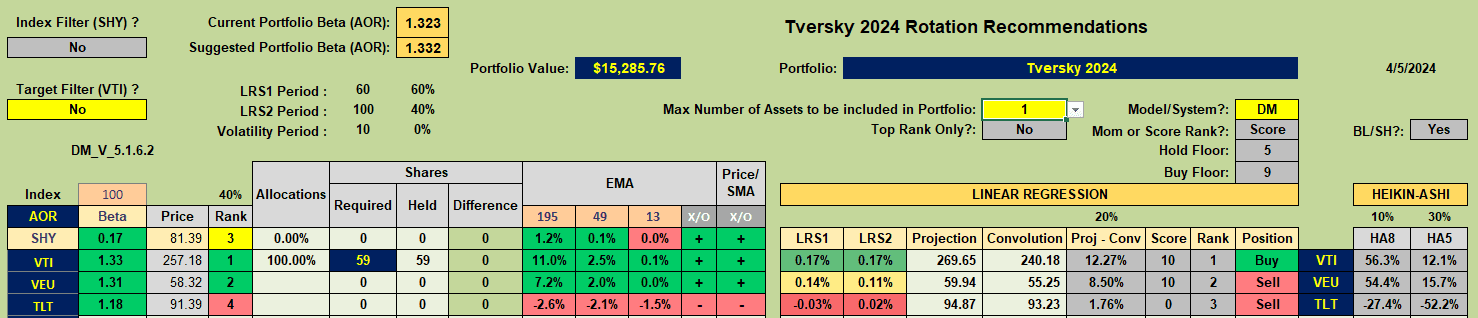

However, since the longer term perspectives are used to manage this portfolio and select the assets to hold, the model suggests both portions of the portfolio should continue to hold VTI:

Although the above screenshot shows the recommendations for the slower moving Kahneman portion of the portfolio rankings are identical for the Tversky portion.

No adjustments will be made to this portfolio at this time and we continue to hold 100% of funds allocated to VTI.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.